Introduction:

American cannabis is a movement. Legalization momentum for the product is growing with each passing election season, and there is no sign of that slowing down.

To put into perspective how overwhelming the interest in marijuana already is, the state of Illinois now collects 50% more tax revenue from cannabis than from alcohol. The demand has always been strong, it’s just now shifting from illicit market activity to the regulated, legal world.

With a 20% compound annual growth rate (CAGR) expected for the next decade and a current total addressable market (TAM) of roughly $20 billion, this legal opportunity is now coming to fruition before our eyes. Already there exist several American multi-state operators (MSOs) boasting rapid growth and strong unit economics, but the regulatory fog continues to keep tight handcuffs on these fundamentally thriving firms.

Here, we will explore the cannabis regulatory path. I’ll cover the key pieces of possible future legislation, and what the passing of each would mean for American cannabis investors.

Let’s begin.

1. Most Likely Regulation

More states legalizing

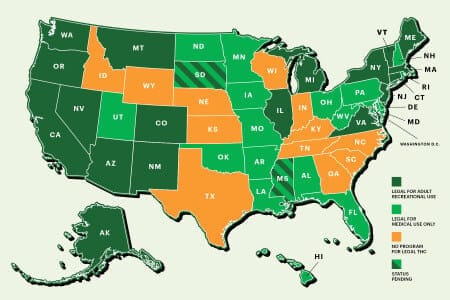

Today, 36 states offer medical-use cannabis and 17 support adult-use. When I was born in 1997, just over 25% of Americans supported legalization and now, that number sits at an overwhelming 68% according to Gallup.

With deeply-conservative states such as South Dakota and Mississippi passing cannabis reform, it’s safe to say a bipartisan legalization train has long left the station. Even the Governor of Texas — the most high-profile state hold-out — is now voicing his support for cannabis use by veterans to help with PTSD. America wants legal cannabis.

Beyond public approval, the COVID-19 pandemic up-ended state budgets and legalizing cannabis is the least disruptive way to create new tax revenue streams. Raising existing income taxes will only create more economic headwinds as we exit this daunting crisis. A state legalizing cannabis would continue to move consumption from the black market to legal channels and boost tax revenues without sacrificing economic prosperity.

To give states even more reason to pass reform, the presence of cannabis dispensaries contributes to a 21% decline in opioid related deaths according to the British Medical Journal. In my view, more states legalizing cannabis is not just possible, it’s inevitable.

2. Somewhat Likely Regulation

a) The Secure and Fair Enforcement Banking Act of 2021 (SAFE Banking Act)

States can legalize marijuana, but that doesn’t change the issue of federal prohibition creating added business costs and complications for operators. The SAFE Banking Act is a piece of legislation designed to offer creditors protection against the current federal ban on cannabis. With it, banks and credit unions would gain immunity from the punishments associated with supplying capital to a company selling cannabis.

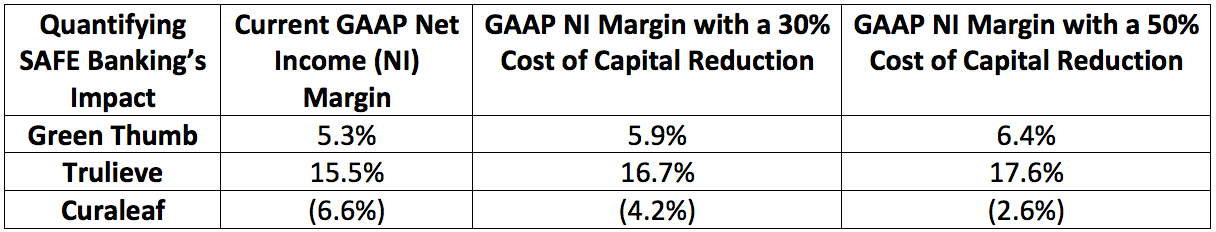

Safe and secure banking legislation should be something all MSO investors are rooting for. It would greatly reduce the lofty cost of capital that growers currently pay. It would also allow these companies to gain more complete business insurance coverage offsetting some of the unique risks associated with American cannabis involvement. Green Thumb — a company with one of the strongest balance sheets in the space — rightfully celebrated paying 7% on their most recent debt issuance. This is still quite elevated and has ample room to come down.

Lower cost of capital would allow MSOs to more aggressively pursue growth while boosting underlying profitability as well: An immediate win-win.

This is one of the more likely pieces of legislation to be passed. In 2018 and 2019, the act was struck down by a republican-controlled Congress. It has since been re-introduced this year with broad, bipartisan support and passed the House of Representatives easily. It’s still waiting for a Senate vote and while getting to 60 votes is far from a guarantee, we will see what happens.

Senate Majority Leader Chuck Schumer is also of the opinion that the SAFE Banking Act doesn’t quite go far enough. He advocates for including things like sentencing and social equity reform which offers a new layer of doubt for compromise being made.

Even if it doesn’t pass this time around, we are slowly progressing as the two parties have every incentive to continue working on getting something done. Not only are the public and state budgets calling for reform, but one of the most conservative Supreme Court Justices — Justice Clarence Thomas — is now suggesting comprehensive federal reform. He refers to the current laws as “contradictory” and “unstable.”

Motivation to create a layer of protection from the federal government for the cannabis industry is not new. In 2013, the Obama Administration sent out what’s known as the “Cole Memorandum” to discourage the enforcement of federal cannabis law for people in compliance with state law.

In 2018 AG Jeff Sessions effectively threw out this memo and threatened to crack down on cannabis enforcement. This turned out to be all bark and no bite. It did, however, more recently prompt lawmakers to introduce legislation like the States Act and the Sensible Enforcement of Cannabis Act to re-incorporate similar protections. SAFE Banking is a compromise born from both of these acts.

b) Uplisting

It’s widely expected that the SAFE Banking Act is the final hurdle obstructing MSOs from uplisting to major U.S. stock exchanges. Enacting this would mean MSOs can move to the New York Stock Exchange (NYSE) from The Canadian Securities Exchange (CSE) and U.S. OTC markets where they currently reside. It seems many MSOs are expecting this to be a when, not if as Trulieve, Ayr Wellness and many more have already converted to GAAP accounting to comply with American exchange regulations.

Uplisting would help lower cost of capital just like with safe and secure banking, but it also helps in another way.

Uplisting would open the door for institutional dollars to finally flood into MSOs. Today, things such as regulation, illiquidity fostered by not being listed on a major exchange and not being able to obtain appropriate insurance all prevent many institutions from investing here — regardless of the momentum.

With institutional demand making up such a large portion of overall stock market volume, unlocking this buying power would be a very powerful multiple expansion event for MSOs. For evidence, look no further than the discrepancy in performance and valuation between an MSO like Green Thumb and a Canadian LP like Canopy Growth in their most recent quarters.

Green Thumb:

- Revenues rose 89.5% year over year to $194.4 million

- 57% gross profit margin

- 34.2% EBITDA margin

- 5.3% net income margin

- $6.5 billion enterprise value

Canopy Growth:

- Revenues rose 37.5% year over year to $148.4 million

- 7% gross profit margin

- (63.5%) EBITDA margin

- (416%) net income margin

- $6.8 billion enterprise value

Green Thumb enjoys far faster growth, better margins, a larger market opportunity and yet a smaller enterprise value. What gives? This is likely the effect of Canadian cannabis growers being able to list on major exchanges in the United States to garner that coveted institutional demand.

Translation? Whenever uplisting does come these MSOs like Green Thumb should finally trade more in line with their true intrinsic value. Today, the companies are thriving in every sense of the imagination offering me confidence that when this day comes, institutions will be ready to pounce.

Just like with the SAFE Banking act, uplisting is an objectively positive event for American cannabis investors.