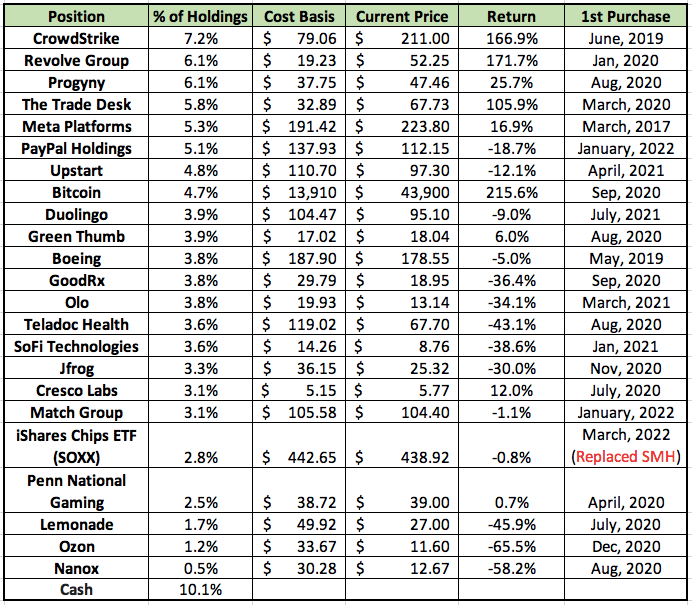

1. My Holdings

Note that this portfolio chart does not include exited positions such as ViacomCBS (thank you Bill Hwang) and Royal Caribbean which represent 2 of my most successful investments ever. It also doesn't include companies like Butterfly Networks and CuriosityStream which represent two of my worst.

New positions this quarter:

- PayPal Holdings

- Match Group

Watch List:

- Shopify -- I will post a condensed Shopify thesis in a News of the Week article and begin covering the name this quarter. I've made no final decision to start a position, but it's likely that I will own it as some point in the future.

- Airbnb

- Sprout Social

- SentinelOne

2. Summing Up Another Earnings Season

a) The Stand-outs

Revolve Group:

The global online retailer is supposed to be struggling with supply chain issues, input cost inflation and underwhelming e-commerce growth as the industry laps pandemic comps, right? Not so fast. Revolve's management team continues to deliver elite quarter after quarter despite numerous headwinds it has had to continue to successfully navigate.

The company posted an 8.5% revenue beat for the quarter with sales growing 70.3% YoY while its 2-year growth rate continued brisk acceleration from 58% to 63% YoY. As we move through strange YoY comps, growth should slow back to Revolve's long run target of 20%+, although it expects to comfortably surpass that benchmark even after 54% sales growth in 2021.

It reversed a 5-year trend of average order value (AOV) falling (as management told us would happen) and it broke (crushed really) last quarter's customer adds record with 162,000 additions. Revolve's leadership even offered guidance into the first seven weeks of its next quarter (Q1 2022) with results continuing to be exceedingly strong. From a profitability perspective, despite macro issues that other competition readily blamed, Revolve more than doubled its earnings estimates. It also set a new adjusted EBITDA margin record with outperforming gross margin of 55.0% for 2021 as a whole -- which is already at Revolve's long term goal.

How is this company seemingly insulated from somewhat daunting exogenous headwinds?

- Revolve's luxury niche and lofty AOV both make its customer cohort generally less price conscious than other areas of the market.

- Revolve has been able to combat the margin hit from rising freight costs with things like:

- thriving owned-brands growth (margin accretive).

- a record percentage of sales at full price.

- outperforming top line growth extracting more variable profit out of the portion of Revolve's cost base that's fixed.

- 12% lower fulfillment cost YoY thanks to automation and other operational efficiency gains.

- Revolve sells clothing people wear to go out, go to work and "look and feel their best." It also markets heavily at live events. These two factors actually translate into it being a net beneficiary from the pandemic fading away despite being an e-commerce company.

Upstart:

Another quarter, and another absolute masterpiece delivered by Upstart's team. The company's revenue beat analyst expectations by 16.3% while it posted a 19.3% GAAP net income margin vs. implied expectations of 7.0%. That is not a typo.

Its 2022 revenue guide was 15.7% ahead of expectations despite tightening credit markets and a tougher macroeconomic climate for the company overall. Upstart's 2022 EBITDA guidance was light, but for perhaps the most ideal reason: Its auto business is ramping faster than expected. That allowed the firm to offer a $1.5 billion 2022 auto origination volume guide which will weigh on short term margins as the product ramps and matures (and so becomes more profitable over time). 2023 and 2024 EBITDA expectations from analysts exploded higher after the call to depict confidence in this being "controllable and intentional" like Dave Girouard said it is.

7 partners have now dropped all FICO score minimums which depicts growing confidence in Upstart's risk underwriting and the company even authorized a $400 million share buy-back to take advantage of its stock's volatility, profitability and balance sheet strength. It continues to invest heavily into new growth vectors but its unique unit economics allow it to walk and chew gum at the same time.

As the company told us would occur, default rates have begun to tick up as the world distances itself from stimulus and payment holidays and as credit mix evolves. There's been no impact on its loan performance as Upstart's underwriting model has assumed these changes in its risk assessment. It expects to continue seeing no impact -- hence the strong 2022 guide. We'll see if it can continue to deliver solid results into an increasingly difficult operating environment.

Click here for my Upstart Deep Dive.

b) The Good

The following companies materially exceeded expectations while also offering up-beat guidance:

- CrowdStrike

- The Trade Desk

- Duolingo

- Ozon

c) The Fine

The following companies reported roughly in-line results and guidance:

- Teladoc Health

- JFrog

- Olo (click here for my Olo Deep Dive)

- SoFi Technologies

- Green Thumb Industries

- Penn National Gaming