Among secular growth stories in stock markets, programmatic advertising is among the most compelling. Through the year 2025, the industry is poised to grow by at least 11% annually with some data sources predicting a much faster rate. Within that theme, The Trade Desk (Ticker: TTD) looks to be a strong player. For years, the company has delivered lofty top-line growth with a superb margin profile.

The Trade Desk was founded 12 years ago in California by Jeff Green and Dave Pickles who both remain executives for the organization today. Here I will cover in detail the company’s mission, path and investment case, including:

- The Evolution of Ad-Buying

- a. The Old: Up-Fronts

- b. The New: The Trade Desk’s Programmatic Niche

- A Transaction with The Trade Desk

- Why Would One Advertiser Pay More?

- A Purely Unbiased Partner

- Programmatic’s Growing Edge

- CTV: It’s a Movement

- Pandemic Impact

- a. Short Term

- b. Long Term

- Why Buy-Side?

- Main Risk: The Cookie Monster (Google) and Apple

- Unified ID 2.0 (UID2)

- Solimar Product Launch

- What’s Next?

- Leadership

- Financials and Valuation

- Balance Sheet

- My Approach

- Research and Image Citations

1. The Evolution of Ad-Buying

a. The Old: Up-Fronts

To understand The Trade Desk’s programmatic ad-buying niche, I should first discuss the legacy up-front model (AKA traditional direct) that it’s actively replacing. The up-front model involves advertisers buying large blocks of advertising supply from publishers months in advance. Traditionally, publishers have set fixed prices with advertisers placing orders via rate cards. This somewhat strict process is antiquated — why?

Up-fronts lack the flexibility for advertisers and agencies to make real-time decisions based on data and global trends. It also lacks the flexibility to target advertisements on a per consumer (or per impression) basis making precision a pipe-dream.

How can a specific ad-slot today be properly valued 6 weeks from now? Absent a crystal ball, taking an educated guess is the only option in the up-front system. Up-fronts require us to forecast future audience and interests rather than making decisions based on real-time consumer preferences.

The Trade Desk changes that.

b. The New: The Trade Desk’s Programmatic Niche

The Trade Desk brings a far more granular and precise approach to ad-buying. It does help advertisers make more data-driven decisions within the up-front model, but does so mainly to transition clients to its bread and butter: programmatic advertising.

Through a process known as Programmatic Activations, The Trade Desk’s platform equips ad-buyers with tools to ensure maximum campaign return on investment (ROI) with the ability to track results and optimize to key performance indicators (KPIs) in real time. With its software, parameters like device type, region, a plethora of audience data, consumer preferences, and Nielsen’s gross rating point system are just a few of the targetable signals available to benefit advertisers. Users can even manage multiple sets of parameters when running more complex campaigns to ensure the most granular of targeting and, in turn, effective marketing campaigns.

Thanks to the firm’s software, advertisers can utilize and make actionable decisions on both 1st party data as well as the plethora of 3rd party data that The Trade Desk has access to. When an individual ad-slot becomes available, campaigns running on The Trade Desk are helped to quantify what the slot is worth specifically to that respective advertiser. This ensures the avoidance of overpaying or missing out on a lucrative opportunity.

All of this happens in real-time enabling price discovery per consumer impression, rather than accepting a fixed price on millions of impressions at a time. It’s easy to see how more precisely quantifying the value of each and every ad-dollar spent greatly enhances campaign success.

To deepen its value proposition further, The Trade Desk also offers a media planner to advertisers. This tool provides a goals-based system to craft campaigns with a clear view of audience characteristics — this guarantees they don’t miss anything important.

Agencies and advertisers directly access The Trade Desk’s self-serve, cloud-based platform to ensure complete transparency of performance and knowledge of any incremental costs. Unlike many ‘black box’ players in ad-tech, there is never a doubt where fees came from when partnering with this organization.

