Table of Contents

- a. Key Points

- b. Demand

- c. Profits & Margins

- d. Balance Sheet

- e. Guidance & Valuation

- f. Call & Release

- g. Take

PayPal provides branded omnichannel checkout and financial services to a massive base of consumers and merchants. It also provides non-branded payment processing through Braintree, payouts-as-a-service through Hyperwallet, identifiable guest checkout through Fastlane and it owns Venmo. To read up on everything there is to know about PayPal, my deep dive can be found here. Aside from financials (which I update every quarter), most of that information is still relevant and mostly current.

a. Key Points

- Solid quarter and noisy guidance.

- Venmo monetization is ramping and Braintree conversations are ongoing.

- Stable branded checkout growth.

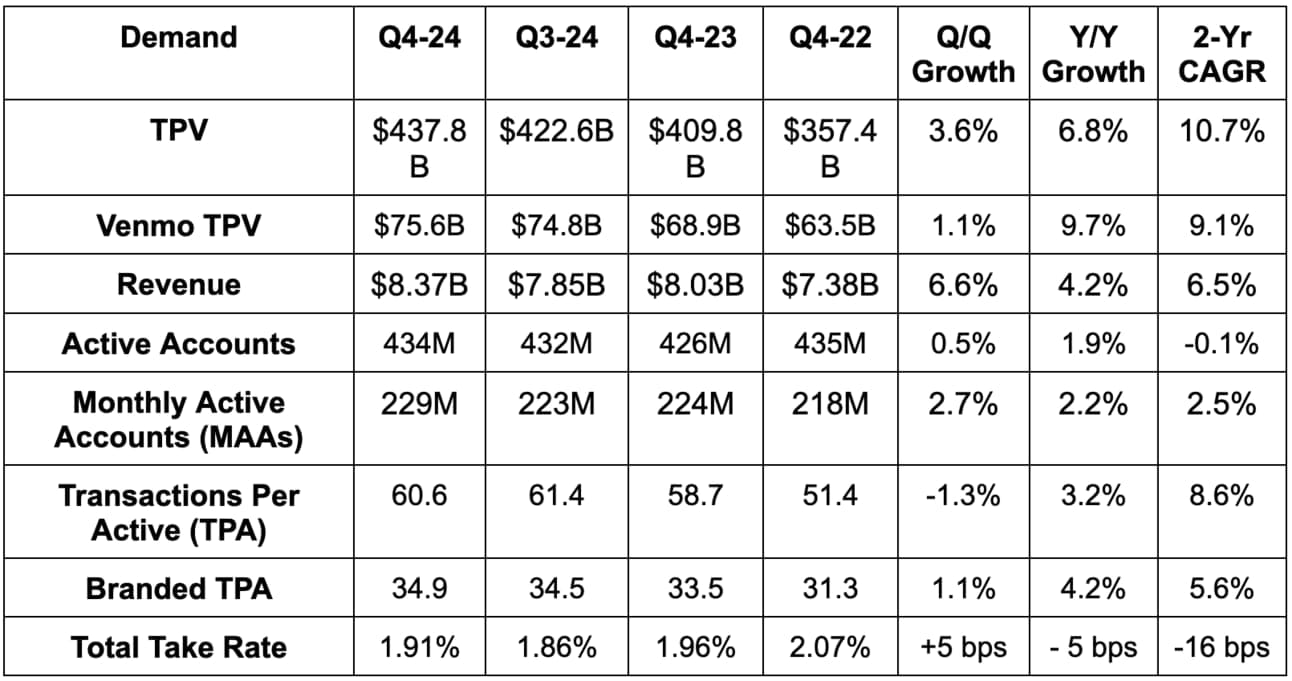

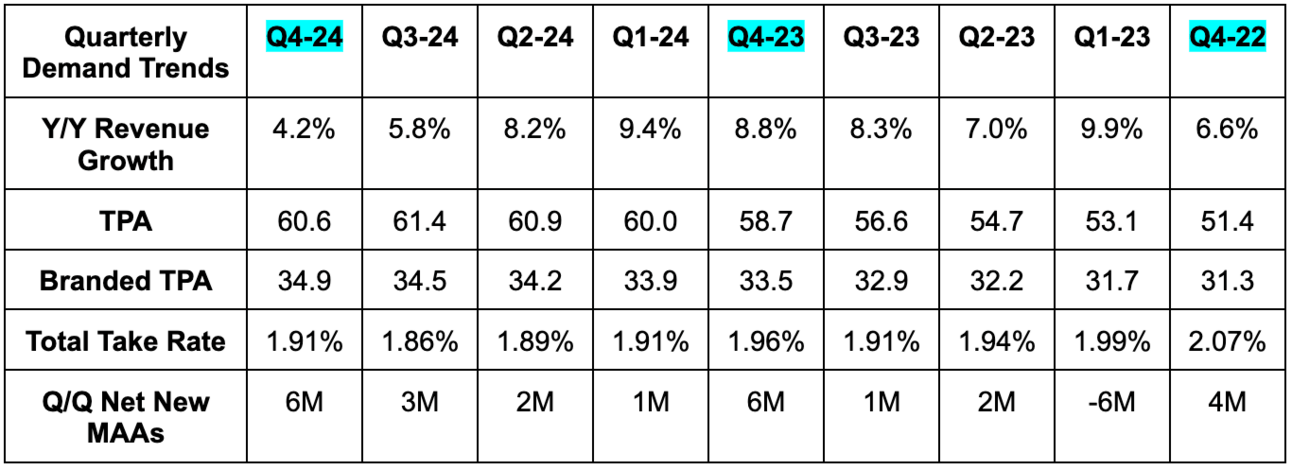

b. Demand

- Beat revenue estimates by 1.2% & beat low-single-digit growth guidance.

- Beat transaction revenue estimates by 0.6%;

