Today’s article is powered by Savvy Trader, the company allowing me to offer free text message transaction alerts. To sign up, click here.

1. My Holdings — September 2022

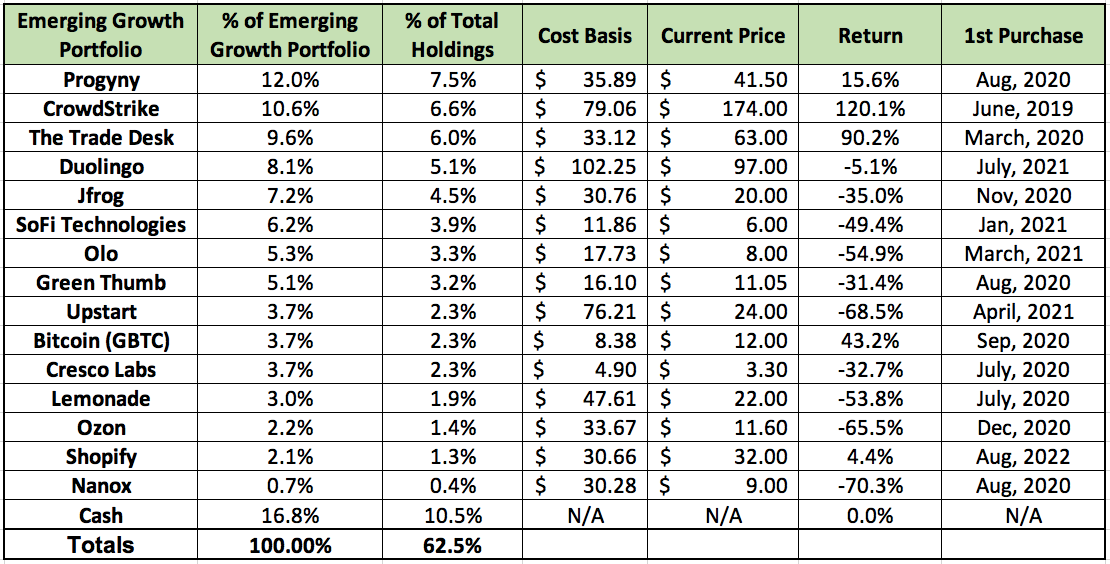

a) Emerging Growth Portfolio

Please note that I do not include exited positions like FedEx, Royal Caribbean, Planet Fitness, Goldman Sachs, Microsoft, Viacom etc. which have represented my best investments to date.

I exited GoodRx this quarter and initiated a new position in Shopify.

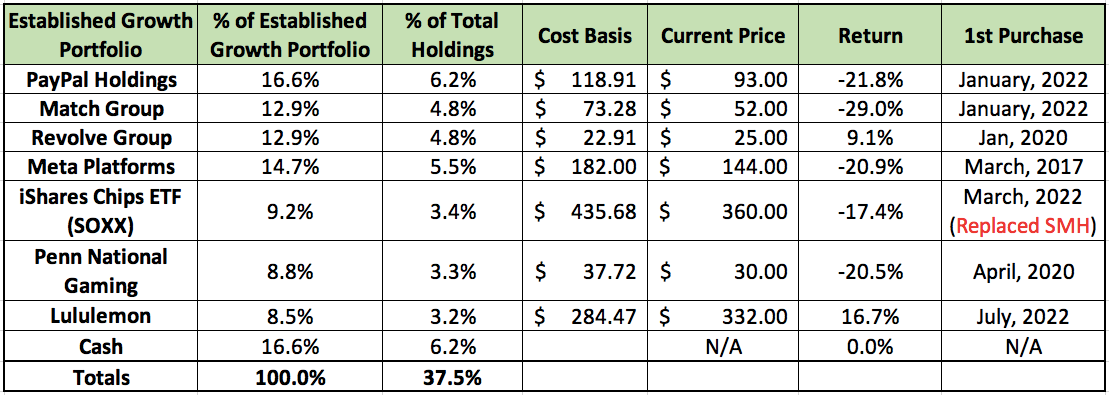

b) Established Growth Portfolio

c) Watch List

- Chipotle

- Airbnb

- Adyen

- Sprout Social

- Planet Fitness

- FedEx

- Wingstop

2. Summing Up Another Earnings Season

a) The Stand-Outs

Lululemon:

