1. Shopify (SHOP) Q2 2023 Earnings Review

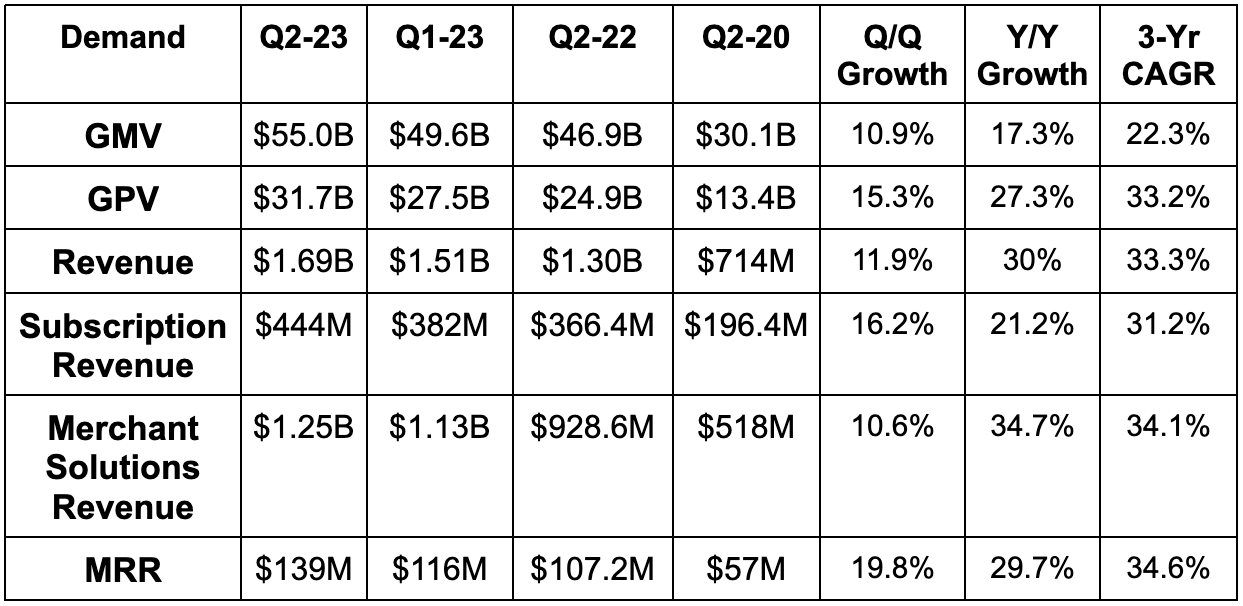

a. Demand

Beat revenue estimate by 4.3% & beat guidance by 4.3%.

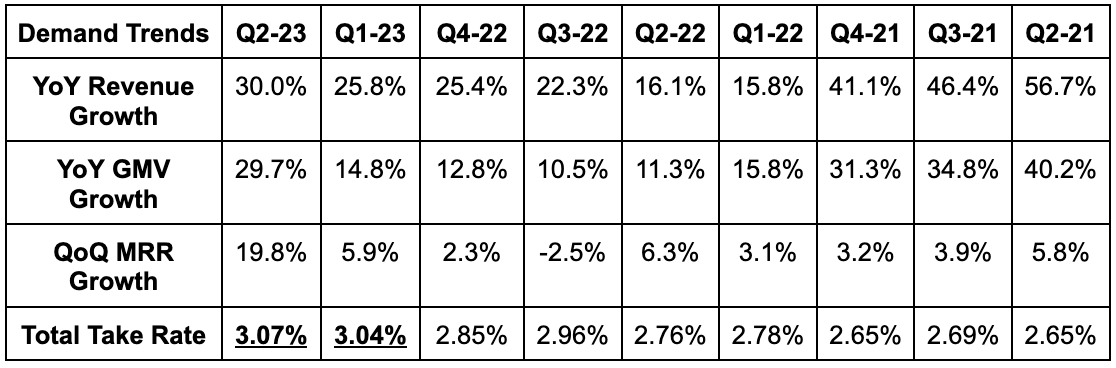

Demand Context:

- 22.3% 3-yr revenue CAGR vs. 41.8% Q/Q & 50.7% 2 quarters ago.

