Introducing Palantir:

This is a new name being added to my coverage network. It’s not a holding, but it is a company that I’m constantly asked to follow (and is a fascinating name too). I thought it would be valuable to offer a brief introduction with a 30,000 ft view of what Palantir actually does. This should help frame future discussions about it.

Palantir is a software company that helps customers get the most out of their structured and unstructured data. Like many others, it pulls from years upon years of AI/ML work to automate insight-gleaning. It utilizes complex neural networks to power anomaly detection, trend forecasting and natural language processing too. Overall, it frees clients to aggregate and conjoin disparate data sources and utilizes its software to connect data dots and uncover ideas that manual analytics as well as legacy competition cannot match. It gives customers a birds-eye view of their operations with detailed suggestions to help optimize pieces of their enterprises.

Revenue is neatly split into two buckets – “Government” and “Commercial.” Government clients predominantly use its Gotham Product Platform while Commercial clients mainly use its Foundry Product Platform. With Gotham, Palantir routinely builds custom use cases for individual government clients. Foundry was built to be more malleable with far more pre-built app integrations available. That diminishes the need to conduct custom builds for commercial clients.

It has also seamlessly molded the commercial platform to cater to industry-specific needs. By-industry models are intuitively named “micro-models” and boast sector-specific use cases and regulatory compliance help. A financial services model from Palantir, for example, may specialize in assessing credit risk or fraud detection.

Palantir Apollo is its software suite, which provides continuous integration and continuous delivery (CI/CD) to automate software package building and deployment. It’s a foundational piece of the firm’s ability to collect, leverage and drive value from broad data ingestion. Apollo ties very closely into Foundry and Gotham as a software enabler for both platforms.

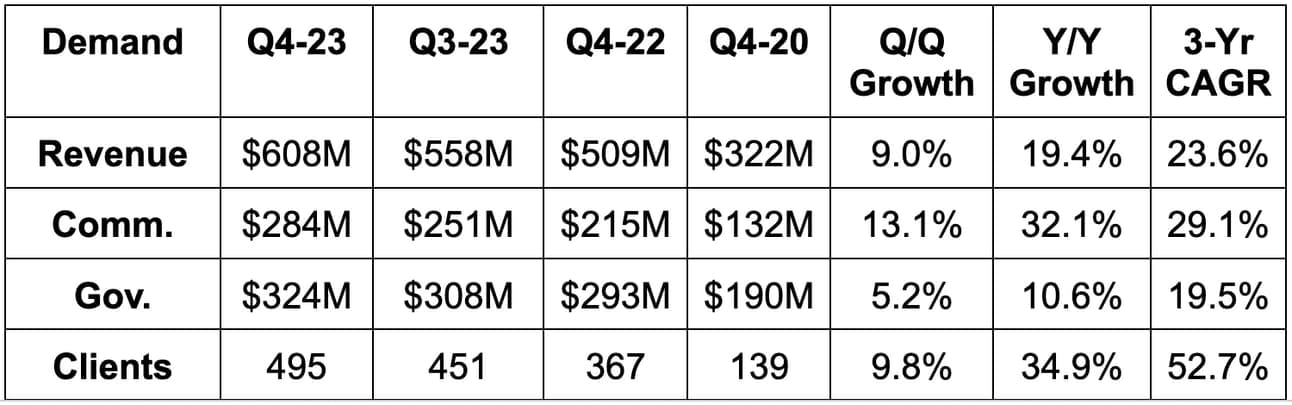

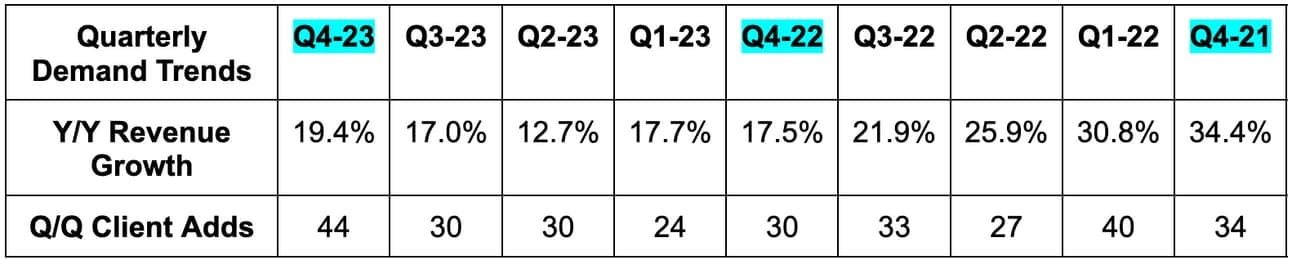

1. Demand

Palantir beat revenue estimates by 0.9% & beat guidance by 1.2%. Commercial revenue was about 5.2% better than expected while government revenue was 2.7% worse than expected.

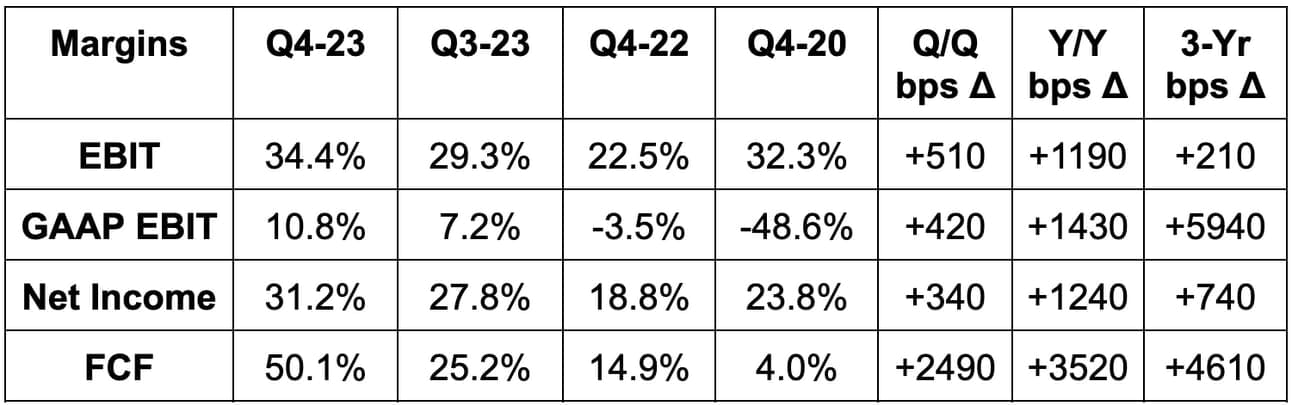

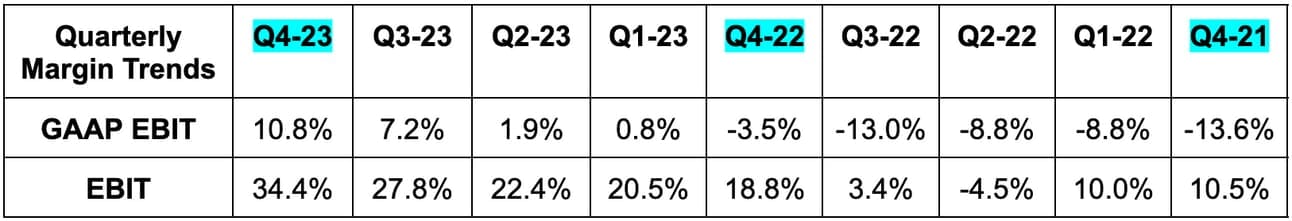

2. Profitability

- Beat EBIT estimates by 6.8% & beat EBIT guidance by 12.6%.

- Beat $0.03 GAAP earnings per share (EPS) estimates by $0.01.

- Beat 81.7% GAAP gross profit margin (GPM) estimates by 40 basis points (bps; 1 bps = 0.01%).

For the full year, Palantir generated $0.09 in GAAP EPS vs. -$0.18 Y/Y. Strong profit inflection.

3. Balance Sheet

- $3.7B in cash & equivalents.

- No traditional debt.

- Diluted shares rose 7% Y/Y; basic shares rose 4.6% Y/Y. This is the most negative part of the report.

- Please note that quarterly free cash flow generation is lumpy.

4. Annual Guidance & Valuation

Palantir met annual revenue expectations for 2024. It sees 40%+ Y/Y commercial revenue growth for the year.

Palantir beat annual EBIT estimates by 14.2%. Adjusted FCF guidance of $900 million is also much better than expected. It sees positive GAAP EBIT and EPS for all four quarters, as expected. This is despite a planned ramp in 2024 operating expenses (OpEx) to support growth. Palantir sees EBIT and net income margins expanding Y/Y, which is better than the flat Y/Y margins analysts expected coming into this report. Expect upward profit revisions in the coming weeks following its great profit guide.

Palantir trades for 40x 2024 EBIT guidance and about 38x 2024 adjusted FCF guidance. EBIT is expected to grow by 33% Y/Y and adjusted FCF is expected to grow by 23% Y/Y.