Table of Contents

- 1. Block (SQ) – Earnings Review

- 2. Sea Limited (SE) – Earnings Summary

- 3. Nu (NU) – Earrings Review

- 4. Starbucks (SBUX) – New Hire

- 5. Progyny (PGNY) – Investor Day

- 6. DraftKings (DKNG) — Flutter

- 7. Alphabet (GOOGL) — Break-Up

1. Block (SQ) – Earnings Review

a. Results

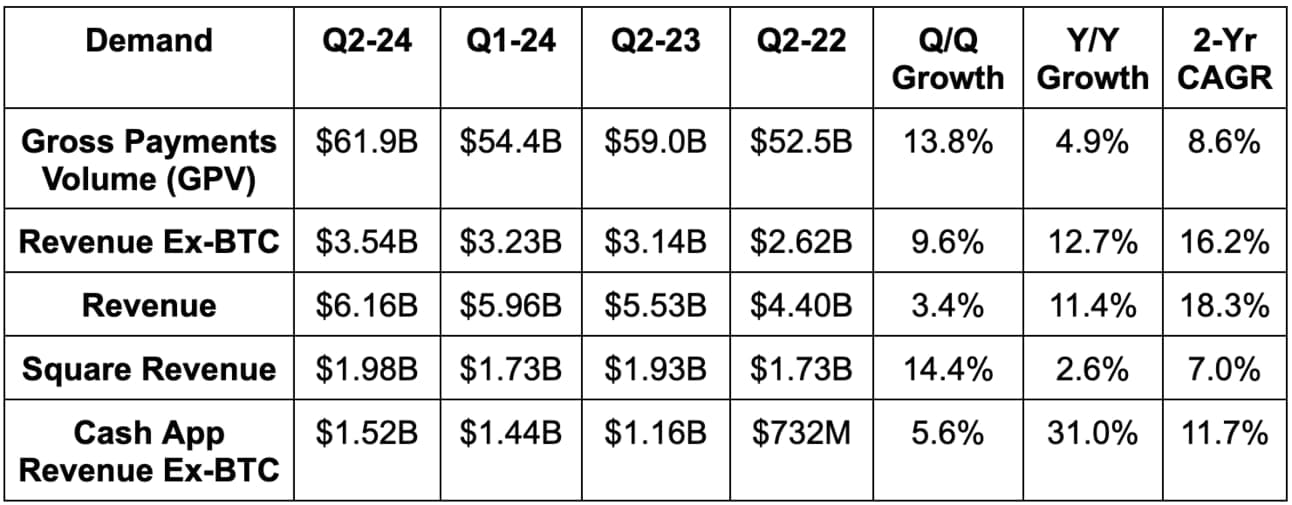

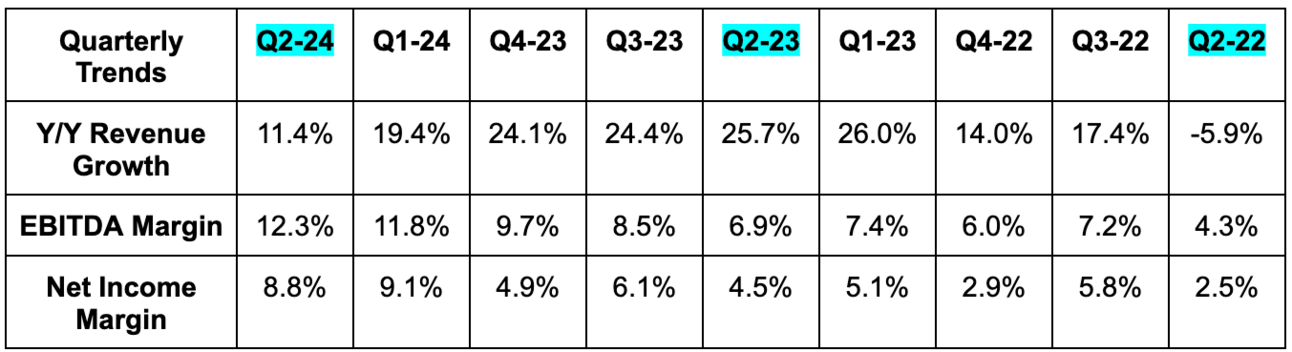

- Missed revenue estimates by 2.3%. Transaction revenue rose 4% Y/Y; subscription and service revenue rose 27% Y/Y.

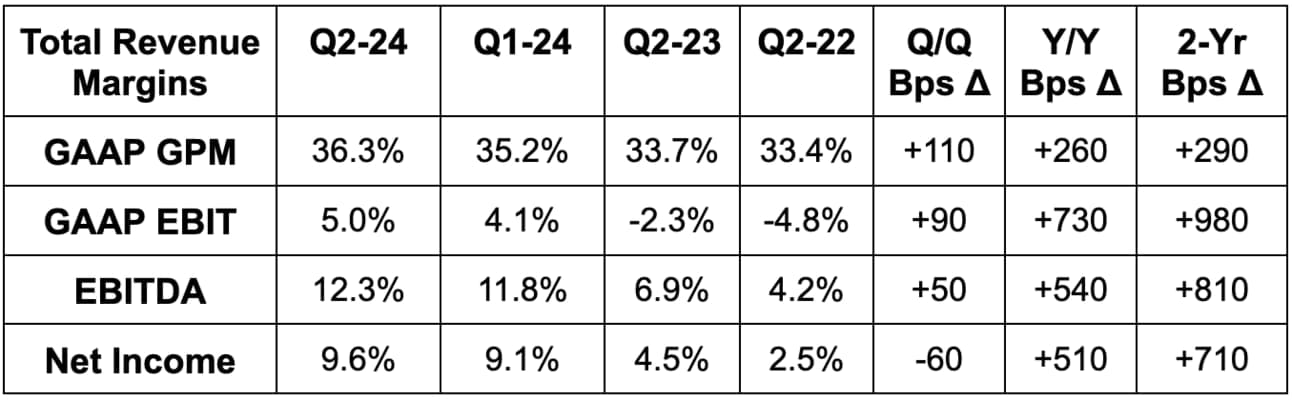

- Gross profit beat guidance by about 2.2%.

- Beat EBITDA estimates by 10.4% & beat EBITDA guidance by 11.6%.

- Beat GAAP EBIT estimates by a robust 32%. Lighter stock comp helped.

- Beat $0.84 EPS estimates by $0.09.

- Cash App gross profit was ahead of internal expectations while Square gross profit met expectations.

b. Balance Sheet

- $8.4B in cash & equivalents.

- $961M in loans held for sale vs. $775M six months ago.

- $6.1B in total debt ($1B is current).

- Issued $2 billion in senior unsecured notes due in 2032.

- Diluted share count rose by 4.5% Y/Y; basic share count rose by a modest 1.8% Y/Y.

- Block remains committed to its headcount cap for the years to come. It sees more operating leverage coming from this.

- Added $3 billion in new buyback capacity.

c. Annual Guidance & Valuation:

- Raised gross profit guide by 1.3%.

- Raised EBITDA guide by 5.1%, which beat by 3.9%.

- For Q3, EBITDA guidance was 2.5% ahead of expectations.

