Introduction:

Olo began its journey as Mobo Systems when Noah Glass founded the company in New York City 16 years ago. The first iteration was born to enable coffee shops to accept orders and payments from mobile phones within what Olo calls the “on-demand commerce” space.

Five years later, Glass and his team pivoted to serving larger, enterprise clients and changed the company’s name to Olo — short for online ordering. Today, it operates as the core connector and enabler for national restaurant chains to economically build a digital business in a world where that is now imperative.

Olo services roughly 1.8 million digital orders per day and according to Glass, the first inning of its remarkable growth story has not even begun. Here I will cover all there is to know about this company, including:

- Restaurant Challenges

- Olo’s Solution

- Olo’s Product Modules

- Olo’s Business Model

- Olo’s Market

- Olo’s Reach and Impact

- Financials

- Balance Sheet

- Valuation

- What’s Next?

- Leadership and Ownership

- Competition and Risks

- My Plan

1. Restaurant Challenges

Restaurants face a plethora of challenges making a digital, off-premise business pursuit overwhelmingly daunting.

Off-premise defined: includes take-out, drive-thru, delivery, catering and any ordering process not conducted entirely in-store.

All restaurants sell perishable goods. Near-future expiration dates force restaurants to be nimble with gauging inventory demand. Once prepared, these perishable goods are under strict FDA regulations which mandate when that food can be served or delivered as well as when it must be consumed. If this window of time is not met, the restaurant must throw away its product and eat the cost itself. Selling this food on-premise within the time restriction is simply far easier than attempting to juggle off-premise, digital service along with on-premise dining.

Not only are these products perishable, but a restaurant’s menu is also generally quite fluid. Consumers frequently add to, or subtract from orders; with food allergies so prevalent in our society, forgetting a request could be a matter of life or death. Furthermore, specific locations within a chain can occasionally run out of certain menu items making accurate fulfillment quite the difficult task.

Restaurants trying to embrace off-premise business also have to continue accommodating in-house dining. They can’t simply dedicate all resources to off-premise as on-premise execution requires a great deal of attention to be done effectively.

The combination of perishable goods, fluid menus and on-premise accommodation makes running a brick and mortar business complicated enough, let alone trying to service multiple off-premise channels as well. It’s one thing for a company like Amazon or FedEx to ship a toy or a pair of headphones. The stakes are significantly raised for businesses to thread the service needle when a company is sending something perishable and consumable.

The obstacles don’t stop there.

70% of restaurant chains need up to 4 different 3rd party technology vendors to enable their digital operations.

The vast majority of these restaurants do not have the infrastructure or expertise to develop their own, integrated solutions. To put it plainly: No restaurant is in a position to build a better point of sale (POS) system than Square. In reality, with the multi-channel, multi-location businesses that restaurants run, they often need several POS systems to fully capture demand. The cumulative effect of multiple 3rd parties is inconsistent integration, poor communication and unpredictable service among often antiquated solutions.

Even within an individual chain, frequent usage of franchisee and licensing models for expansion means tech stacks from location to location are often not the same. This merely complicates unification further.

Inconsistent integration makes accepting, organizing and prioritizing orders across on-premise and off-premise channels IN REAL-TIME extremely challenging. Doing so while maintaining a level of customer service to keep people happy is virtually impossible for most chains on their own. They need a trusted integration partner to avoid treating demand fulfillment like a guessing game.

For chains able to effectively embrace their digital opportunity, profitability is a real concern. Restaurant margins aren’t terribly high to begin with. Furthermore, delivery service providers (DSPs) and demand aggregators are expensive (and also vital) pieces of making digital operations a reality.

This part of the value chain commands a large (up to 30%) chunk of the total profits, withholds lucrative consumer data, disconnects consumers from a restaurant’s brand and forces chains to compete against substitutes often on the same marketplace. This is not the greatest situation but is a necessary evil if restaurants want the added volume associated with digital proliferation. Adding this to the issues I highlighted above makes it clear why the restaurant industry has been so hesitant to modernize — and numbers support this assertion.

Before the pandemic began, just 10% of total restaurant sales were digitized according to research from Cowen. This compares to 50% for books and electronics, as well as 20% for American e-commerce as a whole. The pandemic invariably boosted this 10% metric, but there remains a long runway for off-premise restaurant chain operations to grow.

That is exactly the Olo niche.

2. Olo’s Solution

Olo builds customizable application programming interfaces (APIs) to empower off-premise, on-demand commerce while simultaneously improving customer experience. It unlocks digital demand WITHOUT sacrificing access to coveted consumer data and WITHOUT threatening brand equity or profit margins. Chains also forgo the hefty costs associated with building out an internal solution. In other words, Olo is quicker, easier & more efficient.

Application Programming Interface (API) Defined: APIs are blocks of code that enable software to perform various tasks. APIs act as the ‘language’ that empower access to data services, operating systems and other applications to create an end product. A user interface (UI) is what the consumer sees and APIs are what the enterprise uses to build a platform’s UI and user experience (UX).

Based on the prevalent 3rd party technology integration issues that most restaurant chains face, Olo integrates with over 100 technology platforms in the industry. This ensures compatibility with all relevant technologies — including those built before the dawn of the internet’s ubiquity to guarantee even the toughest of combinations. To date, most chains have had to constantly and manually integrate the various pieces of their antiquated tech stacks — Olo fixes that.

Olo doesn’t replace the solutions a restaurant chain has deployed, but instead acts as an interface layer on top of the various products to conjoin them and bring them to their full economic potential. Broad 3rd party integration is the key to making this happen. This approach means Olo can function as a centralized platform for data and demand aggregation as well as day-to-day decision making for all locations in one place. The effect is higher volumes at lower cost which incrementally feeds the profits of Olo’s clients.

Beyond broad integration, every single product Olo offers is white label, and not Olo-branded. Consumers will never see the Olo brand when ordering food, meaning chains can embrace digital without jeopardizing the power of their brand. This translates into enhanced consumer loyalty by raising brand awareness and also boosts profit margins because of the sale becoming more direct-to-consumer (DTC) in nature. With Olo, the brand is at the centerstage of the fulfillment value chain rather than an aggregator like DoorDash.

Olo’s unique white label approach also ensures brands can keep control of their lucrative consumer data and even helps to digest and organize all of this data to assist partners in decision making. Demand aggregators generally restrict which data they’re willing to share with restaurant chain clients. Less consumer data means less informed service and menu-item decisions for chains.

As a result, 70% of Olo’s chain clients stated the primary reason for their original shift to Olo was to take back control of their brand and data. Furthermore — according to the National Restaurant Association (NRA) — 64% of consumers prefer ordering directly with a brand rather than through a marketplace. A combination of familiarity and loyalty powers this preference. Clearly, this white label approach appeals to both restaurant chains and consumers.

3. Olo’s Product Modules

a. Ordering

Olo’s ordering module was its very first enterprise product. With this module, chains build a branded website that enables orders to flow from various direct digital channels. It essentially functions as a white-label, on-demand commerce solution to free a consumer to order from and pay restaurants via mobile, web, voice and more. The module can fulfill orders across all of these pieces of a chain’s operations to help restaurants internally juice volume wherever possible.

Olo’s suite of fully customizable APIs allows a chain to construct digital operations in a way that uniquely captures its specific consumer base. This is far from a one-size-fits-all product.

Ordering also functions as a central logistics platform thanks to all of the broad 3rd party integrations mentioned above. Chains can use the module to enforce day-to-day decision making in one place and across all locations.

More recently, the company has added features on top of Ordering to boost its appeal. This upgrade includes a product-type designed for “ghost kitchens” (virtual food prep kitchens with no dine in capacity) like Guy Fieri’s Flavortown Kitchen which recently became an Olo client. It even added a coupon manager to allow brands to run national digital promotions while leveraging all of the consumer data Olo gathers, arranges and shares with its chain clients.

Finally, Switchboard is a product that supports Olo Ordering. It facilitates the acceptance of phone-in orders by integrating with call centers or in-store agents to place orders through the ordering module.

b. Dispatch

The Dispatch module is Olo’s same hour delivery management solution. It’s important to note: Olo does not fulfill any delivery internally; it has 0 delivery drivers. Olo is merely facilitating delivery for chains in the most effective way possible.

With Dispatch, Olo clients can source and accept delivery orders directly from their ordering module website without the need for a delivery fleet. Here, it’s up to a restaurant what percent of deliveries it wants to fulfill internally — but Olo helps greatly with making that economically vital decision.

In real-time — when the Ordering module receives a delivery order — Dispatch chooses from up to 8 external delivery service providers (DSPs) and any available internal options to optimize for cost and service. Dispatch works with more than 2 dozen DSPs in total.

When DSPs are charging up to 30% for fulfillment, this feature serves as a wonderfully powerful margin tailwind for restaurants by forcing these 3rd parties to compete for the business rather than automatically assuming it at whatever fee they choose. Much like GoodRX brings down prescription prices via price competition, Olo is doing the same for restaurant chains. Dispatch has also enabled chains with internal delivery capacity to reduce their reliance on DSP fulfillment by 50% thus boosting profit margins further.

Beyond bringing down 3rd party commissions, Dispatch coordinates the timing of a DSP’s arrival to ensure food is fresh and fulfillment is timely. With the FDA regulations highlighted above, this is nothing short of imperative. If a specific DSP is not meeting delivery service criteria, Dispatch can exclude them on a per location basis.

The module does allow DSPs to pick and choose where they want to participate in this process, but based on the massive scale Olo enjoys (covered below) it’s increasingly hard for them to not participate. Like all other Olo products, Dispatch seamlessly integrates into all tech stacks and POS systems to guarantee ALL digital demand is captured profitably.

c. Rails

Rails is an internal and external channel manager for the Ordering module. The product has a complete view of all corners of a chain’s business which allows it to accurately communicate with the Ordering module for setting, tweaking and controlling menu pricing and availability. Much like an airline price discriminates based on fluid supply and demand, Rails allows restaurants to do the same. This module is an imperative enabler of the Ordering module’s strong utility.

With Rails, restaurants also no longer need to manually transfer orders from one piece of a technology stack to another — this is done automatically and, in a way to optimize workflow efficiency.

Externally for participating aggregators such as GrubHub, Rails allows these 3rd parties to receive accurate menu data. This means they can all enjoy added volume from submitting orders placed by their users directly into a respective chain’s demand flow. The accuracy elevates consumer satisfaction as well as conversion rates — a profitable win-win.

The Rails module essentially functions as a powerful affiliate marketing tool to economically boost sales for restaurants.

d. Network

Olo Network opens chains up to collecting business from non-marketplace channels like search engines and social media platforms. For example — through a partnership with Google — Olo Network allows chains to place menu items directly on the Google search page where consumers can order without accessing an aggregator’s site. It takes all of this incremental demand and transmits it to the Olo Ordering module to streamline fulfillment.

The product ensures brands have direct and complete access to their lucrative consumer data which, again, demand aggregators generally keep to themselves. Furthermore, Network actively works to limit 3rd party fees taken from aggregators (just like Dispatch) as it funnels these payments directly into a chain’s merchant account and POS system. Less involvement by an aggregator means more profits for a chain.

Network was born from the reality of what a consumer finds when they search for a specific brand on Google. People often see several links to demand aggregators before the brand’s website that they searched for. Regardless of the actual restaurant having the clout to generate the direct search, consumers are frequently re-directed to an aggregator where chains lose access to data, brand power and profit margin as discussed above.

Now with Olo Network, if a brand is being searched for, they will get the direct to consumer sale far more often.

I asked CEO and Founder Noah Glass about other potential partnerships for Olo Network and I explicitly mentioned Facebook and Instagram as possibilities. I received zero pushback hinting at these deals possibly being on the table in the years to come.

“Olo Network can bring other consumer-facing platforms into the mix of where a consumer can find their favorite restaurant and place an order. Our ambition on behalf of our customers is to put their menus wherever a consumer is looking for food and to put customers in more of a direct relationship with the brand.” — Glass

“I am inspired by the work that Shopify does with Facebook, Instagram and now TikTok. It’s a similar ethos of a motivation to help the brands to transact wherever their customer may be and to let 1000 flowers bloom on the platform. That’s our same guiding principal.” — Glass

e. Rails + Network

The combination of Rails and Network creates a newfound ability for chains to generate demand and levels the playing field for restaurant chains vs. demand aggregators. How?

Without these 2 products, chains cannot spend as aggressively on consumer acquisition compared to a DoorDash for example. This type of aggregator collects more lifetime value (LTV) per dollar spent on consumer acquisition cost (CAC) because they’ve been so successful at accumulating brands onto their platform. This means they can often out-promote a chain’s operations.

With Olo, chains can get more aggressive on spending because they now have actionable visibility into the channels creating profitable growth. Put simply, a dollar spent just became that much more valuable for a restaurant brand thanks to Olo.

f. Additional Products

Serve is Olo’s new user interface (UI) with the aim of presenting food in a more aesthetically pleasing manner. Its engineering team had the goal of limiting clicks per order whenever possible to reduce ordering friction.

According to QSR magazine, the upgrade has directly boosted basket conversion rates by 6% and has reduced time to place an order by 5 seconds while lowering customer interactions per order by 3. The goal of Serve was to streamline the digital ordering and checkout processes and it has already worked.

Serve is also set to be a key part of Olo’s expansion into on-premise dining. It comes with features like QR code scans for menus and kiosk ordering capacity. Olo originally set the ambitious goal of being involved in the majority of its customer’s total orders. Now that it has already achieved this feat, it has set its sights on 100% involvement in a restaurant’s digital orders. Expansion into on-premise service is how the company will do this, and Serve is one of the first steps in this exciting new direction.

Glass’s company has effectively removed the sacrifices that restaurant chains previously had to make to participate in this digital revolution. Now a chain can enjoy the added volume while maintaining control of data and margin. It can participate in off-premise growth without sacrificing quality of service or the power of its brand. So many pain points have vanished because of this company.

4. Olo’s Business Model

Olo generates revenue from platform and professional service fees. Platform fees represent 96% of its total sales year to date and cover all revenue collected from usage of its various modules. Professional service revenue makes up the remaining 4% of total sales and covers sales collected from installing new modules. This segment is not recurring and is lower margin vs. platform revenue.

Olo generally signs 3 year contracts with newly on-boarded brands and 1 year extensions thereafter. It does not seek out individual locations to onboard, but instead entire enterprise chains where it signs exclusive agreements to integrate its software across every single location. This translates into a highly efficient go-to-market approach which shows up in Olo’s strong margins covered below.

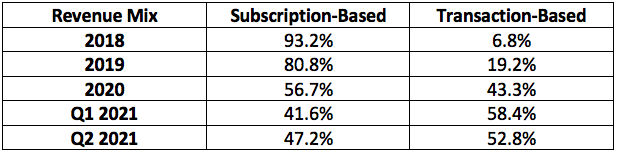

Within the platform segment, Olo collects both transaction-based and subscription-based revenue. The Ordering module is subscription-based and charged on a per restaurant basis. Recently, Olo introduced a newer pricing option for chains to buy a fixed number of monthly orders for a fee with additional fees paid per order beyond the limit. The company considers this to be subscription revenue as well.

With the subscription approach Olo is able to grow with its customers as they add new locations. Because the company already serves more than half of our nation’s fastest growing private chains, this should be a powerful growth driver going forward.

The Rails, Network and Dispatch modules are solely transaction-based. Restaurant chains, aggregators and all other participating service providers are charged per usage of the Olo ecosystem.

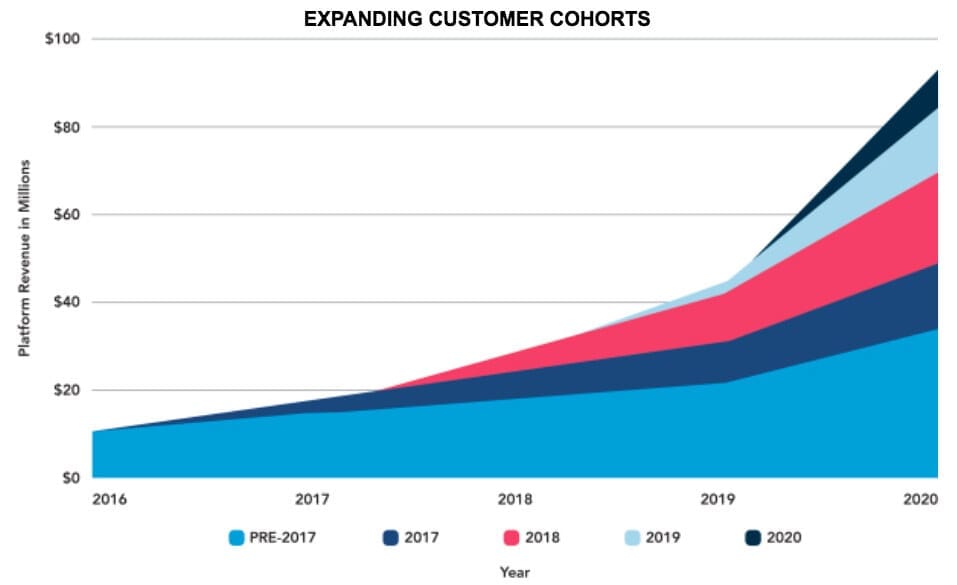

The usage-based model also means Olo grows as revenue per location grows. Olo’s 51% growth in year over year (YoY) revenue per location plus its users 7Xing average spend from 2018-2020 (to $21 million) both provide explicit evidence of this approach working.

Rails and Dispatch are much newer products than the Ordering module. As these modules continue to gain traction, transaction revenue as a portion of total sales will continue to increase. That trend is playing out with 71% of Olo customers using all 3 core-company modules as of December 31, 2020 (Ordering, Dispatch and Rails) vs. 44% YoY.

5. Olo’s Market

As mentioned above, in recent quarters Olo has adjusted its internal goal of touching 51% of total restaurant transaction volume to now 100% as it works to bolster its on-premise offerings. With this new ambitious target, it has opened itself up to a restaurant total addressable market (TAM) expected to reach $1.1 trillion by 2024 — per The Freedonia Group.