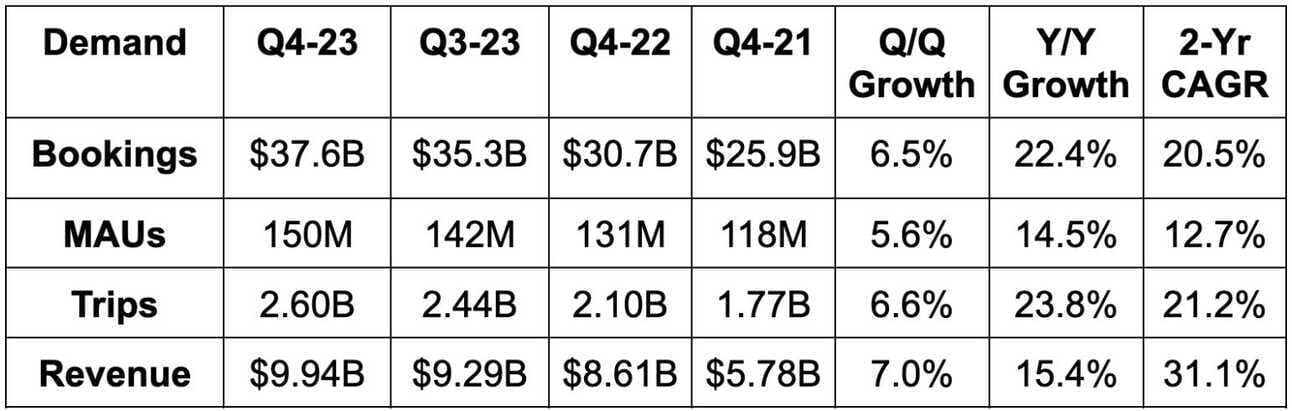

1. Demand

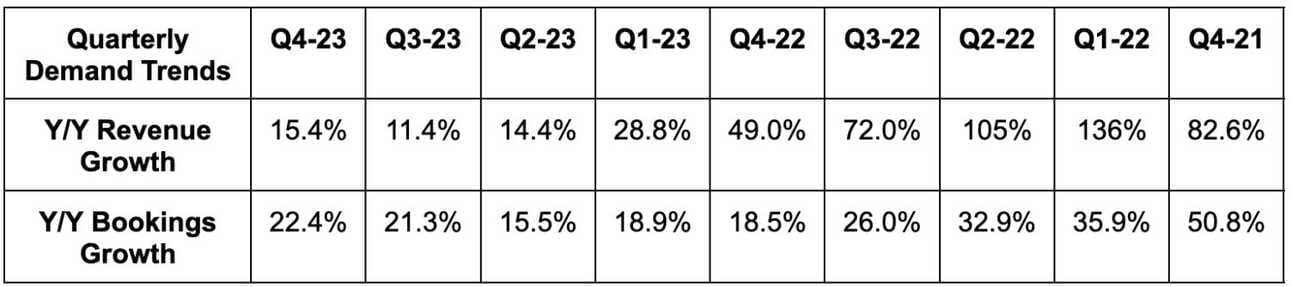

Uber beat bookings estimates by 1.3% & beat bookings guidance by 1.6%. It also beat revenue estimates by 1.8% and beat monthly active user (MAU) estimates by 1.4%. It roughly met foreign exchange neutral (FXN) Y/Y growth guidance across its segments. A business model change in the UK made it classify some sales & marketing spend as a contra-revenue item. This slowed delivery & mobility revenue growth by about 700 bps Y/Y. Comps will normalize in 2024.

