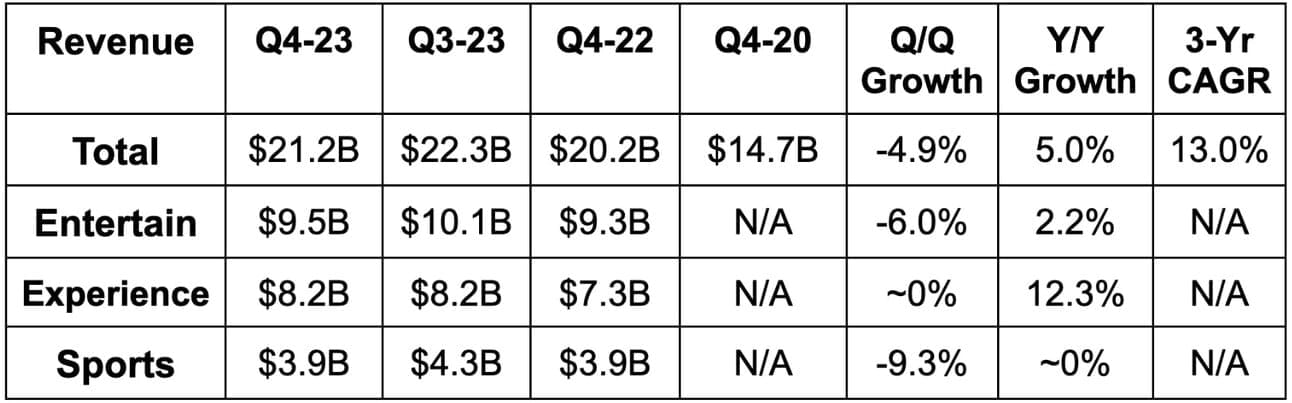

As a reminder, this is Disney’s first quarter under new reporting segments. The segments are:

- “Entertainment”

- “Sports”

- “Experiences”

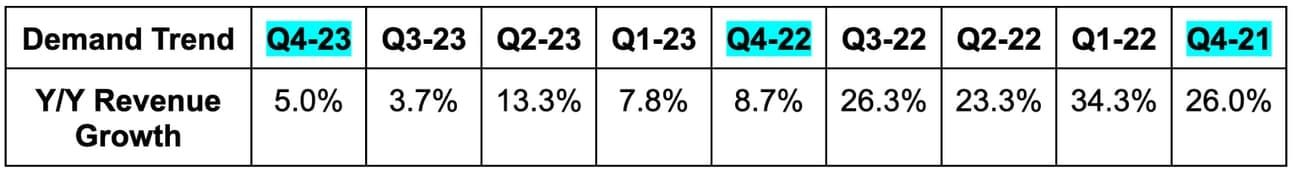

1. Demand

Disney missed revenue estimates by 0.7%. Sports and Experiences met revenue expectations while Entertainment slightly lagged.

- Perhaps more importantly, it crushed Disney+ subscriber estimates of 2.7 million adds. It added 7 million.

- Revenue rose 7% Y/Y for the full year.

Demand Highlights:

Within entertainment, linear revenue fell by 9% as the secular decline there continues. Affiliate and advertising revenue remain highly challenged within this bucket. Streaming revenue rose by 12% Y/Y. Disney+ subscribers rose 7% Q/Q, Hulu was flat and ESPN+ rose by 3% Q/Q. Disney+ revenue per user rose by 2% Q/Q thanks to “higher advertising revenue.” This is direct evidence of ad-supported tiers having higher value for Disney. Price hikes will boost revenue per user in the coming quarters as they went live after October 1st.

For experiences, rapid international park growth and its thriving resorts and cruises powered the success. Walt Disney World was the weak spot once again. More later.

