Table of Contents

- 1. Datadog (DDOG) — Earnings Review

- 2. Earnings Round-Up — Cloudflare & DraftKings

- 3. Airbnb (ABNB) – Earnings Review

- 4. The Trade Desk (TTD) – Earnings Review

1. Datadog (DDOG) — Earnings Review

Datadog 101:

There’s a lot going on within this product suite and I think understanding the basics is important. This recurring section will be review for some. If it’s not for you, let’s learn:

This is a dominant player in the data observability space. Observability simply refers to the practice of monitoring an entire asset ecosystem to track issues, vulnerabilities and performance. Other players within this area include the hyper-scalers, Splunk, Elastic, CrowdStrike and many more. Datadog splits its observability niche into 3 smaller buckets: infrastructure monitoring, log management and Application Performance Monitoring (APM).

Infrastructure monitoring: provides a holistic view of assets like servers and networks. It automates the collection of traffic and overall usage insights. That means it can more expediently fix and uncover infrastructure issues. This can also help clients and their other vendors uncover where compute capacity is being suboptimally distributed. Fixing those inefficiencies cuts costs.

Log management: collects and manages logs or “timestamped records of events.” This also facilitates faster issue remediation and optimization of performance. This product routinely supports infrastructure monitoring, BUT there’s a key difference between the two. Log management handles event-based data like customer service interactions, while infrastructure monitoring (as the name indicates) handles infrastructure-based metrics.

Application Performance Monitoring (APM): tracks app performance and uncovers/prioritizes performance issues to be remediated.

There’s also a newer, related form of Datadog monitoring called Digital Experience Monitoring. It’s exactly what it sounds like. This product includes real-time user monitoring (RUM) to track precise, observed interactions, and also Datadog Synthetics, which is similar to RUM, but tracks a simulation of expected interactions. Datadog delivers detailed churn analysis, engagement metrics and more from these tools. It also provides mobile app and feature testing, as well as actionable user journey visualization reports.

These four product categories, which frequently work together, form its “unified platform.” Other products to know within this overarching offering include Flex Logs. These offer a cost effective means to store and retain large batches of logs by separating storage and query usage. This makes it ideal for long term data storage and regulatory compliance. Separation also unleashes more data scalability, query customization and cost optimization. Conversely, querying from a flex log is slower than standard logs. That makes Flex Logs better suited for lower priority data.

Because Datadog already handles network viability, security is a wonderfully relevant growth adjacency. Products like Cloud Infrastructure Entitlement Management (CIEM) for example, ensure identity controls are strict and minimum access permissibility is in place. There’s a lot of competition with configuration-based cloud tools like this one, but Datadog is no slouch. CIEM diminishes risk of identity attacks in a cloud environment. Its Security Information and Event Management (SIEM) product allows for “long term data log visualization for security investigations.” Most recently, it added agentless environment scanning (no security agent installation needed) to match with its agent-based product. It also debuted data security and code security tools to detect and prioritize source code blunders as it moves “further left” on the DevSecOps scale towards developers.

It also offers a host of products within Cloud Service management. For example, its Kubernetes Autoscaling tool handles resource usage and expansion optimization. It pulls from extensive usage data to tell customers where they can save on compute capacity and other areas. This is part of its cloud service management push.”

But… this intro would not be complete without its GenAI product work. As we’ll explore, Datadog should thrive after the initial infrastructure GenAI boom. This isn’t Nvidia or Broadcom; they don’t sell GPUs or networking equipment. That hardware foundation is being laid. It’s positioning its portfolio accordingly for future model and app monetization. Toto is the name of its first foundational large language model (FLLM) and Bits AI is its copilot. So far, this can summarize incidents and conversationally field questions. Much more is coming. And unsurprisingly, it also tweaked and configured its core products to cater to LLM observability.

