Table of Contents

- 1. Uber (UBER) – Earnings Review

- 2. Airbnb (ABNB) — Earnings Review

- 3. Celsius (CELH) – Earnings Whisper

- 4. Progyny — Opening Thoughts on Earnings

1. Uber (UBER) – Earnings Review

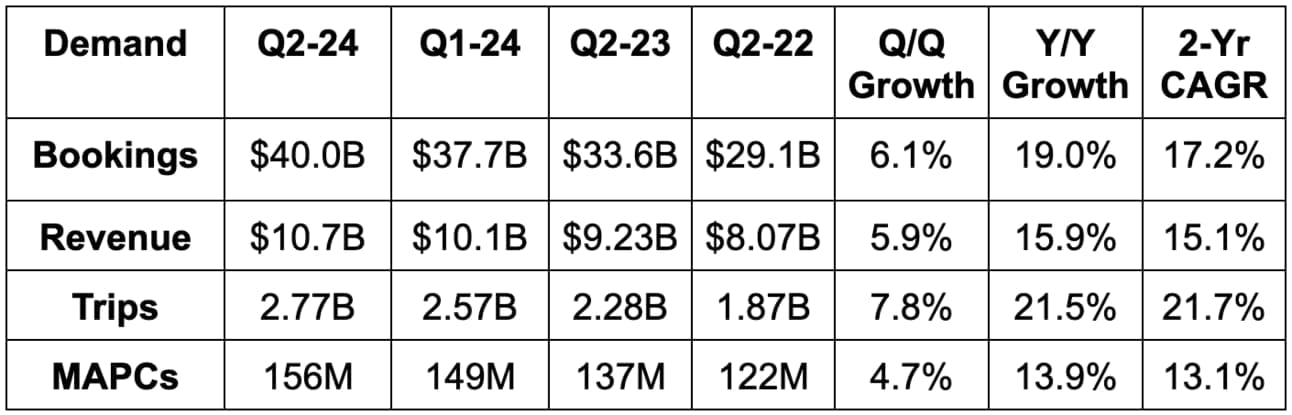

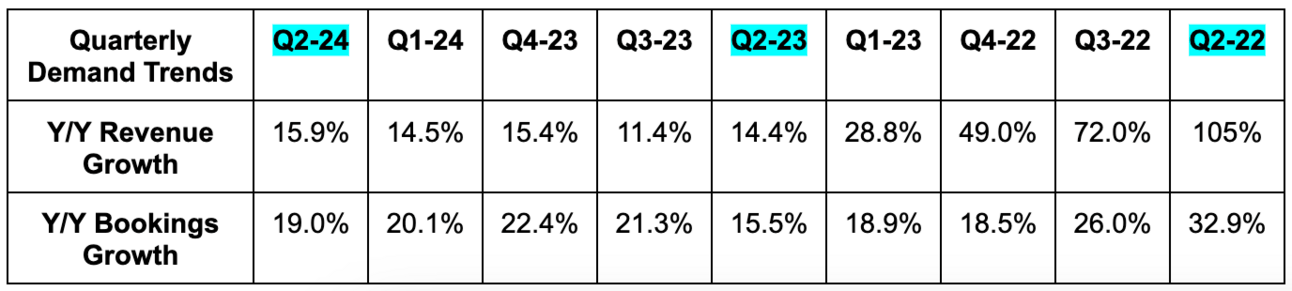

a. Demand

- Beat bookings estimate by 0.8% & beat guidance by 1.3%.

- Beat revenue estimate by 1.1%.

- Revenue growth includes a 700 basis point (bps; 1 basis point = 0.01%) headwind from a business model change where it reclassified some marketing spend as contra revenue.

- Foreign exchange headwinds were 250 bps vs. the 300 bps headwind that it baked into its guidance. Without this currency help, revenue would have been a 0.6% beat.

- Beat user estimate by 0.6%.

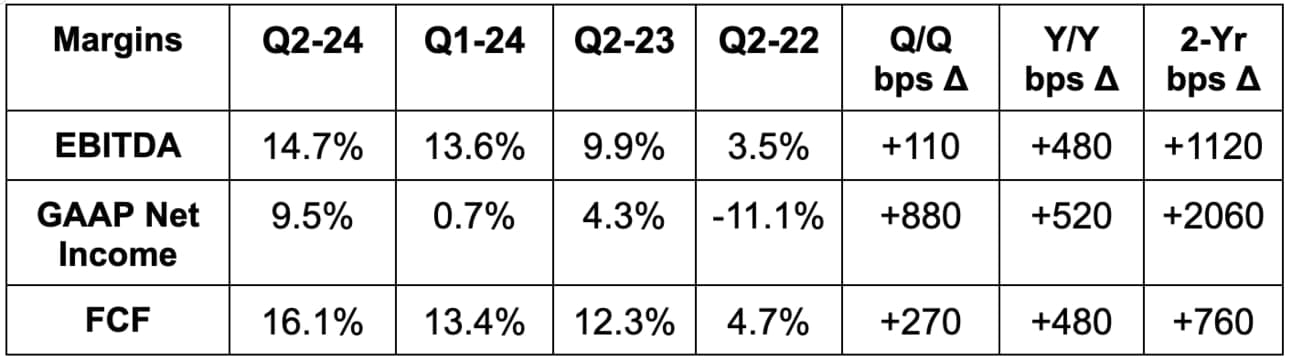

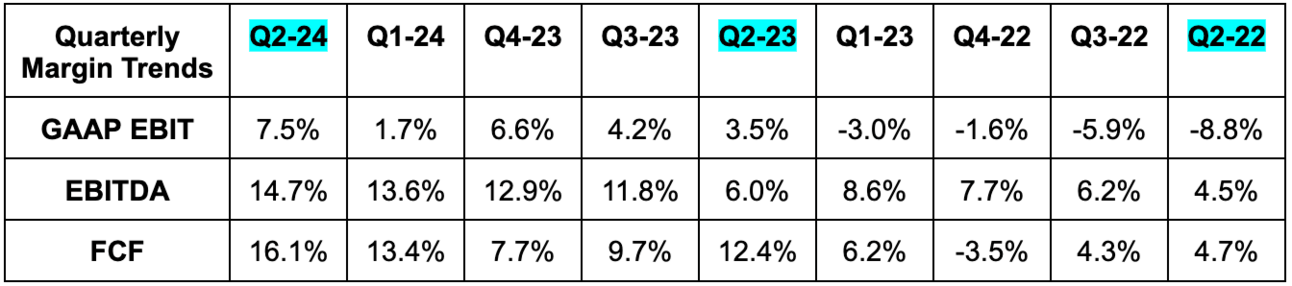

b. Profits & Margins

- Beat EBITDA estimate by 4% & beat guidance by 5.4%.

- Met GAAP EBIT estimate.

- Beat $0.31 GAAP EPS estimates by $0.16. GAAP EPS rose from $0.18 to $0.47 Y/Y. The profit explosion is upon us.

c. Balance Sheet

- $6.3B in cash & equivalents; $6.2B in investments.

- $9.45B in debt.

- Diluted share count +3.4% Y/Y.

d. Guidance & Valuation

Uber’s Q3 guidance was 0.6% behind estimates on bookings and 0.6% ahead of estimates on EBITDA. Its guide includes $400 million in recently added foreign exchange (FX) headwinds. Without this incremental challenge, its bookings guidance would have been slightly ahead. It sees mobility FX neutral (FXN) bookings growth remaining in the mid-20% range in Q3.

Uber trades for 31x 2024 EPS and 70x 2024 GAAP EPS. EPS is expected to grow by 10% Y/Y (lapping 155% Y/Y growth) and by 59% Y/Y next year. GAAP EPS is expected to be flat Y/Y (lapping 120% Y/Y growth and some legal charges) and by 136% Y/Y next year.

e. Call & Release

Supply & Demand:

As a global marketplace, Uber must nurture both sides of its network to make sure systems are working optimally. Leading driver supply fosters lower surcharge rates, faster wait times and more delivery batching opportunities to juice margin. It’s great for customer delight & Uber cash flow. Win, win. At the same time, leading customer supply means more earnings and happier drivers. Both sides of the equation must be strong to spin the compelling flywheel.

