In case you missed it:

- Lemonade, Hims and Coupang Earnings Reviews

- Uber & Shopify Earnings Reviews

- Palantir & Mercado Libre Earnings Reviews

- Amazon & Microsoft Earnings Reviews

- Meta & Robinhood Earnings Reviews

- SoFi & PayPal Earnings Reviews

- Alphabet & Tesla Earnings Reviews

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix & Taiwan Semi Earnings Reviews

- Starbucks & Apple Earnings Reviews

- Current Nerd Portfolio & Performance

Table of Contents

- 1. Duolingo (DUOL) – Earnings Review

- 2. The Trade Desk (TTD) — Earnings Review

- 3. DraftKings (DKNG) -- Earnings Review

1. Duolingo (DUOL) – Earnings Review

a. Duolingo 101 (DUOL)

Duolingo is a leader in app-based language learning. It’s now expanding into music and math. While this is a learning-based platform, the learning is meant to be fun, competitive, social and engaging. This is a proven formula to keep users coming back. The foundation driving DUOL’s business model is a commitment to rapid, obsessive iterations of every single piece of its product to ensure that every facet is always getting better. Constantly split-testing every single variable is in its DNA. It leads with product, rather than advertising and relies on word-of-mouth growth to power the vast majority of its success. It then supplements that with efficient marketing (from social media to the Super Bowl) to create viral moments and demand accelerants. This results in a low Customer Acquisition Cost (CAC).

b. Key Points

- Resilient performance through an especially noisy quarter.

- Great chess growth.

- Modest user weakness is not structural.

- Potentially large app store GPM tailwind for 2026.

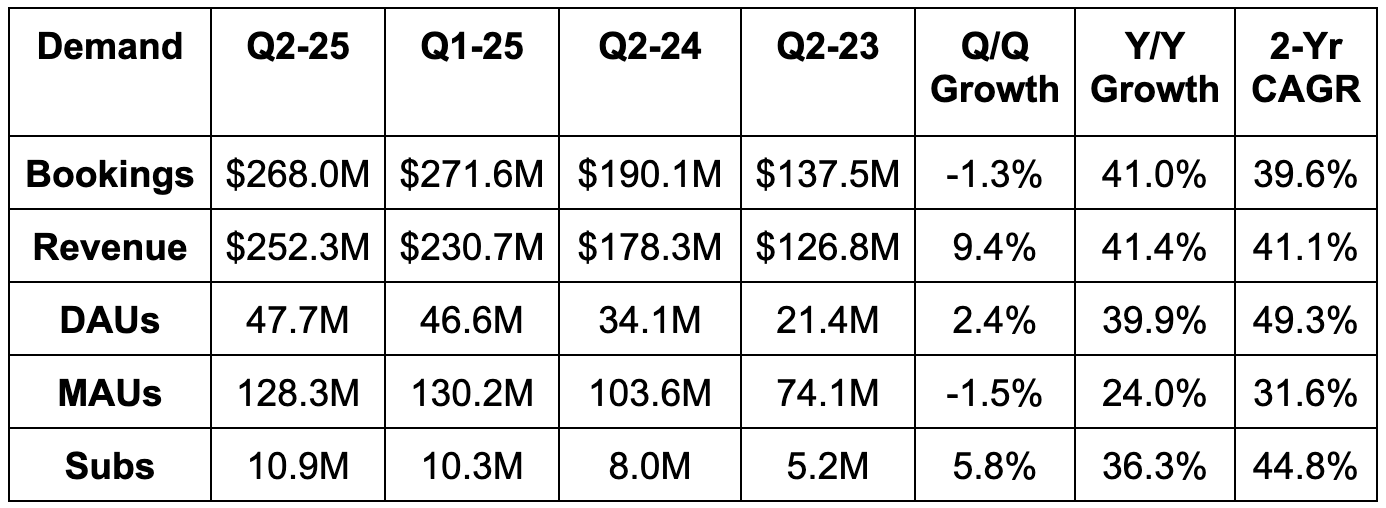

c. Demand

- Beat bookings estimate by 8.8% & beat guide by 9.4%.

- Foreign exchange helped power some of the beat. Still, constant currency (CC) bookings growth was 39% vs. 30% growth guidance.

- Duolingo Super price hikes also very modestly boosted results.

- Beat revenue estimate by 4.9% & beat guide by 5.1%.

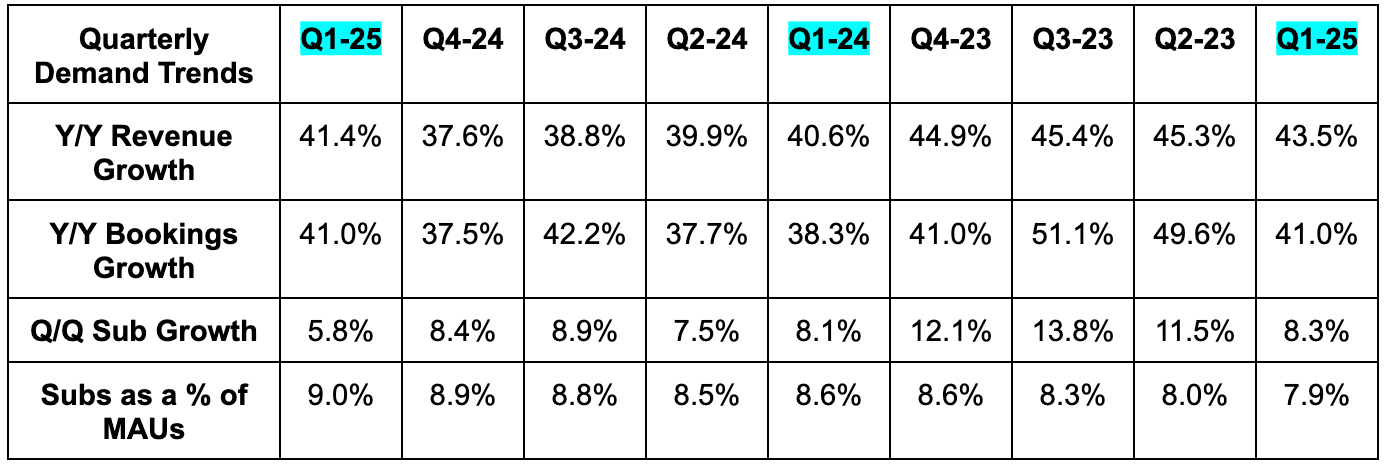

- Its 41.1% 2-year revenue compounded annual growth rate (CAGR) compares to 39.2% Q/Q & 42.1% 2 quarters ago.

- Missed daily active user (DAU) estimate by 2.5% & missed 42.5% DAU growth guidance,

- Met subscriber estimate.

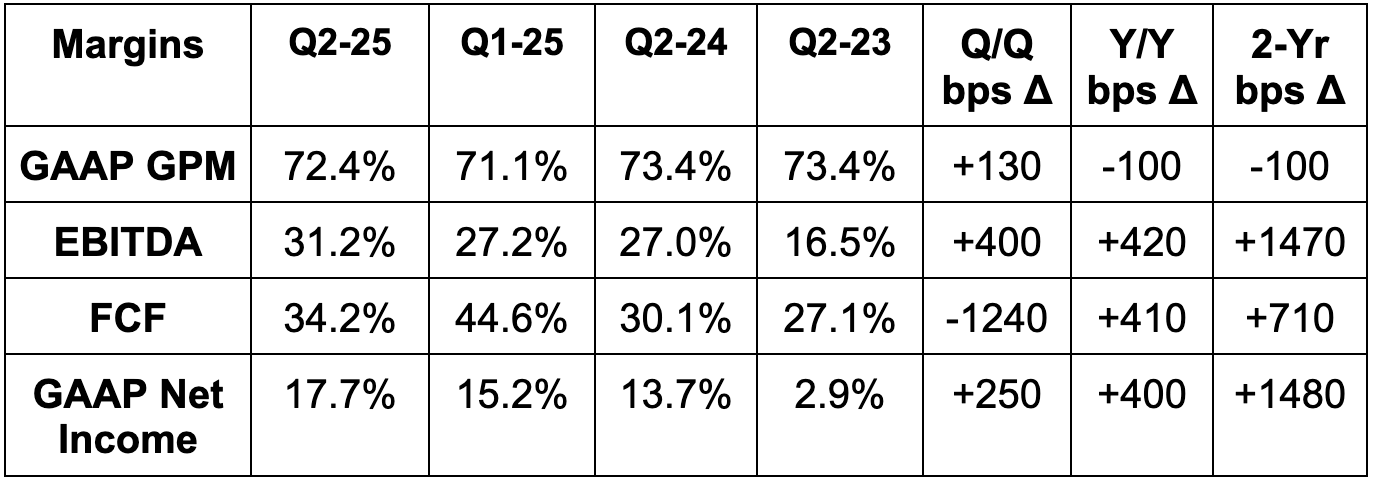

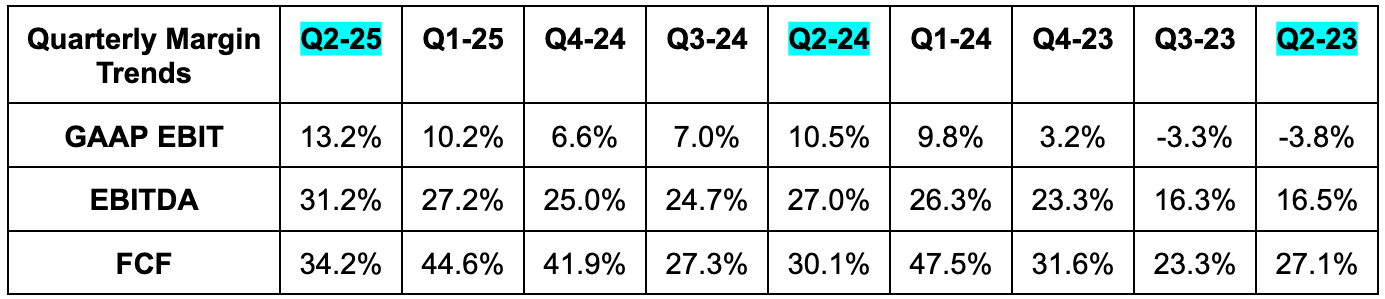

d. Profits & Margins

- Beat GPM estimates by 180 basis points (bps; 1 basis point = 0.01%).

- AI cost deflation is helping a lot.

- Beat $0.58 GAAP EPS estimates by $0.40. EPS rose by 75% Y/Y

- Beat EBITDA estimate by 29% & beat guide by 32%.

- Beat FCF estimate by 9%.

e. Balance Sheet

- $1.1B in cash & equivalents,

- No debt.

- 27% year-to-date stock compensation growth.

f. Guidance & Valuation

- Raised annual bookings guide by 2.8%, which beat estimates by 2.3%.

- Raised annual CC bookings growth guidance from 30% to 32%.

- Q3 guidance was similarly ahead of expectations.

- Raised annual revenue guide by 2.4%, which beat estimates by 1.8%.

- Q3 guidance was similarly ahead of expectations.

- Raised annual EBITDA guide by 3.8%, which beat estimates by 2.6%.

- Q3 guidance was slightly ahead of expectations.

Guidance includes Duolingo English Test (DET) weakness, as international student attendance at USA universities is challenged. It also doesn’t rely on a normalization in its social media engine (much more on this later).

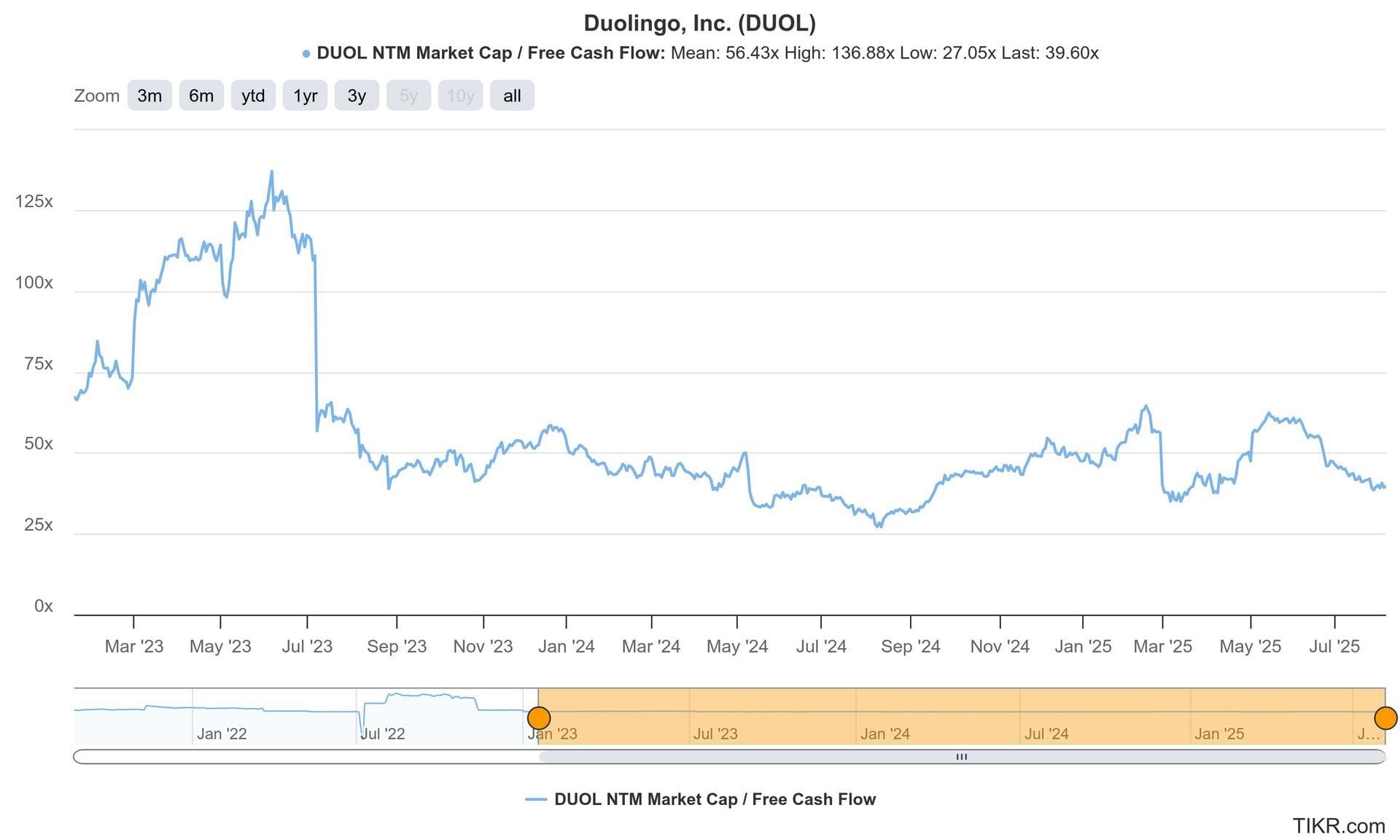

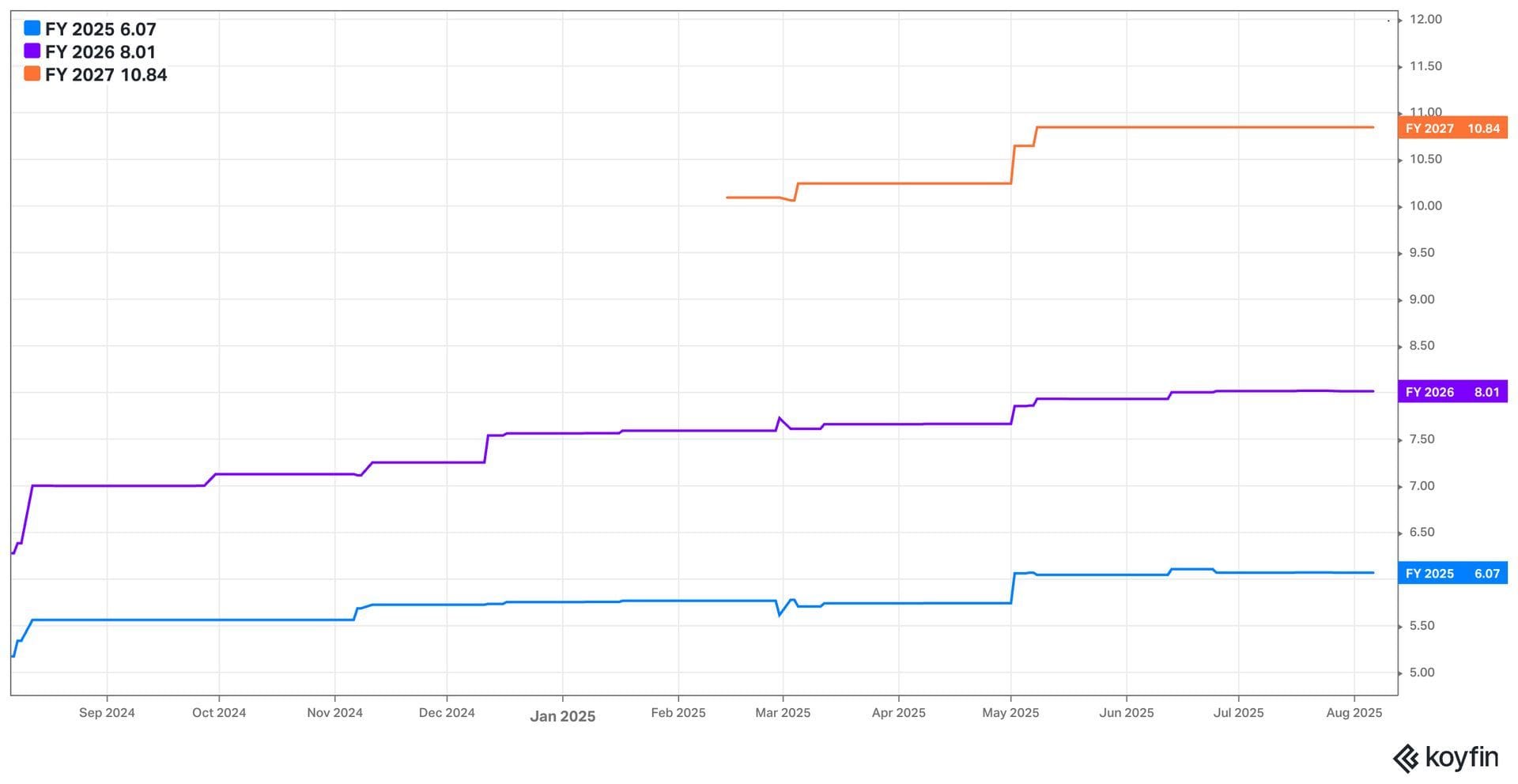

Duolingo trades for 40x forward FCF & 58x forward EPS. FCF is expected to compound at a 38% clip for the next two years. It also trades for 55x forward EPS. EPS is expected to compound at a 40% clip for the next two years.

g. Call & Release

Modest User Growth Weakness & Mid-Quarter Drama:

As many of you know, there was considerable mid-quarter noise regarding Duolingo. Their talented co-founder/CEO Luis von Ahn excitedly took to social media to share Duolingo’s plans on being an AI-first company. This was very well received internally, but led to considerable user backlash against the company and souring social media sentiment. Per von Ahn, he just did not word things very well, and led people to assume AI would replace their workforce, rather than supporting it. Some took to social media to announce their product boycotts and this is what led to DAU growth coming in modestly below expectations. This was specific to the USA, which is why weakness was specific to that single market.

The boycotts very modestly hit top-of-funnel growth, while Duolingo was forced to pivot from its edgy, routinely viral social media content in a bid to recover positive sentiment trends. That further slowed growth down. Encouragingly, DAU growth stabilized as they improved and normalized overall social media sentiment. That, along with rising subscriber retention, represents proof that this weakness was not related to competition or a worsening value proposition. Notably, it also had absolutely nothing to do with language-based GenAI products from OpenAI. That has been irrelevant for Duolingo’s business, just like their launch today showing a very simple game being made with the models will be too. Not structural… ephemeral… great news.