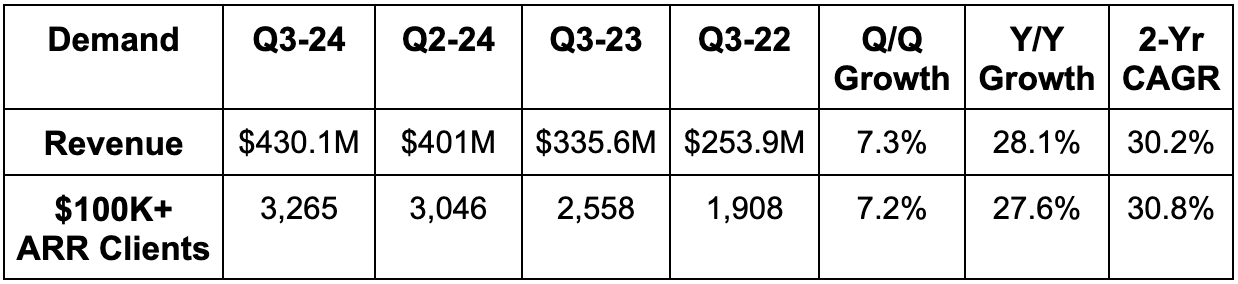

a. Demand

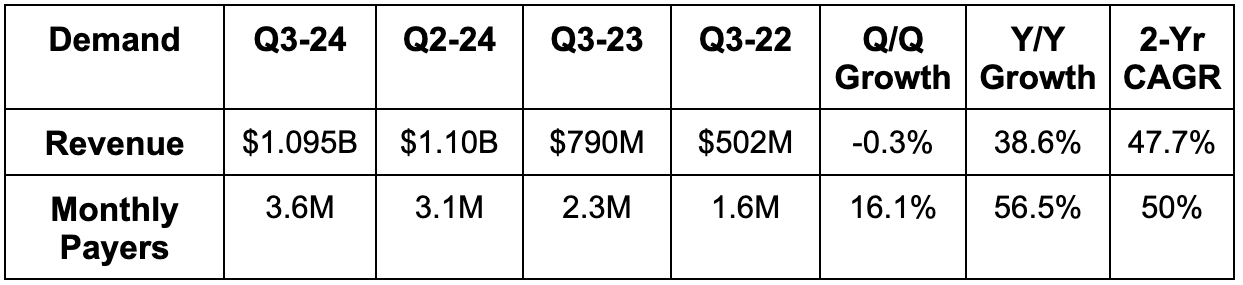

- Beat revenue estimate by 3.8% & beat guidance by 4.2%.

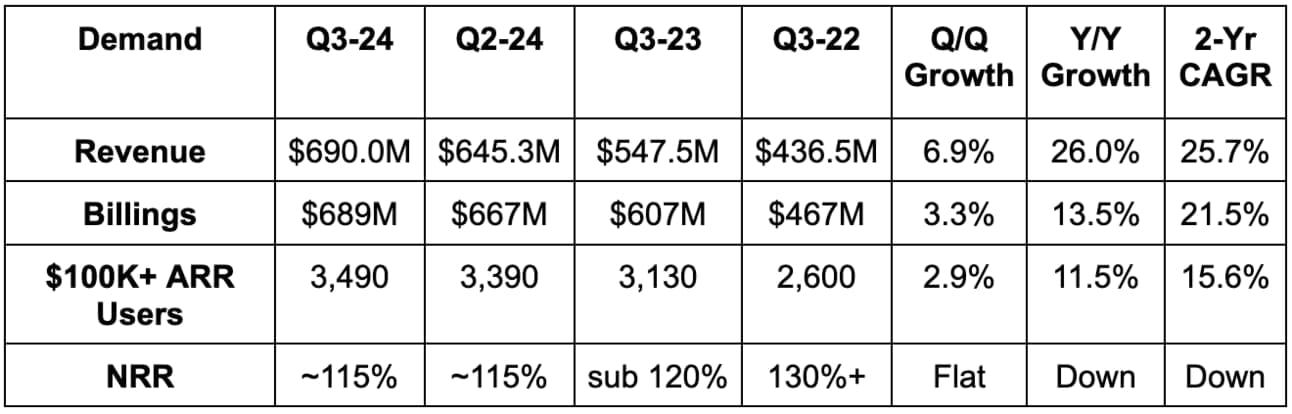

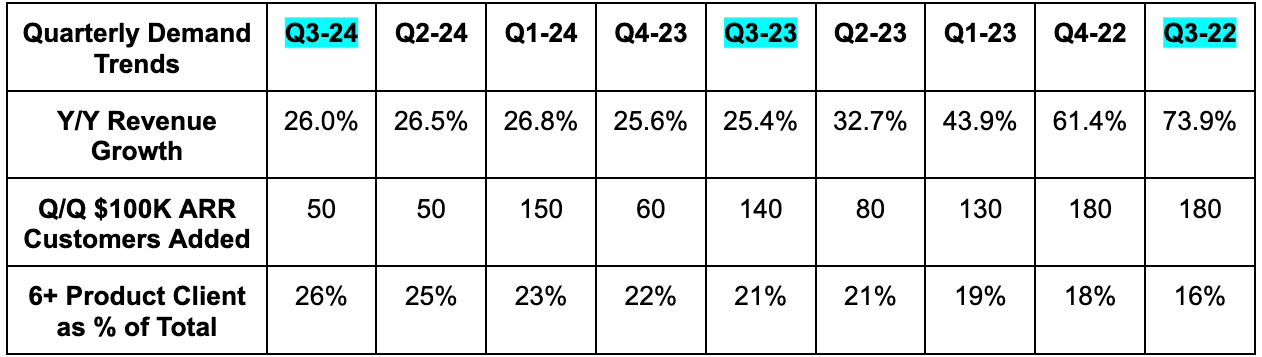

- Its 25.7% 2-year revenue compounded annual growth rate (CAGR) compares to 26.0% Q/Q & 29.8% 2 Qs ago.

- Billings missed estimates by 6%.

- While net revenue retention (NRR) was disclosed as stable in its financials, the team did tell us that it improved Q/Q.

The billings metric is related to things like timing of service and invoices and can fluctuate materially on a quarterly basis. This quarter, timing and a decrease in average billings duration Y/Y mightily impacted Y/Y growth. Without these lumpy headwinds, growth would have been somewhere around 25% Y/Y. Remaining performance obligations (RPO) also rose 26% Y/Y.

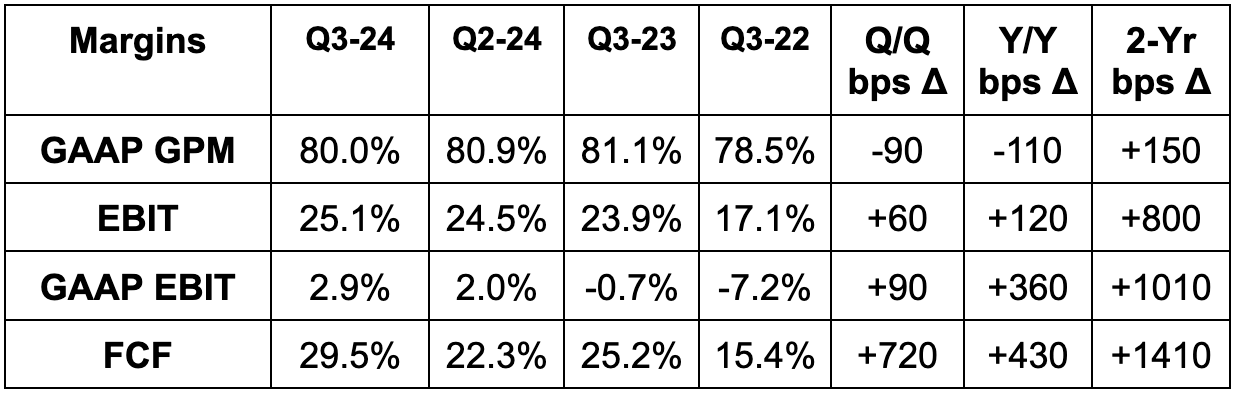

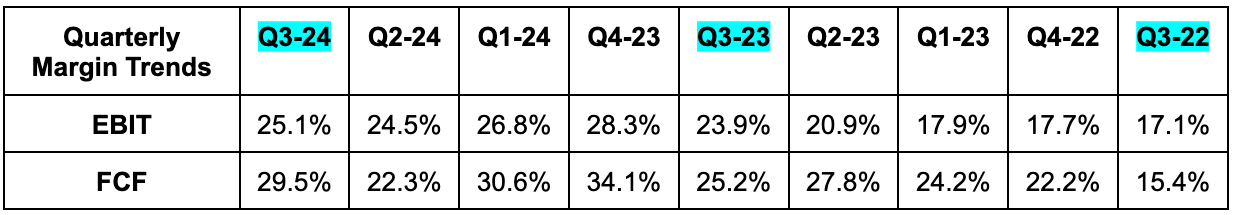

b. Profits & Margins

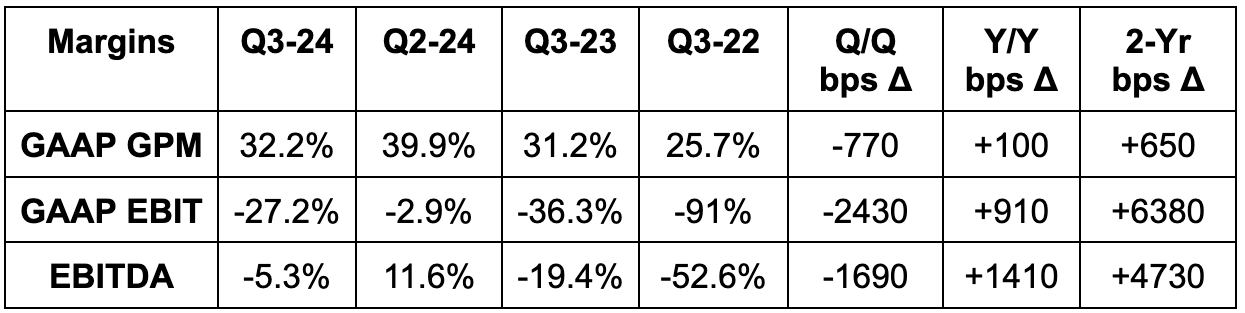

- Missed 81.9% gross profit margin (GPM) estimates by 60 basis points (bps; 1 basis point = 0.01%).

- Beat EBITDA estimates by 16.3% & beat guidance by 17.0%.

- Beat $0.40 EPS estimates by $0.06 & beat guidance by $0.07.

- Beat free cash flow (FCF) estimates by 22%.

OpEx rose by 21% Y/Y as expected due to telegraphed headcount growth to support demand.

c. Balance Sheet

- $3.2B in cash & equivalents.

- No traditional debt; $745M in convertible notes.

- Diluted share count +1.8% Y/Y; stock compensation rose 16% Y/Y.

d. Q4 Guidance & Valuation

- Raised Q4 revenue guidance by 0.6%, which slightly missed estimates.

- Raised Q4 EBIT guidance by 6.4%, which beat by 5.9%.

- Raised $0.40 Q4 EPS guidance to $0.43, which beat by $0.03.

“Overall, we continue to see no change to the multiyear trend towards digital transformation and cloud migration, which we continue to believe are still in early days.”

CEO Oliver Pomel

DDOG EPS is expected to grow by 26% this year, 17% next year and 24% the following year.

e. Call & Release

GenAI Positioning:

Interest in DDOG’s GenAI suite “continues to rise.” It’s seeing rapid app-level experimentation, which will eventually mean broad-scaled deployment. That deployment of high performance computing apps, with far more data and context to monitor vs. general compute apps, will be great for Datadog. Again, app monetization will come after hardware monetization and that is where DDOG will win. It’s a similar idea as MongoDB, Snowflake and others.

Still, it already is enjoying 6% of total ARR from GenAI customers and these customers did add 4 points to revenue growth vs. 2 points Y/Y. Not quite an Azure or Palantir level impact, but still really good. So clearly there’s already some real financial meat here. When digging in, that is coming from its presence within the model layer of GenAI. This positioning isn’t quite as pervasive as it should be within the app layer, but it is still compelling.

Its LLM observability tool is arguably off to the best start among its GenAI services. Hundreds of customers are now using this, with paying customers routinely “cutting time spent to investigate LLM latency, errors and quality from days or hours to minutes.” This is a wonderful bridge to app-level monetization that can allow DDOG to join the party here before most of its success will be enjoyed. And encouragingly, LLM observability is often being used with its APM offering to show you how directly model-level monetization can eventually feed into app-level profit.

It’s also worth noting that all hyperscalers have observability tools and all of them are crafting these tools for LLMs – either directly, through partners or both. Encouragingly, DDOG signed a large deal with a hyper-scaler for LLM observability. Cloud Kings are embracing this company’s substitute product over their own.

All in all, 3,000 customers are using a DDOG GenAI integration vs. 2,500 Q/Q and 2,000 2 quarters ago. Not only does this point to more usage, but also more data to train Toto and its other offerings.

The Platform Play & Macro:

Datadog now has $10 million ARR for 15 of its 23 total products. Broken record alert: secure platforms drive vendor consolidation, broader interoperability, lower cost and better outcomes. The business environment has not improved Q/Q. There’s still some budget hesitancy being offset by cloud migration urgency to yield an average but not amazing backdrop. Platformization is what is cutting through this noise and allowing for the outperforming results. Usage growth rose Y/Y and Q/Q, with gains sharpest among its largest customers. Gross revenue retention remains somewhere between 95%-99% and net revenue retention improved Y/Y and Q/Q.

Nothing paints this picture of continued platform momentum more clearly than some large wins:

- 7 figure contract with an e-commerce platform in India. India is understandably a focal point for international expansion, making this especially good news. Pretty much the most exciting market in the world right now.

- 6 figure U.S. federal agency contract. This includes 8 products across observability, cloud service management and cloud security.

