I did some adding today. Mr. Market is reacting to a red-hot jobs report, which adds doubt over the pace of rate cuts. I don’t know about you, but I’ll take a healthy consumer and better-than-expected employment over a deteriorating economy and a frantic need to cut rates more. Consumer spending powers 70% of economic growth, and that spending should remain resilient with rock-solid hiring and wage numbers.

Furthermore, the disinflationary trend remains firmly intact in my view. The Y/Y inflation metrics being cited still include a few months of hotter readings that will soon be lapped. And when looking at 6 months, for example, we don’t need much more meaningful progress to approach the Fed’s 2% target. Just more of the same for a chunk of time. With housing disinflation still working its way through the system, I view today’s economic data releases as supporting a soft landing and Goldilocks thesis more than anything. And? If Mr. Market wants to throw a fit because of all of this, I’ll take advantage. For context, my most rate-sensitive holding today is SoFi. The company explicitly said all they needed to reaccelerate their growth engine was 2 rate cuts. We’ve already gotten 3.

I also think preliminary talks from some on the next Fed move being a hike are unfounded at this point. Things could change with sharply worsening economic data, but that has not at all surfaced. If it does, I’ll change path accordingly.

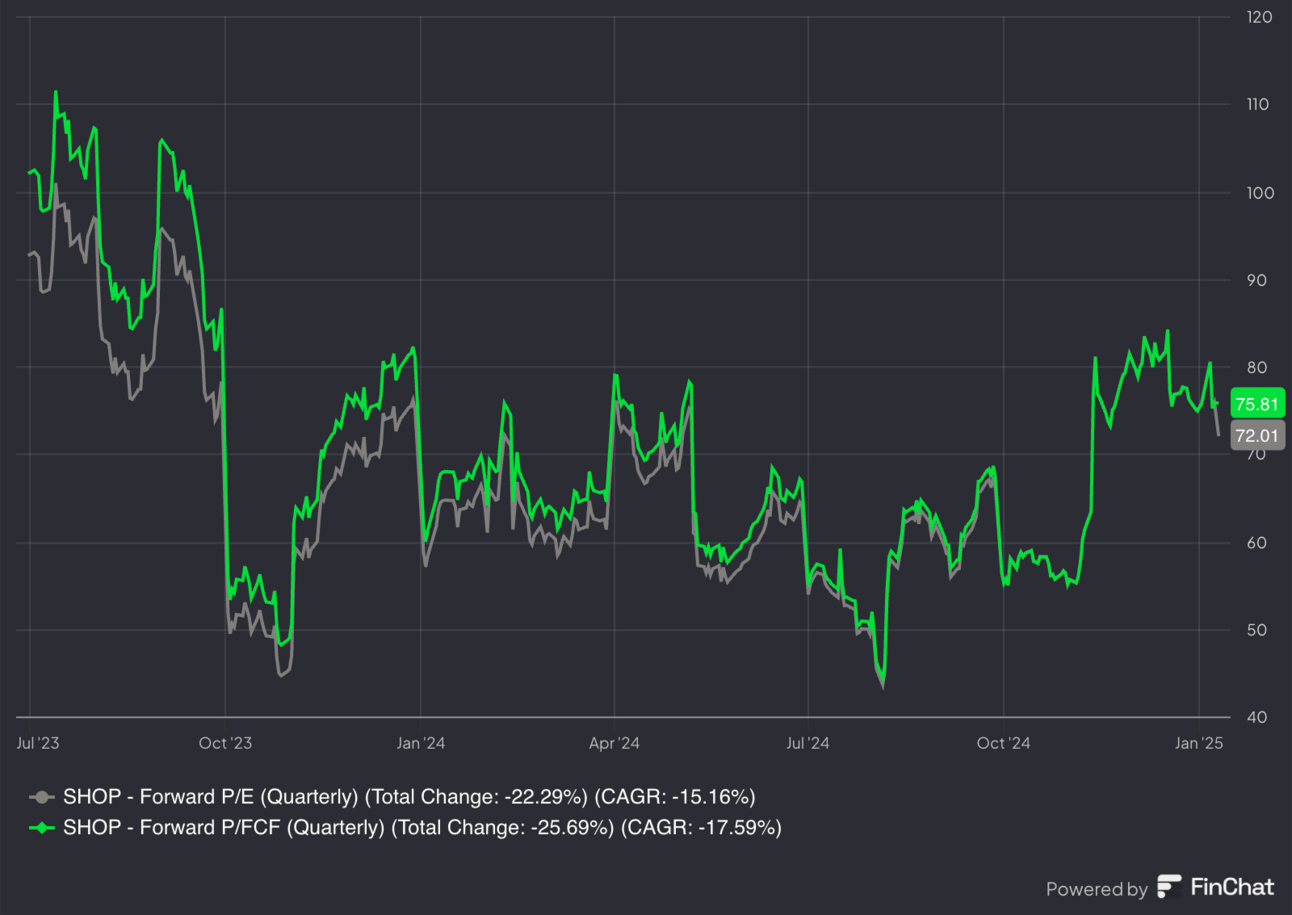

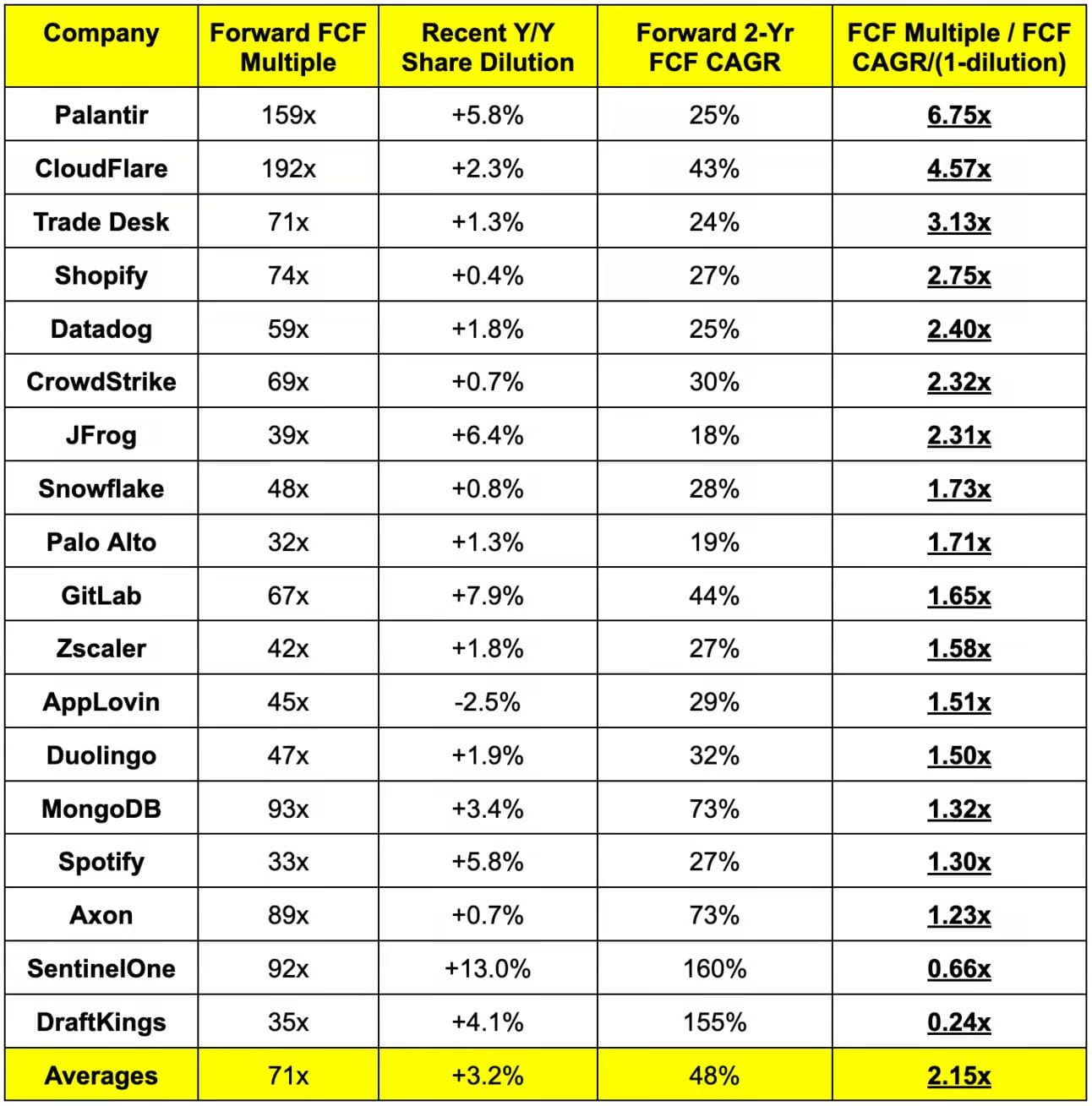

For the most part, the highest-flying names I own are the ones pulling back the most. Many of these are still up 50%+ on a 90-day basis and many still have not given back a lot of the multiple expansion recently enjoyed. I’m still not ready to resume accumulating shares of my more expensive holdings like Shopify or Trade Desk, but there are a few areas where I think things are compelling enough to add.