Today's piece is presented by Commonstock:

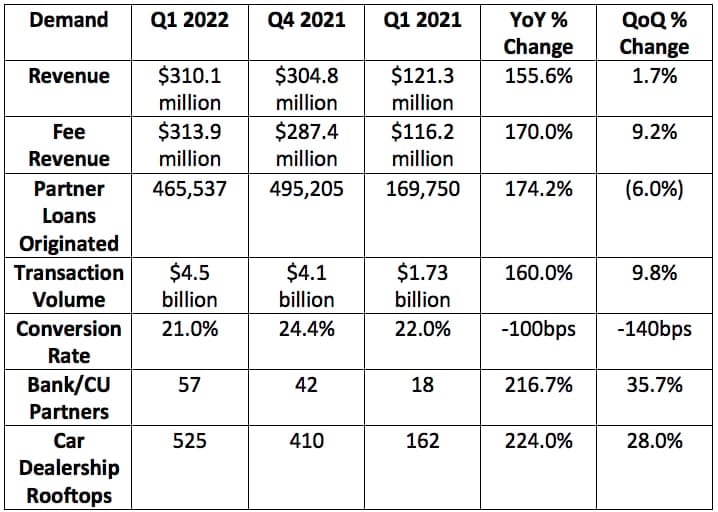

1. Upstart Demand

“We see a clear path to more than $10 billion in revenue in the coming years.” — Co-Founder/CEO Dave Girouard

Upstart guided to a midpoint of $300 million in quarterly revenue while analysts expected roughly the same. The company posted $310.1 million in sales, beating expectations by roughly 3.4%.

Upstart percent revenue beats by quarter:

- 3.4% beat in Q1 2022

- 17.2% beat in Q4 2021

- 8.8% beat in Q3 2021

- 22.9% beat in Q2 2021

- 4.3% beat in Q1 2021

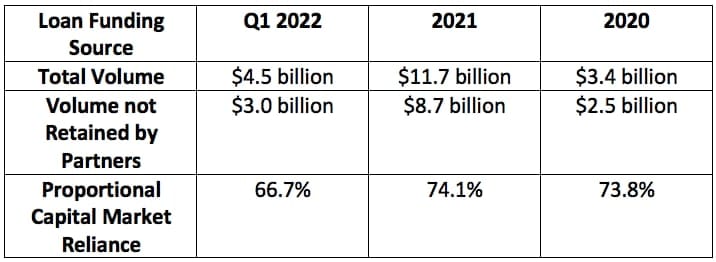

Loan funding source:

Upstart’ proportional capital market reliance fell sharply in Q4 2021 which marked an encouraging reversion of a consistently rising trend. For context, its reliance sat at 76.7% over the first 9 months of 2021, yet fell to 74.1% for 2021 as a whole (while including a 9 month 76.7% weighting). Section 6 of my Upstart Deep Dive explains why it is so important for partners to retain more loans. Lower capital market reliance is a good thing and that process is now playing out.

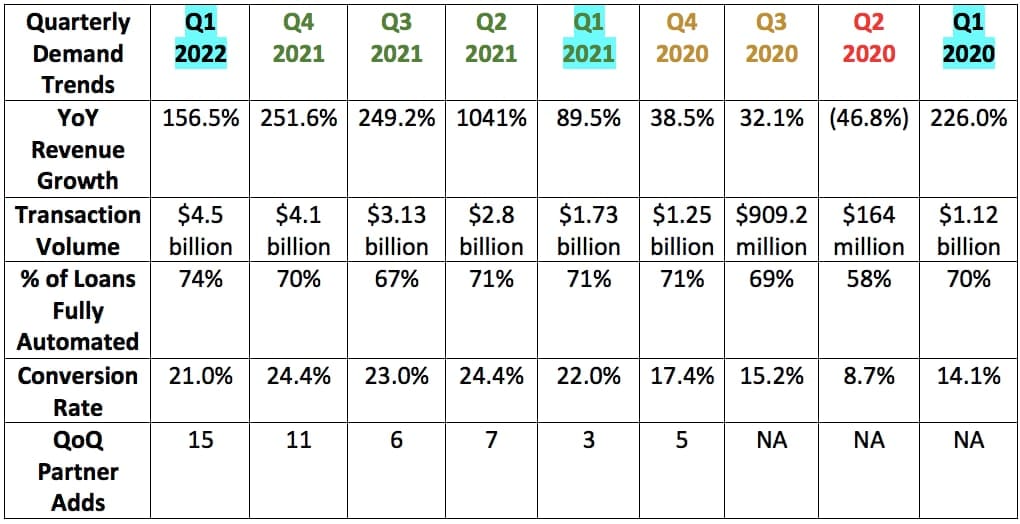

More quarterly demand context:

- Q3 2021 conversion rate was impacted by a fraud incident that forced Upstart to implement heavier manual controls on a temporary basis. This quarter, falling conversion rate was via rising loan prices as rates rapidly moved higher.