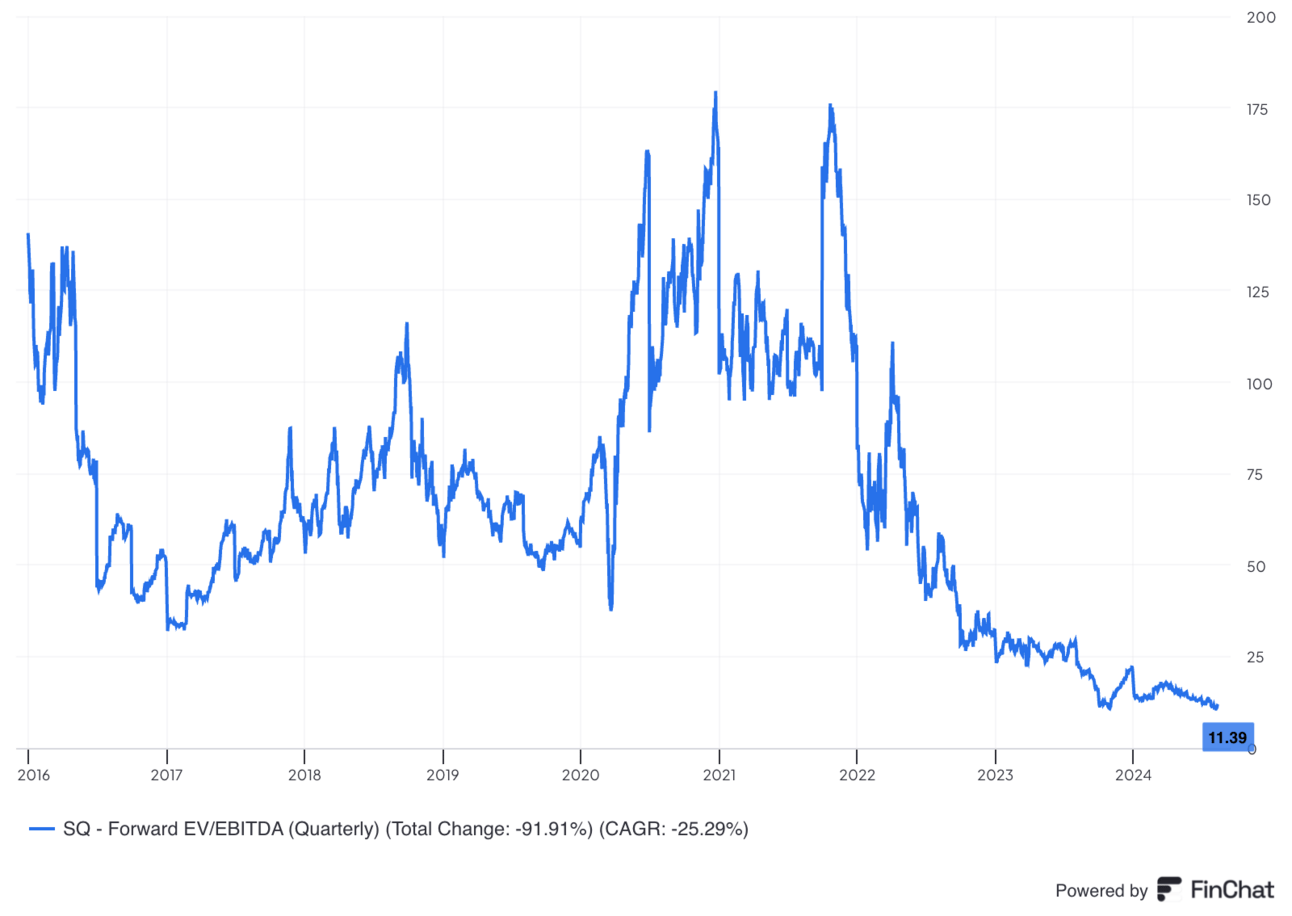

Block trades for 17x 2024 earnings. EPS is expected to grow by 95% this year and by 28% next year. It is currently inflected to positive GAAP EPS as well.

d. Call & Letter

Fixing Things:

Over the last few quarters, we’ve heard about several restructuring and strategic initiatives happening at Block. It tweaked Cash App’s focus to prioritize paycheck deposits, engagement gains and more monetization. Cash App also extended its target demographic to households earning up to $150,000 ($100,000 previously) and pushed to accelerate engineering and design innovation. Pretty much everything in Cash App needed tweaking, and the 20%+ gross profit growth for that segment is evidence of its work bearing fruit. Beyond Cash App, Block capped its headcount at 12,000 for the years ahead, reorganized teams under clearer roles, cut costs and committed to delivering operating leverage (including GAAP operating leverage).

