1. Demand

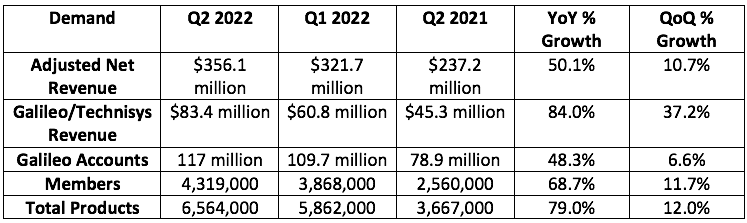

Analysts were looking for $344.5 million in revenue for the quarter while SoFi guided to $335.0 million in revenue. It posted $356.1 million, beating analyst estimates by 3.3% and its own guide by 6.3%.

“While the political, fiscal and economic landscapes continue to shift around us, we have maintained strong and consistent business momentum. We built SoFi to provide durable growth and that is what we are delivering.” — CEO Anthony Noto

More Context on Demand:

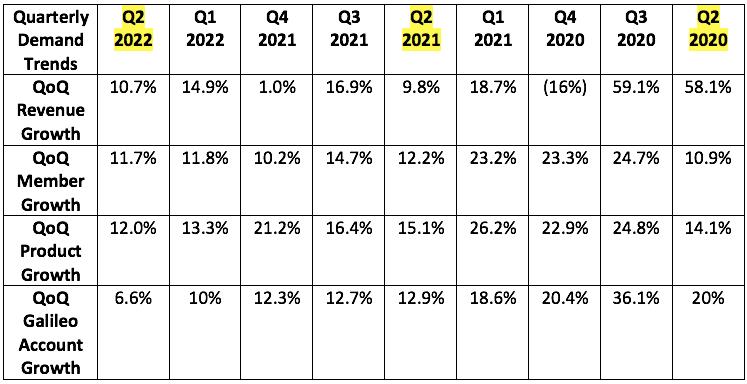

- Lending products rose 22% YoY to mark SoFi's 5th straight quarter of acceleration there.

- This was SoFi’s 2nd highest member and product net add quarter... ever.

- Cross-buying volumes rose 24% YoY.

- YoY financial services revenue growth was held back by one-time IPO revenues in Q2 2021. Growth here was 78% YoY, but 140% without this headwind.

- The Technisys acquisition slightly propped up YoY growth rates.

- SoFi's loan volumes are at double its pre-pandemic levels.

- Student loan volumes are now 25% off of pre-pandemic levels vs. 50% off previously.

2. Profit

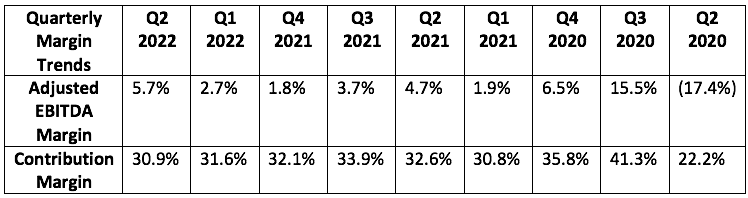

Analysts were looking for $9.5 million in EBITDA for the quarter while SoFi guided to $10.0 million. It earned $20.3 million, more than doubling estimates.

Analysts were also looking for a loss of $0.10 per share for the quarter. SoFi doesn't guide to this. It lost $0.12 per share, missing analyst expectations by $0.02.

More context on margins:

- SoFi has now delivered positive EBITDA for 2 straight years.

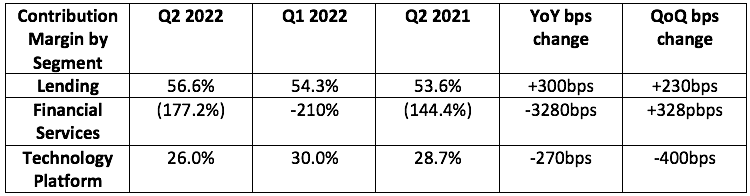

- Financial service contribution margin continues to be hard hit by building current expected credit losses (CECL) within its new SoFI Credit Card business. This will continue for now.

- Sales and marketing as a percent of revenue has declined for 2 straight quarters. The benefits of rising monetization and brand awareness are kicking in.

3. Balance Sheet

- SoFi has $1.4 billion in cash and highly liquid investments -- up about $200 million YoY.

- Sequentially, the decline in cash was via funding the bank and its loan book. That cash is now deployed and earning yield.

- SoFi is using $1.6 billion of its $7 billion in warehouse capacity vs. $2.7 billion QoQ.

- This is part of the power of the bank. It can fund more loans with its deposits vs. more expensive warehouse facilities.