Intro:

Nvidia designs semiconductors for data center, gaming and other use cases. It’s unanimously considered the technology leader in chips meant for high performance compute (HPC) and GenAI use cases. The following are important acronyms and definitions to know for this company:

- GPU: Graphics Processing Unit. This is an electronic circuit to display screen images.

- CPU: Central Processing Unit. This is a different type of electronic circuit that carries out tasks/assignments and data processing from applications.

- DGX: Nvidia’s full stack platform combining its chipsets and software services.

- Hopper: Nvidia’s modern GPU architecture designed for accelerated compute and Generative AI. Key piece of the DGX platform.

- H100: Its Hopper 100 Chip.

- L40S: Another, more barebones GPU chipset based on Ada Lovelace architecture. This works best for less complex needs.

- Ampere: The GPU architecture that Hopper replaces for a 16x performance boost.

- Grace: Nvidia’s new CPU architecture designed for accelerated compute and Generative AI. Key piece of the DGX platform.

- GH200: Its Grace Hopper 200 Superchip with Nvidia GPUs and ARM Holdings tech.

- InfiniBand: Interconnectivity tech providing an ultra-low latency computing network.

- NeMo: Guided step-functions to build granular Gen AI models for client-specific needs. Its standardized environment for model creation.

- Generative AI Model Training: One of two key layers to model development. This seasons a model by feeding it specific data.

- Generative AI Model Inference: The second key layer to model development. This pushes trained models to create new insights and uncover new, related patterns. It connects data dots that we didn’t realize were related. Training comes first. Inference comes second.

1. Demand

“Accelerated computing and GenAI have hit their tipping points. Demand is surging worldwide across companies, industries and nations.” – Nvidia Founder/CEO Jensen Huang

