1. The Holdings

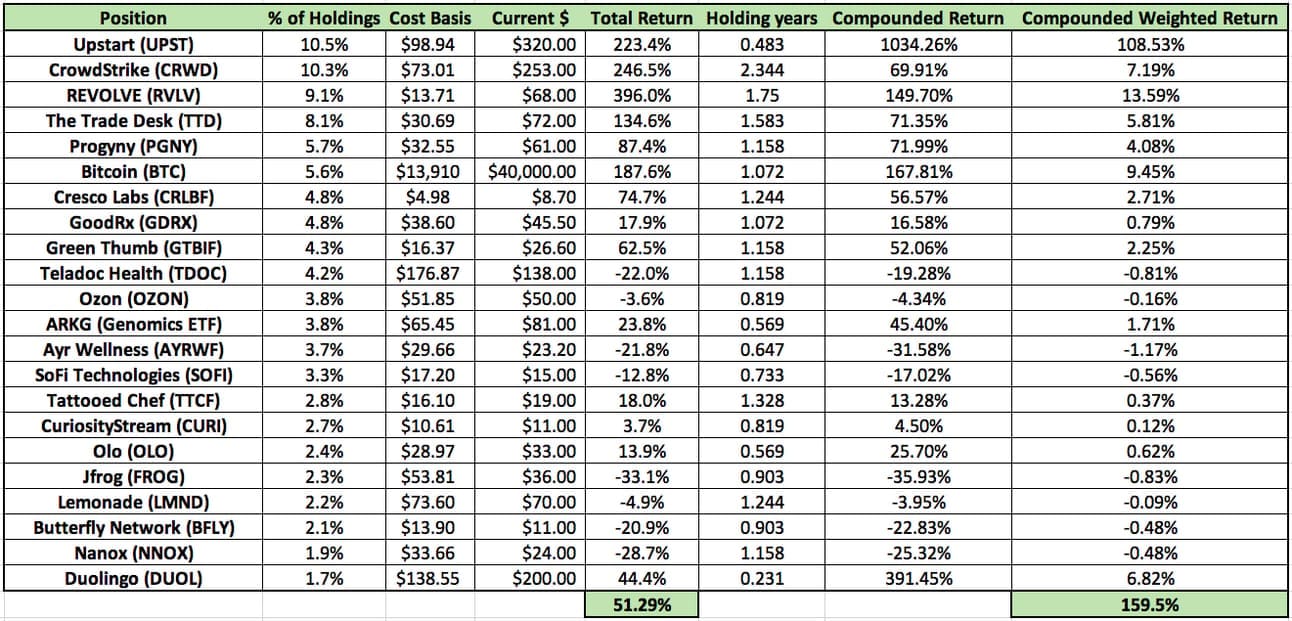

a. High Growth Disruptor Portfolio

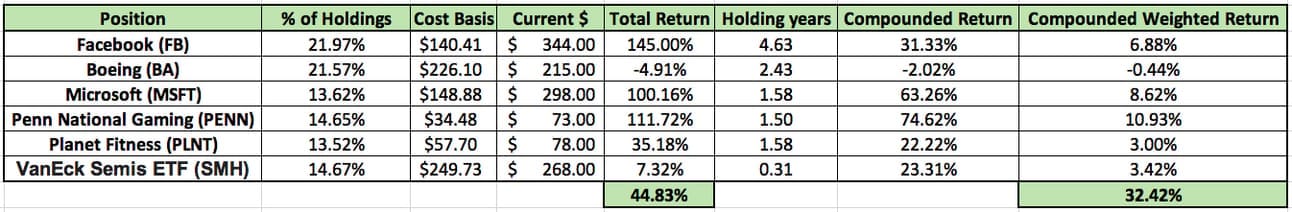

b. Mature Value Portfolio

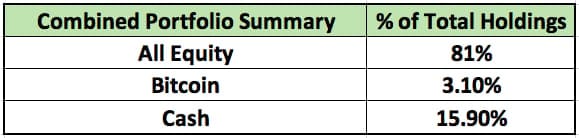

c. Summary

The 81% from “all equity” represents the total ownership from both equity portfolios depicted above. I consider my 15.9% cash position available for accumulating shares in both of my equity buckets. It is not split into different groups but accounted for as one cash position.

2. Summing Up Earnings Season

Another earnings season has now come and gone. Detailed commentary on all 25 reports can be found on my Substack feed. After reading through the reports of all 25 positions, here are the key takeaways:

a. The Stand Out

Upstart delivered a remarkable beat and raise in every metric imaginable — just like it did in its previous two quarterly reports. Click here for my overview of the results. All three quarters since Upstart went public have been phenomenal.

To put things into perspective, in this quarter Upstart earned in profit what analysts were expecting for the entire year and raised its 2021 revenue outlook by another 25%. When it went public, expectations were for the company to generate roughly $350 million in 2021 revenue — it now expects $750 million. Go team Upstart.

b. The Good

The following companies modestly exceeded expectations while also raising guidance:

High growth disruptor portfolio: