The transcript for The Trade Desk has not yet been released on the services that I use. The call just became available for replay, but these calls are always extremely dense. I need to read through it to make sure I don’t miss anything. I also wanted to get these to you all before the middle of the night. For now, I included a brief overview of The Trade Desk’s report along with these full Uber and Shopify reviews. Tomorrow, I will publish the rest of this review, an Airbnb review and a Duolingo review.

One more note — I know this earnings season has been no fun. I know we’ve had very few positive reactions to enjoy. I know it seems like every good report is being inexplicably punished. I know there’s been a lot of “get excited about better risk/reward” lately with little “get excited about positions becoming worth more.” While indexes are near ATHs, I know there have been some sizable pullbacks for many individual names. I know… you know… we all know.

And it sucks… for now.

It is during very moments that staying the course becomes most important. This is when the uninformed retail investor panics and capitulates and when you generate your alpha. This is when we exhale, smile at Mr. Market’s madness and carefully take advantage. A calm mind amid the frustration and constant noise is an edge. If the last century+ is any indication, focusing on pace of profitable compounding at a fair price is what will win out eventually. Focus. On. The. Data. Hold your companies responsible if they deliver poor results… but don’t blame them for their stock not moving higher after a strong report. If anything, that is an opportunity to carefully lean in. And I have.

There will be fun days in the future. There will be more not so fun days too. It’s an inevitable part of participating in the greatest wealth builder of all time. This earnings season has been frustrating, but this frustration too shall pass.

1. Uber (UBER)

Uber needs no introduction.

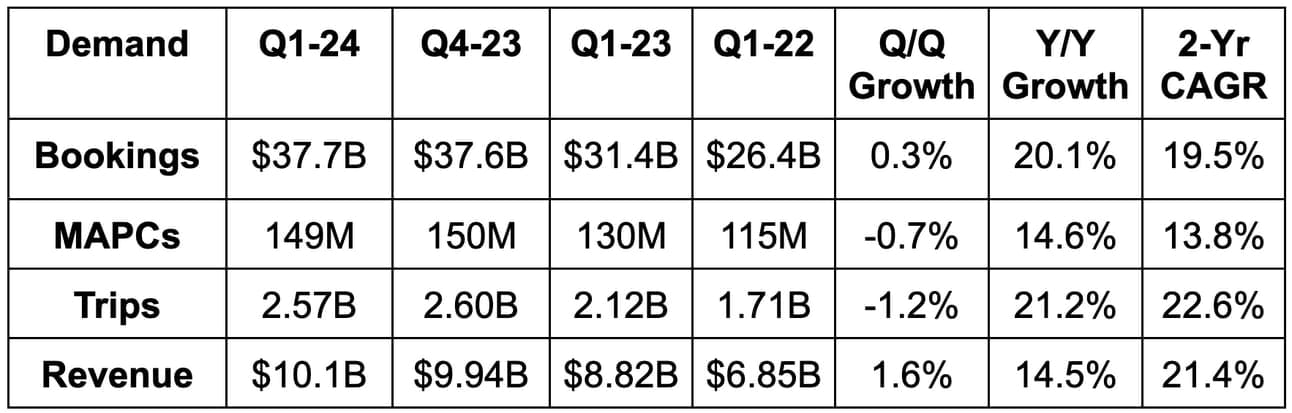

a. Demand

- Missed bookings estimates by 0.8% & slightly missed bookings guidance by 0.3%.

- Uber blamed the miss on very modest Latin American weakness following a strong Carnival last year and holiday timing shifts.

- FX neutral (FXN) bookings growth was 21% Y/Y.

- Met revenue estimates.

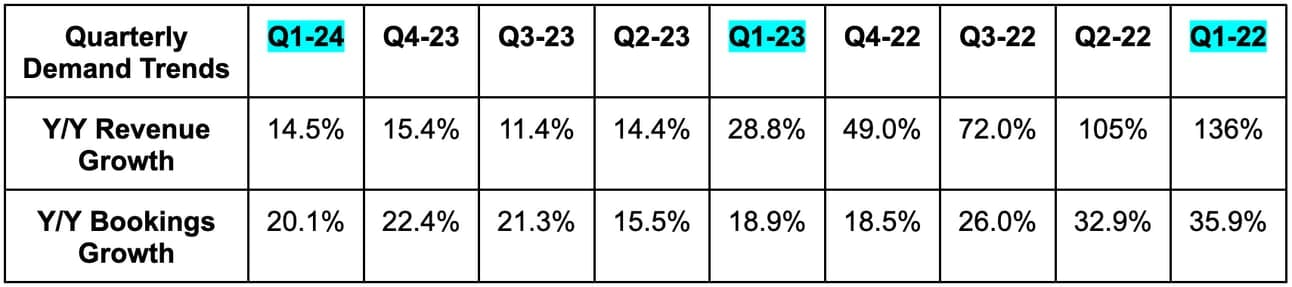

- Revenue growth includes an 800 basis point (bps; 1 bps = 0.01%) headwind from changing its revenue recognition structure last year. That comp headwind will remain in place for Q2 before getting lapped in Q3.

- Met monthly active platform consumer (MAPC) estimates.

- Trips per MAPC rose 6% Y/Y.

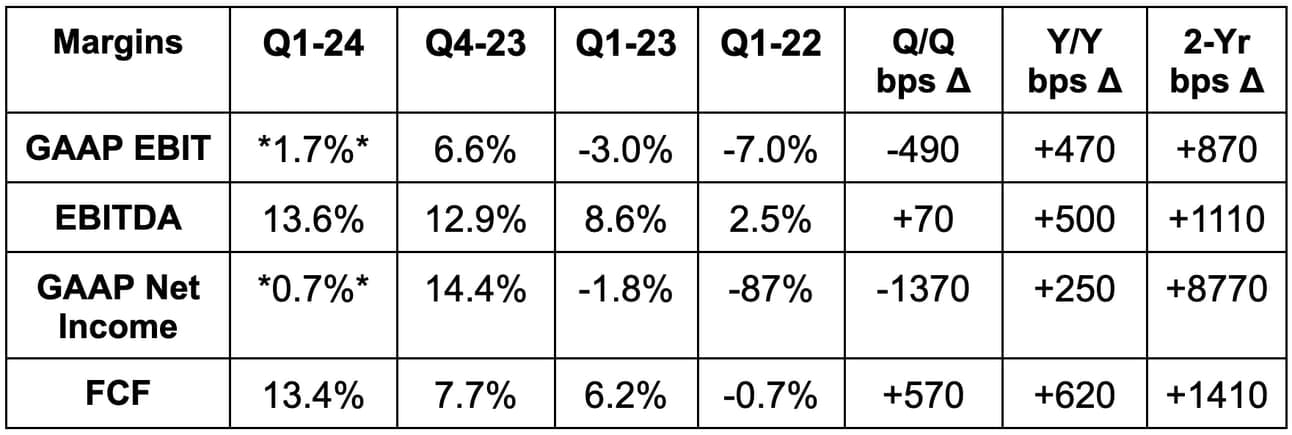

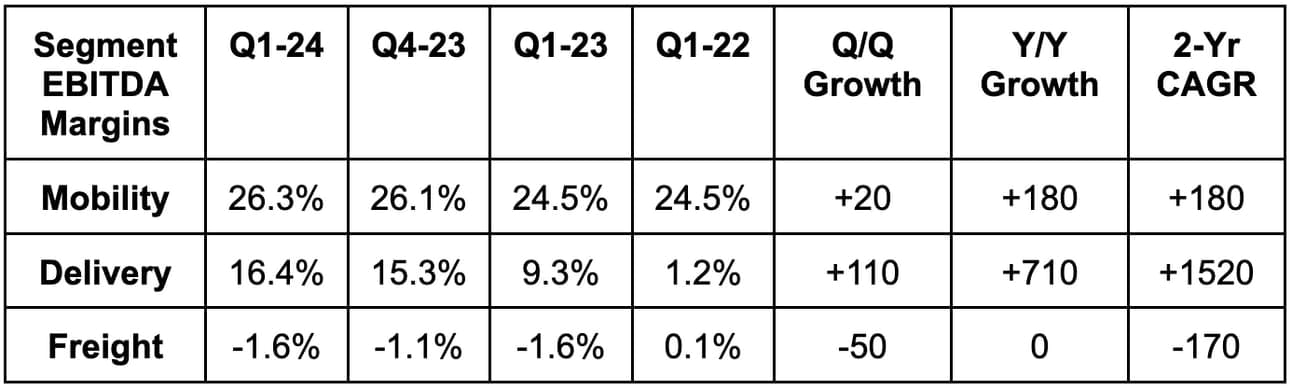

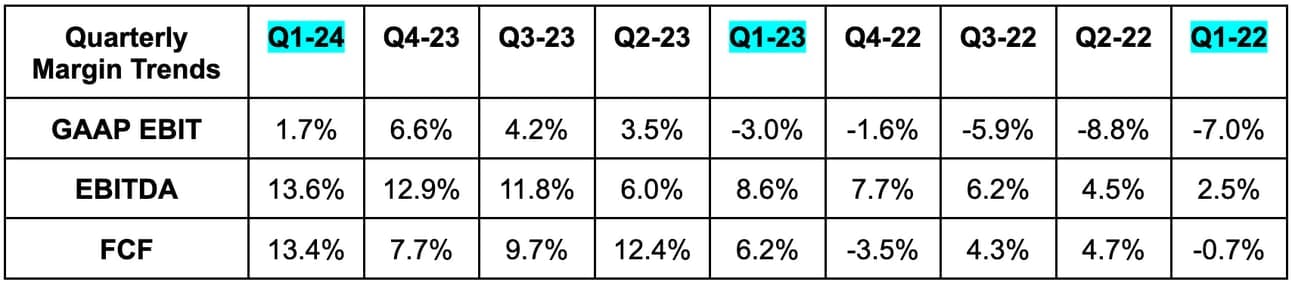

b. Profits and Margins

- Beat EBITDA estimates by 4% & beat EBITDA guidance by 6%.

- Beat free cash flow (FCF) estimates by 24%.

- Sharply missed GAAP EBIT and GAAP EPS expectations. Why? Glad you asked:

The headlines stemming from the media were “Uber disappoints on profitability” or “surprise losses.” While that does make for excellent clickbait, it’s a half-truth. You’ll notice that all non-GAAP profit metrics were comfortably ahead of expectations, while GAAP was not. This was related to $527 million in legal charges incurred (for GAAP EBIT and net income) and $721 million in mark-to-market equity investment losses (impacting only net income). Without these charges, both metrics would have been comfortably ahead of expectations. Considering the legal issues are now resolved and the equity item is irrelevant to operations, these misses didn’t bother me in the least. And as you know, I would bluntly tell you if it did bother me. More context is usually needed. That’s what I’m here for.

c. Balance Sheet

- $5B in cash & equivalents.

- $6B in investments.

- $9.5B in debt.

- Share count rose 3.5% Y/Y.

d. Guidance & Valuation

Second quarter bookings guidance missed estimates by 0.3%, while EBITDA guidance met expectations. Argentina is driving incremental FX headwinds, which is why demand guidance was slightly, slightly weak. Furthermore, it delayed some marketing spend from Q1 to Q2 due to better expected returns. EBITDA would have been ahead of expectations had it not made this decision.