To empower advertisers, The Trade Desk leverages trillions of unique data points and a decade of training data to constantly feed and improve its machine learning algorithms — these algorithms then aid its clients in running the highest performing (and most profitable) campaigns possible. Koa is The Trade Desk’s core artificial intelligence (AI) engine enabling all of this to be a reality. It explicitly functions to free users to make better decisions thanks to timely, accurate recommendations.

Koa is specifically what helps advertisers to quantify an impression’s value; as it collects more data, it becomes better and better at doing so. With it, users can be proactive with data rather than reactive, but importantly, advertisers maintain control of this entire process by picking which optimizations they prefer and forgoing others.

It is no longer necessary to guess what an ad-slot will be worth in a few months or if that ad-slot is truly relevant to a campaign. Now, advertisers can just bid on it at the exact time that it becomes available. This reduces booking costs by 50% while improving campaign ROI for advertisers and campaign managers when using The Trade Desk’s platform.

Today, the ad-tech company enjoys industry-leading scale with its advertisers accessing 12 million ad-slots per second through The Trade Desk’s platform. As a very oversimplified but still accurate rule of thumb: The more data a company is using and more granularly each ad-dollar is deployed the higher the ROI that company can deliver. In this light, advantage: The Trade Desk.

2. A Transaction with The Trade Desk

Each transaction that The Trade Desk participates in begins with a publisher having an ad-slot to sell to the open market. A publisher could be any platform like Pluto TV, Barstool Sports or something entirely different. As long as they’re selling ads and not one of the few walled-garden behemoths like Facebook, The Trade Desk is probably working with them in some capacity.

Walled Garden Defined: A platform where the host has total control over all operations, content and functionality. Walled Gardens dictate (and often restrict) the ways in which 3rd parties can access their assets such as media and 1st party data. Google is a walled garden.

