Read my Nu Deep Dive here to learn about the company in more detail. More recent content to read:

- Amazon, Cloudflare and Disney Earnings Reviews

- Datadog Earnings Review

- Airbnb Earnings Review

- Uber Earnings Review

- Shopify & Chipotle Earnings Reviews

- Alphabet & AMD Earnings Reviews

- PayPal Earnings Review

- Palantir Earnings Review

- Meta, Tesla & Starbucks Earnings Reviews + DeepSeek News & Implications

- Microsoft & Apple Earnings Reviews

- ServiceNow Earnings Review (section 2)

- Spotify Earnings Review (section 3)

- The Trade Desk Earnings Review

- My Updated Holdings & Performance

- Consistent weekly news & analysis

Table of Contents

- a. Key Points

- b. Demand

- c. Profits & Margin

- d. Balance Sheet

- e. Valuation (no guidance given as always)

- f. Call & Release

- g. Take

a. Key Points

- Solid quarter but massive foreign exchange (FX) headwinds.

- Great progress in Mexico and Colombia.

- Leadership is confident in macro resilience (not immunity).

- Its marketplace product now has 1 million shoppers as it expands beyond financial services.

- More international expansion is inevitable.

b. Demand

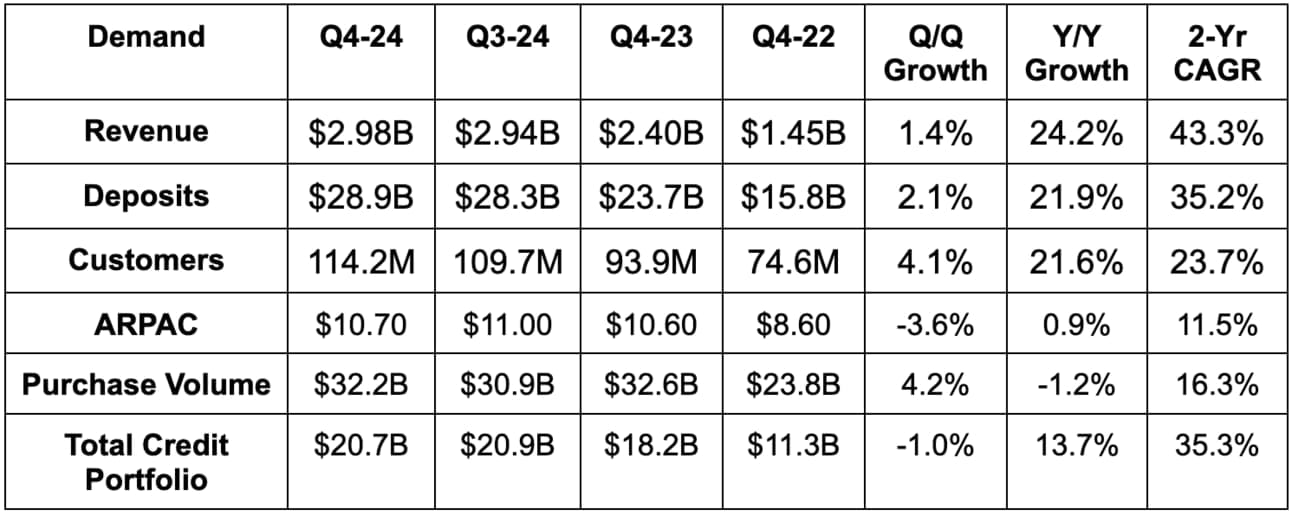

- Missed revenue estimates by 7%.

- Met customer estimates.

- Missed purchase volume estimates by 6.7%.

- Missed deposit estimates by 7.5%.

- Missed $11.80 average revenue per active customer (ARPAC) estimates by $1.10.

- Credit portfolio size missed estimates by 6.5%.