2022 has been a year to forget for the consumer discretionary category. Even for more affluent-focused brands like Revolve, times became abruptly more difficult while demand and margins grew more challenging. Lululemon did not get the memo.

This company posted a masterpiece quarter in every sense of the imagination. Demand remains incredibly robust with up-beat forward expectations as well. International growth recovered ahead of schedule, and it took more category marketshare than any other competitor during the quarter at 1.4% incremental gains. New categories are working. Legacy categories are working. It’s all working.

From a margin standpoint, things were equally positive. Gross margin held up admirably (regardless of large freight and FX headwinds not impacting it as materially last year).

“We are pleased to see some promising signs of supply chain improvement yet recognize further normalization will take time.” -- CEO Calvin McDonald

Operating and net margins both materially expanded, and the firm crushed profit per share estimates with guidance well ahead of forecasts as well. The company has been obsessively monitoring macro trends to seek out the weakness that its competition has cited — but it has seen no deterioration to date. This continued healthy traffic is also not being created via promotional activity, but largely at full price.

The ONLY slight negative from the report was the 85% YoY rise in inventory levels. But the reasoning eased that concern for me entirely. First — and most importantly — demand remains very strong and it feels like it’s “better positioned for the fall season” than it had been a year ago. Recall that 2021 was a period when Lulu was dealing with frequent supply outages and “leaving demand on the table.” The spike is its response to ensure that issue doesn’t recur. It anticipates zero pricing promotion to work through the new inventory — meaning it won’t weigh on margins.

Times are getting tough, but Lululemon seems to be tougher.

Duolingo:

Duolingo is quickly establishing itself as a quarterly stand-out. Countless app-based businesses have struggled with the post-pandemic hangover paired with macro pain in 2022; results have suffered as a result. Duolingo has managed to side-step all of this. How? Perhaps it’s the company’s prominent position in nearly half of American classrooms… maybe it’s the habitual split testing and core focus on product enhancement over marketing… or maybe it’s the robust word-of-mouth growth it gets because of that. Whatever the cause is, it’s working.

Bookings beat estimates by 11%, conversion from free to paid users materially accelerated and users overall continued to easily set company records. Again, this is not a Pinterest or a Snapchat — its model is proving to be far more durable across economic cycling.

“Subscribers as a percent of MAUs has outperformed what I thought would happen... I don’t see a reason why this can’t get to the mid-teens.” — Co-Founder/CEO Luis von Ahn

The company earned a slight EBITDA profit with expectations to be EBITDA negative, its gross margin continued to expand to an even more robust 73% and it exponentially (small base) raised its EBITDA guide for the rest of the year. Not bad.

The app is again live in China, finding rapid growth in India and quickly establishing itself as a digital education juggernaut.

“The macro environment is pretty crazy, but so far we have seen no weakness in our numbers whatsoever. We expect strong numbers… no layoffs are coming and we continue to hire.” — Co-Founder/CEO Luis von Ahn

b) The Good

The following companies materially exceeded expectations while offering up-beat guidance:

- CrowdStrike

- The Trade Desk

- Progyny

- JFrog

- SoFi Technologies

- Lemonade

- Penn Entertainment

c) The “Meh”

The following companies reported roughly in-line results and guidance with perhaps a bit of downside amid chaotic macro:

- Nanox

- PayPal Holdings

- Green Thumb (no guide like always)

- Cresco (no guide like always)

- Shopify

d) The Underwhelming

The following companies reported results that I found disappointing: