“We delivered an outstanding performance while significantly outpacing programmatic advertising. More leading brands are signing major new or expanded agreements with us. This speaks to the value of our platform vs. the limitations of Walled Gardens.” — Co-Founder/CEO Jeff Green

1. The Trade Desk Demand

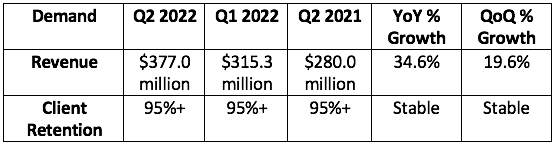

The Trade Desk guided to “at least” $364 million in revenue for the quarter while analysts were expecting $365.2 million. It posted $377.0 million in sales, beating analyst estimates by 3.2%.

More context on demand:

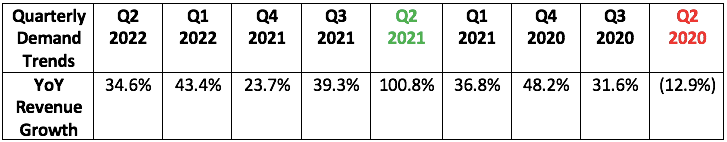

- This quarter represents The Trade Desk’s toughest pandemic-related YoY comp as it grew sales by over 100% in Q2 2021. Regardless, it grew revenue well above its long term ~25%-30% average.

- The Trade Desk has sported a gross retention rate over 95% for the last 8 years.

2. Profitability

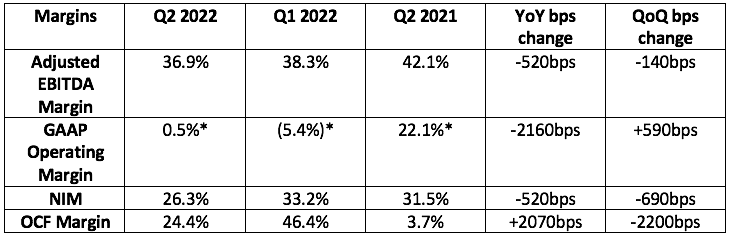

The Trade Desk guided to $121 million in adjusted EBITDA for the quarter while analysts were looking for $123.3 million. It earned $138.9 million, beating its guide by 14.8% and analyst estimates by 12.7%.

The Trade Desk also earned $0.20 per share -- in line with analyst expectations.

More context on margins:

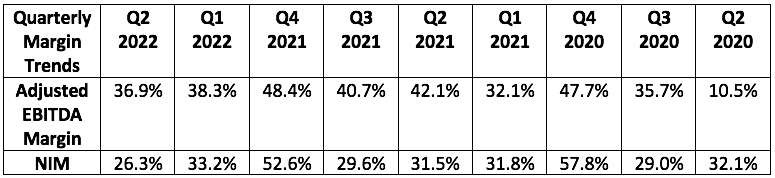

- 2022 GAAP operating margins continue to be impacted by about $80 million in incremental YoY stock based compensation for Q2 and $90 million in Q1. Without this hit, GAAP operating margin would have been 21.7% for Q2 2022.

- The Trade Desk guided to leaning back into growth spend staring this quarter. This move is expected to lead to some margin compression this year.

- Cash flows are seasonally lumpy for The Trade Desk.

- Its tax bill grew 53% YoY which weighed slightly on NIM.

The balance sheet is beautiful. It has $1.21 billion in cash, equivalents and short term investments with no debt.

3. Guidance

Q3 2022:

- Analysts were looking for $382.3 million in sales. The Trade Desk guided to "at least" $385 million. The company always beats its "at least" revenue guides.

- Analysts were also looking for $134.7 million in adjusted EBITDA. The Trade Desk guided to "approximately" $140.0 million, beating expectations by 3.9%.

The company does not guide to annual results.

4. Notes from Co-Founder/CEO/Superstar Jeff Green

The call was essentially a victory lap from management... and a fun one at that.