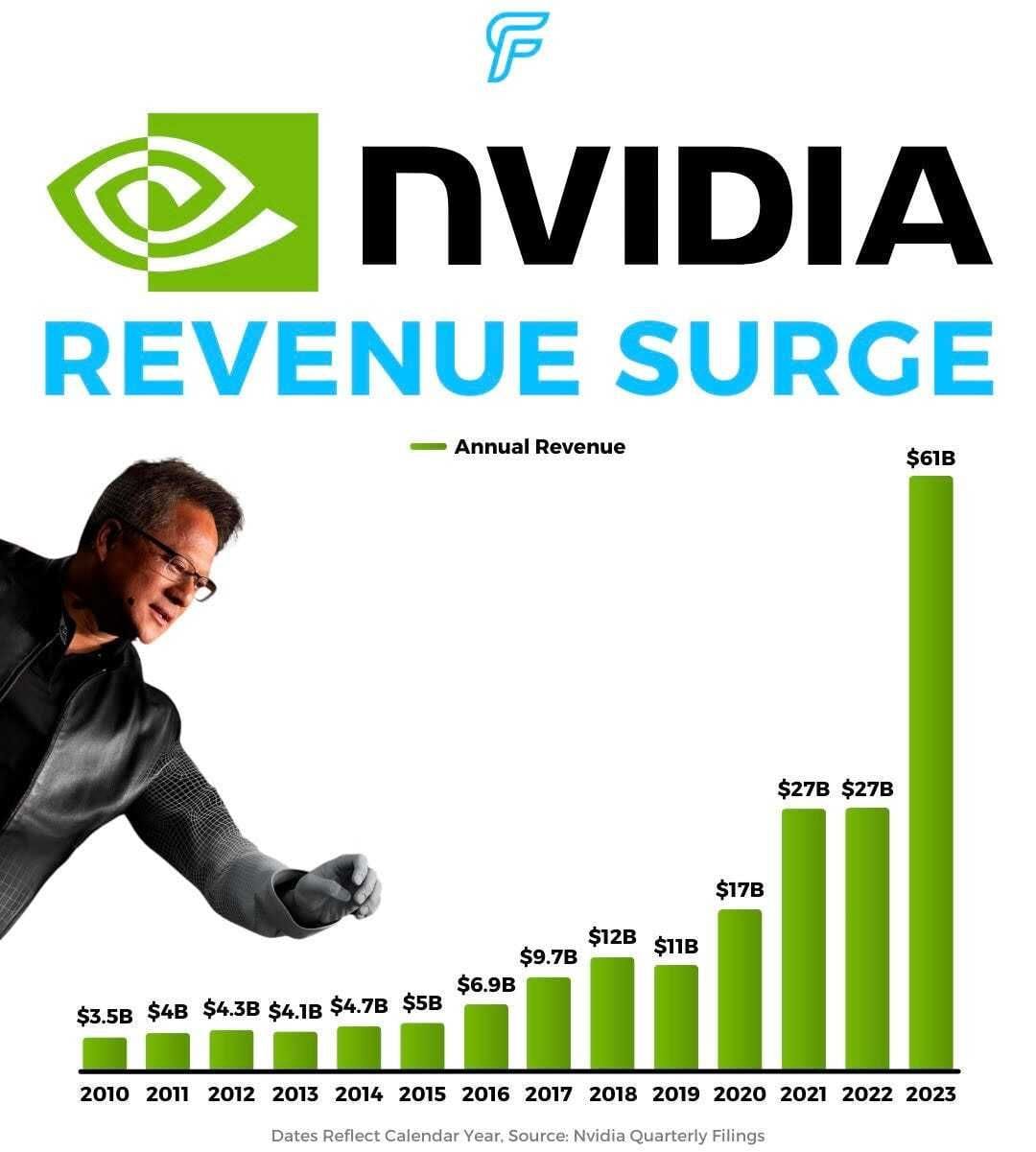

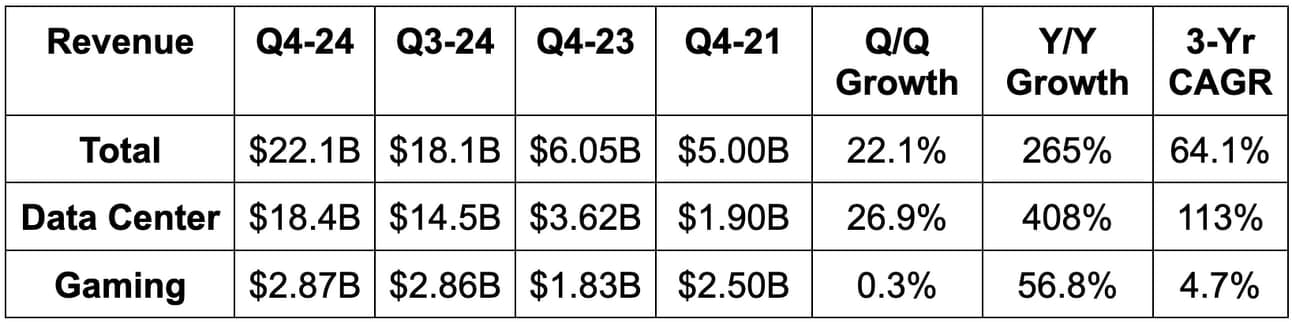

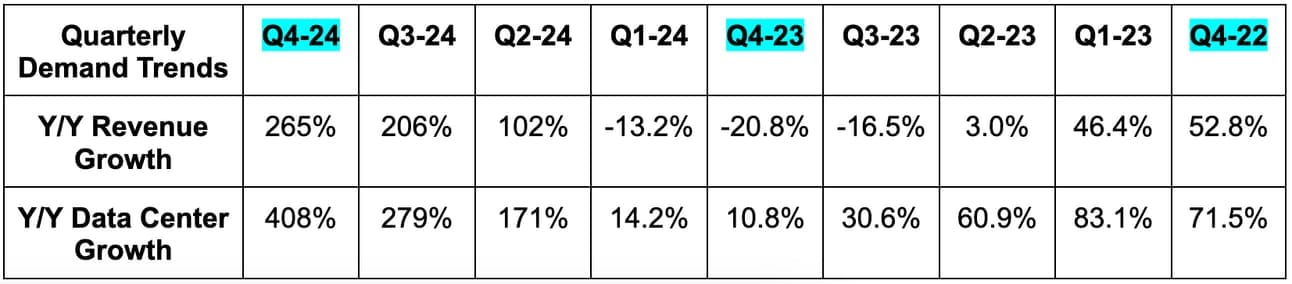

Nvidia beat revenue estimates by 7.5% & beat its guidance 10.5%. Its 64.1% 3-year revenue compounded annual growth rate (CAGR) compares to 56.4% as of last quarter & 51.7% 2 quarters ago. For revenue buckets besides data center:

- Gaming was flat Q/Q & rose 56% Y/Y.

- Professional Visualization was up 11% Q/Q & up 105% Y/Y.

- Automotive was up 8% Y/Y & fell 4% Y/Y.

2. Profitability

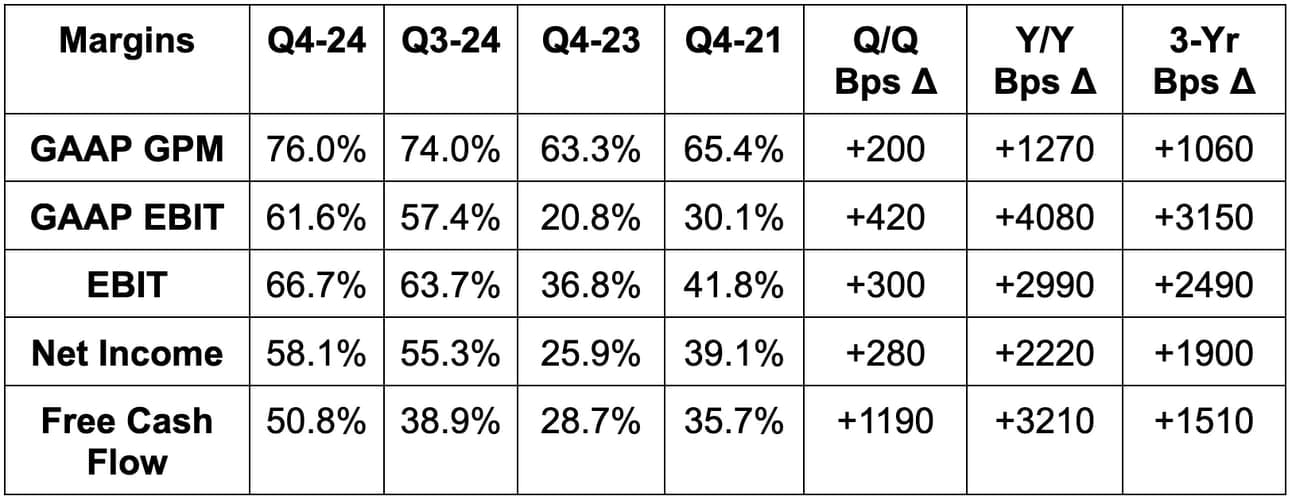

- Beat 75.5% gross profit margin (GPM) estimates & beat same GPM guidance by 120 basis points (bps; 1 bps = 0.01%).

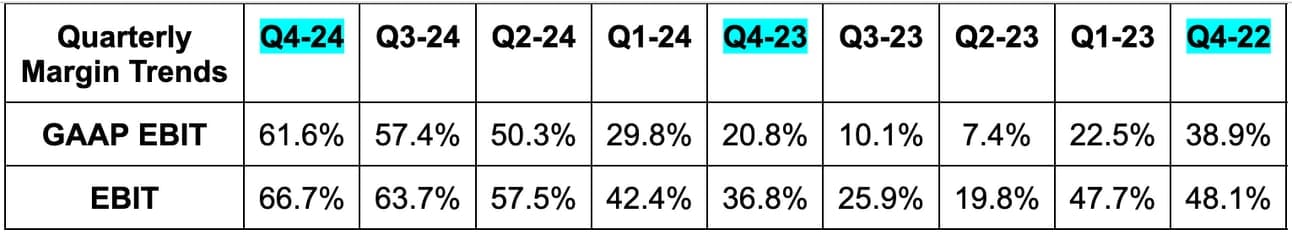

- Beat EBIT estimates by 10.2% & beat EBIT guidance by 26.1%.

- Beat $4.64 earnings per share (EPS) estimates by $0.52 or 11.2%.

- It generated $5.16 in EPS vs. $0.88 Y/Y. Wow. Just wow.

3. Balance Sheet

- $26 billion in cash & equivalents. It had $13.3 billion just 12 months ago.

- Accounts receivable fell a bit Y/Y.

- Days sales outstanding improved from 42 to 41 Q/Q.

- $5.3 billion in inventory.

- Days of inventory improved from 92 to 91 Q/Q.

- Purchase commitments for inventory and manufacturing capacity fell Q/Q “due to shortening lead times for certain components.” This is likely their H100 supply bottleneck improving as expected. CFO Colette Kress said on the call that it had nothing to do with demand levels, which are excellent by all accounts.

- Nearly $10 billion in debt.

- Share count is down slightly Y/Y. It bought back $9.5 billion in stock during fiscal 2024.

4. Guidance & Valuation

Nvidia’s next quarter guidance was 9.1% ahead on revenue, 12.2% on EBIT, 17.1% ahead on net income and 150 bps ahead on GPM. It also guided to $14.8 billion in GAAP EBIT.

Based on current estimates, which are set to rise in the coming days, Nvidia trades for 34x fiscal year 2025 EPS. EPS is expected to grow by 74% Y/Y.