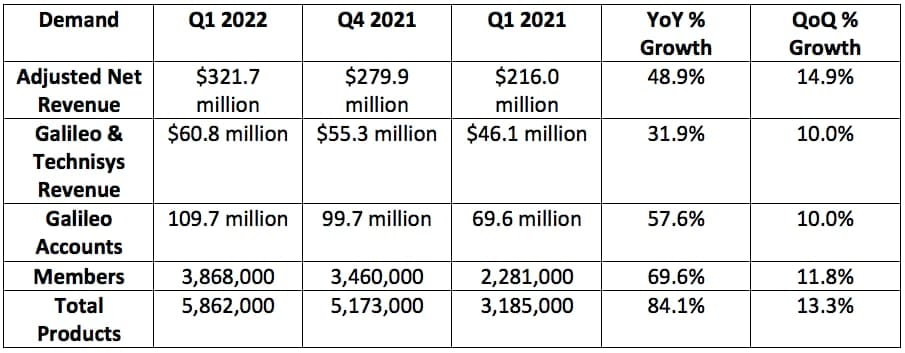

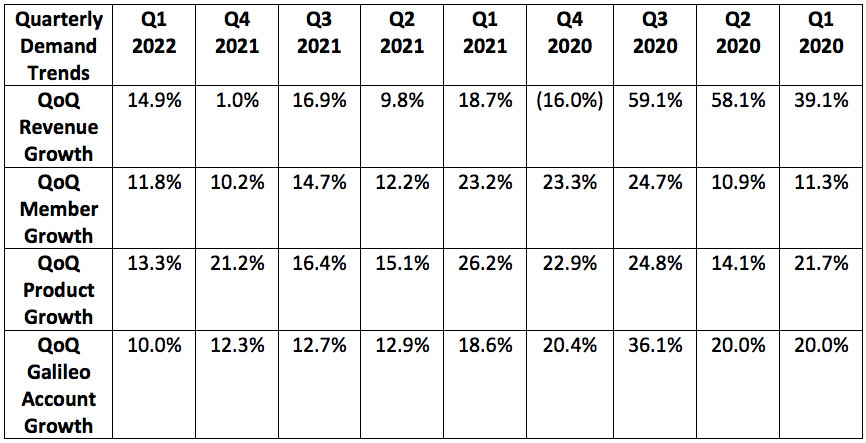

1. Demand

SoFi guided to a midpoint of $282.5 million in revenue for the quarter, while analysts were expecting $284.0 million. The company posted $321.7 million, beating its expectations by 13.8% and analyst estimate by 13.2%.

More context on demand:

- This represented SoFi’s 3rd highest member growth quarter and 2nd highest product growth quarter after its record-setting Q4 2021. This is despite the benefits of several product launches in 2021 and 2020.

- Cross-selling volumes rose 22% YoY.

- Technisys contributed "a small amount" to quarterly sales.

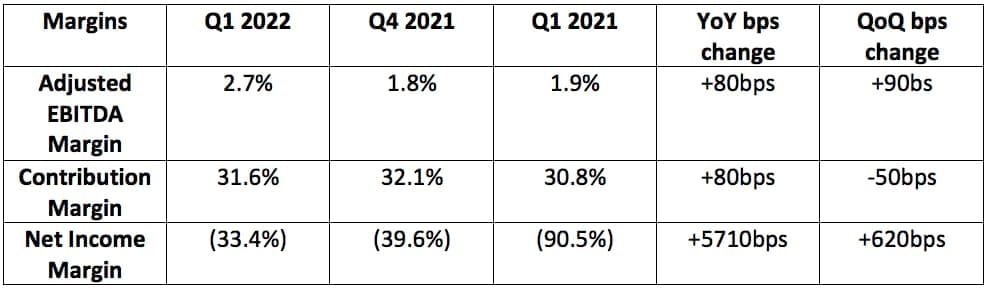

2. Profitability

SoFi guided to a midpoint of $2.5 million in adjusted EBITDA for the quarter while analysts were looking for $5.0 million. It generated $8.7 million, sharply beating expectations.

Analysts were also looking for a net loss of $0.13 per share. SoFi lost $0.14 per share, missing expectations by 7.6% or $0.01.

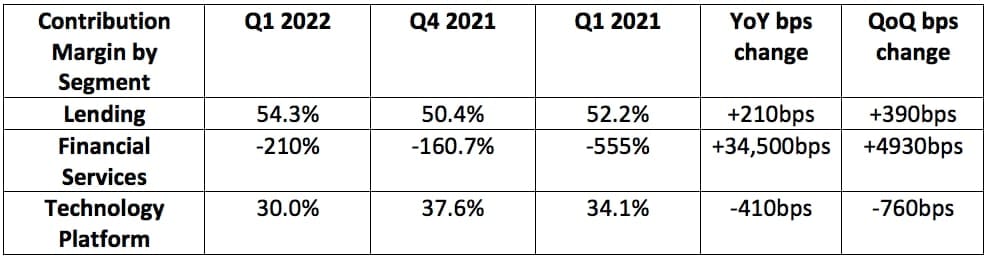

More context on margins:

- Factors contributing to margin compression:

- The student loan moratorium is hitting its most profitable segment's volume by just over 50%.

- Its thriving financial services growth which comes with lower margins.

- SoFi’s long term EBITDA margin target is 30%.

- Financial services contribution margin continues to be hit by Current Expected Credit Loss (CECL) reserve building. This is now largely behind us.

- The Technology Platform contribution margin compression was powered by “continued heavy investments to capture accelerating secular growth opportunities.”

- It expects to operate this segment at a 20-30% contribution margin while it invests in more growth.

- Lending contribution margin expansion was powered by an issue with a 3rd party lending partner last quarter which did not reoccur. Underwriting improvements were also given some credit.

Just like last quarter, SoFi's net accumulation of $1 billion in loans on its balance sheet led to technical "cash burn" of $1 billion during the quarter. This is a planned reaction to getting its banking charter as it now will have access to lower cost of capital vs. its existing warehouse facilities and far more loan holding period flexibility. The longer holding periods are the key contributor to the cash burn. While it is considered cash burn from an accounting perspective, it's really just a change in capital/balance sheet structure... not a matter of poor unit economics.

3. Guidance

2022:

- SoFi previously guided to $1.47 billion in revenue while analysts expected $1.44 billion in revenue. SoFi changed its guidance to just under $1.51 billion.

- This represents a 2.6% raise vs. its own guide and a 4.7% raise vs. analyst expectations.

- SoFi previously guided to $100 million in EBITDA while analysts expected $97.4 million. SoFi changed its guidance to $102.5 million.

- This represents a 2.5% raise vs. its own guide and a 5.2% raise vs. analyst expectations.

Note that SoFi revised its guidance lower in April due to the student loan moratorium extension. This is now assumed to be extended through the end of 2022.

Q2 2022: