“My passion for SoFi grows every day. We are committed to running faster, reaching higher and achieving more.” — CEO Anthony Noto

a. Demand

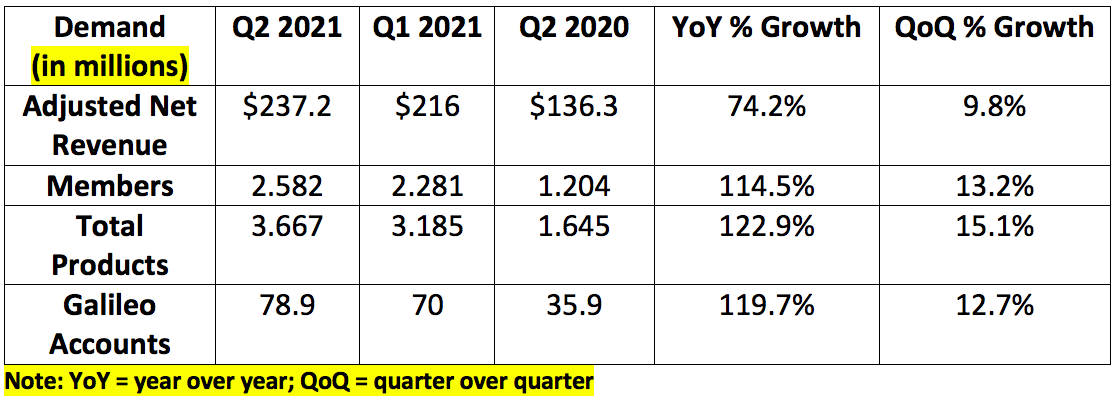

SoFi’s internal guidance called for $215-$220 million in adjusted net revenue. Analysts expected $231 million. The company posted $237.2 million in adjusted net revenue topping the highpoint of internal guidance by 7.8% and analyst forecasts by 2.7%.

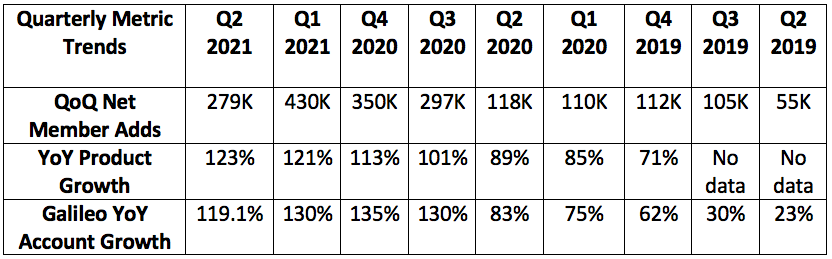

This quarter represents the 8th straight period of accelerating membership growth. Similarly, total product growth has accelerated for 7 straight quarters. Brisk expansion is one thing, but rising sequential growth rates point to strong momentum going forward.

The company’s most mature product — student loans — saw 11% year over year growth despite the moratorium and pandemic headwinds cutting industry volume for this segment by 50%.

SoFi’s financial services segment saw 602% year over year growth to reach $17 million and roughly doubled sequentially. This newer part of the organization still does not feature a positive contribution profit margin but that is quickly moving in the right direction. Every financial services product grew triple digits year over year.

The company continues to intentionally go slowly with monetizing its financial services segment to fuel early growth. It will launch new revenue streams here (options and margin accounts) in the future. With very little incremental cost to launch new products, this will directly boost profit margins.

Galileo — SoFi’s application programming interface (API) developer — saw revenue rise 138% year over year to reach $45.3 million. This was despite a delay in revenue recognition from a key client and fading stimulus check benefits.

“We are expecting to see stronger sequential growth for Galileo into the third quarter.” — CFO Chris Lapointe

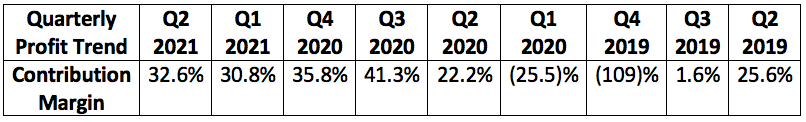

b. Profitability

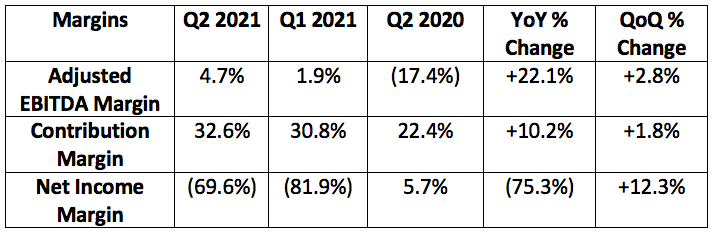

SoFi’s internal guide called for $(8)-$2 million in Adjusted EBITDA. It posted $11.2 million thus beating the high point of its outlook by $9.2 million.

$144 million of the company’s $163 million net loss came from non-recurring charges related to going public and a change in the fair value of warrant liabilities. Without these charges, net income margin would have been (8.8)%.

c. Guidance Updates

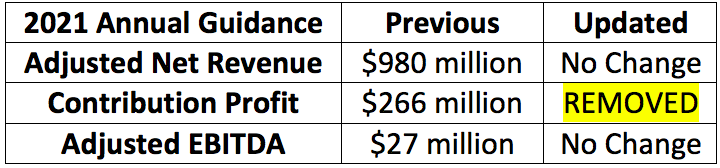

SoFi is reiterating its 2021 revenue and EBITDA guidance despite a $40 million annual revenue hit from the CARES Act moratorium extension on federal student loan payments. This hit should not repeat in 2022 as it’s set to expire at the beginning of next year. It also does not include the $12 million in revenue from its APEX acquisition which was originally included in its 2021 guidance.

Third Quarter 2021 Guidance is as follows:

- $245-$255 million in adjusted net revenue

- Analysts were expecting $260 million. This was lowered primarily due to the CARES Act extension.

- $(7)-$3 million in adjusted EBITDA