If you find these reviews valuable, please share them far & wide with your networks. That is how we grow, and it would mean a lot.

If you’re new to Stock Market Nerd, this is the kind of quality content that you can consistently expect. If you’re willing to pay $0 a month for institutional-grade research on 50 popular companies and macro, subscribe below:

1. Tesla (TSLA) — Q4 Earnings Review

Tesla needs no introduction.

a. Demand

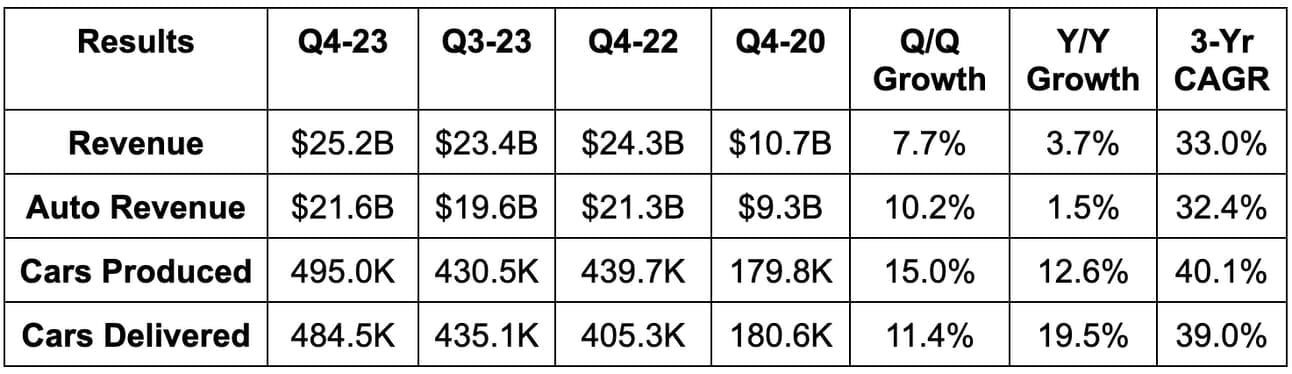

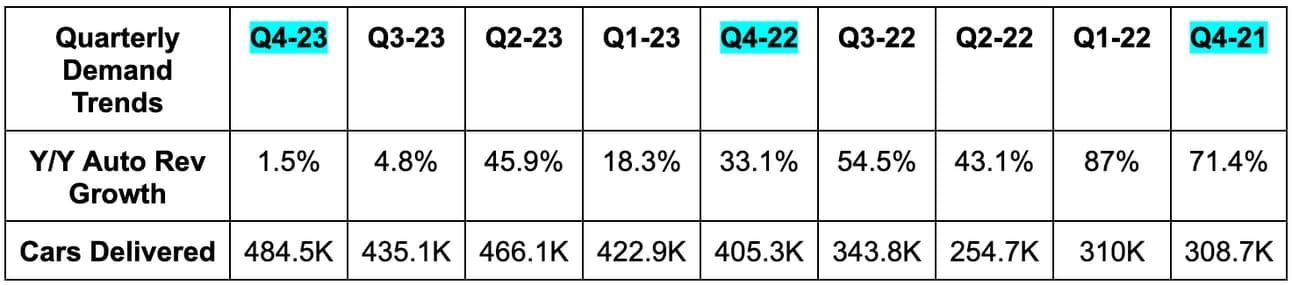

Tesla missed revenue estimates by 2.2%. Its 33.0% 3-year revenue compounded annual growth rate (CAGR) compares to 38.7% as of last quarter and 60.3% 2 quarters ago.

b. Margins

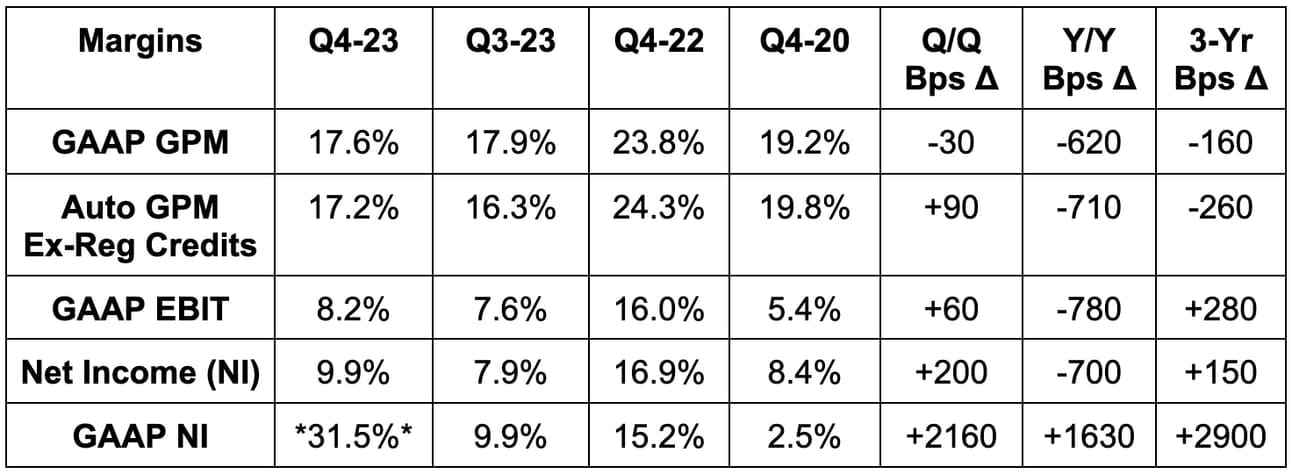

- Missed EBIT (means earnings before interest & tax or just operating income) by 9.1%.

- Missed $0.74 earnings per share (EPS) estimates by $0.03.

- Missed 18.1% GAAP gross profit margin (GPM) estimates by 50 basis points (bps; 1 bps = 0.01%).

- Beat the 15.7% auto GPM ex-regulatory credits margin estimate by 150 bps.

- Formula: ((Auto revenue + auto leasing) - (auto cost of revenue + auto leasing cost of revenue)) / (Auto revenue + auto leasing)

GAAP EPS was heavily influenced by a roughly $6 billion tax benefit, so it is not a relevant metric for this quarter.

c. Balance Sheet

- $29 billion in cash & equivalents.

- $5 billion in debt.

- Share count rose by 0.5% Y/Y.

- Global vehicle inventory days in supply rose from 13 days to 15 days Y/Y. Inventory overall rose by 6.1% Y/Y.

d. Guidance

Tesla told us that volume growth for its auto business in 2024 would be “notably lower” vs. 2023. It guided to $10 billion in capital expenditures as well representing 12.3% Y/Y growth.

Tesla trades for 57x next 12 month (NTM) EBIT, 55x NTM FCF and 61x NTM earnings. EBIT, FCF and earnings are set to grow Y/Y by 49%, 55% and 44% respectively in 2024.

e. Call & Release Highlights

Bears say vs. Bulls say:

Tesla’s margin trajectory has been the topic of fascinating debate over the last year+. Bulls will say that Tesla is intentionally cutting some vehicle costs to make them even harder to compete with amid a higher cost of capital environment. Tesla’s unmatched margin profile (both gross & net vs. all other EV programs) gives it the flexibility to profitably lean into consumer affordability. After all, higher rates mean higher interest payments and so more expensive cars (all else equal). Optimists here will tell you Tesla is controlling its average selling price to counteract this reality for its consumers. They say that Tesla is willing to accept lower up-front margins today as it knows there are software up-sells coming in the future (like hopefully Full Self Driving (FSD)) to “harvest more profits” over time. Leadership has said the same thing.