- The impact of the pandemic on Upstart’s business was aggressive, abrupt and short-lived.

- Q2 2020 -- highlighted in red -- is the quarter with the heaviest negative impact by far.

- The quarters highlighted in yellow feature periods when volumes were recovering but still off-trend.

- Quarters highlighted in green feature the easiest comps via pent-up demand unwinding as the world recovered and things like stimulus checks (a large Upstart demand headwind) fade away.

- Upstart waits to disclose concentration risk from Credit Karma and its originating conduits until its quarterly filing is published.

- I’ll include that information on Saturday after the document is released.

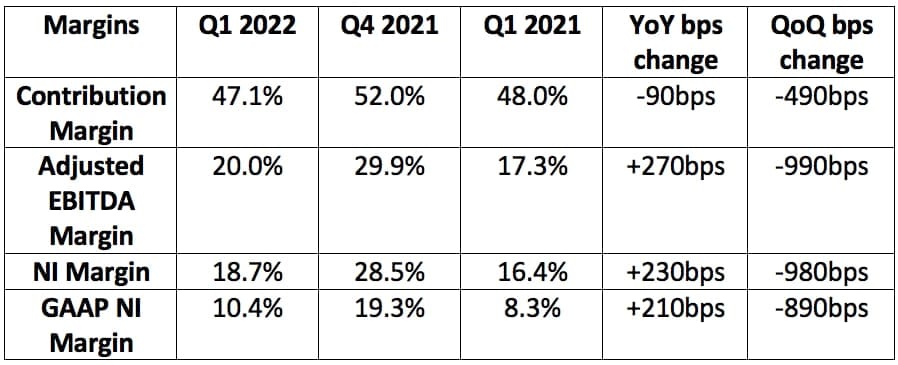

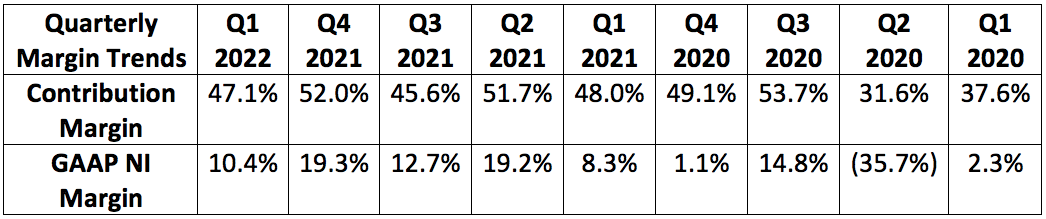

2. Upstart Profitability

Upstart guided to:

- A 46% contribution margin -- it posted a 47.1% margin beating expectations by 110 bps.

- $20 million in GAAP net income (NI) -- it posted $32.7 million beating expectations by 63.5%.

- $0.60 in earnings per share while analysts were looking for $0.53 per share. Upstart posted $0.61, beating its expectations by $0.01 and analyst estimates by $0.08.

- $57 million in adjusted EBITDA while analysts were looking for $55.2 million. Upstart posted $62.6 million, beating its expectations by 9.8% and analyst estimates by 13.4%.

More margin context:

- Upstart's contribution margin compression is solely a factor of its newer auto business outperforming demand ramp expectations. Its products debut at contribution margin troughs before improving thereafter with more data and scale.

- EBITDA and contribution margin divergence is related to rising rates lowering the fair value of the loans on its balance sheet. This does not impact contribution margin.

- Upstart's personal lending contribution margin was 51% during the quarter.

Commonstock is a friendly community of passionate investors who believe that transparency can elevate discussion and performance. This platform strikes the perfect balance between collaborative debate and uplifting camaraderie. I like to think of it as a more focused, verifiable, productive and kind version of FinTwit -- without all of the noise.

There's a reason why I have linked my portfolio to the service and am a daily active user.

Come join us to see what all of the hype is about. Sign up is free and you'll be glad you did.