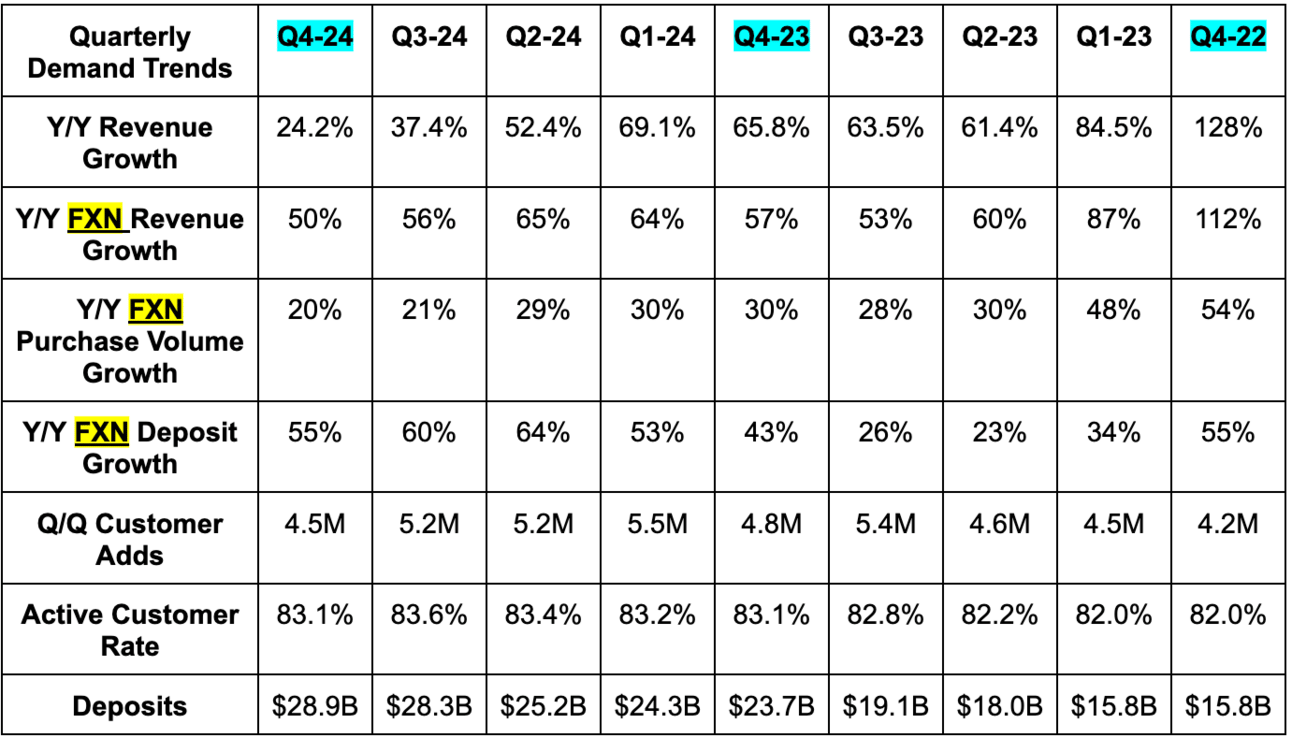

As you can see in the second chart below, FX had a larger impact on growth than it has in over 10 quarters. The 26-point headwind was a full 7 points worse than anything it has experienced in years. It’s always important to focus on foreign exchange neutral (FXN) growth for the company, but that’s especially true today. Deposits rose 55% Y/Y FXN; ARPAC rose 23% Y/Y FXN; purchase volume rose 20% Y/Y FXN; the credit portfolio rose 45% Y/Y FXN.

Note that the active customer rate fell for the first time in a long time due to Mexico and Colombia expansion. Nu doesn’t have its full product suite in those two nations like it does in Brazil. Furthermore, activity levels always start at low points for its users and build over time. So? Rapid customer growth outside of Brazil is an active customer rate headwind. They’re very confident in this being temporary as they roll more products out to those customers.