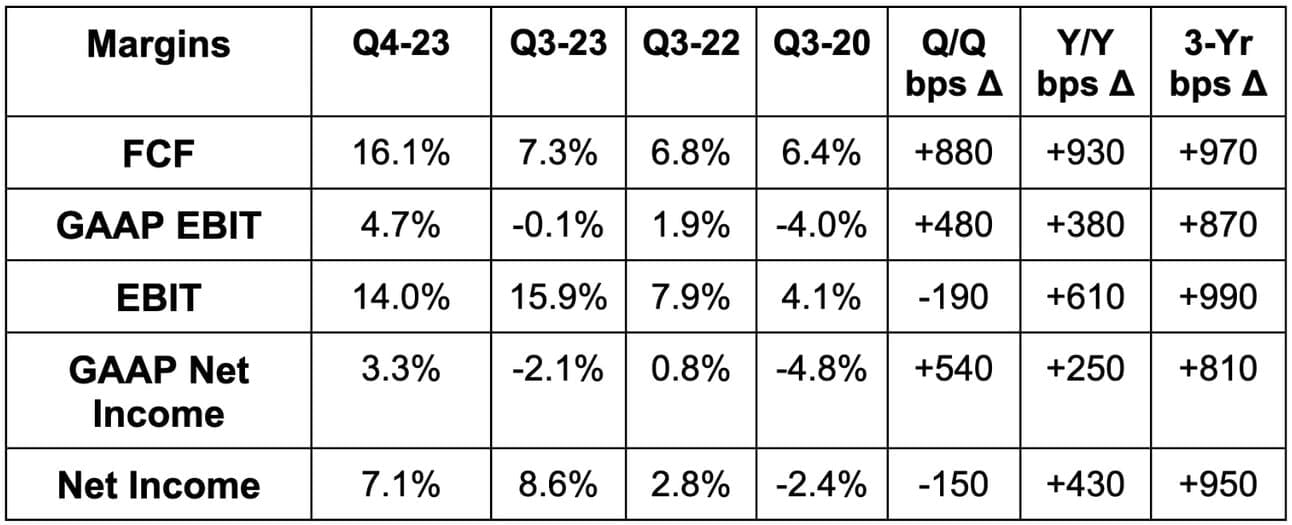

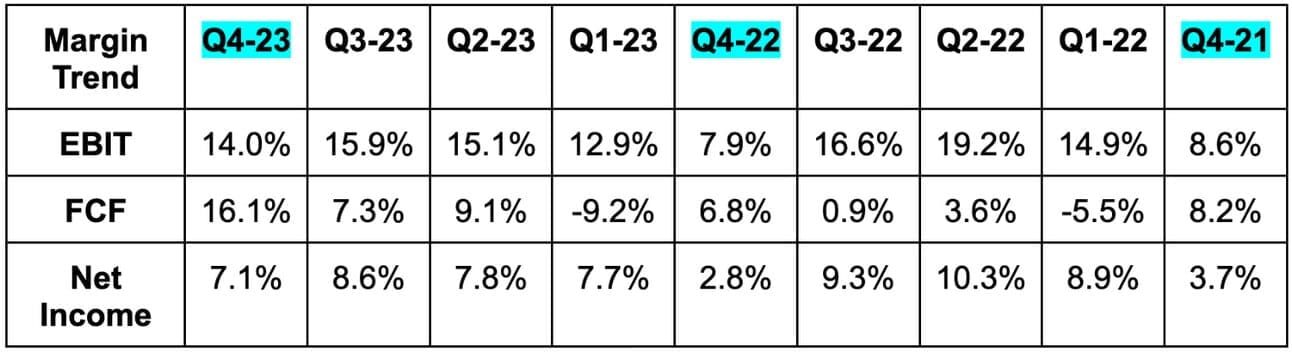

2. Profitability

Disney beat EBIT estimates by 5.9%, beat free cash flow (FCF) estimates by 19.4% and beat $0.71 earnings per share (EPS) estimates by $0.11.

Margin Highlights:

Earnings per share rose from $0.30 to $0.82 Y/Y. For the full year, earnings rose by 7% Y/Y while GAAP earnings fell by 26% Y/Y. This fall is entirely related to restructuring and content impairment charges. These charges are excluded from non-GAAP metrics. There was another roughly $1 billion in restructuring for this quarter. As restructuring charges won’t recur, I think it’s better to focus on non-GAAP performance at this time for Disney.

Full year FCF grew by nearly 5x from $1.06 billion to $4.9 billion. Based on the guide, more explosive growth is coming.

By segment:

- 2.5% Entertainment EBIT margin vs. -6.5% Y/Y.

- This was powered by lower streaming losses and linear cost cutting.

- 25.1% Sports EBIT margin vs. 22.1% Y/Y.

- This was helped by the absence of Big Ten Football rights, but ESPN+ subscriber growth was healthy regardless.

- 21.6% Experiences EBIT margin vs. 18.5% Y/Y.

- This was helped by strong reopening tailwinds at its international parks.

- EBIT margin expanded domestically despite some temporary Walt Disney World challenges.