1. Demand

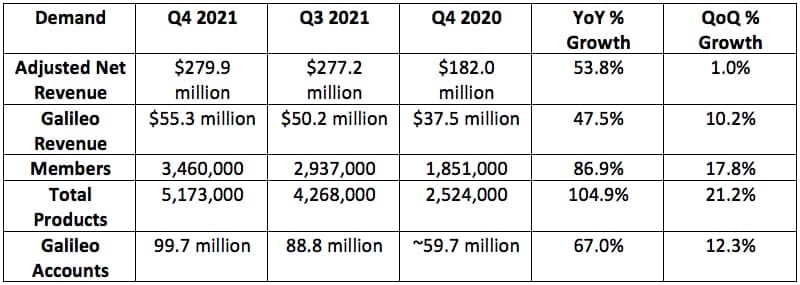

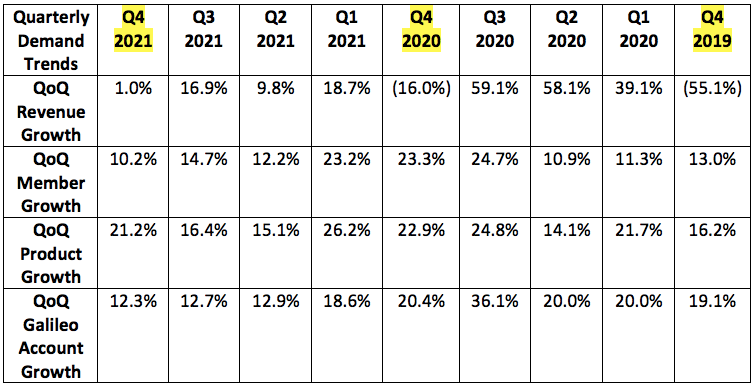

SoFi guided to $277 million in quarterly revenue and analysts were looking for $279.5 million for the period. The company posted $279.9 million, beating its expectations by 1.0% and analyst estimates by 0.1%.

Notes:

- The company originally guided to reaching 3 million members by the end of 2021 in its SPAC investor presentation. The 3.46 million members it boasts today shattered that estimate by 15%.

- SoFi’s product growth exceeding its member growth is direct evidence of deepening cross-buying momentum in the business.

- Member, product and Galileo sequential growth all accelerated form last quarter.

- The quarter represented a new record for both sequential member and product adds at 523,000 and 906,000 respectively. Product adds specifically beat its previous record by nearly 50%.

SoFi posted $1.01 billion in sales for the year. This beat its original $980 million forecast by 3% DESPITE the student loan moratorium in the U.S. extending through the remainder of 2021 (and a delayed banking charter). This extension yielded a 50% volume hit to SoFi’s largest business line. In its original $980 million 2021 sales guide, SoFi assumed the moratorium would end in September, 2021.

Student loan demand had been building throughout the 4th quarter in anticipation of the moratorium expiring in January — but it was since extended. The extension severely hit SoFi’s student loan demand in the last week of December, 2021 which hurt these quarterly results.

Note that SoFi had seen a sharp sequential revenue decline from Q3 to Q4 in 2020 and 2019. That trend encouragingly reverted this year.

2. Profitability

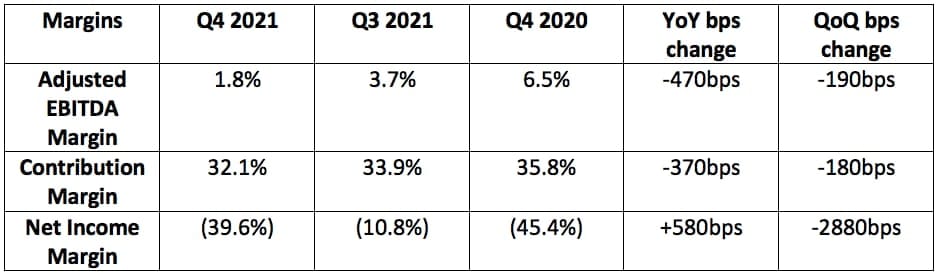

SoFi guided to $3.5 million in adjusted EBITDA for the quarter and analysts were expecting $3.0 million in adjusted EBITDA. The company generated $5.0 million in adjusted EBITDA, beating its estimate by 42.8% and analyst estimates by 66.7%.

Analysts were also looking for a loss of $0.12 per share for the quarter. The company lost $0.15 per share, missing expectations by $0.03.

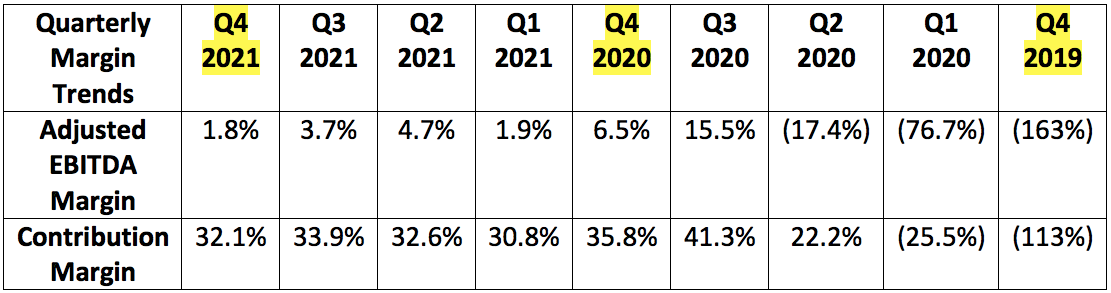

SoFi earned $30.2 million in adjusted EBITDA for 2021 as a whole vs. losing $44.8 million in 2020. Similarly to revenue outperformance for the firm, the $30.2 million EBITDA outcome beat SoFi’s original SPAC guidance of $27 million for 2021. While many de-SPACs haven fallen victim to overpromise and underdeliver, CEO Anthony Noto and SoFi are the polar opposite — they’re the exception.

Again, this is all DESPITE student loan volumes being immensely challenged in 2021. This is not only SoFi’s largest business, but its most profitable as well.

SoFi’s lowest margin financial services segment continues to rapidly grow. That — plus heavy investments in Galileo — is the source of the margin compression seen below:

SoFi has long term EBITDA margin targets of 30% and it is already there when looking at the incremental EBITDA margin on its new business having eclipsed 30%. This hints at vast margin expansion to come over the very long term.

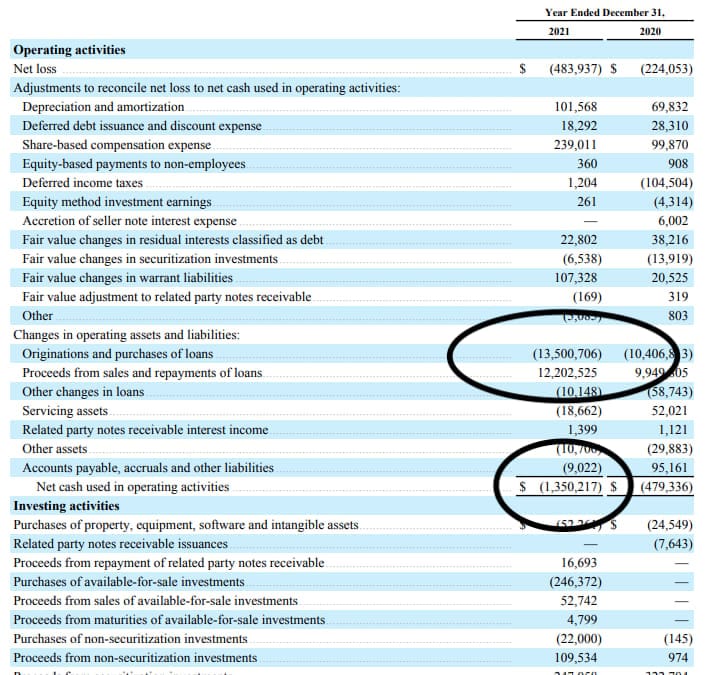

Note that some have pointed out SoFi’s $1.4 billion operating cash burn in 2021 as a red flag — it isn’t. This appears to be solely related to accumulating more loans on its balance sheet. While it’s called “cash burn” in accounting terms, it’s really just a change in capital structure. I’ve reached out to Noto to confirm. See the image below for what I’m referring to:

3. Guidance

a. Guidance assumes the following:

- A $30-$35 million negative impact from the moratorium extension.

- The moratorium will not be extended past May, 2022.

- Student loan refinance origination volume returns to pre-pandemic levels in Q2.

- SoFi Bank will start contributing meaningfully to results in Q2, not Q1.

“Because SoFi Bank was initially capitalized with cash from the balance sheet and not loans, SoFi will not begin to realize the lower cost of capital benefits of SoFi Bank until it can originate and fund loans for SoFi Bank. Management believes this will take until Q2.”

- 20-25% Technisys growth.

- Incremental adjusted EBITDA margins of 30% ex-Technisys in 2022 — consistent with its long term target.

b. 2022 — Analysts were looking for the following:

- $1.45 billion in 2022 revenue. SoFi guided to $1.57 billion, beating expectation by 8.3%. This includes a roughly $65 million contribution from Technisys. Without this boost, SoFi’s guidance of roughly $1.5 billion would have beaten expectations by 3.4%.

- $155.5 million in 2022 EBITDA. SoFi guided to $180 million, beating expectations by 15.8%. This beat was all organic, as Technisys is not yet a material EBITDA contributor.

- A loss of $0.60 per share. SoFi doesn’t offer guidance here.