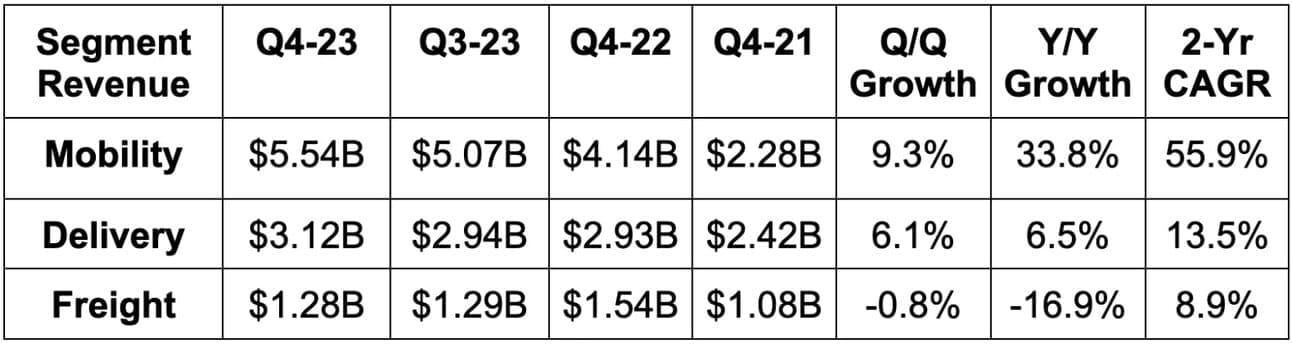

- Mobility bookings rose 29% Y/Y FXN; delivery bookings rose 19% Y/Y FXN; freight bookings fell 17% Y/Y FXN.

- Mobility revenue rose 31% Y/Y FXN; delivery revenue rose 4% Y/Y FXN; freight revenue fell 17% Y/Y FXN.

- Mobility take rate was 28.7% vs. 27.8% Y/Y; delivery take rate was 18.3% vs. 20.5% Y/Y.

