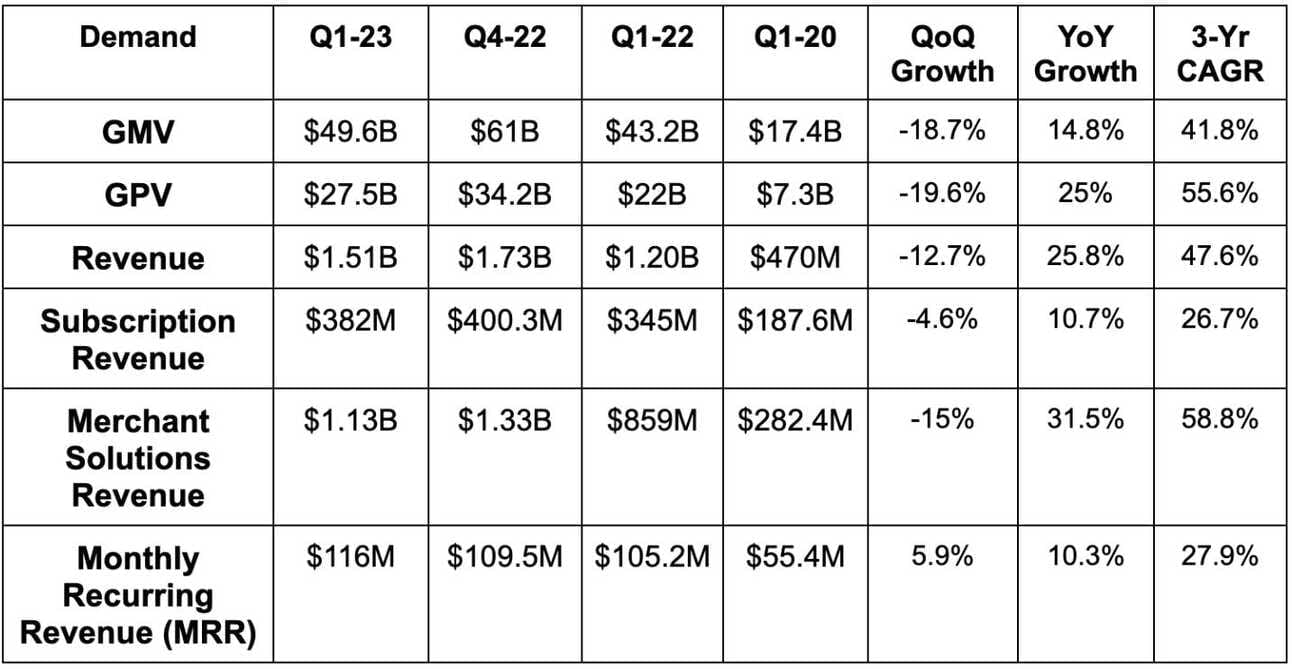

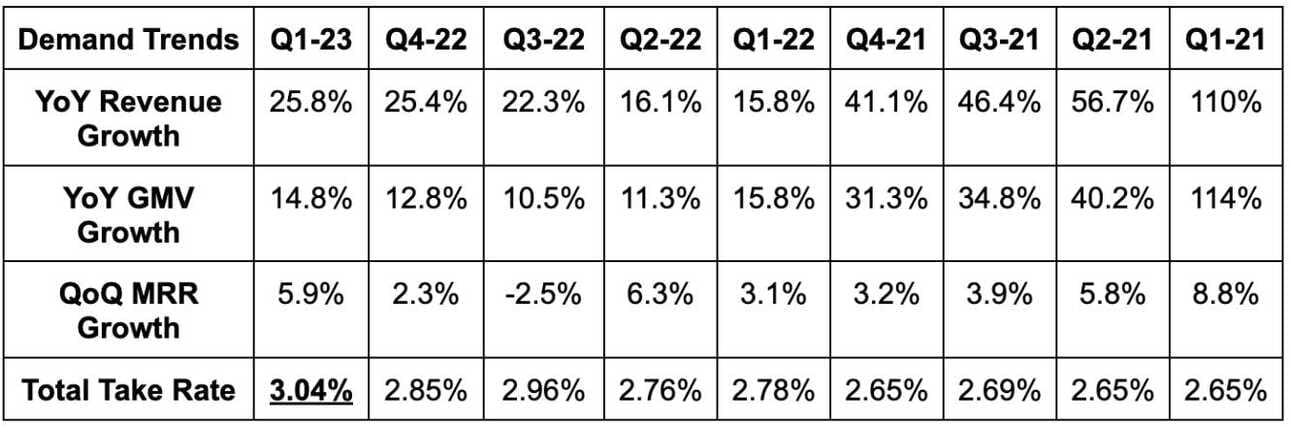

1. Demand

Shopify beat revenue estimates and its similar guide by 5.2%.

More Demand Context:

- Large outperformance was via better than feared consumer spend (especially in Europe) with a bit of help from easing FX headwinds. This makes the macro headwinds some other tech firms have blamed for poor results less believable. The cream is rising to the top. The strongest are overcoming a tough backdrop.

- Q4 is seasonally strong for demand.

- GMV rose 18% YoY FX neutral (FXN); Revenue rose 27% YoY FXN.

- GPV = 56% of GMV vs. 56% QoQ and 51% YoY.

- Plus revenue is now 34% of MRR vs. 30% YoY.

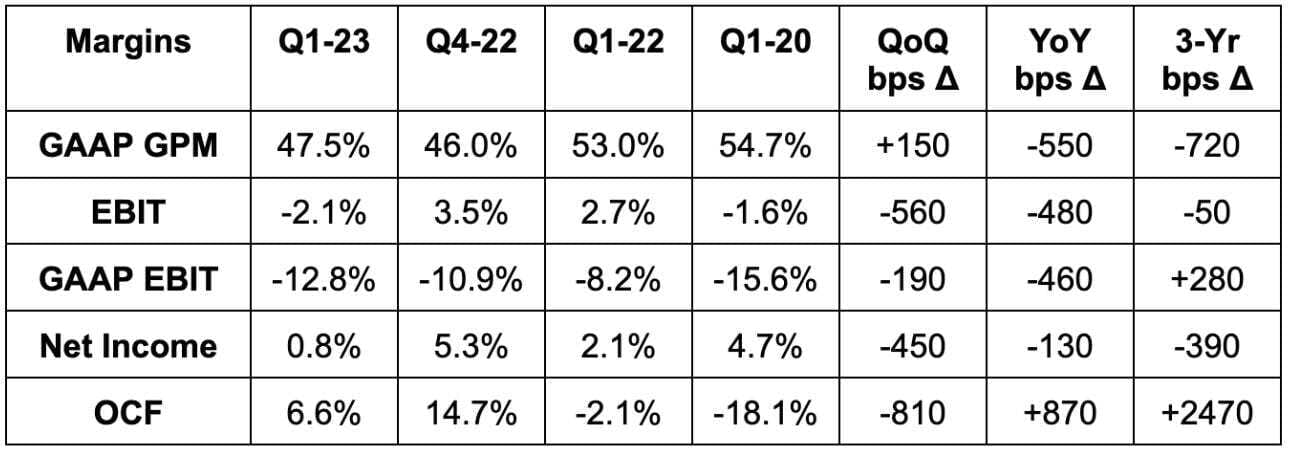

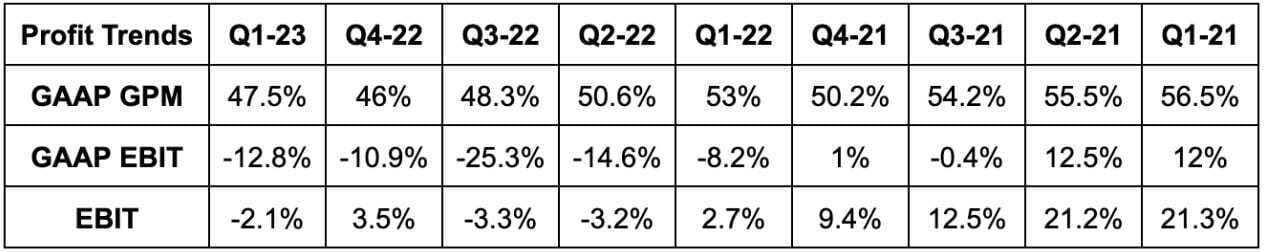

2. Profitability

Shopify slightly beat non-GAAP gross margin estimates, beat EBIT loss projections by over 50% and beat -$134 million free cash flow estimates by a whopping $222 million.

Margin context:

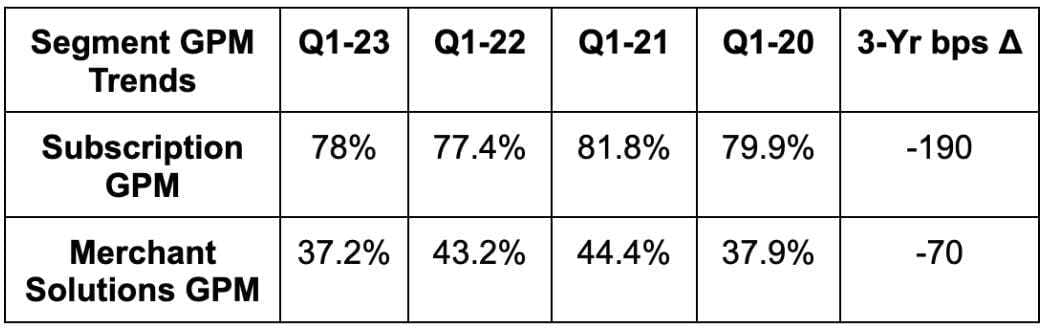

- GPM contraction is being driven mainly by its fulfillment business which will be sold this year to Flexport. More later. Other GPM headwinds are from rapid payments proliferation and a shift back from debit-funded transactions to credit-funded transactions for that business as the stimulus boosts fades.

- Importantly, Payments carries a similar EBIT profile to its subscription business due to lower operating expense (OpEx) needs.

- OpEx rose 1% QoQ via Deliverr and will decline by single digit percentages YoY starting next quarter.

- Sales and Marketing declined YoY and QoQ due to shifting external marketing strategies that led to a 50% boost in payback for Shopify.

“You will hear us talk more frequently going forward about free cash flow.” – CFO Jeff Hoffmeister

3. Guidance

- Shopify guided to roughly 26% YoY revenue growth. This beat estimates by 4%.

- It expects gross margin to be stable QoQ which is slightly ahead of consensus.

- It will take a $1.25 billion impairment and $145 million severance charge via asset sales and layoffs discussed below.

- Guidance still assumes poor macro and cautious spending all year despite signs of improvement this quarter. Under promise, over deliver.