Uber also reiterated its multi-year targets offered at its February investor day. That means it reiterated roughly $10 billion in 2026 FCF (if I bake pessimism into its guidance ranges). This represents a 2 year FCF compounded annual growth rate (CAGR) of about 35%. Uber trades for 27x 2024 FCF.

e. Call & Release

Supply & Demand:

Uber continues to briskly grow its driver count to 7.1 million vs. 6.8 million last quarter and 6.5 million 2 quarters ago. Mobility drivers specifically rose by 29% Y/Y as India became its 3rd market to reach 1 million. Despite cutting incentives for drivers, earnings rose by 24% Y/Y FXN as Uber’s consumer network and broader product suite foster more opportunity for earning vs. others. Demand across the platform remains “robust” to support continued earnings strength for these drivers. Happier and more abundant drivers mean lower surcharge rates, shorter wait times and happier customers. This spins a compelling flywheel.

To ensure this flywheel is as durable as it can be, Uber continues to drive a higher proportion of volume to its Uber One subscription. It now makes up 32% of total mobility and delivery bookings vs. 30% Y/Y; the subscription also enjoyed a 2 point improvement in Y/Y retention as annual plan adoption grew in popularity. It also debuted “member welcome quests,” which motivate free trial customers to convert to paid with Uber Cash offers. Overall, Uber One subscription revenue crossed $1 billion annually, while members continued to spend 3.4x per month compared to non-members. The firm is now working on making Uber Cash usage more intuitive and some “member exclusives” to facilitate more Uber One delight.