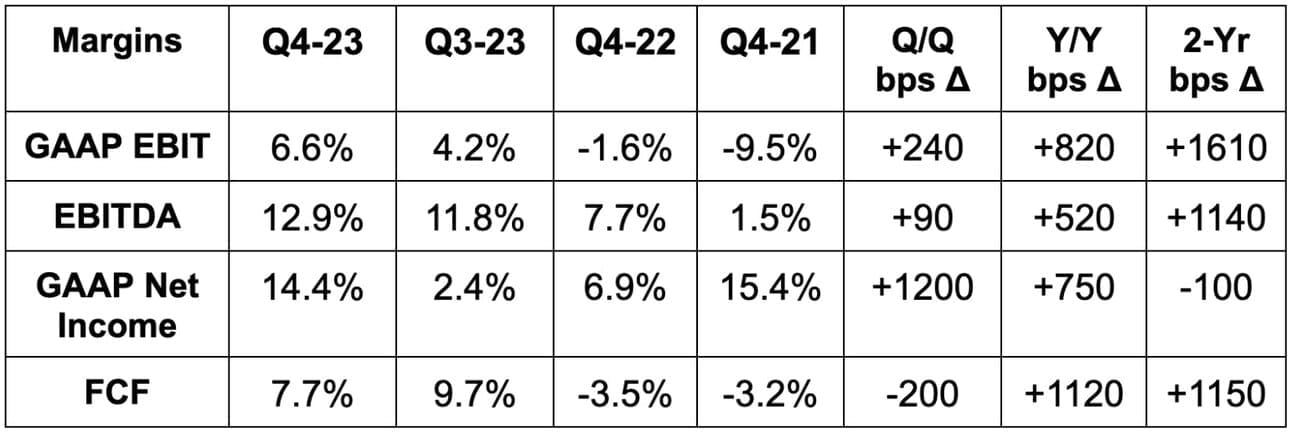

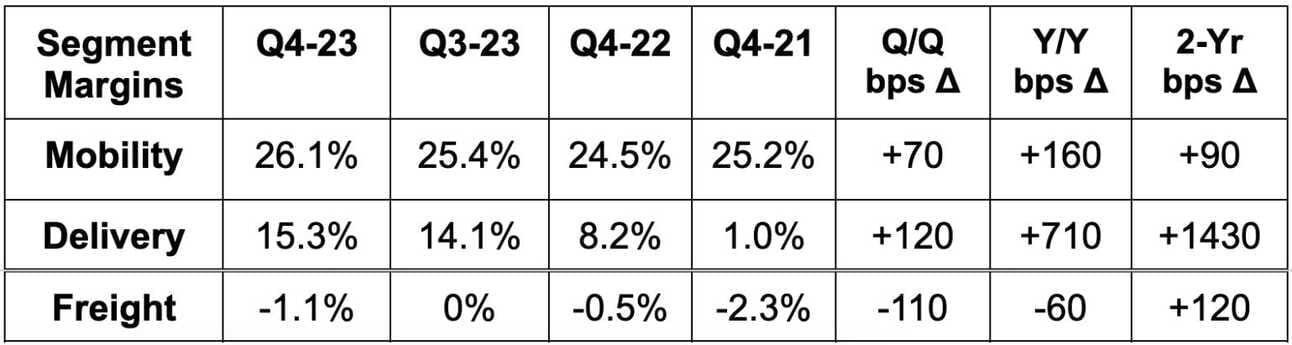

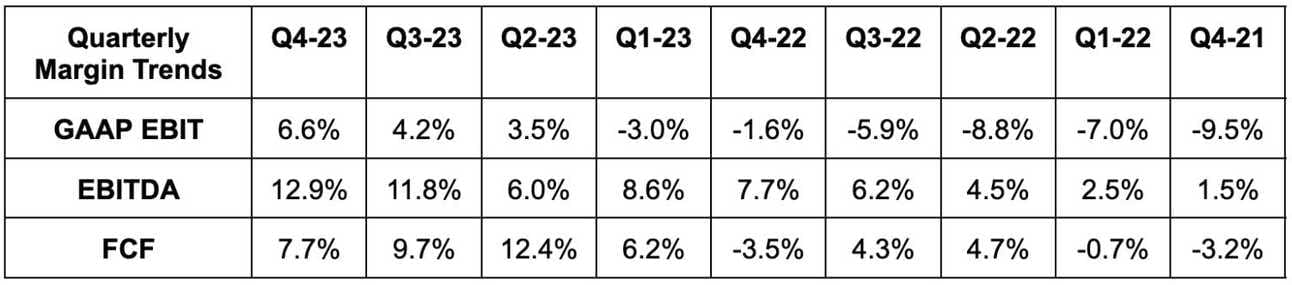

2. Profitability

Uber beat EBITDA estimates by 5.2% and beat EBITDA guidance by 6%. GAAP EBIT was 26% ahead of estimates and GAAP earnings per share (EPS) was well ahead of estimates due to equity investment gains. When excluding these gains, it earned $0.20 per share vs. $0.17 expected.

- Cost of revenue was 16.1% of volume vs. 17.3% Y/Y.

- Operations & support costs were 1.7% of volume vs. 1.8% Y/Y.

- Sales & marketing costs were 2.4% of volume vs. 3.6% Y/Y.

- R&D costs were 1.3% of volume vs. 1.5% Y/Y.

- G&A costs were steady at 1.5% of volume.

Corporate G&A + Platform R&D was $625 million vs. $580 million Y/Y. This cost is not allocated to a specific segment, but is deducted from company-wide EBITDA.

3. Balance Sheet

- $5.4 billion in $ & equivalents.

- $6.1 billion in investments.

- $9.5 billion in debt.

- Share count rose 3% Y/Y. The team all but told us that it would announce a buyback at its investor day next week.

4. Q1 Guidance & Valuation

Uber’s bookings guidance is 0.8% better than expected while its EBITDA guidance is 3.2% better than expected.

Uber trades for 40x 2024 earnings and 32x 2024 free cash flow. Earnings are expected to grow by 44% Y/Y on a non-GAAP basis and by 198% Y/Y on a GAAP basis. Free cash flow is expected to grow by 60% Y/Y.

“We expect to demonstrate further leverage over the coming quarters… There’s a tremendous runway for more leverage… Free cash flow will keep ramping over the coming years.” – CFO Prashanth Mahendra-Rajah

“Customer activity remained strong across the world… We look forward to healthy top line growth in 2024.” – CEO Dara Khosrowshahi