- Foreign exchange neutral revenue growth was also 4% Y/Y.

- Slightly beat total payment volume (TPV) estimates by 0.3%.

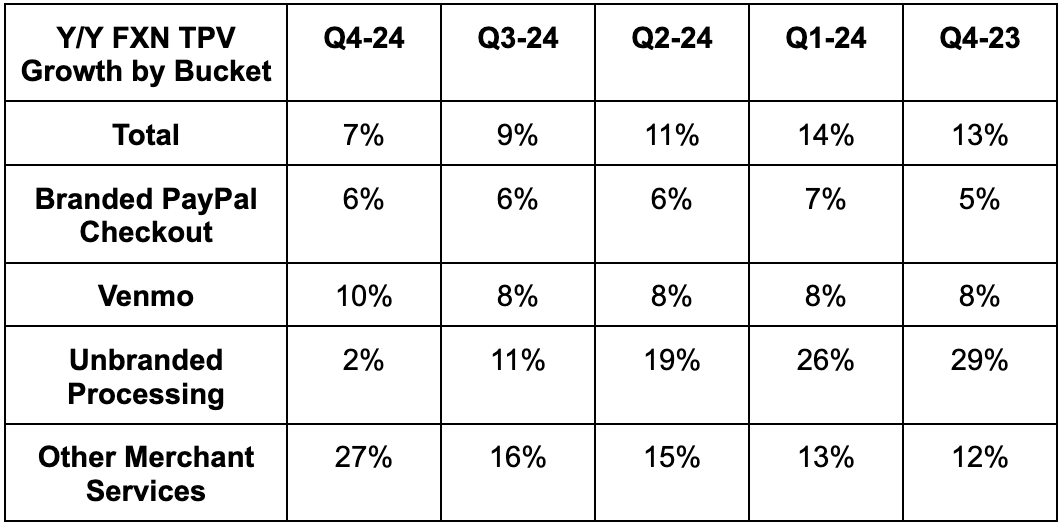

- 6% branded checkout growth missed 7% growth estimates.

- Venmo beat volume estimates by 0.5%.

- USA volume growth accelerated by 3 points Q/Q; international volume growth slowed by under a point. This was related to European macro softness. It continues to take market share in Europe.

- Beat new account estimates by 1M. PayPal and Venmo consumer accounts rose Y/Y. Venmo active accounts rose 4% Y/Y.

- Value-added services revenue was roughly flat Q/Q and rose by about 5% Y/Y. This was powered by a “return to growth in credit revenue.”

- Payment transactions fell 3% Y/Y due to Braintree contract renegotiations and price hikes to prioritize profit over volume there. Excluding Braintree, payment transactions rose 7% Y/Y.

- Other merchant services volume acceleration continued to be driven by Hyperwallet (payouts).

