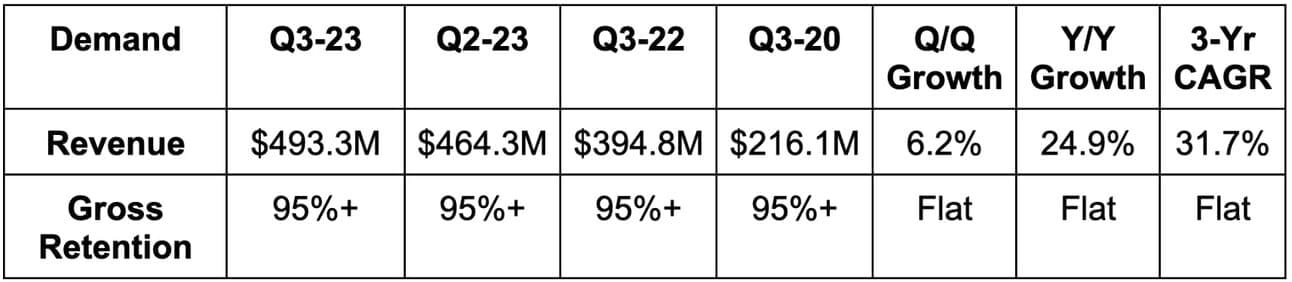

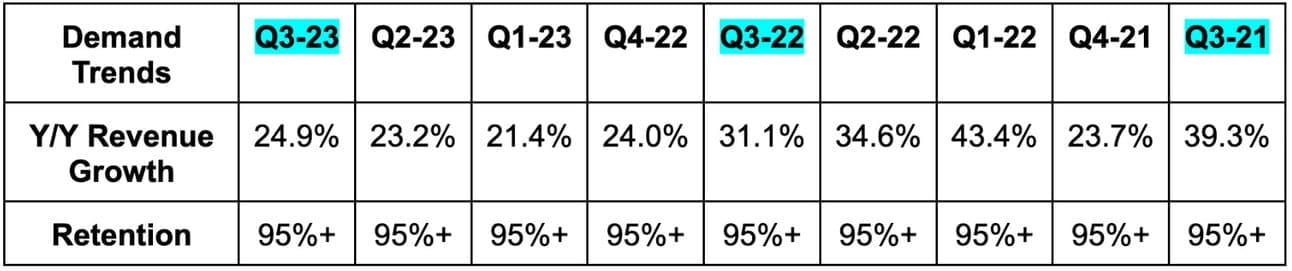

1. Demand

The Trade Desk beat revenue estimates by 1.2% and beat its guidance by 1.6%. Gross retention has been over 95% since it went public in 2016.

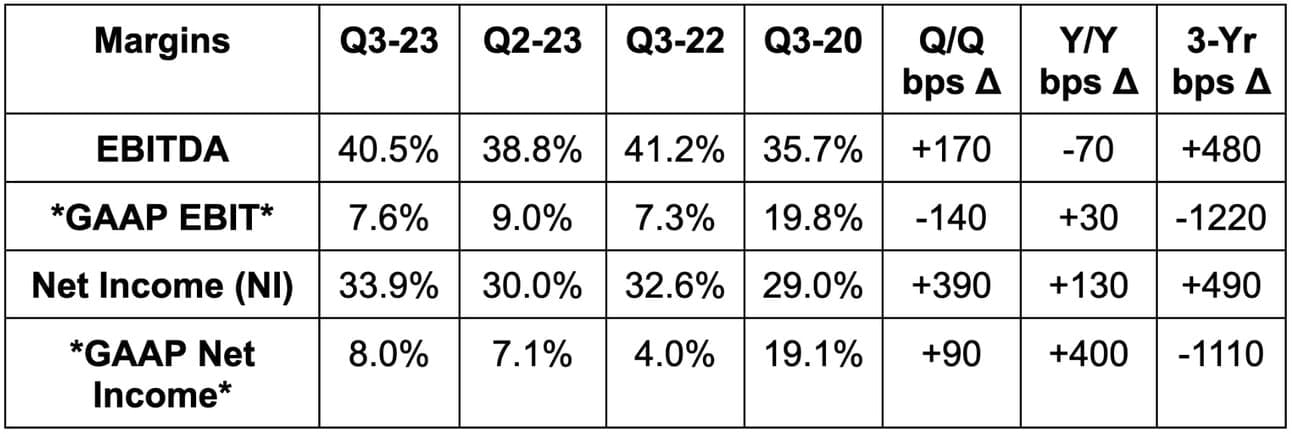

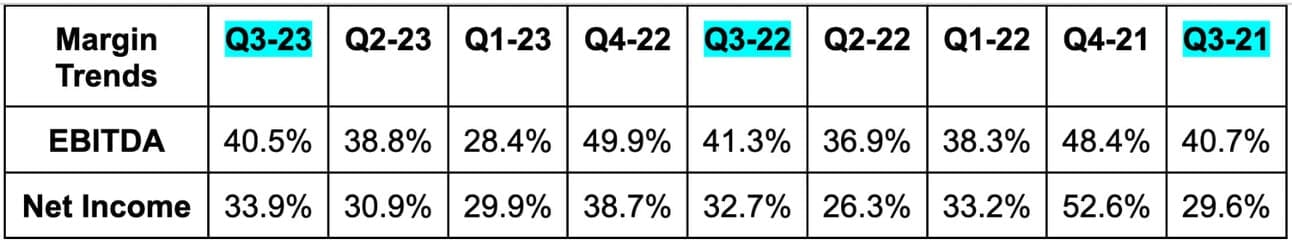

2. Profitability

- Beat EBITDA estimates by 6.0% & beat guidance by 8.1%.

- Beat $0.29 earnings per share (EPS) estimates by $0.04.

- Met GAAP EPS estimates.

It has generated $600 million in free cash flow (FCF) over the last 12 months. This puts it around 40x trailing 12 month free cash flow and a likely mid-to-high 30s next 12 month FCF multiple. It’s amazing how a 30% stock price haircut can magically make valuation look far better in a hurry.

c. Guidance

“At least” revenue guidance was 5% below consensus (at most) with EBITDA about 7% worse than consensus. Revenue guidance represents 18% Y/Y growth and 22% Y/Y when excluding the impact of political spend in Q4 2022.

This is the first time in TTD’s public history that it missed on top and bottom line guidance. The weak guidance was due to cautious spending that started in the 2nd week of October. Hesitation was related to macro headwinds and industry strikes as well. That caution stabilized starting this month but led to the firm baking added prudence into the Q4 guidance. It said over and over again that it’s highly optimistic about Q4 and 2024 as a whole, but wanted to be overly conservative for this specific guide.

I’d be surprised if they didn’t handsomely beat next quarter. This feels like underpromising to overdeliver. If this quarter is an anomaly like I expect, this is not concerning to me. If it isn’t, this becomes much more concerning.

d. Balance Sheet

- Share count rose by 0.3% Y/Y as it controls dilution with its small buyback. It repurchased $90 million in stock during the quarter.

- $1.6 billion in cash & equivalents.

- No debt.