Table of Contents

- To Stock Market Nerd Readers & Friends -- A Major …

- 1. Netflix (NFLX) – Earnings Review

- 2. Bank of America (BAC), American Express (AXP), …

- 3. Tesla (TSLA) – Some Thoughts

- 4. Intuitive Surgical (ISRG) – Earnings Snapshot

- 5. Meta Platforms (META) – Meta AI Release & Whats …

- 6. SoFi (SOFI) – Miscellaneous

- 7. Amazon (AMZN) – Prime Growth & Another Bullish …

- 8. Market Headlines:

- 9. Macro

- 10. Portfolio

To Stock Market Nerd Readers & Friends -- A Major Announcement:

After thousands of pages of regular, rational, reliable, in-depth & free stock analysis, Stock Market Nerd newsletter will be going to a paid subscription model on June 1. I have spent the last four years building a record of high quality research, strong performance, blunt honesty & hard work. I have loved every minute of it and I truly appreciate the passionate interest from each and every one of you.

I have 2 things to say to all of you:

- Thank you.

- Keep reading & subscribe.

Here's how things will work:

You will no longer see any ads starting June 1st. News of the Week will continue to be published every Saturday, with a change that I think you’ll all love. News of the Week is going to become “Remaining News of the Week.” More high-profile earnings reviews will be sent mid-week. Major news coverage for investor days, fed press conferences, M&A etc. will also be sent mid-week more frequently. Remaining News of the Week will feature everything not yet covered.

The first section of each weekly article will often be entirely free to give new readers a sense of what they can consistently expect. Additionally, short pieces of some of the other sections explaining the "what happened" will be free. Full analysis will be placed behind a paywall. Working through implications, context and opinions (so the majority of the newsletter) will be pay-walled. The occasional earnings review for immensely popular firms like Tesla or Microsoft will also be free; Twitter, Threads, Instagram and other similar content will always be free. I will no longer share holdings and transactions on social media.

Subscription Tiers:

- Tier one ($25/month) - This includes all of my articles: the weekly news pieces, deep dives, earnings reviews, & a new quarterly portfolio outlook article concept. Paid subscribers will get all Stock Market Nerd content sent to their inboxes.

- Tier two ($20/month) - This will include contextualized transactions (& my updated portfolio plus performance vs. benchmarks) sent in real-time. I will field comments, questions and concerns from paid subs on transactions in a timely fashion.

- These can be bundled for $35/month.

I'm deeply excited by this opportunity and to keep delivering in-depth research for many more years to come. The next 6 weeks will be spent putting the systems in place to ensure this transition is smooth. I’ll also be switching to Beehiiv as part of this process. No action is needed on your end, as you’ll be automatically moved over to the new email list. Cheers to continuing to work my butt off for you. Onwards & upwards.

1. Netflix (NFLX) – Earnings Review

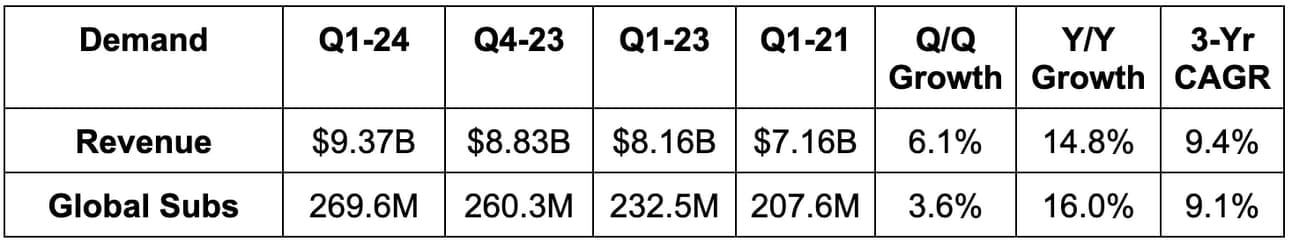

a. Demand

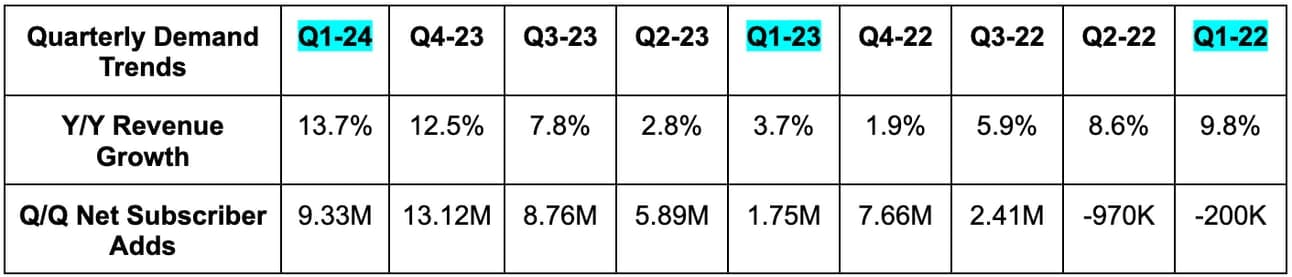

- Beat revenue estimates by 1.0% & beat guidance by 1.4%.

- Revenue growth was 18% Y/Y on an FX neutral (FXN) basis. The large gap between actual growth and FXN growth is related to a 75% devaluing of the Argentine Peso.

- Crushed subscriber estimates by 94% or 4.5 million. This was also “better than expected” according to leadership. It no longer offers specific guidance on that metric.

- Average revenue per member (ARM) rose 1% Y/Y & 4% Y/Y on an FXN basis.

Going forward, Netflix will no longer disclose total subscribers on a quarterly basis; it will instead disclose concrete annual revenue expectations, like it did this quarter. Per the team, its new add-an-extra-member feature and advertising growth levers are making subscribers a less important indicator for revenue growth. It was highly important at the beginning of the Netflix journey when subscribers served as a leading indicator for future financial success. Now, as a more mature company increasingly focused on optimizing monetization of current members through maximizing engagement, it’s not as valuable of an indicator. That’s how Netflix explained the change during the call and in the letter.

That’s what the team says, but I am certain there will be skeptics saying this is due to expectations of slowing member growth. While I always prefer more disclosures, and while total subscriber count is a great metric to track overall engagement potential, I really don’t think anything nefarious is going on here. Netflix has a stellar team with a fantastic track record and it does a better job of sharing engagement progress throughout the year than most. It will also still update us on subscribers when it reaches major milestones.

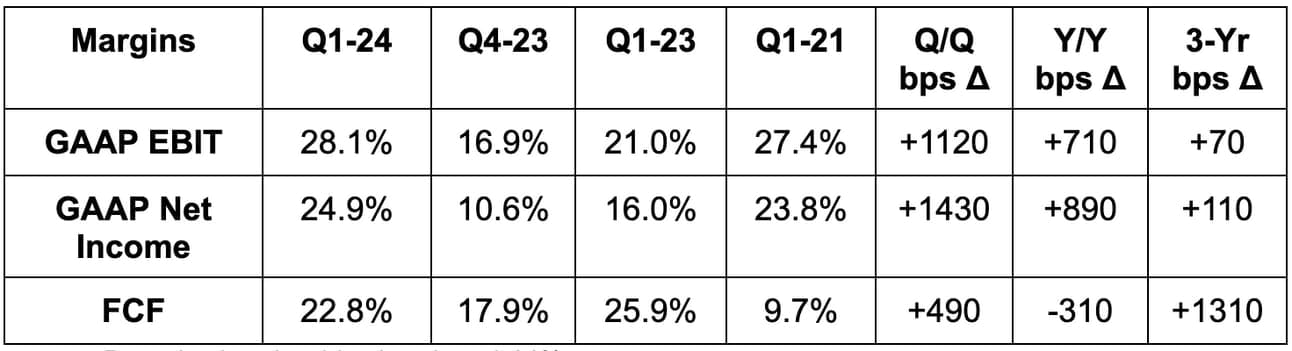

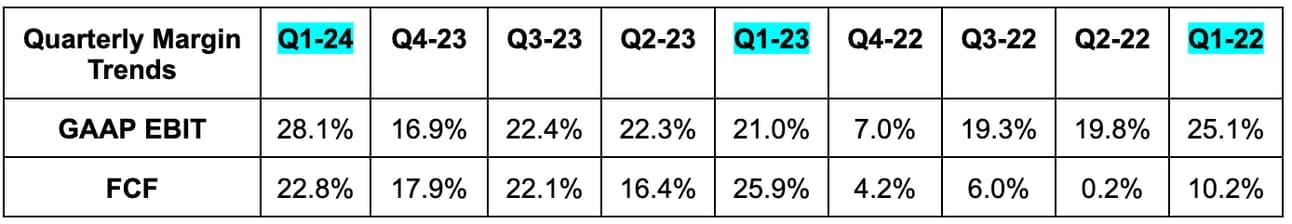

b. Profitability

- Beat GAAP EBIT estimates by 8.5% & beat guidance by 8.7%.