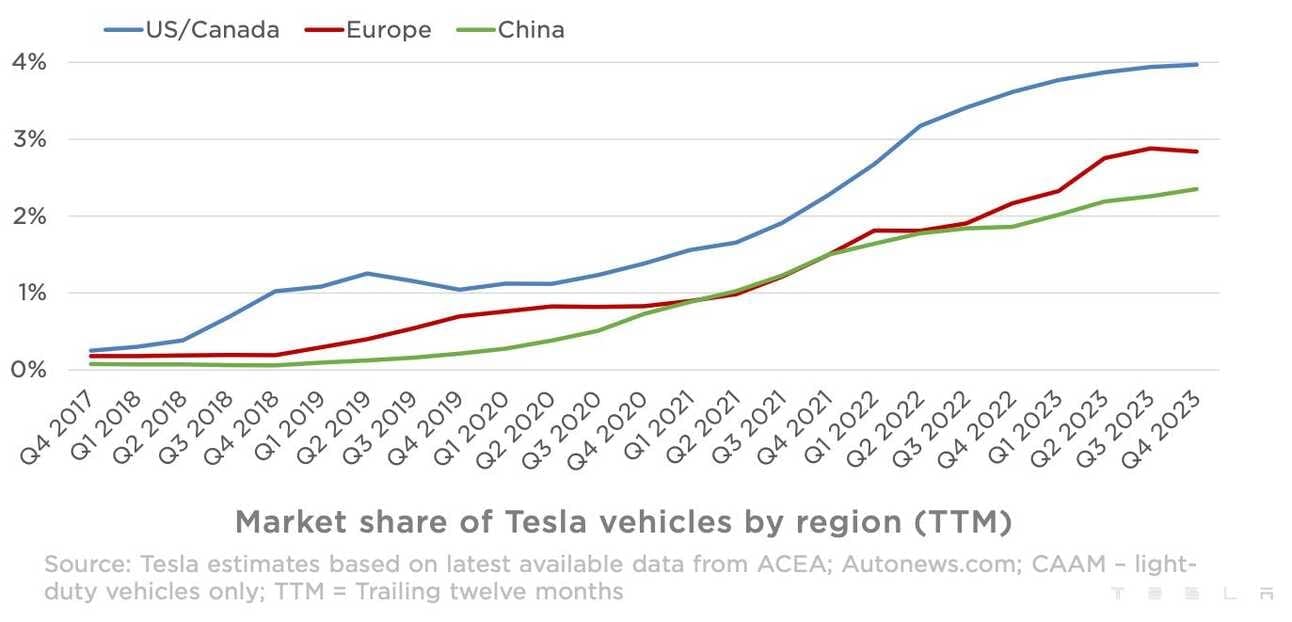

With tougher macro today, keeping selling prices low makes finding demand amid the not-so-fun part of this auto cycle tougher for others. Tesla is using its competitive positioning to amplify this pain for its competition. That should mean stronger Tesla market share over time as headwinds abate & growth likely re-accelerates. Again… that’s the bull case here. Not my opinion… but the opinion of many bright Tesla bulls.

Bears will say that Tesla is cutting costs and seeing margins tank due to intensifying competition across the sector. Especially in Europe and China, without the same tax benefits, skeptics simply think others are catching up, Tesla’s differentiation is shrinking and so its pricing power is too. That’s what they will tell you — regardless of market share trends. This is also not my opinion, but the opinion of many bright Tesla bears.

There’s likely truth to both of these arguments. 2024 will tell us a lot about who is right.

Margin Puts & Takes:

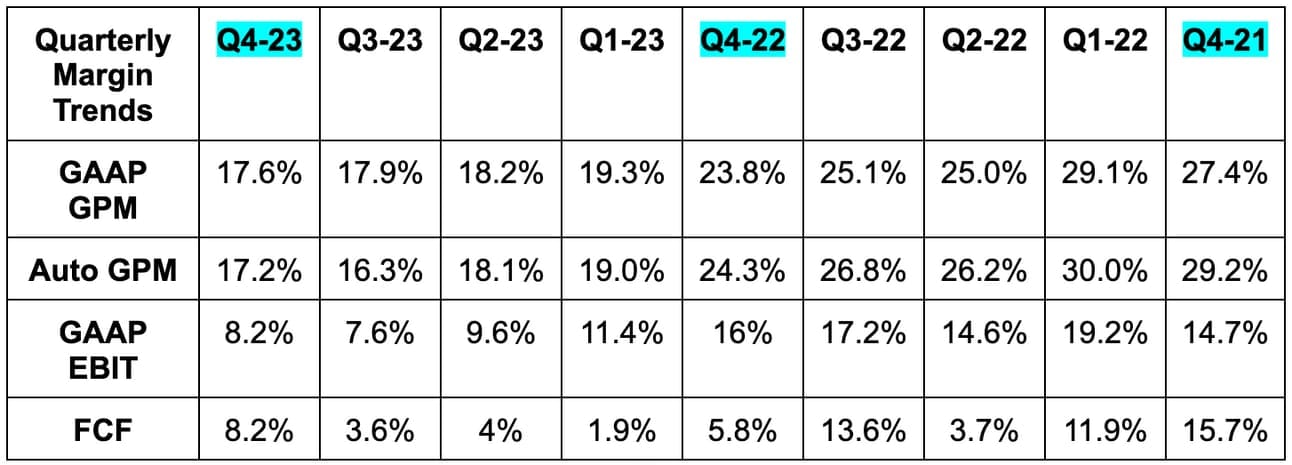

Tesla continues to cut input costs per vehicle. Specifically, costs fell Y/Y from a bit over $39,000 to just over $36,000 this quarter; it remains committed to consistently lowering this number over time. Input cost disinflation is helping a lot. Furthermore, cutting scrap bills from its newer 4680 cell battery as production scales is helping, while ramping capacity at its newer gigafactories is too.

Conversely, mix shift to lower price vehicles and a falling average price per vehicle are both margin headwinds today. Cybertruck costs are another headwind as the production line hasn’t yet ramped (but costs have). Finally, it continues to invest aggressively in AI and R&D to support its next-gen vehicle line-up. This, paired with weaker than normal sector demand, is hurting margins too.

“If rates fall quickly, margins will be good [in 2024] and if they don’t then margins won’t be good [in 2024].” — Elon

More Demand & Efficiency Metrics:

- Model 3 & Y production rose 14% Y/Y while older lines saw production fall 12% Y/Y.

- Super-charger stations and super-charger connectors rose 27% Y/Y and 29% Y/Y respectively.

- Tesla reached a 2 million vehicle annual production run rate this past quarter. Its Fremont Factory in California is now the highest output plant in North America.

- The China plant resumed normal production after pauses in Q3 for factory maintenance.

- Model Y Production in Germany continued to ramp to full scale.

Advertising:

- Tesla has begun to selectively advertise its brand to build awareness. It’s in the experimentation phase here.

- 90% of its 2023 buyers were brand new to Tesla. The opportunity for boosting brand awareness remains very large.

Car Updates & Launches:

- Model Y was the best selling car in the world in 2023.

- Its model 3 refresh is now complete. The upgraded vehicle looks similar, but with a quieter cabin and a longer range — among other improvements.

- The Cybertruck will ramp production and deliveries throughout 2024.

Elon told us that “Tesla is between 2 growth waves.” It’s now investing heavily in its next generation vehicles to support longer term demand. Elon thinks the next generation vehicles will be ready to be shipped by the end of 2025. Importantly, production involves some of the most impactful manufacturing innovation in Tesla’s existence — per the team. It’s now working on proving out the potential profitability of this newer assembly technology. All of this must be done internally, as nobody else has the manufacturing capabilities to outsource and partner. Continued vertical integration is what makes Tesla so special and is also a risk.