1. Demand

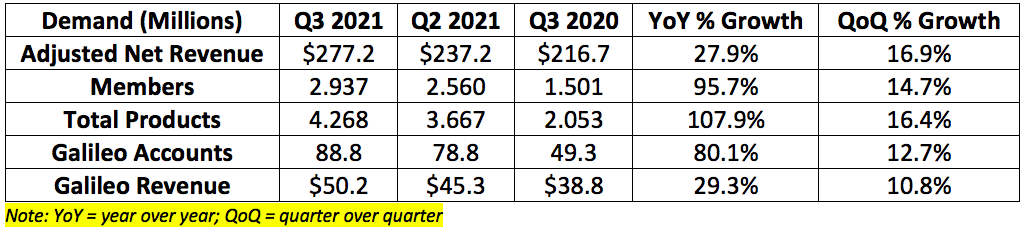

SoFi guided to $245-$255 million in adjusted net revenue and analysts expected $251.6 million. The company posted $277.2 million beating its midpoint guidance by 10.8% and analyst expectations by 10.2%.

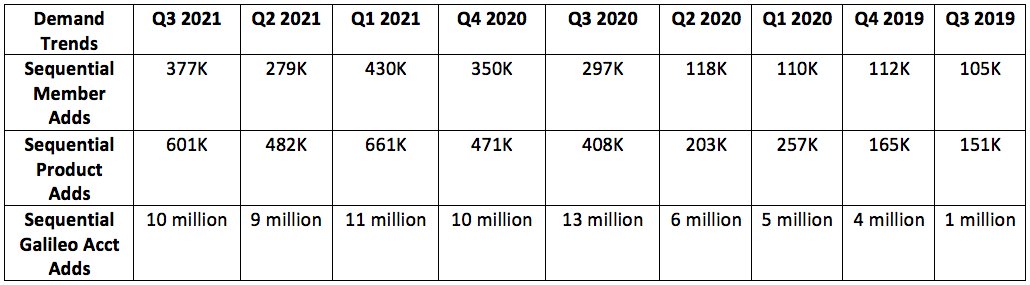

Sequential revenue, product and member growth all improved in this quarter vs. last quarter.

CEO Anthony Noto told us on the call that SoFi is now over 3 million members.

Galileo was immensely helped by stimulus in Q3 of last year. It still reported 80.1% year over year growth regardless of the difficult comparison.

Product additions continue to greatly outpace member additions pointing to strong cross-selling momentum and the “one-stop-shop” approach working more and more every quarter.

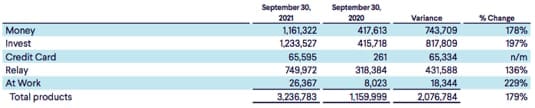

Here’s a breakdown of where all of this product growth is coming from via the company’s shareholder letter:

2. Profitability

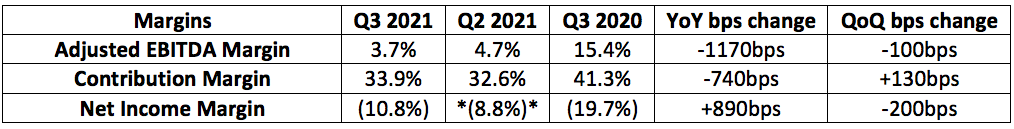

SoFi was projected to lose $0.14 per share. The company lost $0.05 per share beating expectations by $0.09.

SoFi guided to ($7)-$3 million in adjusted EBITDA for the quarter. It posted $10.2 million in adjusted EBITDA beating the midpoint of expectations by $12.2 million.

**Note that the (8.8%) Q2 2021 net income margin is adjusted for the hit that profit took last quarter via a change in the fair value of warrant liabilities. My adjustment made the comparison more apples to apples but the true net income margin was (69.6%) last quarter.**

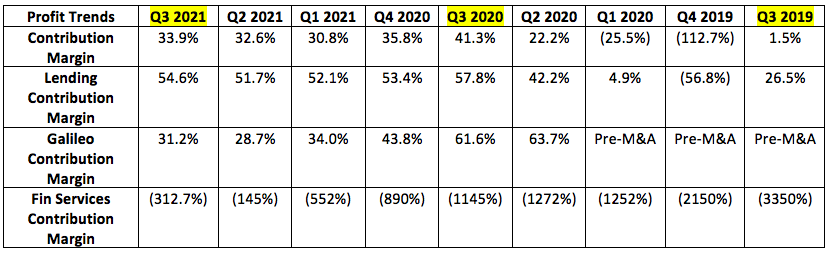

SoFi’s total financial service products in circulation is now more than triple its total lending products. These 2 were roughly the same just a year ago. The proliferation of the newer, lower margin financial services segment is what is weighing on some (not all) margin lines. Specifically, financial service products grew by 166.6% year over year which outpaced the company’s growth as a whole. Financial services revenue also soared by 290% to depict the momentum it’s enjoying.

Downward pressure on Galileo’s contribution margin was the result of continuing to invest in broadening and improving the platform’s suite of products. Operating expenses for this segment rose 132% year over year to support all of SoFi’s ambitious plans. The company anticipates this segment’s contribution margin will be in the 20%-30% range going forward to fund these plans. Right now, Galileo’s bread and butter is payment processing and SoFi feels the company can offer many more APIs and use cases in the future. Q3 2020 margins also benefitted from an APEX clearinghouse contribution (a company that SoFi acquired) that it did not enjoy this period.

Application Programming Interfaces (APIs) Defined: APIs are blocks of code that enable software to perform various tasks. APIs act as the ‘language’ that empower access to data services, operating systems, and other applications to create an end product. A user interface (UI) is what the consumer sees and APIs are what the enterprise uses to build the platform’s UI and user experience (UX).

3. Guidance Updates

SoFi guided to the following for the 4th quarter:

- $272-$282 million in next quarter revenue. Analysts were expecting $274.9 million. This revenue growth estimate implies an acceleration to 49-55% YoY growth.

- Adjusted EBITDA of $2-$5 million.