- Gross payment volume (GPV) = 58% of GMV vs. 53% Y/Y.

- Monthly recurring revenue (MRR) growth was helped by price hikes on standard plans which also led to Shopify Plus as a percent of MRR falling from 31% to 29% Y/Y. Churn from the hikes was very minimal.

- Social channel GMV rose nearly 100% Y/Y.

- Shop Pay crossed $100 billion in total GMV since launching in 2019.

- Ex-fulfillment (which was still a part of Shopify for part of this quarter) revenue growth was 28% Y/Y.

- Total take rate was 3.01% ex-fulfillment.

- Growth greatly outpaced industry benchmarks as it rapidly takes more share.

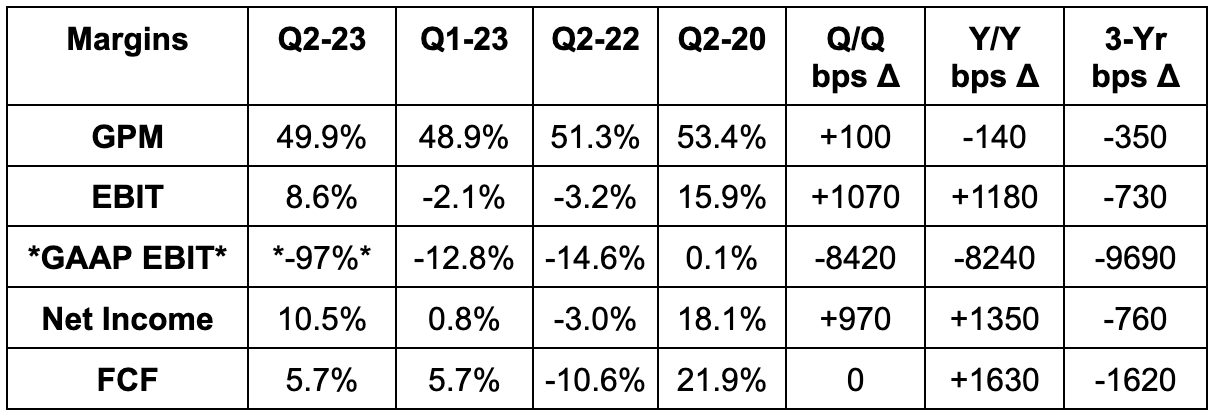

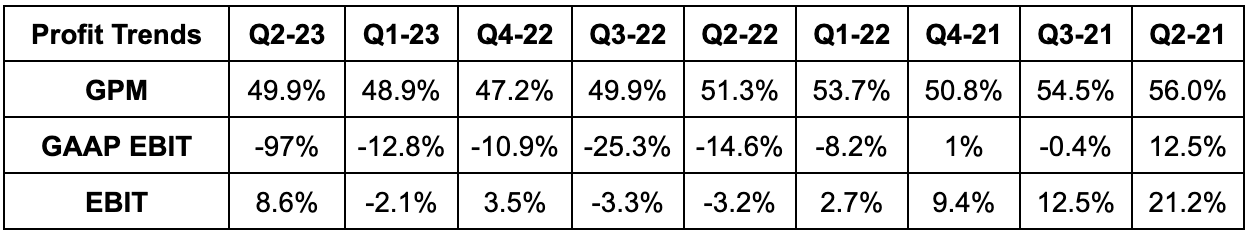

b. Profitability

- Beat EBIT estimate by 137% & beat guidance by 136%. Not a typo.

- More than tripled free cash flow (FCF) estimates with $97 million in FCF.

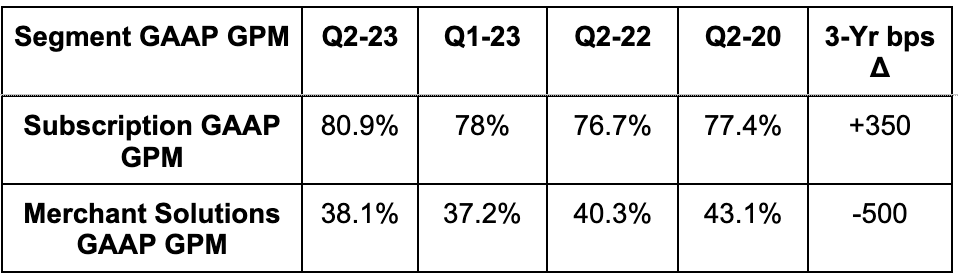

- Beat 48.9% gross margin (GPM) estimate by 100 bps.