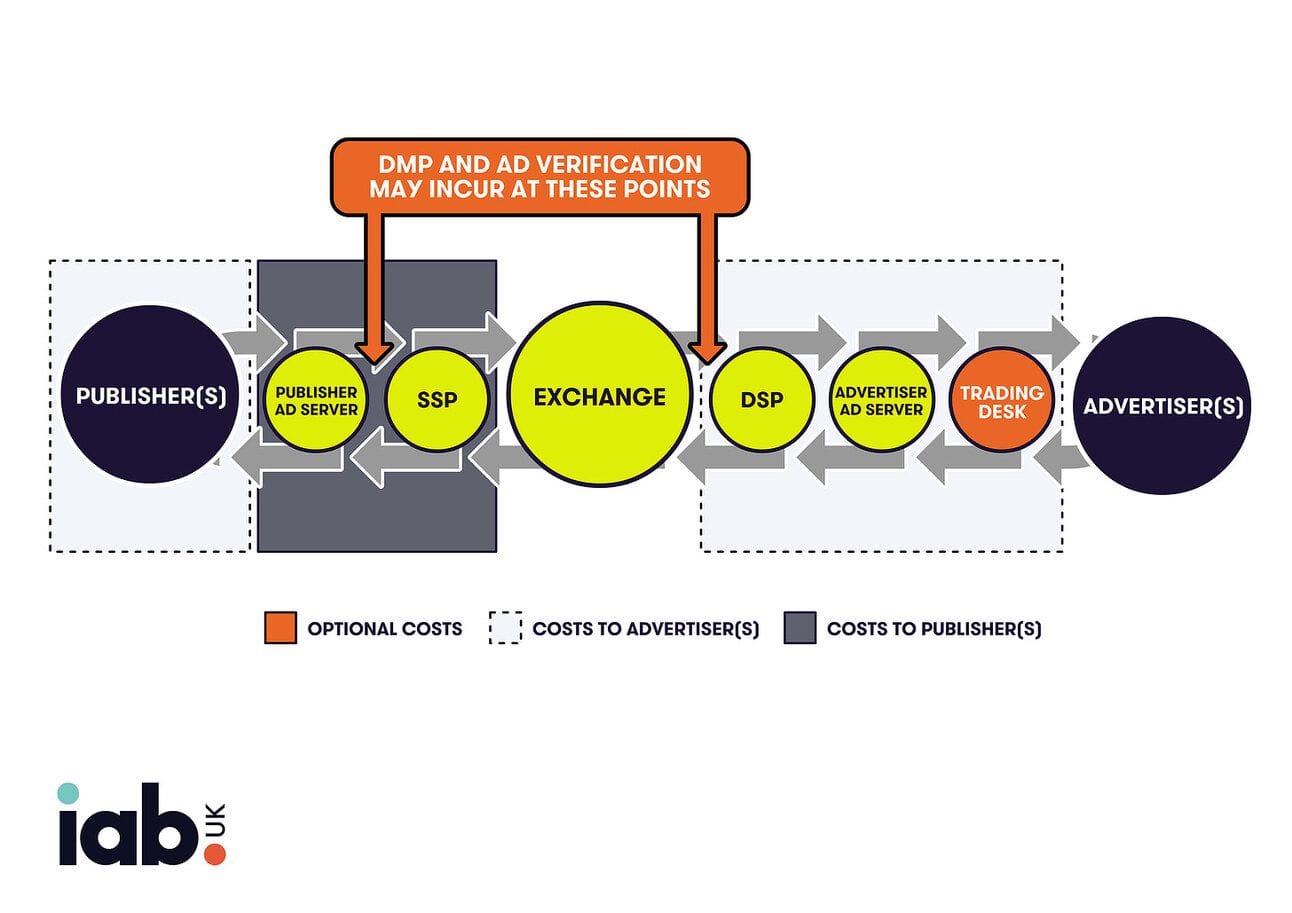

This publisher will generally work with a supply side platform (SSP), like Magnite which functions as the piece of the value chain that actually controls ad-inventory. These SSPs enable publishers to more effectively monetize their supply and thus can enhance the value an ad-seller provides to its buyers.

The SSP then sends individual slots to a digital marketplace where the supply side and demand side interact. All in all, The Trade Desk works with 82 integrated ad-exchanges and SSPs to serve as the conduit bringing this ad-inventory to the demand side buyers.

With these ad-slots, a demand side platform (DSP) like The Trade Desk hosts live auctions for each potential impression it has access to with the highest bidder winning. Remember, The Trade Desk always tells its customers what these impressions are worth.

To generate revenue, the ad-tech organization signs Master Service Agreements (MSAs) with demand-side players and by collecting a fixed percentage of a client’s total spend. It also generates sales via data analytics services but these MSAs make up the majority of The Trade Desk’s business today.

3. Why Would One Advertiser Pay More?

Let’s use Interactive Brokers specifically to see why everyone wouldn’t just pay the same for an impression. Interactive Brokers advertises on CNBC’s cable, audio and streaming services. For a company serving investors like this one, a CNBC impression is likely worth more to it than it is for a company selling cosmetics for example. The more relevant the audience, the more an impression is worth.

We have to ask ourselves: who is consuming the content, what do they want, and will they exhibit an action? The Trade Desk has automated the answers to these pressing questions for the advertising industry and this is why it can tell us what to pay for an impression.

4. A Purely Unbiased Partner

Importantly, The Trade Desk has no affiliation to inventory and supply side players in this space. It has earned the title of largest independent and unbiased programmatic ad-buying platform on the planet. It believes that avoiding conflict-of-interest when serving both the demand and supply side is all but impossible, so it doesn’t. By staying truly unbiased, The Trade Desk can guarantee it’s providing the most value possible for both its own clients and integrated SSPs.

Once-independent competitors like BeesWax are actively being bought up by behemoths like Comcast making The Trade Desk’s lack of platform or publisher bias all the more unique and valuable. The absence of affiliation ensures agencies can trust The Trade Desk with their 1st party data and campaign performance without any intervening agendas. It’s a true team effort here.