The team expects to maintain lofty 40% DAU growth next quarter. They are confident that the drama is behind them, optimistic that their world-class social media marketing will fully normalize in the coming weeks, and adamant that it will be back to business as usual… I think they’re right. Luis von Ahn is an elite founder and an elite operator who is data-driven and always improving. This will simply be a learning experience and, I think, an immaterial blip on the radar.

And one more note here. This is what Duolingo’s financials look like when they have a “challenging quarter.” Their “challenging quarter,” entailing 40% top-line growth with expanding margins and only a very modest user miss, is simply a testament to how impressive this firm truly is. Other companies would dream of this “challenging quarter” being their best one.

On falling Q/Q monthly active users (MAUs), Duolingo is not focused on this metric. Language learners need to engage daily to get value from this product and to have a good chance of actually paying for it. These are not the users who are likely to power their growth engine. Furthermore, Duolingo got a massive boost from their “Dead Duo” campaign in Q1, which drew in casual users and drove that specific metric. The Q/Q decline is that temporary spike reverting; they’re “not worried” about this.

- AI backlash doesn’t change their plans for using this tech across their product. They’ll just get a lot more quiet about it.

- Video calls continue to accelerate advanced English learner growth as hoped for.

More on USA DAU Growth:

DAU growth in the USA is slowing faster than leadership wants it to, and it knows exactly why.