More to Fix – Square:

This quarter, there was another area of restructuring that dominated the shareholder letter and call. Block is pushing to fix Square’s go-to-market and product velocity. It split this initiative into four groups: Sales, marketing, partnerships and products.

First, on sales, CEO and co-founder of Afterpay Nick Molnar (BNPL platform that Block bought) will add Square to his responsibilities. Going forward, he will lead a “centralized sales” push across Afterpay, Cash App and Block. The change will happen this month with “minimal disruption. Afterpay was purchased partially to improve Block’s go-to-market across all products. It came with a “high performing sales culture” and a large base of merchants ripe for Square cross-selling. It wants that energy for Square and wants a more cohesive go-to-market approach to make cross-selling Square and Afterpay products more straightforward. Molnar will focus on “raising the performance bar of the Square team.”

I find conjoining selling efforts across the Square and Cash App ecosystems to be positive and important. Like PayPal, Block has a large, two-sided network to deliver unique value to its stakeholders. Its large consumer base represents considerable purchasing power; its large merchant base wants to secure that purchasing power for themselves and many are happy to offer unique promotions to do so. Block should be aggressively selling customer targeting tools and leveraging the value that Cash App presents for merchants. The firm can greatly augment overall value creation by doing so and this change tells me that’s their plan.

- This quarter, it started testing cash back rewards at Square merchants to tap into this competitive differentiation.

Partnerships are the second item to discuss, and are directly related to supporting go-to-market. Not all customer wins come from direct sales teams. Consultants and value-added resellers are highly important channel partners to ensure Block is being recommended to prospective clients whenever possible. Partners are also instrumental in educating clients on efficient onboarding and usage of products. They shrink the learning curve and augment direct sales.

Block is investing to update its APIs and software development kits (SDKs) to make integration and customization easier for customers. It will also focus more of its partnership work on maximizing distribution. As part of this, it signed a new agreement with U.S. Foods, which has relationships with nearly 40% of U.S. restaurants – a key vertical for Square. Block still thinks its products provide lower total cost of ownership and more transparent pricing than peers, so partners should be eager to help spread the word.

Marketing approach also needs work at Square. It’s seeing “stronger returns on marketing than it has in years” and will lean into this strength to support its revamped sales efforts. More hiring here is coming. Still, it will focus spending on fewer areas to stretch each dollar as far as they can go. It will shift dollars to more high-return trade shows and webinars, as well as cutting some lower traction cities out of its plans. Marketing initiatives will be timed-up to coincide perfectly with its push to ramp product innovation.

Speaking of which…

All of this work will support the most important category of Square’s improvements: Product. Product is always vital for any enterprise. That may be especially true for Block, considering its new business skews to self-serve onboarding, where word-of-mouth powers growth. There were a few items to note from this part of the chat. Block’s new self-serve onboarding process rolled out last month and reduces the steps to join Square from 30 to 4. It upgraded inventory management systems and added more customization tools, like GenAI-powered web design and product descriptions too.

Most notably, its Orders Platform migration work will be wrapped up by the end of the summer. This is essentially just migrating its software stack to a “newer framework.” By doing so, Square will be able to build and iterate far more rapidly. This should also improve system up-time, which is important considering outages have led to Square churn issues in the past. Churn levels for the segment were stable Y/Y.

- The orders migration was used for its new Square Kiosk, which is lowering labor costs and time to order fulfillment for restaurant customers.

- Square is now testing a bar tab feature with its new orders platform.

- It upgraded external bank account linking in the UK with the new platform as well.

Square Stats:

- Transaction based revenue rose 7% Y/Y.

- Subscription based revenue rose 23% Y/Y.

