Earnings season has been wonderfully hectic as always. In case you missed it, I’ve written 30+ detailed reviews so far. These reviews of a single quarter deliver the level of detail that others would call a “deep dive” and do so in a way that’s easy to digest:

- Nvidia & Cava Earnings Reviews

- Lemonade (LMND) Earnings Review

- Coupang Earnings Review

- SoFi Earnings Review

- Netflix Earnings Review

- Nu (NU) Earnings Review

- Celsius (CELH) Earnings Review

- Mercado Libre (MELI) Earnings Review

- Amazon, Cloudflare and Disney Earnings Reviews

- Datadog Earnings Review

- Taiwan Semi Earnings Review

- Airbnb Earnings Review

- Uber Earnings Review

- Shopify & Chipotle Earnings Reviews

- Alphabet & AMD Earnings Reviews

- PayPal Earnings Review

- Palantir Earnings Review

- Meta, Tesla & Starbucks Earnings Reviews

- Microsoft & Apple Earnings Reviews

- ServiceNow Earnings Review (section 2)

- Spotify Earnings Review (section 3)

- The Trade Desk Earnings Review

- Hims (HIMS) Earnings Review

- Grab (GRAB) Earnings Review

- Palo Alto, DraftKings & Robinhood Earnings Reviews (sections 2, 3 & 4)

I also liquidated a position today and added to a couple others. My updated holdings and performance can be seen here.

1. Snowflake (SNOW) – Earnings Review

a. Snowflake 101

Snowflake’s overarching platform is called the Data Cloud – a “single foundation to eliminate data silos.” This infrastructure unlocks affordable data storage, organization, querying and learning at gigantic scale. It offers these services with elastic compute capabilities to allow for flexible scaling up and down of usage. The architecture naturally separates the functions of data storage and consumption, unlike legacy data warehouse solutions. That means data consumption capacity is untethered from public computing resources, which helps with controlling costs and waste, handling diverse workloads and resolving potential scale bottlenecks. Under this framework, customers can store as much data as they want without the requirement for immediate processing.

In Snowflake’s case, the storage is done in a centralized data repository in its Data Cloud and processed only as needed. Data is utilized virtually, which removes the need for dedicated hardware. Snowflake does all of this for clients in a managed fashion to minimize client effort and infrastructure needs. There are a few key products to know & track:

The Snowflake Data Warehouse is where structured data is stored and (on command) processed. Structured data is formatted data. It’s utilized for record keeping and report creation. Data can be easily fetched via structured query language (SQL).

Snowflake Data Lake does what the warehouse does for unstructured data. Unstructured data is unformatted and used to uncover new insights and patterns.

- The Data Lake debuted in 2020 (Warehouse in 2014).

- Generative AI leans heavily on unstructured data for model training, meaning this proliferation will directly support unstructured data consumption on Snowflake.

“Our North Star is to deliver the world's best end-to-end data platform powered by AI.”

CEO Sridhar Ramaswamy

“Snowpark” is its developer platform and data-equipped playground to build new things. It enables working with data in any source code language. With it, they can process and visualize data (through Snowpark functions) and build apps (through Snowpark Native Apps). GenAI models ingest absurd amounts of data. Snowpark Container Services allow GenAI models to run closer to the data that they require. This enhances performance, expedites model training and diminishes costs.

Cortex AI is another important new product. It’s what Snowflake calls its “AI layer” and offers a slew of GenAI-powered tools to (as Snowflake always says) bring AI, application-building and analytics right “to a customer’s data.” That conjoining routinely lowers data transfer and storage costs. Cortex AI offers unstructured text summary, sentiment analysis, helps beginners write SQL etc.

- Cortex Search: Manifests Snowflake’s vision of making complex data querying seamlessly conversational. With it, anyone who knows Sequel can practice advanced, multi-stage queries and work directly with cutting edge large language models (LLMs) from its partners.

- Cortex Analytics: Uncovers patterns, insights and trends from massive, entirely unstructured datasets to sharpen things like trend forecasting. Both tools are enjoying strong early adoption.

Snowflake Data Sharing is its secure product for, as the name indicates, sharing data among the rest of Snowflake’s participating users. As more opt in, a compelling network effect of relevant data builds and Snowflake’s value proposition deepens.

Unistore is Snow’s hybrid table product, which can ingest, store and organize both transactional and analytical workloads. It has long been an analytical workload specialist within the data warehouse part of the business, and this unlocks transactional workload demand.

Snowflake’s revenue model is consumption-based in nature. This means visibility compared to SaaS business models is not as strong. It also means customers can more easily scale down (or up) usage when times are bad (or good).

b. Key Points

- Solid quarter and guidance.

- Product and go-to-market progress is palpable.

- CFO Mike Scarpelli will retire this year.

c. Demand

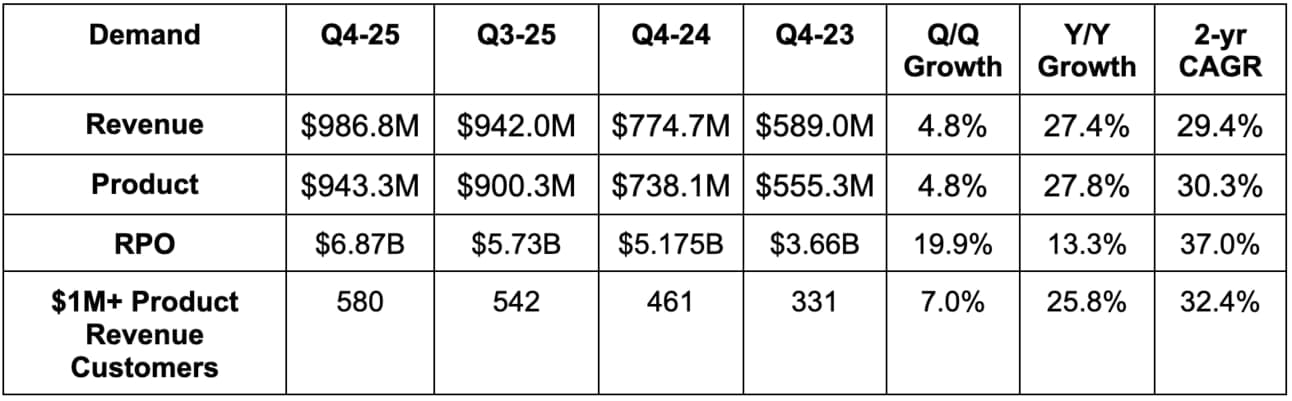

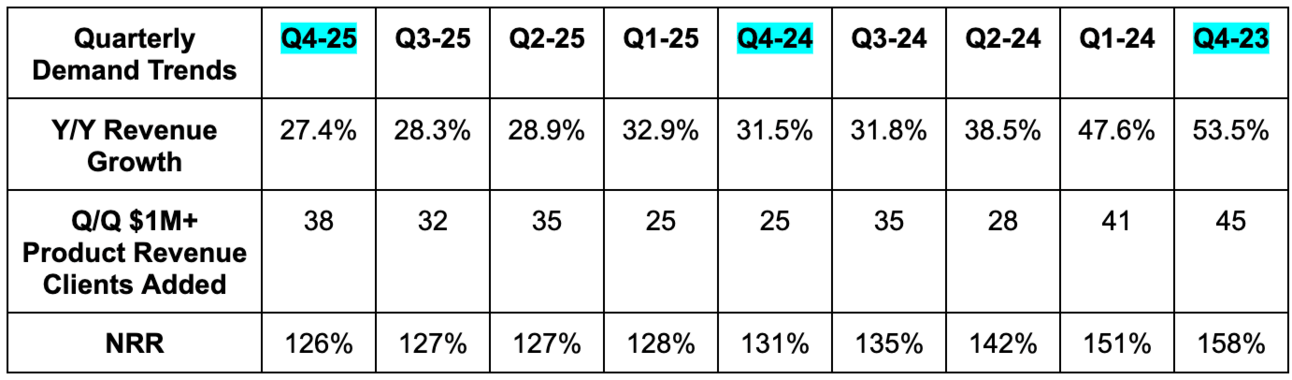

- Beat revenue estimates by 3%.