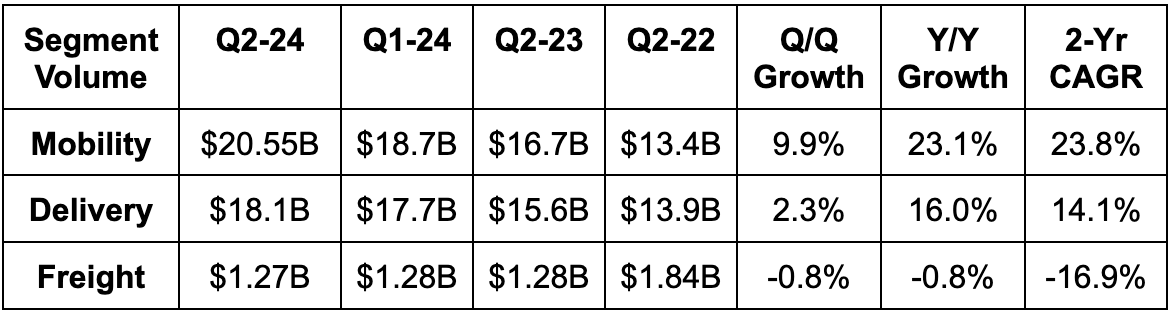

Fortunately for Uber, that’s absolutely the case. Overall bookings rose 21% FXN while mobility bookings growth accelerated from 26% Y/Y FXN last quarter of 27% this quarter. In delivery, 17% Y/Y FXN bookings growth matched its fastest expansion in over a year. Growth was driven by more customers (+14% Y/Y) and engagement (+6% Y/Y), rather than less structural items such as price hikes. It’s outperforming formidable competition across all geographies, with market share gains Y/Y in delivery across its 10 largest markets and in most of its largest mobility markets too. Brazil, India and Australia were highlighted as its strongest countries.

“Our ability to grow faster than the category while increasing margins reflects the quality of our execution and speed of our innovation, as well as the compounding power of our global platform.”

CEO Dara Khosrowshahi

The best ways Uber can drive demand, aside from adding new customers, are via engagement and retention. These are directly tied together. 35% of Uber customers are using multiple products vs. 31% Y/Y and Uber One continues to enjoy strong membership growth. Those members spend more and stick around longer compared to non-members.

From a supply point of view, Uber added 300,000 new drivers for the 3rd straight quarter to reach 7.4 million total. Active driver growth led bookings growth and driver earnings rose 23% Y/Y FXN. Mobility supply hours per driver also set a new all-time high. As part of its recently announced BYD partnership, it will be placing 100,000 of that affordable Chinese EV-maker’s cars across Latin America and Europe. This is one way that it hopes to juice accessibility for drivers.

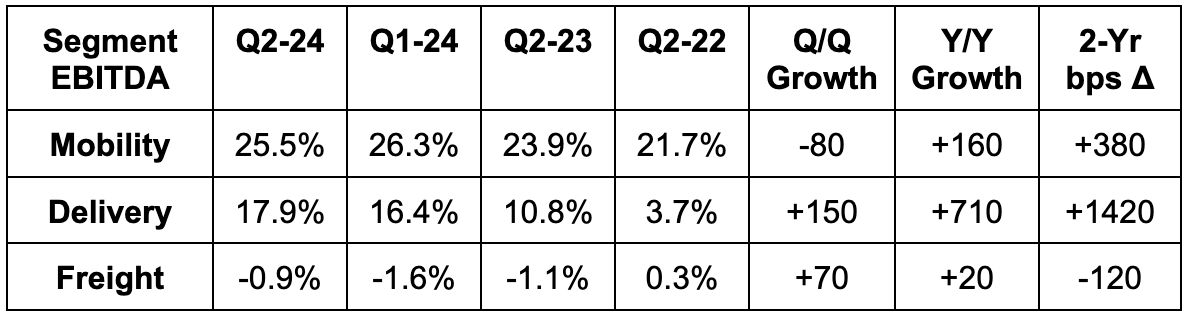

Mobility:

Tech-based investments continue to up-level Uber’s service quality. In travel, new matching algorithms with better pick-up instructions are making that experience much easier. Uber XXL, which offers added room for suitcases, is also a new travel product that’s off to a great start. Uber for Business enjoyed accelerating Y/Y growth to reach 200,000 clients. To support that momentum, the company added delegate profiles to allow executive assistants to manage accommodations for their bosses. Its Moto product, which is doing especially well in Brazil, is still seeing a notable 40% of all users up-sell to more products.

