Today’s piece is powered byMasterworks:

1. Demand

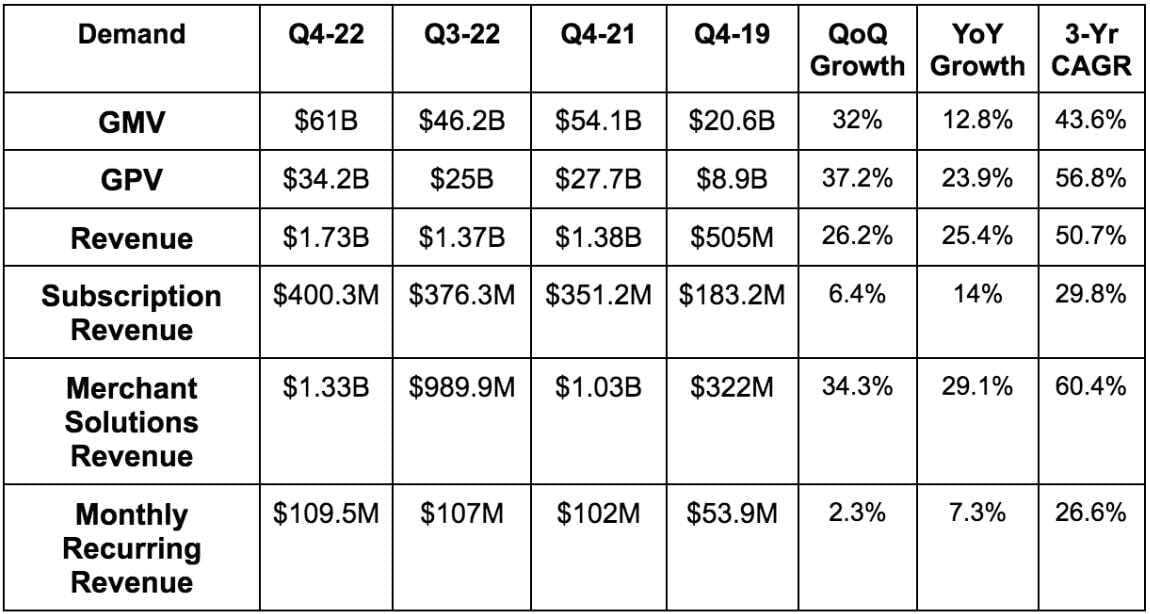

Shopify beat revenue estimates by 4.8%. This includes 200 basis points (bps) of foreign exchange headwinds.

More Demand Context:

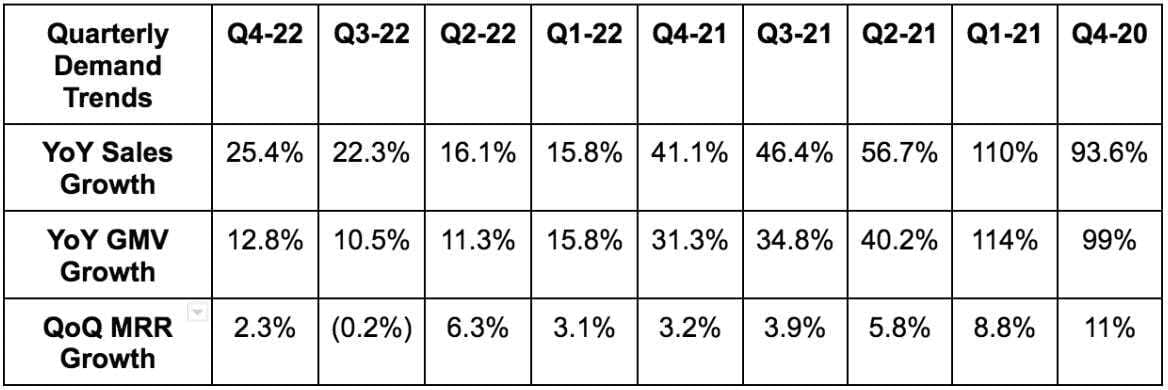

- Shopify’s 13% GMV growth more than doubled overall retail growth of 6% during the quarter as it briskly takes more market share. It enjoys a 10% share of e-commerce with more gains expected.

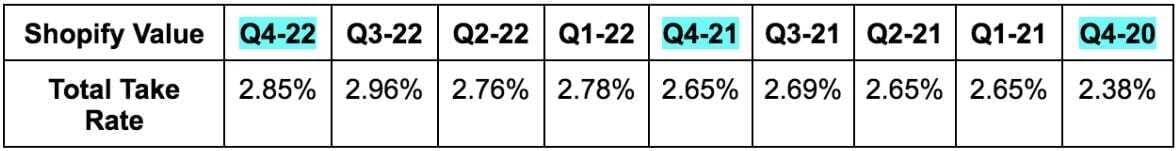

- GPV was 56% of GMV vs. 51% YoY as Shopify Point of Sale (POS) and Payments continue to rapidly proliferate.

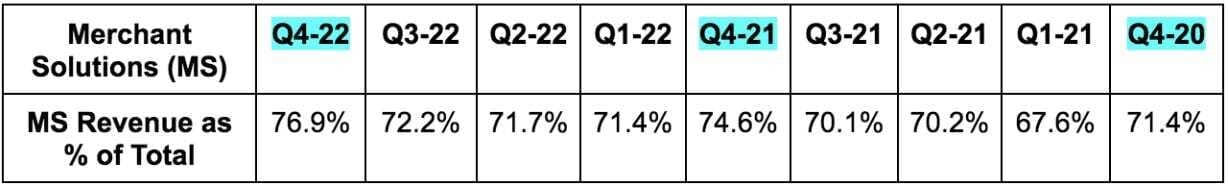

- Merchant solutions revenue is more closely tied to GMV than subscriptions. It’s based on usage of tools like fulfillment & marketing rather than pre-set subscription rates. As a result, the seasonal Q4 GMV boost helps that bucket more than subscriptions.

- The 50.7% 3-yr revenue CAGR compares to 51.8% last quarter & 52.9% 2 quarters ago.

- Shopify Plus = 33% of MRR vs. 29% YoY.

- Inorganic Deliverr growth propped up merchant solutions revenue but this impact was not quantified for us.

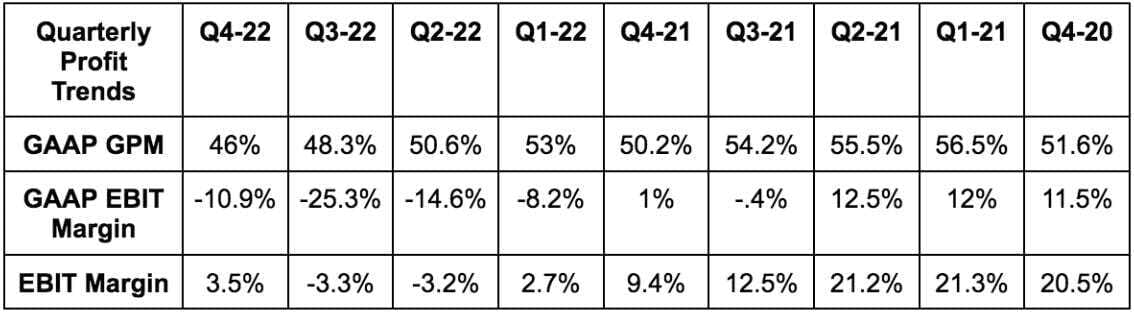

2. Profitability

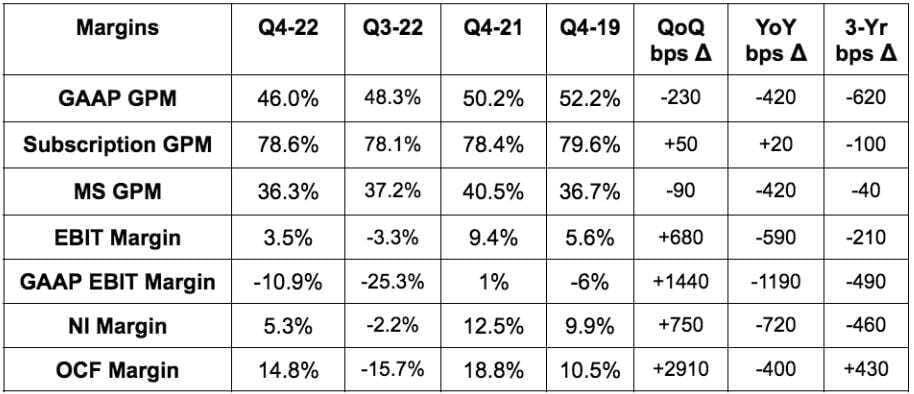

- Beat non-GAAP EBIT estimates of -$45 million by $106 million or 135%. Wowza.

- Beat -$0.02 EPS estimates by $0.09. It unexpectedly turned a non-GAAP profit.

- GAAP EPS missed estimates of -$0.18 by $0.31 largely due to one time real estate, legal & severance charges.

- Missed 46.7% non-GAAP gross profit margin (GPM) estimates by 70 bps.

More Margin Context:

- When excluding one-time charges from real estate downsizing, legal settlements and severance charges, operating expenses (OpEx) were flat QoQ. This powered the adjusted operating leverage.

- The team sees more low hanging cost control fruit within things like cloud usage optimization and enhanced marketing discipline to become more lean and efficient.

- GPM headwinds cited include:

- The “dilutive impact of Deliverr.”

- Payments proliferation and a shift back from debit funding to credit funding as the stimulus impact ends. Credit comes with higher 3rd party interchange fees and so lower Payments margins.

- Lower gross margin merchant solutions growth outpacing subscription solutions growth. This is due partially to a lowered take rate on subscriptions last year but mainly just via robust merchant services demand.

- Importantly, despite the lower gross margin associated with merchant solutions, the operating margin vs. subscription revenue is similar due to lower OpEx needs. This merchant solutions proliferation trend is depicted in the chart below:

If you follow me on Twitter, you’d know the pace of the Fed’s rate hikes has been the fastest since the 1980s. And during these hikes, investors lost an eye-popping $350B.

But one investing app posted record gains in 2022 through all of the chaos.

It’s called Masterworks – the company that has finally democratized access to fine art.

They make real multimillion-dollar paintings investible through shares, similar to how a company is broken up into pieces through stock.