1. Demand

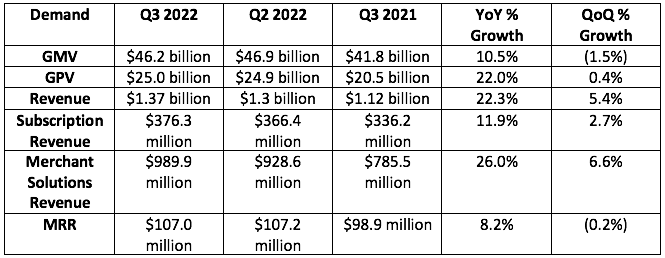

Shopify generated $1.37 billion in revenue which beat analyst estimates of $1.34 billion by 2.2%

More Context on Demand:

- Shopify’s overall GMV growth beat the industry by 22%. Offline GMV grew by 35% to greatly outpace the broader market.

- As a reminder, in Q1 2022, Shopify changed its developer revenue take rate from a flat fee of 20% to 0% on the first $1 million and 15% thereafter. This will continue to hit subscription growth through the first quarter of next year. It’s around a 400 basis point growth headwind today. Also in Q1 2022, Shopify began recognizing theme (design) sales on a net (not gross) basis which will weigh on growth through Q4 2022.

- Revenue was impacted by a 200 basis point FX headwind.

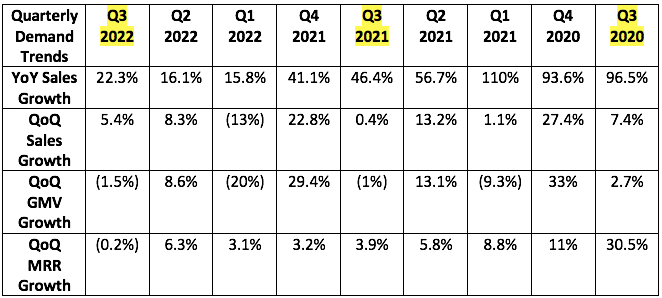

- Shopify’s 3-year revenue compounded annual growth rate (CAGR sits at a robust 52%.

- MRR growth was held back by free trial extensions during the quarter.

- Shopify Plus now is 33% of MRR vs. 28% YoY & 31% QoQ

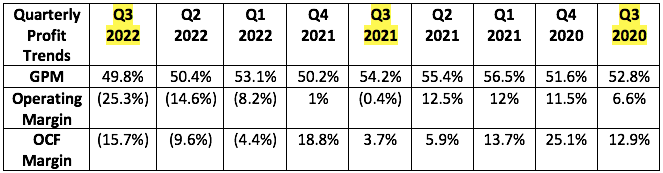

- The pandemic’s impact on Shopify’s demand (and also margins) was most positive from Q2 2020 to Q4 2021. For this reason, the company will still have very tough YoY growth comps through the end of the year. Growth is expected to sharply accelerate thereafter.

- GMV through partner selling channels like Facebook and TikTok tripled YoY.

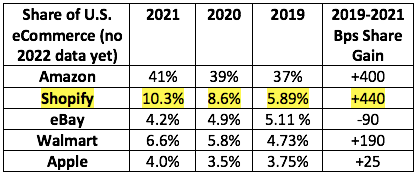

Market Share Data:

The only commentary we have surrounding 2022 market share data is Shopify consistently telling us that it’s outgrowing the market (so gaining more share).

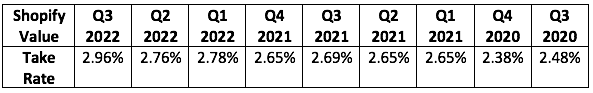

This gradual rise in take rate is a direct result of Shopify’s Merchant Services proliferation. Up-selling these services lets Shopify do more for the merchant, and so allows it to fetch a larger cut. Specifically, the merchant solution take rate set a new record high for the company at 2.14% vs. 1.38% 5 years ago.

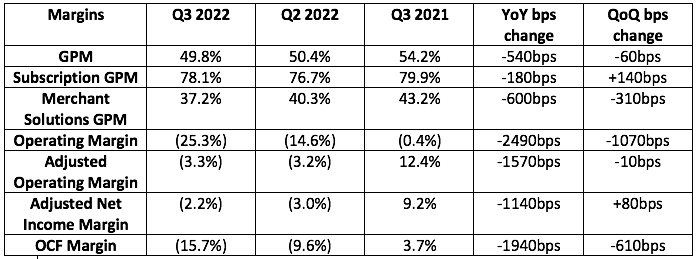

2. Profitability

Analysts were looking for -$95.7 million in adjusted EBITDA (similar to adjusted operating income). Shopify posted a loss of $45 million, sharply beating expectations. It told us to expect a “larger operating loss this quarter vs. last.” That turned out to be the case, but the loss only grew by a few percent.

It lost $0.02 per share in net income which beat analyst expectations of an $0.08 loss. It is controlling costs effectively.