Margin Context:

- GAAP EBIT was hit by a $1.6 billion charge from selling Shopify Fulfillment Network and severance. When these items roll-off, its GAAP operating income will be positive.

- Merchant solutions GPM gets diluted by rapid payments growth. Importantly, payments EBIT margin is similar to subscription EBIT margin due to less operating expense (OpEx) needs.

- Still had a full month of fulfillment business expenses this quarter and 2 full months of higher headcount which both continued to weigh on margins. That headwind is now gone.

- Shopify realized about 2/3 of the OpEx benefits from cost rationalization and asset sale efforts this quarter. The remaining benefit will boost margins starting next quarter.

- Operating expenses fell 3.3% Y/Y and 10% Q/Q ex-one time charges from severance & asset sales.

c. Guidance

- Beat 17.5% Y/Y revenue growth estimate by at least 350 bps. The low 20% range growth rate would be mid 20% ex-fulfillment. Strong.

- It expects to earn over $180 million in FCF next quarter which compares to estimates calling for $30 million. Strong again.

- Gross margin guidance of 51.3% was 80 bps ahead of estimates. Exiting fulfillment is propping this up by about 350 bps.

- OpEx to grow slightly Q/Q as its benefits from exiting fulfillment and lower headcount are being re-deployed to more aggressively market in its highest ad spend return areas and products.

d. Balance Sheet

- Share count rose 1.4% Y/Y.

- $4.8B in cash & equivalents.

- $914M in convertible notes.

- Shopify Capital at $719 million in receivables & cash advances.

e. Call & Release Highlights

Point of Sale:

The company integrated Shopify Installments (buy now, pay later) into the Shopify Point of Sale (PoS) suite. Customers using this pay later option in store are delivering a 5x boost to physical average order value. Point of Sale retailers with 20+ locations on the Shopify platform saw 120% Y/Y volume growth while the PoS sales team delivered a banner quarter for new merchant wins. Offline GMV overall rose 23% Y/Y. This success will lead to it accelerating marketing investments to support the product’s rapidly growing traction.

Shopify leadership covered a lot of the product announcements it revealed at Shopify Editions last week. Click here for a review of those launches.

Bigger Merchant Traction:

- Business to business sales channel volume rose 61% Y/Y over the first 6 months of 2023.

- Hydrogen and Oxygen is its headless build platform which separates back end from front end development to bolster customization for the largest customers. The platform crossed $1 billion in cumulative GMV.

- Shopify’s re-vamped enterprise sales approach is leading to record cross-selling volumes.

- Signed Meta Quest as a new Shopify Plus brand. Meta will launch a Shopify storefront and begin selling through multiple channels. Dollar Shave Club and more Nestle and Unilever brands were also named as new Plus wins.

Checkout & Payments:

- Shop Pay delivers 15% higher conversion on average. It’s the best converting checkout product in the World.

- Shop Pay presence lifts conversion rates by 5% when it’s a merchant site option.

Sign-In with Shop:

Shopify’s payments suite will offer Sign-in with Shop. This will free Shop App accounts to checkout on any Shopify merchant page with auto-filled data. This pins it more directly up against PayPal and open internet checkout options.

Europe:

Strength in Europe surpassed any and all expectations from the team. It’s outperforming everyone else on the continent as GMV growth exceeds 40% Y/Y.

f. Takeaway

This was an elite quarter any way you want to look at it. It’s aggressively cutting costs while finding rapid demand acceleration. Find another company growing revenues at 30% Y/Y in this e-commerce environment while delivering inflecting free cash flow. You can’t. The free cash flow explosion has begun and it’s clear analysts have not come close to catching up to the pace of this ramp.

STILL, the company is extremely expensive. That is why I trimmed last month. Its gross profit multiple is more than double the market average. It deserves a hefty premium, but that feels a bit steep. I have no plans to sell any more shares, but would need a meaningful pullback to add to my stake. Wonderful performance. Two thumbs up and if I had a third that would be pointed up as well.