Hey readers! Please share this article with your network if you feel inspired to do so. That is how we grow and keep the content 100% free.

1. Tesla (TSLA) — Earnings Review

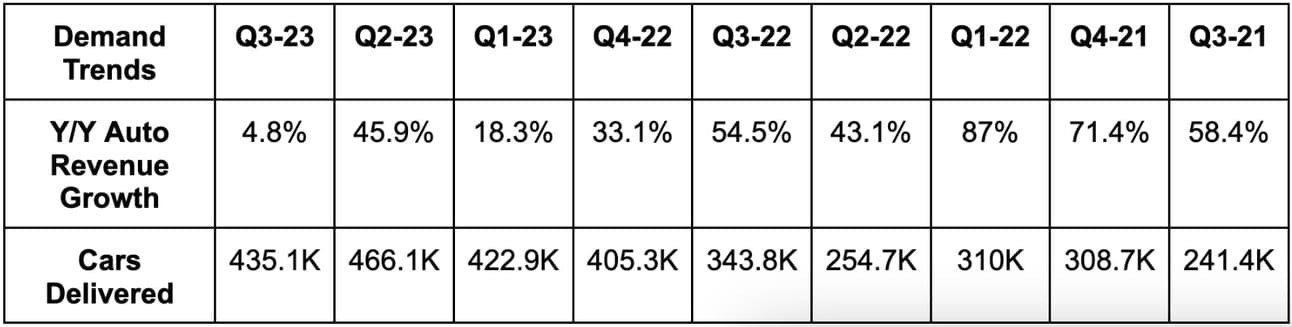

a. Demand

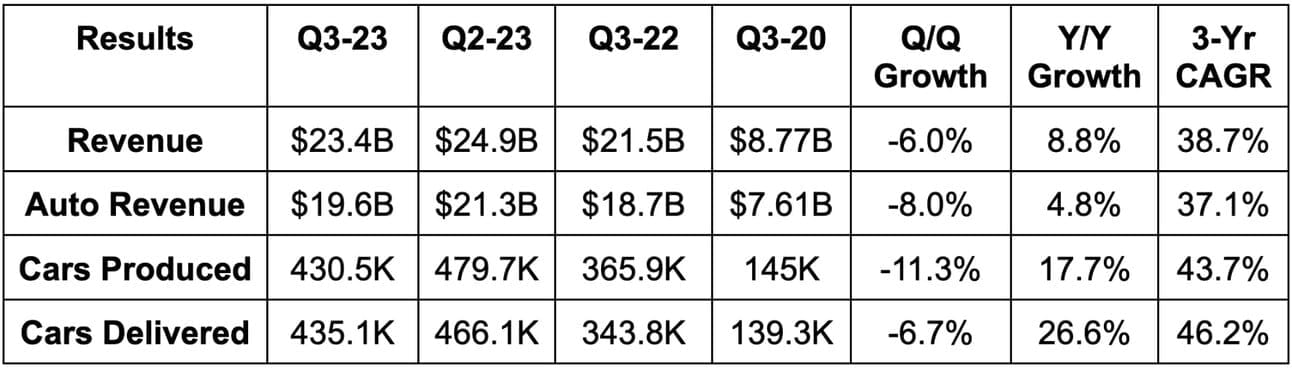

Tesla missed sell side revenue estimates by 3.3%. It does not guide to quarterly revenue.

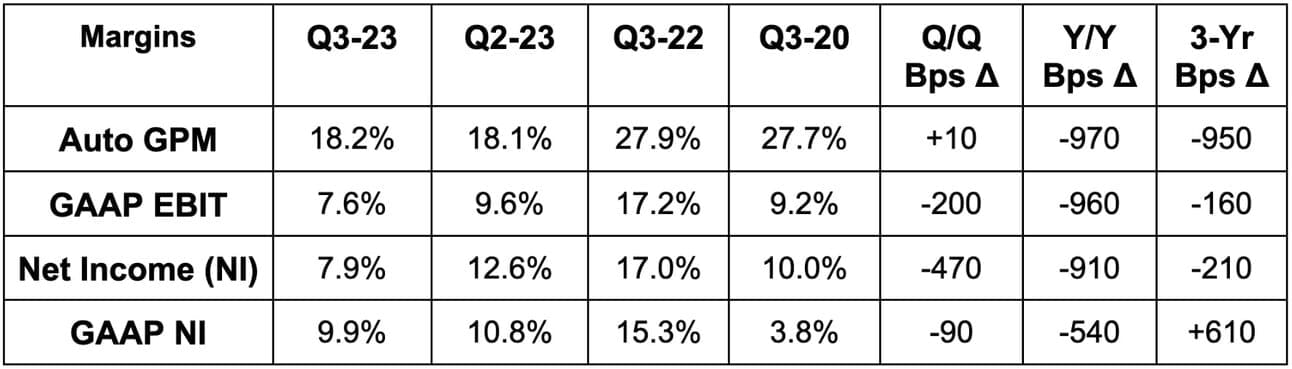

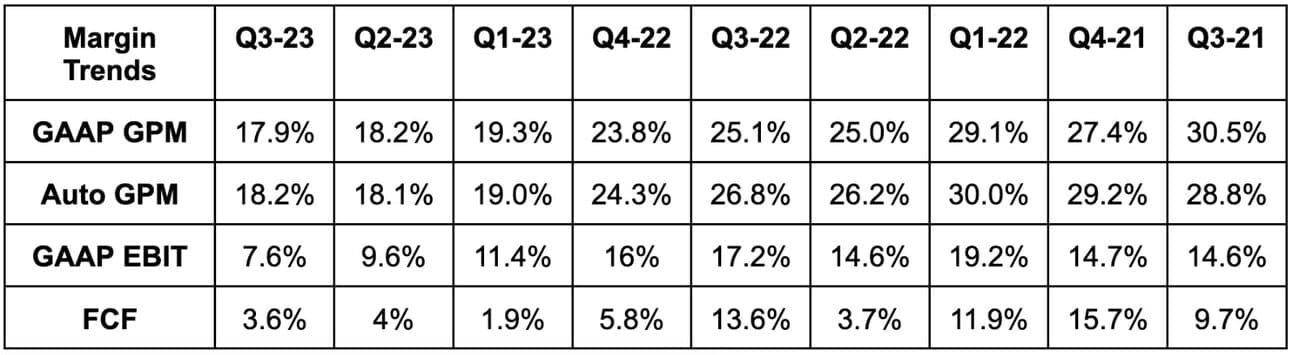

b. Margins

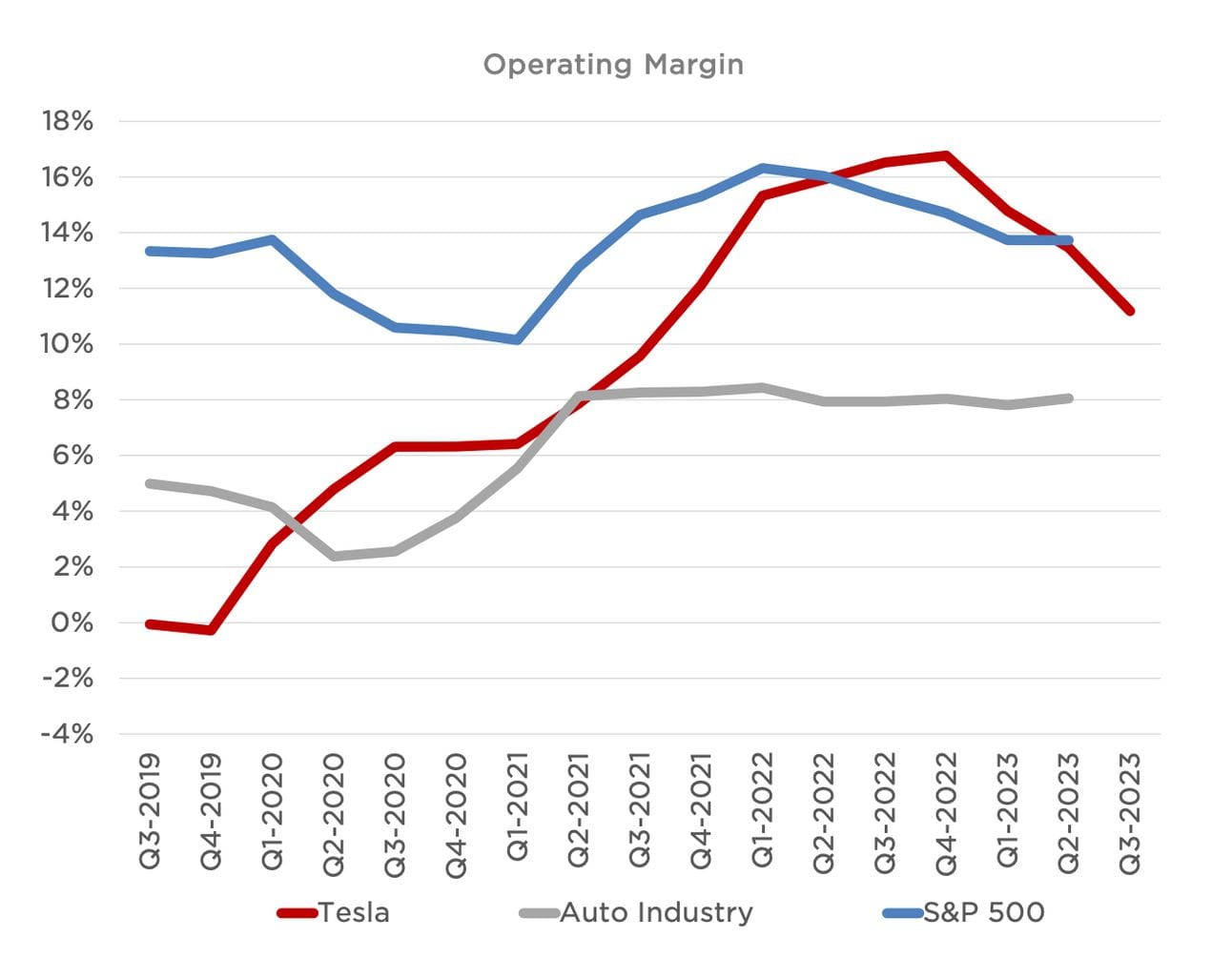

- Missed EBIT estimates by 24.1%.

- Missed $0.74 GAAP earnings per share (EPS) estimates by $0.21.

- Met 18% GAAP gross profit margin (GPM) estimates & roughly met Auto GPM estimates ex-leases.

c. Balance Sheet

- Inventory +33% Y/Y.

- Shares up slightly Y/Y.

- $26B in cash & equivalents.

- $4.4B in debt ($2B is current).

d. Guidance

Tesla reiterated its general long term guidance and its 1.8 million car volume guide for 2023.

e. Call & Presentation Notes

Costs & Selling Price:

Tesla has removed nearly $2,000 in input costs per vehicle over the last year to reach $37,500 on average. This is despite planned maintenance and upgrades on numerous production lines across the globe. Cost initiatives across all factories paired with new locations ramping to full capacity are both helping. Tesla’s newer 4680 cell also lowered the firm’s scrap bill by 40% sequentially. This will be a more and more meaningful gross margin driver over time.

Average cost per vehicle fell due to a combination of continued price cuts as well as mix shift to lower cost vehicles. Tesla explains the cuts in two ways. First, it’s optimizing its margin advantage over the competition. Tesla’s margin profile is astronomically better than all other EV programs.

Most competition doesn’t even have a positive gross margin. It sees pricing competition today, thanks to its vertical integration, scale and overall input cost edges, as the correct approach to maximize market share gains. It thinks it can “harvest” the lost margin over time via