- Beat $4.52 GAAP earnings per share (EPS) estimates by $0.76.

- Beat free cash flow (FCF) estimates by 16.3%.

Aside from outperforming subscriber growth, timing of content spend aided the profit beats this quarter. For GAAP EPS, $131 million in foreign exchange (FX) re-measurement helped by about $0.30. Still a strong beat excluding this non-operating boost.

c. Balance Sheet

- $9.9 billion in cash & equivalents.

- $14 billion in debt ($800 million current).

- Basic shares fell 2.4% Y/Y.

- Diluted shares fell 2.9% Y/Y.

There’s an update to the Netflix capital allocation philosophy. It’s removing the requirement to hold more than two months of cash on the balance sheet as a prerequisite for repurchasing shares. This is in response to its now comfortably investment-grade credit status. It also backed off from the $10-$15 billion in gross debt commitment and flexed an existing credit revolver from $1 billion to $3 billion.

“This will bolster our access to liquidity, and enable us to improve our cash efficiency, over time. We also expect to refinance our upcoming debt maturities and we don’t currently have plans to lever up to buy back stock as we value balance sheet flexibility.” – Shareholder Letter

d. Guidance & Valuation

For the second quarter, revenue guidance was missed by a modest 0.4%. Growth for the quarter is expected to be 16% Y/Y and 21% Y/Y on an FX neutral (FXN) basis (again due to Argentina). The firm’s EBIT guide was 3.3% better than expected, while its $4.55 GAAP EPS guide was $0.13 better than expected. It also guided to adding fewer subscribers Q/Q and modest FXN revenue per member growth. Most of the Q2 and 2024 growth for Netflix will be driven by more members, with little impact from price hikes.

For the full year, revenue guidance also missed estimates by a modest 0.4%. Its guide represents 14% Y/Y growth at the midpoint. It raised its EBIT margin guidance from 24% to 25%, which implies an EBIT guide 4% ahead of expectations. It reiterated its $6 billion FCF guidance, which missed by 4.3%, as the sell-side was looking for a small raise. It continues to expect up to $17 billion in annual content spending.

Netflix trades for about 30x 2024 earnings with a ~30% forward 3-year earnings CAGR expected.

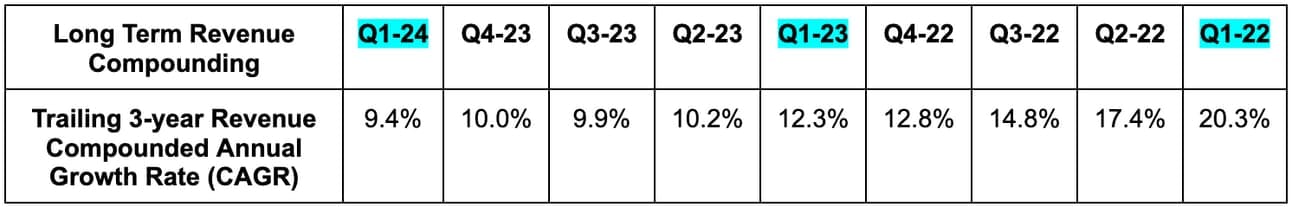

“We will work hard to sustain double digit growth over the long haul… we’re committed to growing margins every year. We see a lot of runway to continue to grow profits and margins over the long term.” – CFO Spencer Neumann