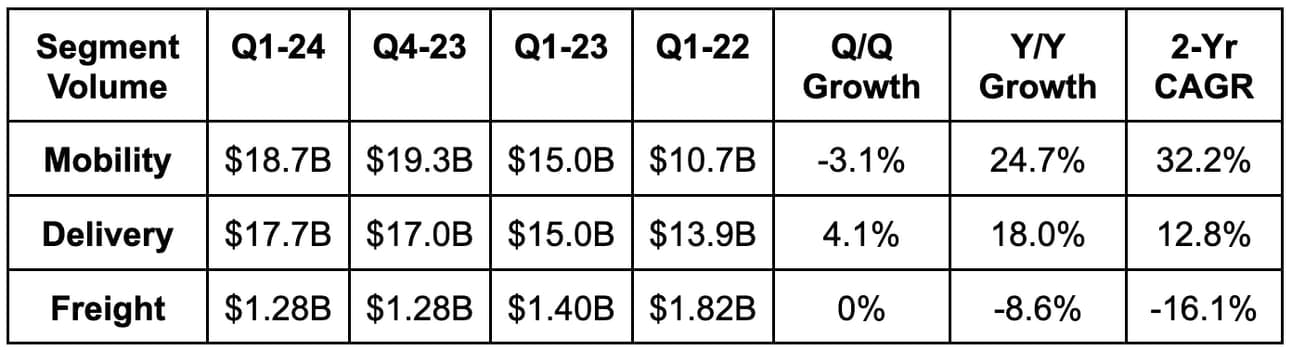

More on Mobility:

Mobility enjoyed 26% Y/Y FXN growth, which was powered by 17% user growth and trip frequency, rather than price hikes. Note that selling off assets from its Careem acquisition lowered growth rates here by 100 bps during the quarter. Airport demand was especially strong, as travel remained healthy. Back to work is also returning with a vengeance with workday session growth outpacing all other common use cases. This helped drive 40% Y/Y growth in Uber for Business; 50% of these Uber for Business customers continue to opt into premium, higher margin mobility products.

New bets within Mobility enjoyed 80% Y/Y growth and attracted 20% of Uber’s total new users. moto and shared sides (6x Y/Y growth from a small base) were the two product standouts for the quarter. For shared rides specifically, it upgraded the interface to offer better expectations on ride matching timelines.

Instacart & Grocery/Retail:

Uber announced a new partnership with Instacart. Going forward, Uber Eats will run Instacart’s restaurant delivery service. This gives Uber more demand for itself and for its merchants, while also giving it significantly more room to grow advertising load. Instacart should give Uber a shot in the arm in terms of non-urban volume and momentum. That’s a key focus area for Uber, as it already dominates in cities. This partnership is using the same integration that was leaned on to add Uber Eats to the main Uber app. Because of this, Uber sees a seamless ability to add more channel partners here in the near future.

This new relationship changes nothing about Uber’s view of the grocery and retail delivery opportunity. It continues to add more merchants and tweak processes to drive better experiences and profitability. Furthemore, 15% of delivery customers now use grocery or retail vs. 12% Y/Y. It expects sustainably rapid growth and progress towards EBITDA breakeven from this newer delivery category.

Finally, the team teased some news coming about the grocery business in the coming weeks.

Delivery:

Delivery bookings growth was stable at 17% Y/Y FXN. Like for mobility, growth was driven by new users and order frequency rather than higher prices. Importantly, MAPC growth accelerated across important markets like the USA, Canada and Mexico, with order frequency reaching an all time high too. Uber added better location sharing tools to expedite handoffs and materially expanded the roster of Domino’s stores on its network.

Freight:

The freight market remains highly challenged, as expected. Uber is committed to staying the course through the tough part of this cycle as competition quickly exits. This should foster stronger market share and pricing power when the freight sector invariably bounces back.

Advertising:

Uber introduced its “creative hub” during the quarter, with more targeting and campaign design tools for its largest buyers. For mobility ads, it’s expanding “Journey Ads” to 12 more countries and now has in-car placements across 50 cities. Coors was named as a large brand now using its journey and post-checkout placements.

- It will do much better than its $1 billion in 2024 advertising revenue previously guided to.

- It has 500 large consumer packaged goods (CPG) brands on the platform now as it looks to grow its non-food ad growth. Non-restaurant product advertising is still very new.

Autonomous Vehicles (AV):

The Waymo partnership expanded to Uber Eats following a successful mobility launch in Phoenix. Uber remains adamant that it will carve out a large stake in AV mobility and delivery. It has by far the largest consumer network to allow fleets to enjoy the best unit economics. And it will probably function as a sort of Expedia-like (where Uber’s CEO came from) demand aggregator across all integrated fleets. It also has the best routing processes, regulatory prowess and a giant base of merchants for these fleets to cater to. Some think AV will be the death of Uber. Some think they can be cut out of the question. I disagree, but it is a longer term risk. For now, the evolution to fully autonomous, unmanned vehicles will likely be a several years-long process. I see some loose similarities to how people assumed card networks would kill PayPal. Instead, card networks partnered with the titan to take advantage of its massive scale and brand awareness.