Table of Contents

- 1. Apple (AAPL) – Earnings Review

- 2. Amazon (AMZN) – Earnings Review

- 3. DraftKings (DKNG) — Earnings Review (Minus Tomo …

In case you missed it, access SoFi, PayPal, Microsoft, Lemonade, Mastercard (brief) and Starbucks earnings reviews from this week here.

1. Apple (AAPL) – Earnings Review

a. Demand

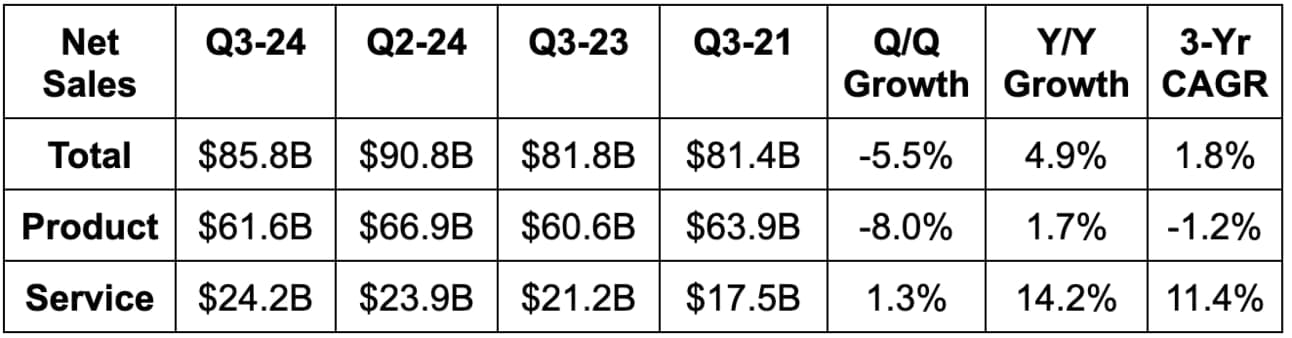

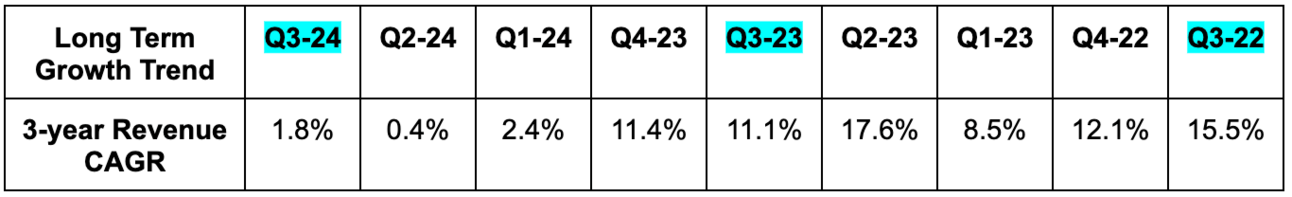

- Beat revenue estimates by 1.3% & beat low single digit growth guidance.

- Foreign exchange (FX) was a 230 basis point (bps; 1 basis point = 0.01%) headwind vs. 250 bps expected. This beat was not largely powered by easier currency exchange rates (which is a good thing).

- Set new revenue records in two dozen countries.

- Services beat revenue estimates by 0.8%.

- iPhone revenue beat estimates by 1.8%. iPhone revenue fell slightly Y/Y, but rose slightly Y/Y FX neural (FXN)

- Mac revenue rose 2.4% Y/Y.

- iPad revenue rose 22% Y/Y.

- Wearables, Home and Accessories revenue fell 2.3% Y/Y (lapping strong Apple Watch debuts)

- China revenue fell 6% Y/Y; Americas revenue rose 6.5% Y/Y; Europe revenue fell slightly Y/Y.

b. Profits & Margins

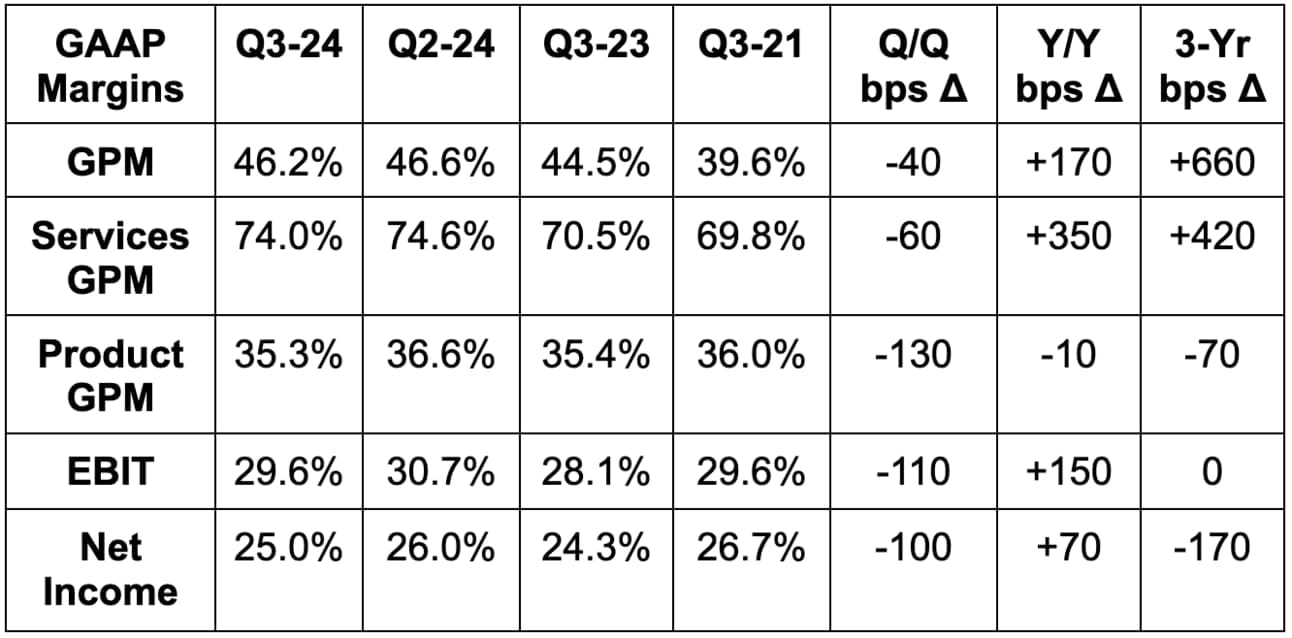

- Beat EBIT estimates by 3.2%.

- Operating expenses (OpEx) rose 7% Y/Y.

- Beat $1.34 EPS estimate by $0.06. EPS rose by 11% Y/Y.

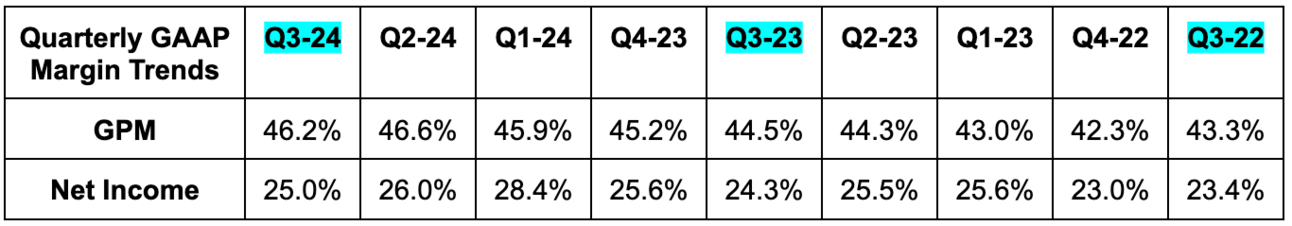

- Beat 46% GAAP gross profit margin (GPM) estimates and its same guidance by 30 bps each.

- GPM fell Q/Q due to hardware mix shift to lower margin products.

- Year-to-date (YTD) Operating Cash flow of $91.4B vs. $88.9B Y/Y.

c. Balance Sheet

- $62B in cash & equivalents & $91B in long term marketable securities (which it includes in cash & equivalents even though these aren’t current assets).

- $101B in total debt.

- Share count fell 2.7% Y/Y.

d. Guidance & Valuation

Apple guided to similar revenue growth next Q vs. this Q. That implies 5% Y/Y growth vs. 4.2% expected. This includes 10%+ Y/Y services growth. It also sees a 46% GAAP GPM, vs. 45.8% expected. Based on OpEx guidance, EBIT was also 2.9% ahead of expectations. Strong guide.

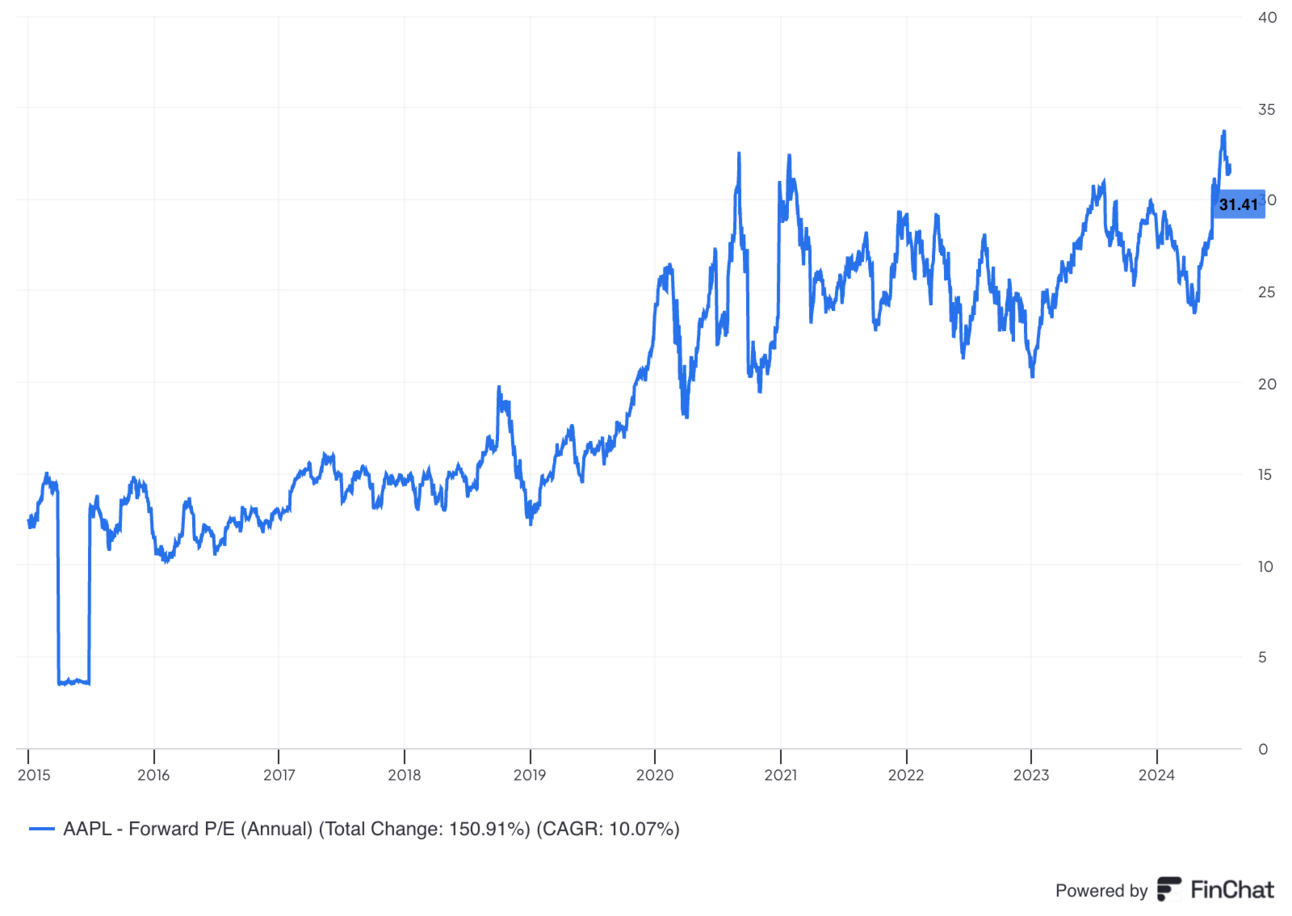

Apple trades for 33× 2024 EPS. EPS is expected to rise by 8% this year and by 11% next year.

e. Call & Release

Apple Intelligence:

Apple Intelligence was a focal point of the call. This is part of the overall release of iPhone Operating System (iOS) 18.1. Early Apple tools from the launch include image generation, notification summarizing and prioritization, Siri upgrades and a ChatGPT integration too. And intuitively, developers will be eager to get their hands on this new technology to build new apps for Apple’s gigantic customer base. As previously announced, Apple is introducing this to developers this week. That news comes after reports of Apple delaying the introduction of Apple Intelligence tools for consumers for a few months – per Bloomberg.

Eventually, Apple Intelligence will touch essentially every 1st and 3rd party app Apple offers. The usage of these tools will require an iPhone 15 model or a Macbook from 2020 or later and will happen in stages. Geographic and language expansion (as well as continued product debuts) will continue well into 2025 and likely beyond.

As reviewed in my coverage of the 2024 Worldwide Developer Conference (WWDC), Apple is taking a privacy-first approach to this launch. As Tim Cook puts it, the firm is “minimizing data sharing while maximizing the amount of data processed on device.” It isn’t impermissibly collecting and using personal data to season GenAI models (although its partner OpenAI has been accused of doing so). And when more processing power is required for a query/question than a device can provide, Apple’s private cloud (run by Apple Silicon) will field traffic. It will do so without any data leakage or storage beyond what it needs at that moment to respond.

CapEx & GenAI Costs:

Apple seems poised to use its supply chain partners to side-step a lot of the CapEx associated with being a big player in GenAI. It sees its chips, device ecosystem, developer network and Apple Intelligence as sufficient. It doesn’t think it needs to play a game of build the best model or the biggest data center. It thinks it can do things like use Alphabet chips to train its AI algorithms and let OpenAI plug the large language model (LLM) gap on its software. It does cost money to build the chips it needs to power Apple’s hardware, but the firm is not feeling the need to ramp CapEx like every other mega cap currently is.

As a general rule of thumb, Apple Intelligence will focus on more personal use cases for granular utility, while ChatGPT will be used for “world knowledge” so Apple doesn’t need to build the infrastructure to offer that itself. It already has the ecosystem moat; there’s no need to try to build another expensive moat.

Vision Pro:

Despite reports of Vision Pro sales sharply missing expectations, Apple remains confident in the prospects of this hardware… and I agree with them. Apple needs to insulate itself from the risk of headsets becoming the next computing device beyond smartphones. That’s not at all a certainty. But? Apple does need to lay the groundwork and invest to ensure it has a large piece of this market if headsets do turn out to be the future. For now, the hardware (Vision Pro and Quest) is clunky, heavy, hot and makes me dizzy. You also can’t really do much with it.

We are several, several iterations away from these headsets being powerful and comfortable enough to drive ubiquity. Manufacturers will likely need to offer far more compelling use cases while also miniaturizing the tech enough to look like a pair of Ray Bans. We are a long way away from that being a reality. But? Investing today positions Apple to be confident in not falling behind tomorrow. Its balance sheet and margin profile also make Vision Pro as a temporary cash incinerator easy to tolerate.

- Vision Pro now has 2,500 native spatial apps and 1.5 million Vision operating system (Vision OS) compatible apps.

Hardware Context:

24% Y/Y iPad growth was helped by a strong iPad Pro debut. The tech comes with Apple’s latest M4 chip and is Apple Intelligence compatible. 50% of all iPad customers were new to the product during the quarter and, per 451 Research, the product has a lofty 97% customer satisfaction rate vs. 96% Q/Q.

iPhone set new records across a lot of Europe and Mexico, although continues to see revenue decline across China and other geographies. When measuring iPhone 15 vs. iPhone 14 at this stage of the new phone’s rollout, iPhone 15 is outperforming its predecessor. The active install base continued to climb, which simply gives Apple more devices to cross-sell margin accretive services to. Per 451 Research, the iPhone has a 98% customer satisfaction rate vs. 99% Q/Q. Beyond Apple Intelligence, iOS 18 will introduce satellite messaging, app hiding (for all you Tinder users), and a photo app redesign, as disclosed at WWDC.

- 50% of all Macbook Air customers during the quarter were new. Per 451 research, the product has a 96% customer satisfaction rate.

- 67% of Apple Watch customers during the quarter were new. The runway is still long.

- USAA & American Express purchased MacBooks for their employees.

Services:

Transacting and paid accounts both reached new records, with paid accounts continuing its streak of 10%+ Y/Y growth. Total subscriptions for Apple have doubled in 2 years, and newer initiatives like ads and payments continue to thrive. It expanded tap-to-pay on iPhone to Japan, Canada, Italy and Germany during the quarter and added rewards to Apple Pay too.

China:

Revenue growth of -6% was -3% FXN and improved vs. the first half of the year. It set a new record for its Greater China install base and a June quarter upgrade record in Mainland China too. Per Kantar survey, iPhones were all 3 of the top models in urban China during the period. Most Chinese buyers remain brand new to Apple and the company remains convinced in the promise of this market for the long haul.

f. Take

This quarter was pretty good. Services drove the revenue and profit outperformance and that theme looks poised to continue into next quarter. Apple’s ecosystem is seemingly impenetrable, and it has an increasingly large series of services to cross-sell and drive more growth. That should continue to keep the slow revenue growth engine humming while it drives more cross-sell and buyback-based operating leverage. I do think that it will likely need to rev the innovation engine a bit at some point to stay king of consumer hardware, but we don’t feel close to an iPhone replacement threat becoming real. This is one of the most expensive names in the market based on forward growth prospects, but its decades of historically strong execution and its fortress moat earn it that premium in droves. Apple keeps on chugging.