Furthermore, The Trade Desk has committed to NEVER actually owning advertising supply. It merely acts as a connector between publishers and agencies thus guaranteeing it is not arbitraging inventory for profit. Another potential conflict of interest, gone.

When combining this fairness with complete KPI and fee authority — as well as the superior ROI — it’s clear to see why The Trade Desk’s user retention rate has remained over 95% for 28 straight quarters.

Its application programming interfaces (APIs) are even open to its demand-side users so that they can build their own features on top of The Trade Desk’s to boost utility if they so choose.

Application Programming Interfaces (APIs): APIs are blocks of code that enable software to perform various tasks. APIs act as the ‘language’ that empower access to data services, operating systems, and other applications to create an end product. A user interface (UI) is what the consumer sees and APIs are what the enterprise uses to build the platform’s UI and user experience (UX).

The company obsessively commits itself to complete data, fee and algorithm transparency which is easier thanks to an absence of supply side conflicts. This is quite the refreshing change from walled-garden mammoths attempting to keep as much traffic within their own ecosystems as possible, rather than providing the greatest possible advertiser utility. These walled gardens tend to be far more timid with data and fee structure sharing which makes a transparent approach all the more appealing.

For the Facebook’s of the world, the more data they can control and monetize, the better. The Trade Desk takes a polar opposite approach and essentially works with every company in the advertising world besides the titans.

This is what creates the powerful, and accurate, label of The Trade Desk being the open internet advocate. And as we will see later with Unified ID 2.0 (UID2), it’s not just calling itself that, it’s acting like it.

5. Programmatic’s Growing Edge

We’ve gone from people consuming content solely on ABC, CBS, Fox & NBC (heritage broadcasters) to hundreds upon hundreds of entertainment options. Furthermore, we don’t solely consume content on a television or a desktop anymore, but tablets, smartphones, watches and more. This combination lends itself to audiences becoming more and more fragmented.

The value gap between programmatic and up-front purchasing widens as this fragmentation expands. More separated audiences make effective targeting all the more important and all the more difficult, which is where the scalable, 1-to-1 impressions that The Trade Desk offers truly shines. The company can consolidate all of this increasingly fragmented traffic in one platform, which makes quantifying the value for advertisers and conducting real-time auctions possible. Whether it’s streaming video, podcasts, video games, smartphone apps or music services — this entity has the demand side covered.

I touched on how programmatic advertising boosts ROI and lowers costs for advertisers, but it also saves valuable time for the entire value chain as well. According to Boston Consulting Group, publishers reduce time to ad-placement by 57% via switching from up-front advertising to programmatic. Agencies reduce their time by 29%. More profits and time means more focus on things like product innovation and creativity rather than solely brand awareness. And that’s what actually builds a sustainably successful company.

As a result of these advantages, programmatic spend as a percentage of total global video and display ad-spend has risen from 49% in 2017 to over 63% last year. The United States specifically saw its programmatic penetration rise from 79.3% to 86.3% over the same period. Markets like Latin American are less tapped at 36.3% but it’s seeing a similar trend and the rest of the world is no different. The programmatic shift is clearly happening.

6. CTV: It’s a Movement

Connected TV (CTV) is probably the most compelling programmatic advertising growth channel thanks to the linear TV cord cutting movement. Notably, there are now more streaming subscriptions in the world than cable subscribers — and there are really no signs of this slowing with more content precipitously moving to streaming services.

Live sports as a category is now making its way over to Paramount+, ESPN+ and others. 88% of the U.S.A’s most watched shows pre-pandemic were live sporting events making it crystal clear to see how this will impact these trends as well. Eyeballs will follow interest and the interesting content is leaving legacy cable at a rapid clip.

We don’t get specific color on how The Trade Desk’s CTV category is growing on quarterly earnings reports, but the company has told us “CTV revenues have more than doubled” for several consecutive quarters.