- Consumption was called stable vs. Q3. Q3 was quite strong.

- Beat remaining performance obligation (RPO) estimates by 2.3%.

- SNOW had some large customers work through consumption commitments. The customers chose to keep consuming under existing contracts, rather than signing new contracts. This is normal and leadership expects contracts to be signed this year. That seemed to hold back RPO this quarter just a tad.

- Beat product revenue estimates by 3.6% & beat guidance by 3.8%.

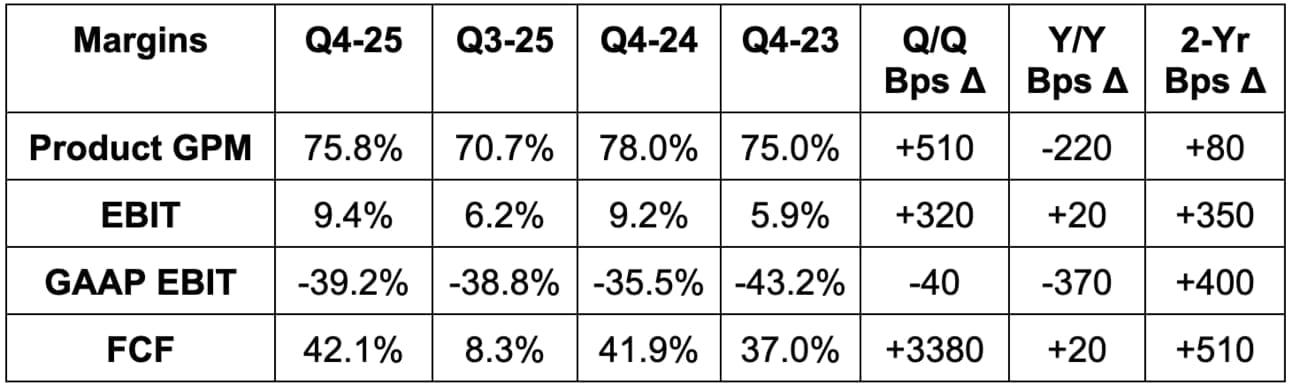

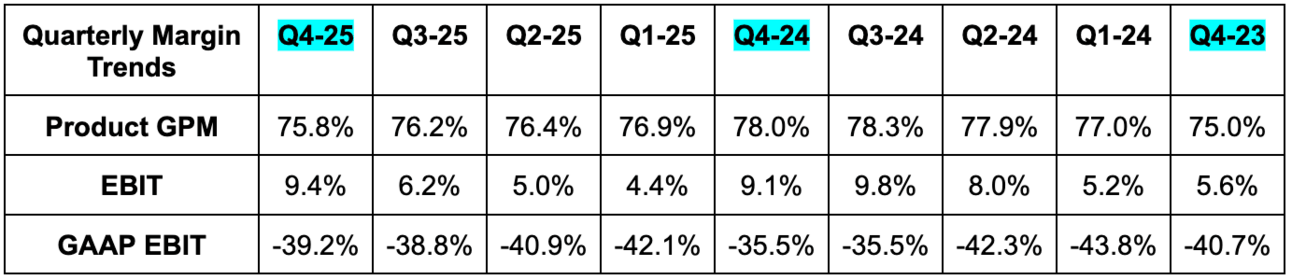

d. Profits & Margins

- Beat EBIT estimate by 121% & more than doubled EBIT margin guide.

- Beat $0.18 EPS estimate by $0.12.

- Slightly beat FCF estimate.