- Software, integrated payments and merchant banking tools drove gross profit growth.

- Gross Payment Volume (GPV) rose 8% Y/Y vs. 9% Y/Y growth last quarter. It sees this growth rate stabilizing through the end of 2024.

- GPV growth in the USA was 6% Y/Y and 19% elsewhere.

- Churn and new merchant growth are steady. Same store sales growth for existing merchants is slowing and leading to slower GPV growth here. Block thinks this is macro-related.

- Card present GPV +9% Y/Y; Card-not-present GPV +4% Y/Y.

- Square loan volume rose 32% Y/Y.

- Hardware revenue fell 5% Y/Y and delivered a $25 million gross loss as Block uses this as a loss leader for cross-selling.

Cash App:

Cash App is performing well. Monthly actives only rose 5% Y/Y and fell short of expectations, but that was due to marketing cuts and prioritizing engagement over top-of-funnel growth.

Its push to bank the base continues to drive paycheck deposit traction and inflows per active growth. It added new Cash App Card spending insights to help customers more responsibly budget; it also continued to find great success with Cash App Borrow. Cash App Borrow is the firm’s short-term, small dollar lending product. Block uses extensive customer data profiles to ensure it knows its user better than a random lender and can enhance underwriting quality as well as approval rates. Volume here rose 3X Y/Y (small base). It will keep adding more financial services to strengthen the overall ecosystem’s value.

- It’s testing BNPL for Cash App Card.

- Cash App Card Monthly Actives rose 13% Y/Y to 24 million.

- It is changing the app’s user interface to make all of the paycheck deposit perks more visible.

- The incentive program it ran last year to drive more direct deposits worked very well. It’s testing more of these incentives.

- It wants to entrench commerce use cases more deeply into all Cash App products.

- Inflows per active rose 10% Y/Y and 0% Q/Q, despite a boost from tax refunds last quarter.

- BNPL volume rose 21% Y/Y as its single use payments (SUP) product gained steam. This lets Afterpay users pay with that method for merchants outside of the network.

- Paycheck deposit actives rose Q/Q.

Expense Discipline:

GAAP OpEx fell 4% Y/Y while non-GAAP OpEx fell 1% Y/Y. It continues to find rapid stock comp leverage, which is why GAAP declines are larger. Product and development expenses rose slightly Y/Y and sales & marketing fell by 6% Y/Y. GAAP G&A fell 14% Y/Y due to headcount control while non-GAAP G&A fell 1% Y/Y.

e. Take

There are a lot of moving pieces at Block right now. Pretty much everything has changed to a certain degree over the last year. Now, attention will turn to how effective these changes will actually be. Cash App and Square are good assets just like Venmo and PayPal are good assets. And just like Venmo and PayPal, Block needs to organize go-to-market and execute a lot better. They’re capable; time to go prove it.