2. Amazon (AMZN) – Earnings Review

a. Demand

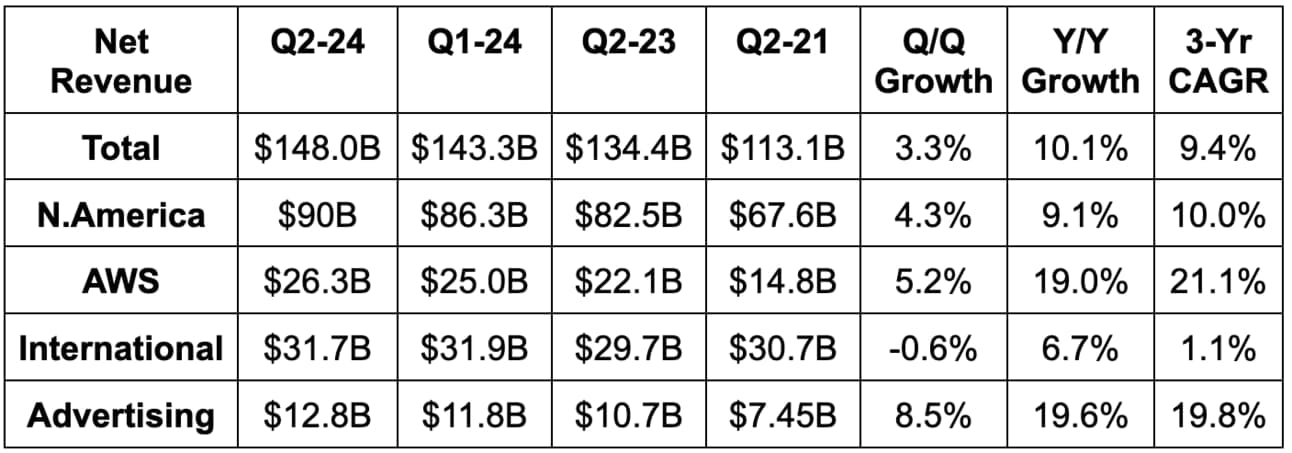

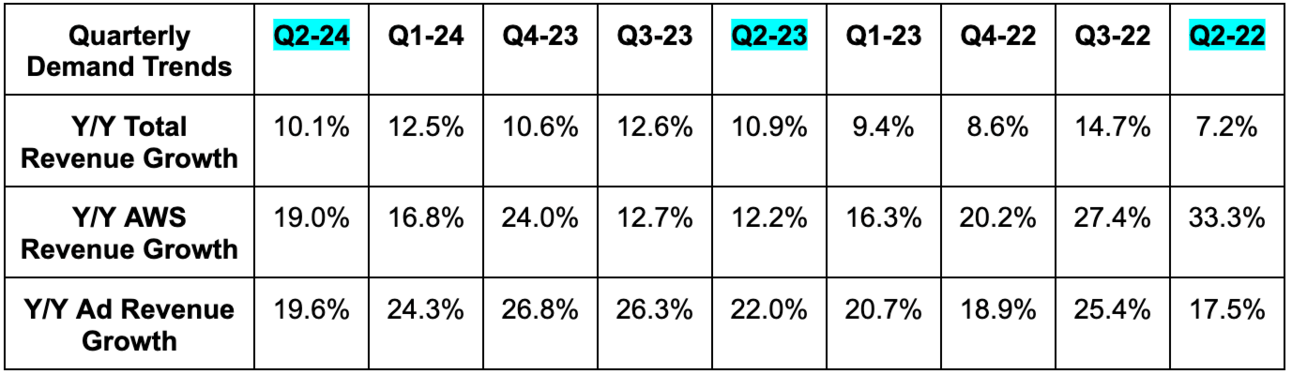

- Missed revenues estimates by 0.5% & beat revenue guidance by 1.0%. Its 9.4% 3-year revenue CAGR compares to 9.7% last quarter and 10.6% two quarters ago.

- If FX headwinds were as expected Amazon revenue would have missed estimates by 0.3%.

- FXN revenue rose 11% Y/Y.

- Beat AWS revenue estimate by 1.2%. The AWS backlog rose 19% Y/Y to $156.6 billion.

- Met North American revenue estimate.

- Missed International revenue estimate by 3.6%. Growth for this segment was 10% Y/Y on an FXN basis. The source of the revenue miss seems to be foreign exchange.

- Missed advertising revenue estimate by 1.8%.