They spend nothing on marketing and rely solely on organic word-of-mouth growth in the U.S. They used to spend nothing in places like Mexico, and had a similar growth issue before adding a very modest performance marketing budget. That did the trick in Mexico and durably reaccelerated growth there. Management believes that the same will be true here, and plans to create a small budget for USA marketing for the rest of 2025. As that kicks in and it gets back to its viral social media ways, expect growth here to improve. The runway in all of their markets remains massive, and its fastest growth continues to come from some of its most mature counties. That tells us that huge opportunities remain and spending productive marketing dollars to capture this market is the right move.

Duolingo Super & Max:

Duolingo Super was actually the subscription tier that drove the firm’s outperformance – not Max. While outperformance for Super does cannibalize a bit of Max demand, they do want Max to be growing more quickly and there are firm plans in place for that. It ticked from 7% of total subs to 8% Q/Q, and the goal is further acceleration. A big piece of that initiative will be making the FaceTime product better for beginners. It’s currently great for advanced speakers, but less capable students are having a hard time with it, as they lack the vocabulary for a full conversation. To help, Duolingo is adding hybrid conversational content that combines the language being learned with a user’s native tongue.

Leadership is excited about new research clearly showing this product improves the speed of learning, and they want that to work for a larger portion of the user base. Beyond this, they still haven’t localized pricing in important markets like India. With model costs plummeting, pricing this package for more markets will get easier, and friction will wane.

With this team, you know they’ll rapidly test, test and test some more until KPI optimization is obvious and performance improves. This is the split-testing and iteration king, with more data and a better understanding of how to use it than the competition.

- Added new backgrounds for the FaceTime to introduce new settings and themes to broaden topics covered.

- Max retention metrics are encouraging, but they still haven’t lapped the introduction of the FaceTime offering. That will be another large cohort churn test.

China:

China outperformed internal expectations during the quarter. This was thanks to a large collaboration with Luckin Coffee that made a lot of their stores Duolingo-themed (with Duolingo drinks). This momentum is coming before Duolingo is even allowed to debut its higher-priced Max offering. They’re awaiting approval from regulators to run the models needed for this product offering. When that happens, it should unlock a lot more growth. Timing uncertain.

App Store Fees:

Duolingo is now testing moving some iPhone and iOS users to its own web-based checkout product. This is leading to some conversion rate declines, as external checkout pages always do, but the profit benefit is more than enough to make up for that small negative. This change allows Duolingo to pocket a nearly 30% take rate for new subscriptions and renewals in the USA. Notably, the impact of this will be quite modest in 2025. Most of the subscriptions they sell are annual, so it will take a full year for renewals to reflect this change. Furthermore, we don’t yet know if this app store side-loading will be allowed past 2025. If that happens, it could provide a large GPM tailwind, as most of its input costs are app store fees. That’s exciting to think about, but we’ll have to see how regulations shake out.

Constant Core Product Improvements:

Duolingo’s fantastic growth engine remains product-driven… not marketing-driven like its competition. They continue to obsessively work on extracting a single drop of engagement at a time, knowing these gains add up over time into something quite meaningful.

This quarter, the change highlighted was its move from “hearts” to “energy.” Hearts are like remaining lives, which fall with wrong answers. When users run out, they either need to wait or pay for more access. Energy is “usage-based,” with energy being drawn as a user takes lessons… but rising if they have 5 correct answers in a row. It shifts to more positive reinforcement and has already boosted user growth, engagement and monetization. It’s very rare for a change like this to be positive for all 3 of those items. They expect to roll this out to their entire user base in the coming months and are quite confident in the change.

The team was asked about some social media blowback. This happens for every major change – just like when it changed the homepage in 2023. The complaints are from a very small cohort of users who got “very good at not paying or making mistakes.” This effectively allowed them to use the entire product offering for free while the energy format won’t… so obviously they’re not thrilled about the news.

New Product Categories:

The chess product is thriving. It’s up to 1M+ DAUs faster than any other launch and just a few months into full availability. This is still only for iPhone users and only in English, with far more expansion coming. Despite that, it has already surpassed math and music courses, with future tools such as live head-to-head matches adding to the momentum. They remain confident in math and music, with a brand new buyout of NextBeat’s music gaming team to support their goals.

While all new subjects are progressing nicely, the vast majority of the business is still language learning and they still haven’t tried to monetize any of this with standalone subscriptions. That will all come eventually, and should support materially incremental growth by 2027… many more subjects will come after that.