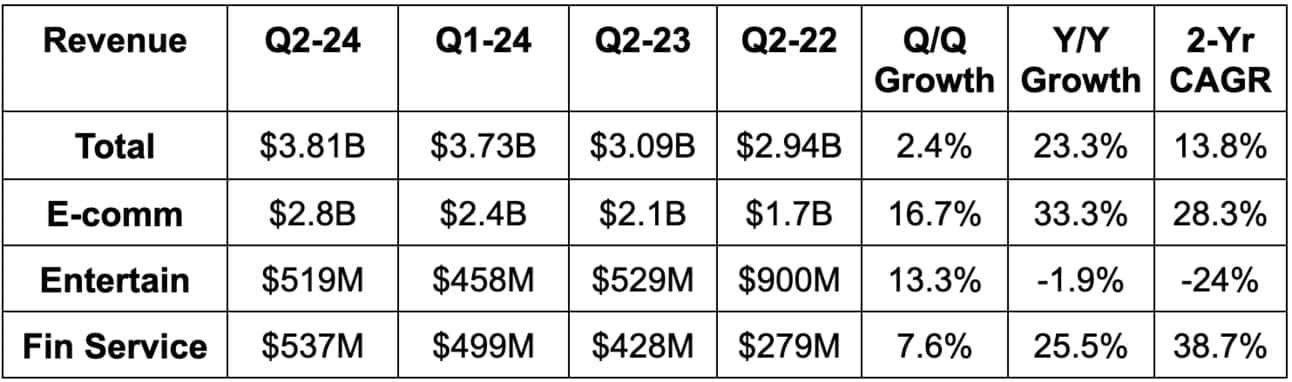

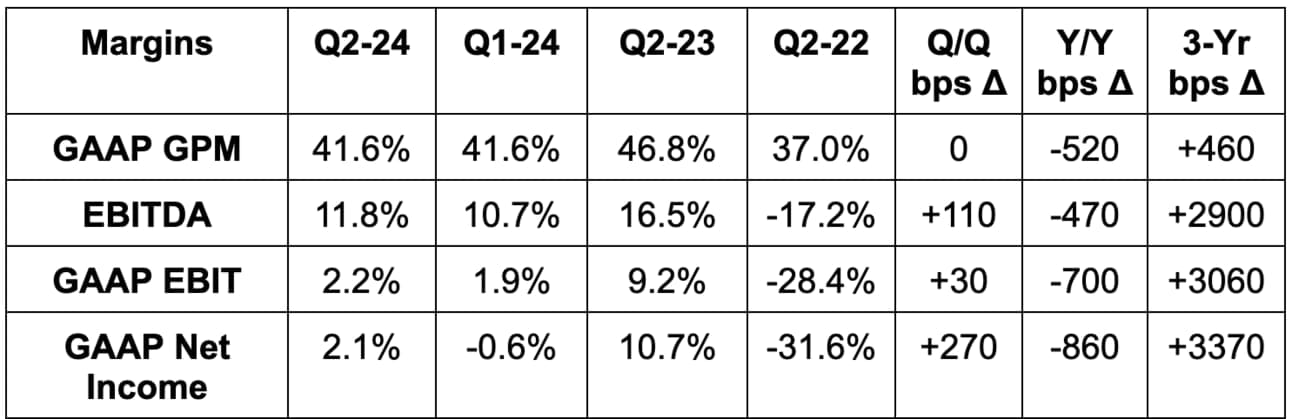

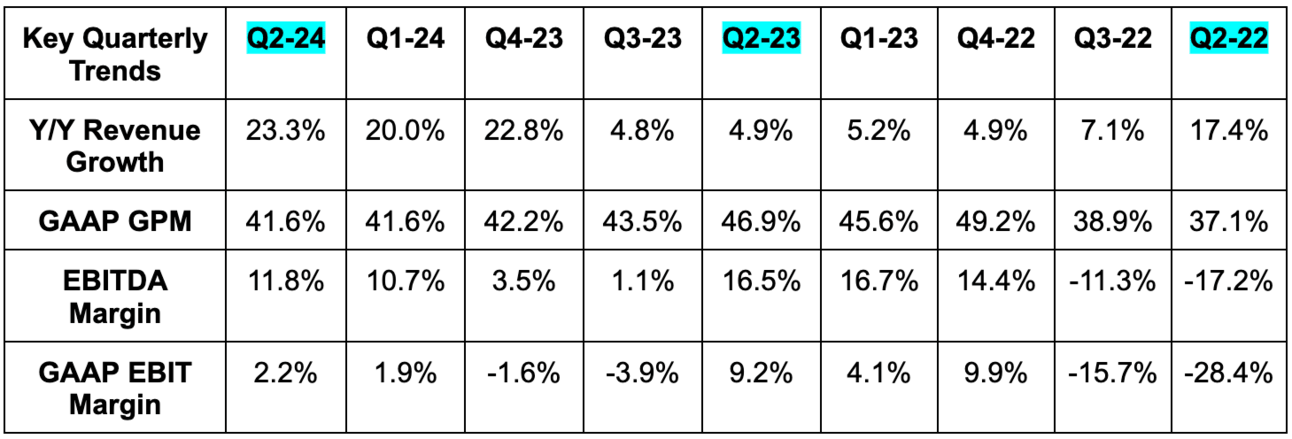

2. Sea Limited (SE) – Earnings Summary

a. Results

- Beat revenue estimates by 2.4%.