e. Call & Letter Highlights

2024 Priorities:

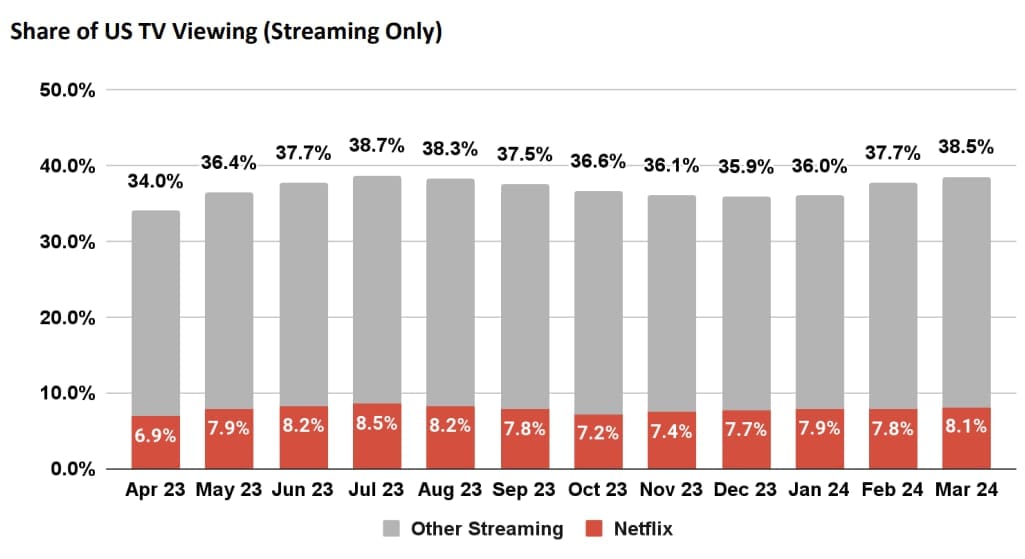

Netflix will continue to do whatever it can to drive engagement. It knows this means higher retention, more advertising revenue and more subscribers – and it’s delivering. This quarter, despite account sharing restrictions that reduced users per member, engagement per member was stable Y/Y. If you make great content, the people will come and they will stay. And so? When Netflix leads the world in Oscar nominations for yet another year while dominating leaderboards for streaming shows and films, it’s no wonder why engagement is so solid.

In 2024, that engagement push will increasingly feature live programming (including some sports), unscripted content, gaming and even a Stranger Things play. As Netflix loves to remind us, the “Netflix Effect” already leads to songs, books, fashion trends and travel destinations storming back onto the scene seemingly out of nowhere. It clearly has a massive base of fiercely loyal and passionate fans, and it’s planning to give these viewers even more to consume in 2024. The entertainment giant wants to capture more of the remaining 90% share of TV viewing hours that it does not yet possess. Creating broader value to accomplish that feat should mean more pricing power and continued best-in-class churn rates – while maintaining strong operating leverage. This company is executing on all fronts.

Advertising:

Netflix’s advertising tier maintained rapid expansion this quarter, with 65% Q/Q growth. That follows 70% Q/Q growth in each of the last two quarters. More than 40% of its new members are going with ads; that matters dearly considering ad buyers’ most frequent request is more scale to reach more eyeballs. Netflix is getting there quickly.

It also needs to build-out better targeting and measurement tools for these advertisers. It’s partnering with Kantar and Nielsen, among a few others, to achieve this. Regardless, there’s a long way to go in building out the services and capabilities needed to be best-in-class here. Disney and Hulu are considered best-in-class at the moment, and I think that has a lot to do with the Disney/Trade Desk partnership. In my view, a similar partnership to complement Netflix’s work with Microsoft Xandr makes all the sense in the world. Full disclosure: I am a shareholder of The Trade Desk.

The phasing out of its basic ad-free plan in Canada and the U.K. is going as planned. Netflix is pushing lower-priced, ad-free subscribers to either choose ad-supported or to pay more for an ad-free experience. With these changes, it can become indifferent to which tier a subscriber chooses as revenue contribution should be roughly the same over the long haul. For now, as Netflix continues to work on tooling and scales the offering, it is a small headwind for revenue per member.

Streaming Industry & Programmatic Advertising Hint:

Netflix included a great chart in its letter that shows a stable-to-rising share of TV viewing hours. But perhaps more interestingly, it shows the rising share of streaming as a percent of viewing hours from December to March. That’s fantastic news for all players in the programmatic advertising space; streaming is the largest, most broadly-enjoyed structural tailwind in that market.

f. Take

I thought this was a great quarter for Netflix. Conspiracy theories will arise on the disclosure changes, but if they keep compounding at a 10%+ clip with leverage, I don’t think shareholders should really care all that much. For now, we have a company that is successfully broadening its content offering and catering to more people while expanding margins. It’s growing Y/Y share of a fiercely competitive market and sees a long runway to keep doing so. Great company and a great quarter in my view… regardless of the stock’s reaction.

My friends at Savvy Trader have some great new tools to share. I may cover a lot of companies during earnings season, but I definitely don’t cover them all. If you’d like transcripts, estimates, breaking news & more, give it a look.

2. Bank of America (BAC), American Express (AXP), Discover Financial (DFS) – Bank & Credit Earnings

Two things are true about this week’s batch of key credit earnings. More lagging indicators are still showing signs of notable deterioration as Y/Y comps continue to be difficult amid worsening macro and normalizing credit metrics. Conversely, provisions and reserve commentary from ultra-prime underwriters and less prime underwriters was actually mainly encouraging.