The company announced a $400 million share re-purchase program. It’s quite rare to see a company growing this rapidly also buying back shares. Profitability and a strong balance sheet are wonderful things.

In the annual filing, Upstart will disclose concentration risk from Credit Karma and its originating conduits. That filing will be published later this week and I will include the information in the News of the Week post.

1. Demand

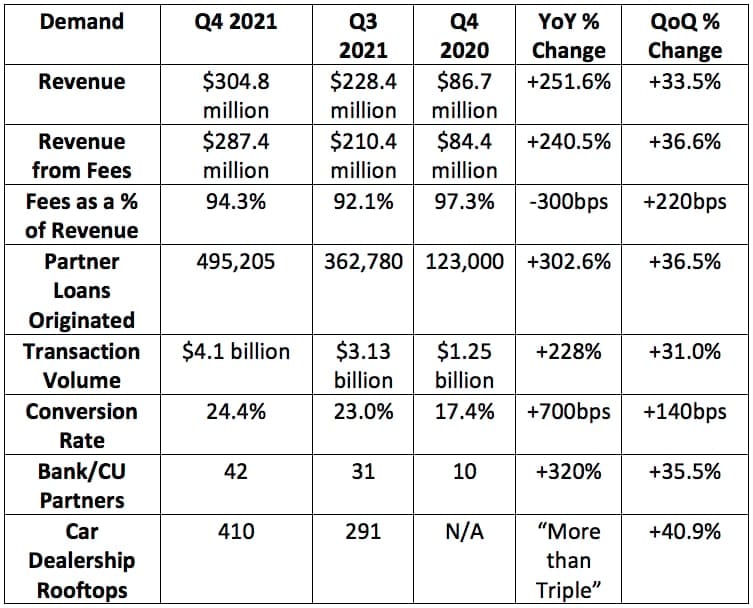

Upstart guided to a midpoint of $260 million in revenue and analysts were looking for $262 million in revenue. Upstart posted $304.8 million in revenue, beating its expectations by 17.2% and analyst estimates by 16.3%.

Upstart now has “over 150” institutional partners to fund its loans via capital markets vs. “over 100” a year ago. It had 6 total in 2016.

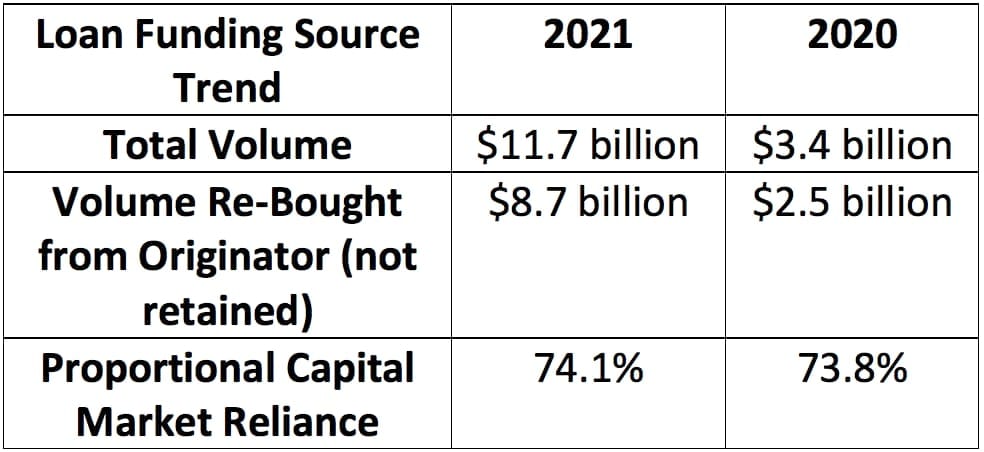

Over the first 9 months of 2021, Upstart’s proportional capital market reliance was at 76.7%. That falling to 74.1% for 2021 as a whole (including the 9 months at 76.7%) marks meaningful progress in eroding Upstart’s capital market needs. For this quarter specifically, Upstart’s capital market reliance fell to 69.3% of total volume. I was not expecting this improvement to come until further into 2022 (as deposit levels and savings rates normalized) — so this was a pleasant surprise. In 2022, I will be looking for proportional capital market reliance to fall further as that would make delivering profitable loan pools easier and more sustainable for Upstart.

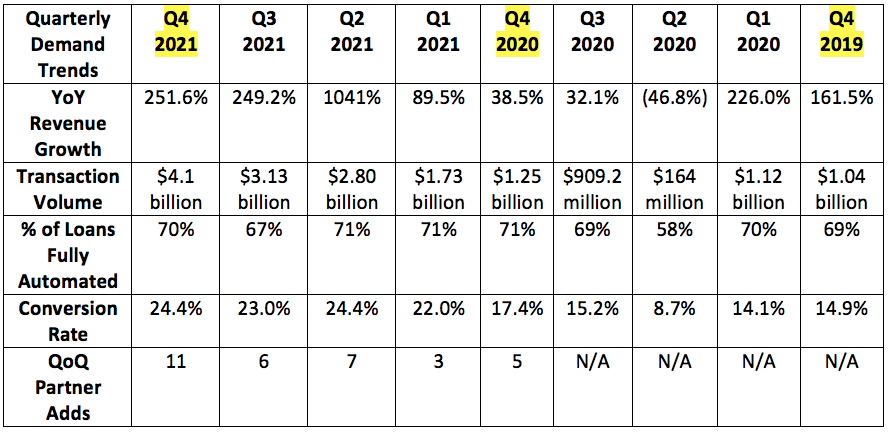

After the company’s fraud incident a quarter ago, it’s good to see conversion and automation rates bounce back. These are two key performance indicators (KPIs) for growth. A few quarters ago, CFO Sanjay Datta told us that Upstart wants conversion rates around 20% and that anything above 20% signals to the company that it can spend more aggressively on growth — so it can spend more aggressively on growth.

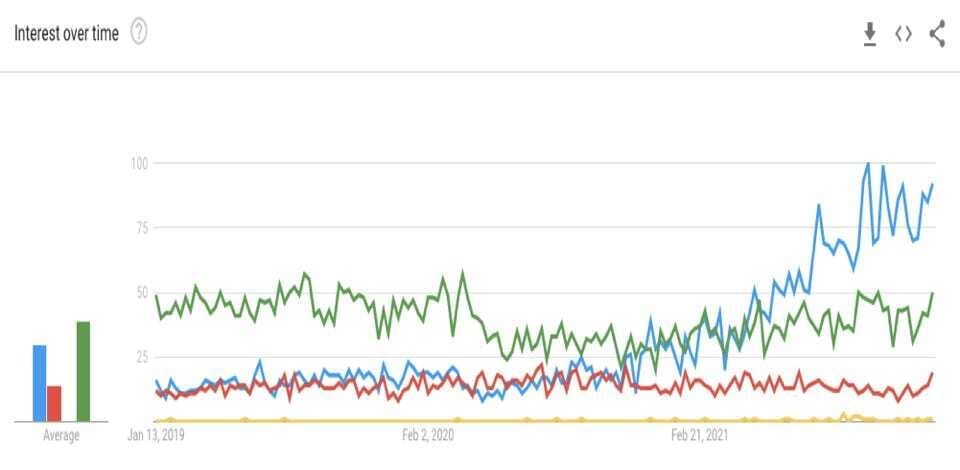

When looking at competition like Lending Club, its recent transaction volume growth essentially brought it back to its own pre-pandemic levels. Conversely, Upstart has now more than tripled its own pre-pandemic volumes. Upstart is taking meaningful share.

2. Profitability

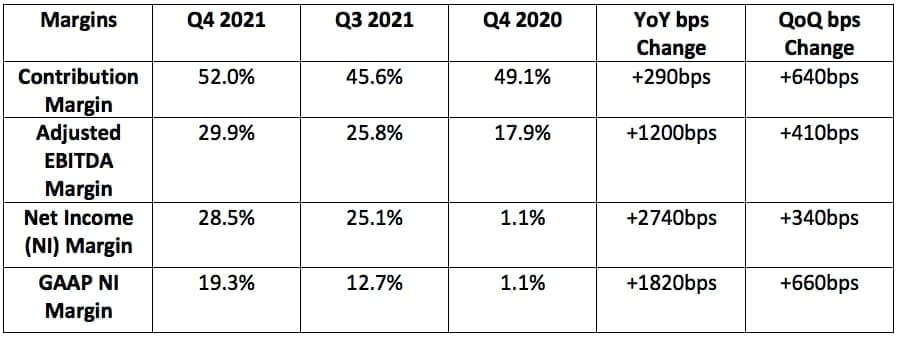

Upstart guided to:

- $52 million in adjusted EBITDA with analysts also expecting $52 million. It posted $91 million beating expectations by 75%.

- A 47% contribution margin (CM). It posted a 52% CM, beating its expectations by 500bps.

- A 6.9% GAAP Net Income (NI) margin. It posted a 19.3% GAAP NI margin beating its expectations by 1240bps.

- An 18.8% net income margin. It posted a 28.5% net income margin beating its expectations by 970bps.

Analysts were looking for earnings per share of $0.51. Upstart posted $0.89 in earnings per share beating expectations by 74.5%

3. Guidance

Q1 2022:

- Analysts were expecting $258.3 million in Q1 2022 revenue. Upstart guided to $300 million, beating expectations by 16.1%

- Analysts were expecting $56.1 million in Q1 2022 EBITDA. Upstart guided to $57 million beating expectations by 1.6%.

- Upstart’s net income guidance implies earnings per share guidance of $0.61 which beat analyst expectations by $0.13 or 27.0%.

2022:

- Analysts were looking for $1.21 billion in revenue. Upstart guided to $1.4 billion, beating expectations by 15.7%

- Analysts were looking for $261.9 million in EBITDA. Upstart guided to $237 million, missing expectations by 9.5%.

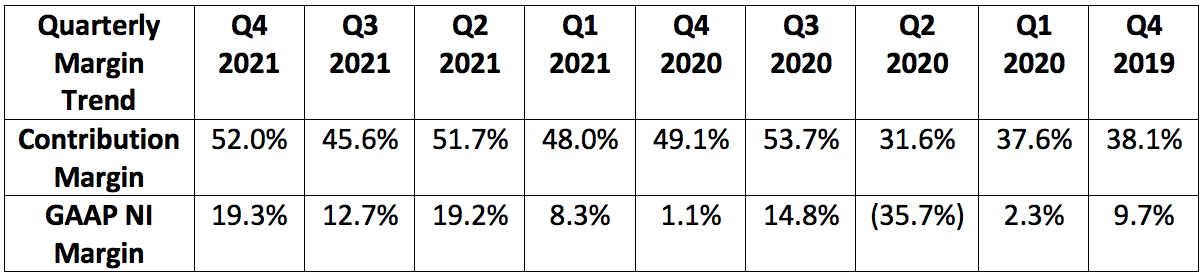

- The expected decrease in 2022 EBITDA margin is intentional and controllable. It’s a function of the ramp up in auto lending which will reduce margins until it achieves meaningful scale. Rapid hiring is also leading to this expectation as Upstart looks to continue to exponentially grow its labor force. This will all foster a 5% hit to contribution margin for Q1 2022 which is why the guide was for a 47% contribution margin vs. 52% sequentially.

- It also issued auto transaction volume guidance of $1.5 billion which is a strong sign of how much traction this new product is quickly gaining.

I want to reiterate: Upstart will be spending more heavily in 2022 than in 2021 to take more market share and develop growth projects. This will weigh on short term margins but is the correct decision (in my view) considering the opportunities ahead for the quickly-moving organization.