- 7 figure contract with a U.S. financial services company. Frequent peak-traffic outages and incidents were costing this firm millions in revenue. Datadog is allowing them to recoup a lot of that waste.

- 7 figure contract with a European airline. They were also losing millions a year in revenue from on-premise application incidents. Datadog will help.

- Contract with a food delivery firm in Latin America (the other most exciting market in the world right now). They’re greatly helping them to improve customer service levels.

Products, Accolades & Partners:

Datadog announced a new Cloud Service Management product called “OnCall.” It combines ecosystem monitoring, alerting (or “paging” as it's called in this sector) and incident response all into one offering. This means more context and faster resolution. When there’s a cloud hygiene issue, for example, this product will send prioritized, ranked alerts. Traction for this product in early availability was called “very strong.” It’s even already becoming a requested tool for top-of-funnel new logo wins.

- Datadog was named a Gartner leader for both Observability & Digital Experience Monitoring specifically.

- The Oracle Cloud Infrastructure (OCI) and Datadog Monitoring integration is complete. This means more convenient access for shared customers and lower adoption friction.

f. Take

Strong quarter. Billings duration is not a structural issue and so the sharp billings miss is not overly concerning to an innocent bystander like myself. What is structural? Continued rapid top-line, margin-accretive compounding within a sector offering miles of additional growth runway. The balance sheet is beautiful and is a powerful weapon, as the M&A environment probably becomes more favorable in the coming quarters. This team’s GenAI monetization (outside of hardware) has been better than most. Really good.

2. Earnings Round-Up — Cloudflare & DraftKings

I’ll post detailed reviews on both of these Saturday.

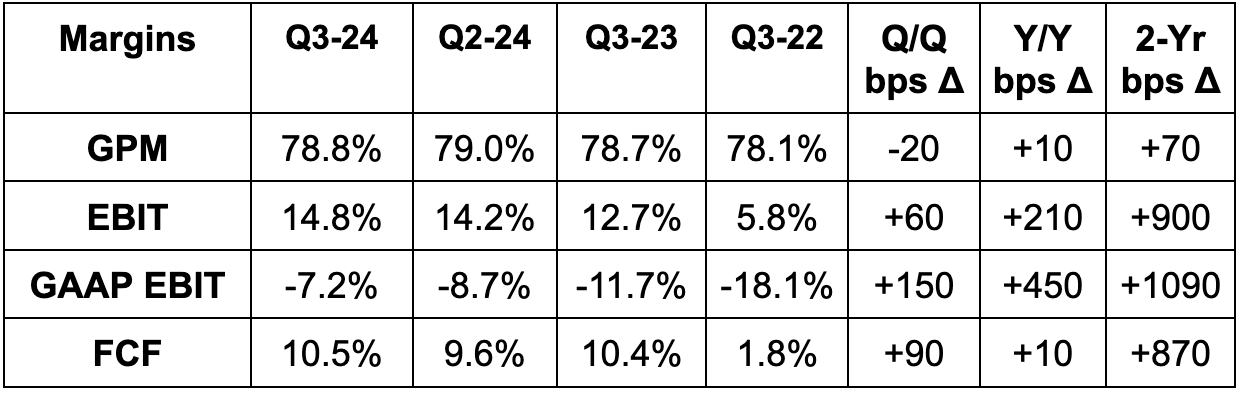

a. Cloudflare (NET)

Results:

- Beat revenue estimates by 1.6% & beat guidance by 1.4%.

- 30.2% 2-yr revenue CAGR vs. X% last Q & X% 2 Qs ago.

- 110% net revenue retention vs. 112% Q/Q & 115% 2 Qs ago. Lowest since IPO.

- Beat EBIT estimates by 23.3% & beat guidance by 25.7%.

- Beat $0.18 EPS estimates & $0.18 EPS guidance by $0.02 each.

Guidance:

- Lowered Q4 revenue guidance by 0.8%, which missed by

- Raised Q4 EBIT guidance by 22%, which beat by 18.8%.

- Raised Q4 $0.17 EPS guidance by $0.01, which beat by $0.01.

Balance Sheet:

- $1.8B in cash & equivalents; $1.29B in convertible senior notes.

- Diluted and basic share counts rose by 2.2% Y/Y.

b. DraftKings (DKNG)

Results:

- Missed revenue estimates by 1.4%.

- Beat -$73M EBITDA estimates by $15M or 21%.

- Beat $0.24 EPS estimates by $0.07.

- Beat 38% GPM estimates by 200 bps.