software upsells. Secondly, this is a reactionary response to rising interest rates. Tesla is trying to maintain monthly payment affordability while rates soar. Bears would say the reasoning is more product and competition based. As an innocent bystander, I’m not quite sure who pessimists think the formidable Tesla competition is today. I don’t see any. Again… not a shareholder… just a realist.

More Margin Context:

Its non-auto businesses are becoming real profit contributors. Together, they added more than 10% to the firm’s overall gross profit. Energy storage is by far the largest factor here with a 24% gross margin.

Hefty Cybertruck costs without any revenue yet generated are also weighing on margins along with large AI investments. These buckets will eventually deliver revenue (not just more cost) to ease the margin headwinds.

Regulatory credit growth helped offset a small portion of margin pressure during the quarter.

AI & Full Self Driving (FSD):

- Tesla doubled its AI training compute capacity (with Nvidia H100 chips) to help FSD and its Optimus Robot project both scale.

- The FSD price cut is temporary. The price of this should grow with rising FSD value over time.

Solar & Energy Storage:

Solar megawatts (MW) deployed were 49 for the quarter vs. 66 Q/Q and 94 Y/Y. This is another area where higher cost of capital greatly hinders growth. The cutting of net metering in California is hurting a lot too. This cuts the value of excess energy credits that producers can then sell back to the grid… thus making solar energy less appealing.

- Energy Storage megawatt hours (MWh) rose 90% Y/Y.

- Supercharger stations rose 31% Y/Y to reach 5,595.