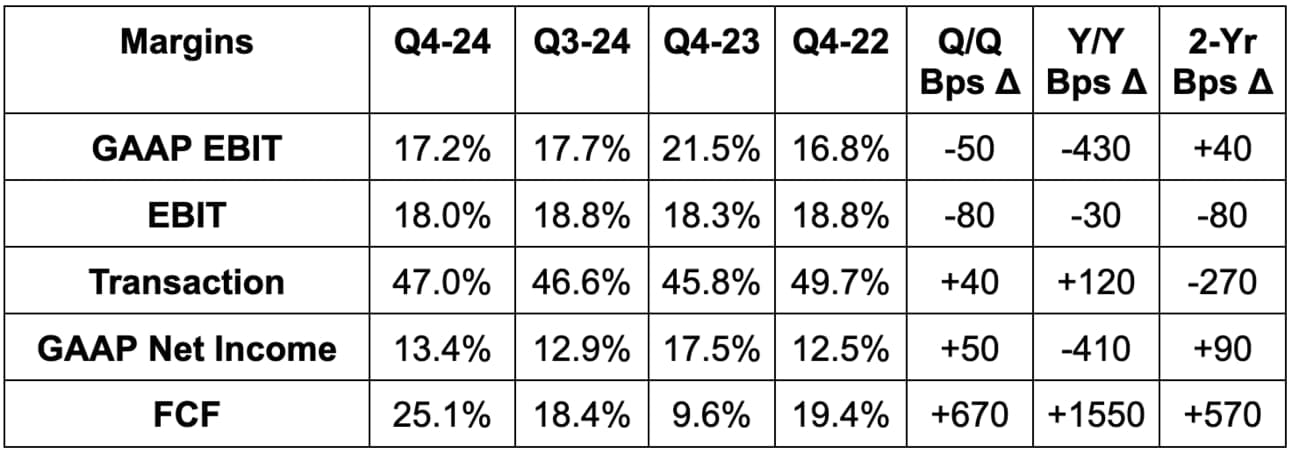

c. Profits & Margins

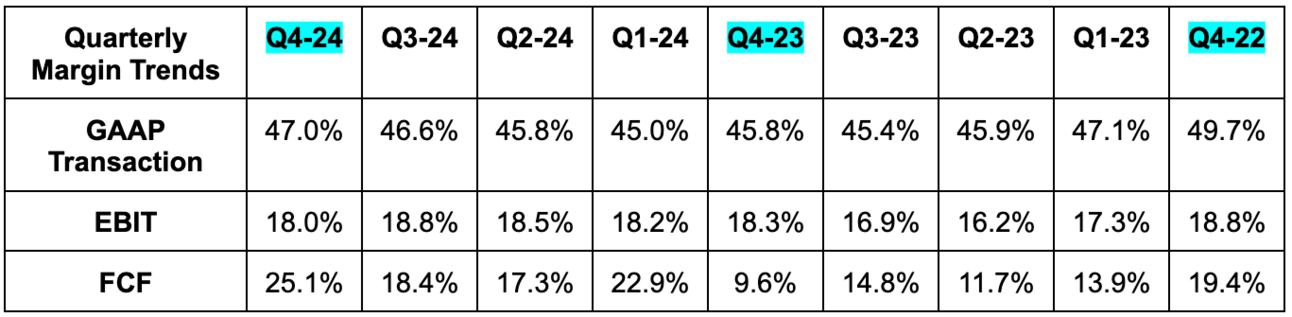

- Beat 45.8% transaction margin estimates by 120 bps.

- Transaction margin dollars rose by 8% Y/Y vs. 7% Y/Y last quarter. Slowing was due to a smaller net interest income tailwind via lower rates. Excluding this impact, growth was stable at 6% Y/Y.

- Beat $1.14 EPS estimates by $0.05 & beat EPS growth guidance. EPS rose by 5% Y/Y, which beat guidance calling for a small Y/Y decline. This was driven by both outperforming demand and continued cost discipline.

- Non-transaction OpEx rose by 10% Y/Y, as it deferred a lot of 2024 marketing expenses to Q4.

- Beat FCF estimates by 59% & beat guidance by 53%.

While continued customer balance helped transaction margin dollar growth, that was not the main benefit here. That matters a lot, considering rates are falling and the net interest income growth tailwind is going away. Branded checkout volume, Venmo and profitable Braintree growth were all more structural growth drivers of this all-important metric for the quarter.

d. Balance Sheet

- ~$11B in $ & equivalents; $4.6B in investments.

- $11B in total debt.

- Diluted shares fell 6.5% Y/Y.

- New $15B buyback worth 17% of the market cap.

e. Guidance & Valuation

For Q1, PayPal guided to 0%-3% revenue growth, which missed 4% growth estimates. This is disappointing, but more context is needed. As a reminder, PayPal is actively renegotiating Braintree contracts to accept lower volume in exchange for more profit and hopefully software add-ons too. This is leading to a full 5-point reduction to full-year revenue growth estimates. The impact for Q1 was called especially “heavy,” which to me explains the miss. Conversely, this move will add 1 point to transaction margin dollar growth for the year. Revenue growth is expected to materially reaccelerate for Braintree and the overall company as we move beyond these contract negotiations. This is why 5% transaction margin dollar growth estimates actually slightly beat estimates. Finally for Q1, low single-digit non-transaction operating expense (OpEx) guidance enabled a $1.16 EPS guide, which beat $1.13 estimates.

PayPal is still not offering formal annual revenue guidance, but we got a lot of other good color. It expects stable mid-single digit branded checkout growth in 2025, which missed some analyst targets hoping for modest acceleration. This guidance was offered on the call. At the midpoint, it expects 4.5% transaction margin dollar growth. This is ahead of estimates ranging from 3.5%-4.0%. This beat is despite an expectation of rising transaction losses as it accelerates credit originations (more later). The beat is also despite net interest income flipping from a tailwind to a $150 million headwind in 2025. Without this item, guidance calls for at least 5% Y/Y growth. FCF guidance missed by 4.5%. Note that it expects about $250 million in Y/Y CapEx growth to support business scaling. It also expects cash taxes to flip from a profit growth tailwind to a headwind in 2025. Lastly, it expects $6 billion in buybacks.