The growth engine here is still in its early innings. Just 20% of its serviceable consumers across its 10 biggest markets are monthly users. And among monthly users, half of them only take 1-2 mobility trips per month. It has ample opportunity to find more riders, delight them with superior service and sell them more bookings.

Core Delivery:

Order growth was healthy across all income cohorts and first time customer growth was higher than at any point during the past 5 quarters. There was building analyst concern that economic headwinds would hurt this consumer-facing business. Uber is not seeing that in mobility or the even more discretionary delivery category. That is notable and pleasantly surprising when compared to Airbnb’s results discussed in section 2.

“The Uber consumer is in great shape. While our consumers are higher income, we are not seeing any softness or trading down across any cohort… I think we can thrive in upturns and downturns.”

CEO Dara Khosrowshahi

What’s driving this resilience? First, Uber’s customers are relatively affluent. That inherently makes them less sensitive to macrocycles. Furthermore, macro fragility drives more supply growth. This supply growth lowers average surcharge rates, drives affordability gains and helps Uber offset budget constraints from consumers. For more affordability relief, its Uber One membership also offers material discounts for consumers and is rising a proportion of overall business. It’s also continuing to find success in cheaper mobility products like motorcycles and shared rides.

Even as it drives affordability through these items and 70% Y/Y merchant-funded promotion growth (more later), it’s enjoying material margin expansion. That’s thanks to more driver supply cutting miles to fulfill and adding to order batching potential, as well as efficiency gains in payments and other back-office costs. It’s also just the byproduct of economies of scale and rising multi-product usage, engagement and retention.

- Thinks merchant growth will stay over 10% Y/Y for the next few years. It was 13% Y/Y this quarter.

Grocery & Retail Delivery:

The Uber Eats Instacart partnership is going quite well. It’s driving incrementality in suburban areas where Uber wanted to establish a deeper presence. Furthermore, the average basket size from these orders is 20% larger than for Uber Eats orders. Uber continues to see a clear path to EBITDA here and is enjoying robust overall delivery margins despite these more nascent products.

- It grew non-restaurant merchants by 9% Y/Y, deepened its Costco relationship and added GNC and 7-Eleven Mexico as new merchants too.

- Uber thinks this opportunity is larger than its current restaurant delivery business.

Freight:

- Launched Premier Autonomy as part of its Aurora partnership to “democratize access to driverless trucks for carriers of all sizes.”

- Added better search, bidding and pricing tools.

- Expanding into Mexico for better cross-border service.

Ads:

Ads crossed a $1 billion, high margin revenue run rate. Its upgraded targeting, attribution and reporting tools, as well as the continued build-out of its sales team, are all helping it win and retain large brand budgets. Spend per advertiser is up, and it just added Google and The Trade Desk to its roster of partners that can tap into its impressions. While sponsored listings are higher margin for Uber vs. merchant-funded offers, it’s still eager to lean into these offers. They drive better affordability, which lowers Uber’s own external marketing intensity needs and raises conversion rates.

- Grocery and retail ad spend rose 3x Y/Y.

- Its mobility ads have a 2.5 click through rate vs. 1.0% on average.

Autonomous Vehicles:

As recently announced, BYD is partnering with Uber in its work on autonomous vehicle technology. Uber prefers to go about this driverless evolution in an asset light way, and this is its way of accomplishing that. The company is adamant that its ability to optimize capacity utilization for fleets will lead to it being the demand aggregator of the future – similarly to Expedia for travel sites or Airbnb for hosts. It knows it can maximize margin for these providers and knows its driver network will be needed to supplement autonomous supply for at least another decade. It’s wildly expensive to build fleets to service peak demand when those fleets will be sitting on lots doing nothing during all other times of the day.

Uber’s drivers will plug that gap in a more malleable way; Uber’s massive consumer network will ensure carriers are profitable and that Uber is part of this equation. That’s what it thinks, and I agree.

This argument relies on there not being one autonomous tech provider to rule them all. Some think Tesla will be the monopoly, but Google, Amazon and countless other private players are pushing hard here. I don’t think any one player will win the entire market and I don’t think any will command the kind of market power that Uber has in demand aggregation. McDonald’s, Chipotle and massive restaurant brands all use Uber to augment demand levels. I think autonomous car makers will too. I could be wrong here, which is another reason why I like the new Alphabet position so much; it’s also a hedge against autonomy displacing Uber.

- Launched airport curbside drop off with Waymo in Phoenix.