- Beat EBITDA estimates by 22%.

- Slightly beat GAAP EBIT estimates.

- Missed $0.19 GAAP EPS estimates by $0.05.

Segment margins & costs:

- E-commerce EBITDA margin was -0.3% vs. 7% Y/Y as it grew marketing expense by 56% Y/Y and incurred more logistics costs.

- Financial Services EBITDA margin was 31.7% vs. 32.0% Y/Y despite nearly 200% Y/Y growth in marketing spend.

- Digital Entertainment EBITDA margin was 69.5% vs. 62.2% Y/Y as it kept marketing spend for the segment flat Y/Y.

- Overall R&D rose 5% Y/Y; overall G&A was roughly flat Y/Y.

b. Balance Sheet

- $2.65B in cash & equivalents; $1.40B in restricted cash

- $3.4B in short-term investments.

- $3.8B in long-term investments.

- $2.81B in loans receivable net of credit loss allowance vs. $2.46B six months ago.

- $70M short-term debt; $117M in long term debt.

- $151M in short-term convertible notes; $2.95B in long term convertible notes.

c. Guidance & Valuation

SE raised its initial Shopee gross merchandise value (GMV) growth target from high teens Y/Y to a mid-20% Y/Y growth rate.

It trades for 36x 2024 EPS and 90x 2024 GAAP EPS. EPS is expected to grow by 148% this year and by 94% next year. GAAP EPS growth is expected to grow by 238% Y/Y this year and by 126% Y/Y next year.

d. Call & Release

E-Commerce:

Gross orders rose 40% Y/Y, GMV rose 29% Y/Y and core marketplace revenue rose 33% Y/Y as this segment continued to regain its momentum. As briefly mentioned, Sea Limited has gotten more aggressive with marketing spend, which in addition to higher logistics costs, was the source of the segment returning to an EBITDA loss. Shopee will return to positive EBITDA next quarter. In Brazil, its newest growth market, unit economics continued to improve with scale. It now generates $0.09 in contribution profit per order there vs. -$0.24 Y/Y.

Competitive concerns from analysts were a key part of the call.

Leadership is “happy” with Shopee’s large and stable market share lead over the competition, which is why its growth outlook was raised. Ad take rate is improving (12.1% of GMV vs. 11.7% Y/Y), as it introduces new placements within live streaming and its marketplace; that should help with profitability. It has a “dedicated tech team working on improving ad bidding algorithms” to juice demand for these placements over time. It also debuted a new onboarding flow, which helped total advertisers on the platform rise by 20% Y/Y.

“We are seeing more market share consolidation, and an industry-wide take rate increase. We believe this will move the industry toward profitability and sustainability, and we welcome this trend.”

Founder/CEO Forrest Li

SE’s SPX Express delivery service is performing well and facilitating shorter delivery times and improved service. Sea Limited made deeper integrations with logistics partners a priority this quarter, and its work paid off. 70% of SPX express orders this quarter were fulfilled in three or fewer days and cost per order fell 8% Y/Y. It’s also investing in optimizations to its return and refund processes to cut miles, touches and costs per package. “Change of Mind” is a 15-day “no-questions-asked” return policy for buyers. This drove a 10% rise in average basket size for Malaysian buyers.

- Core marketplace revenue from transaction fees and ads rose 41.4% Y/Y to $1.8 billion.

- Value-added services (logistics) revenue rose 15.5% Y/Y to $722 million.