Today’s piece is powered by The Investor’s Podcast Network:

“Over the first 9 months of the year, we have gained more market share than at any point in our history.” – Co-Founder/CEO Jeff Green

1. Demand

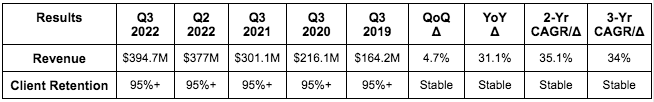

The Trade Desk beat its at least revenue guide by 2.5% and analyst estimates by 2.3%.

More Context on Demand:

- The 34% 3 year CAGR compares to 33.1% last Q & 37.6% 2 Qs ago.

- Client retention has been over 95% for 8 years.

- Video (includes Connected TV (CTV)) represents a low 40% of the company’s revenue which is stable QoQ.

- Disney+ launching ads next month (and Netflix) will fuel the CTV fire more.

- Mobile remains in the high 30% range in terms of revenue contribution.

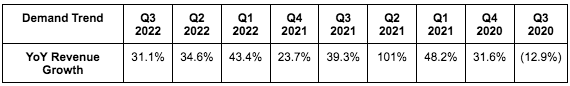

- Q3 2022 is comping vs. nearly 40% growth in Q3 2021 — significantly ahead of The Trade Desk’s run rate growth. It still managed to boast over 31% growth. Impressive.

2. Profitability

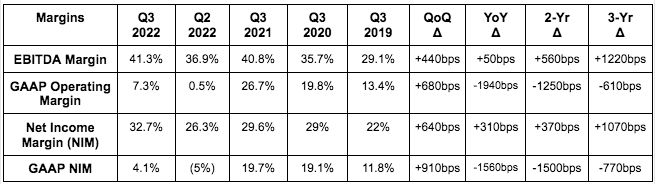

- The Trade Desk beat its EBITDA guide by 16.5% and analyst estimates by 15.6%.

- The Trade Desk beat analyst earnings per share (EPS) estimates of $0.20 by $0.03 or 15%.

More Context on Margins:

- Founder awards in connection with meeting several performance goals began vesting in 2021. That’s the source of the large difference between GAAP and non-GAAP margins. Most of the $600 million package is expected to finish vesting next year when GAAP margins will normalize. A small chunk will vest early 2024.

- CFO Blake Grayson told us that YoY stock comp growth would turn negative next quarter as we have lapped most of these awards.

- The Trade Desk’s trailing 12 month FCF generation is up 53% YoY.

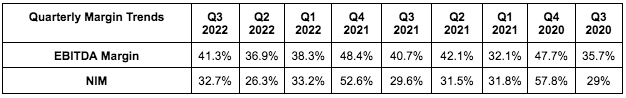

- The sequential margin expansion was a positive surprise. Last quarter the company told us it would lean into operating expense growth starting this quarter and that, that would weigh on margins. Unit economics improved regardless.