- GenAI continues to lower the cost associated with trying to compete in building autonomous cars.

- Will have more partnerships to announce here in the coming weeks (maybe Zoox from Amazon?).

- Uber is driving strong capacity utilization gains for partners early on in testing.

More Notes:

- Uber One for Students will soon launch in more countries.

- It will likely add more membership-gated items for Uber One members and other exclusive perks to drive more adoption.

- Teen trips rose 100% Y/Y as its teen account builds traction & incremental Uber reach.

e. Take

This was a strong showing. Uber’s business is more macro resilient than I think most assume it is. Despite ramping consumer headwinds, its business keeps accelerating and its margins keep expanding. This company has built a massive two-sided network that I think has real staying power, while its subscription continues to uplift its revenue quality and margin ceiling. The runway remains massive, new products continue to work, market share continues to rise and Uber continues to win.

I have no plans to trim any shares.

2. Airbnb (ABNB) — Earnings Review

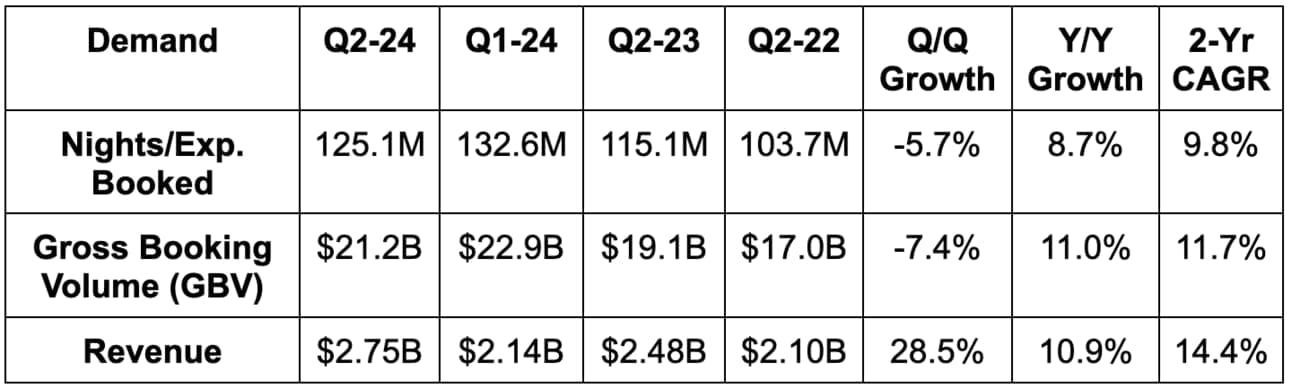

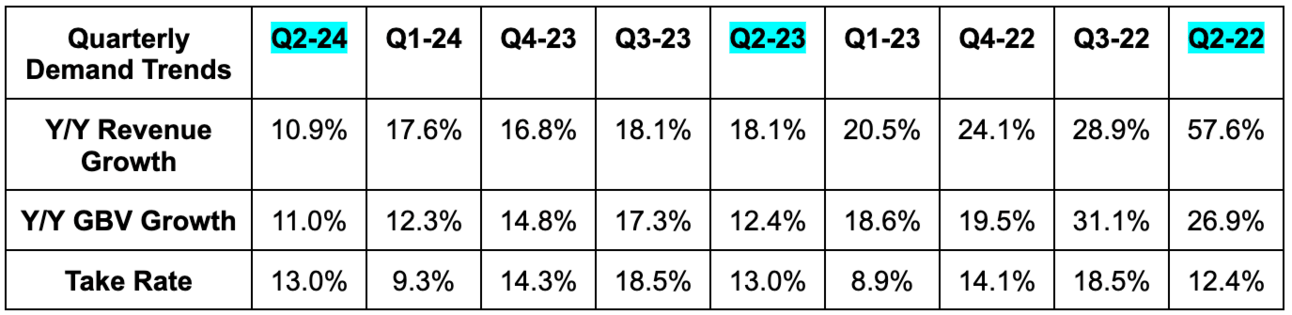

a. Demand

- Beat revenue estimate by 0.5% & beat guide by 1.5%.

- Missed 9.5% Y/Y nights booked growth estimate. Latin American and Asia Pacific were again the two best regions for nights booked growth.

- Take rate gains from its new cross-currency transaction fees were offset by Easter timing headwinds.