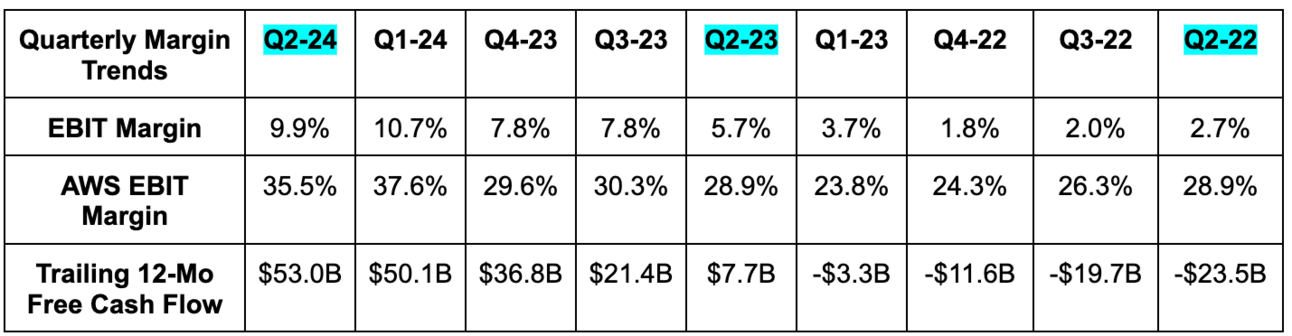

b. Profits & Margin

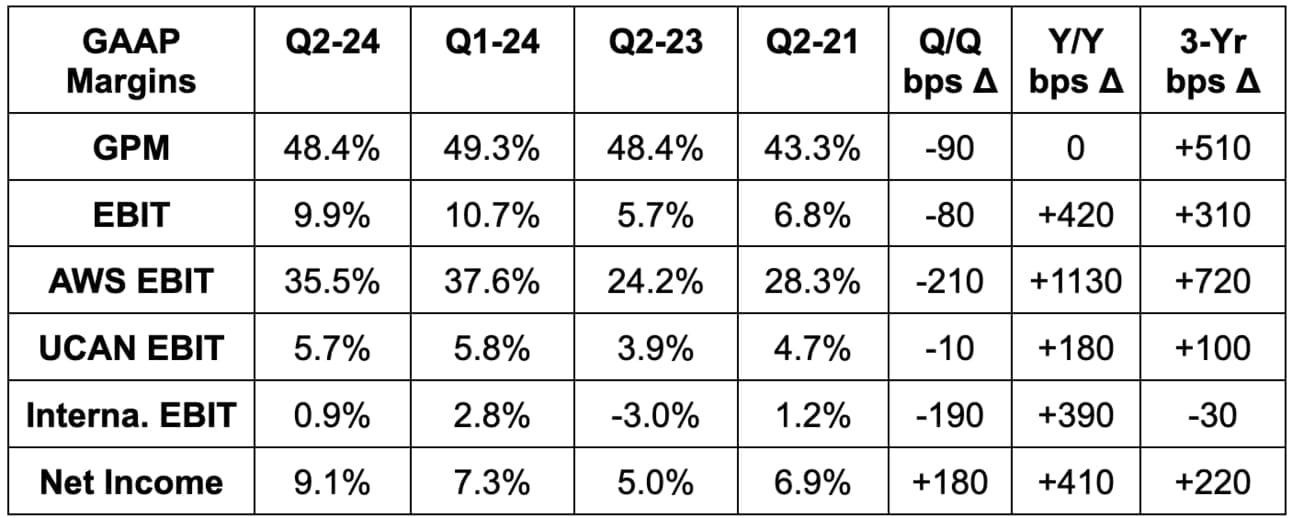

- Beat EBIT estimate by 8% & beat EBIT guidance by 22.5%.

- North American EBIT missed by 2.9%, International EBIT met and AWS EBIT beat by 11%. AWS EBIT margin expansion was boosted 200 bps by the change in useful life of some servers.

- Beat $1.03 GAAP EPS estimate by $0.23. EPS rose 94% Y/Y.

c. Balance Sheet

- $88B in cash & equivalents.

- $55B in debt.

- Diluted share count rose 2.5% Y/Y.

d. Q3 Guidance & Valuation

- Missed revenue estimate by 1.3%.

- Missed EBIT estimate by 13%.

- Expect CapEx to remain elevated.

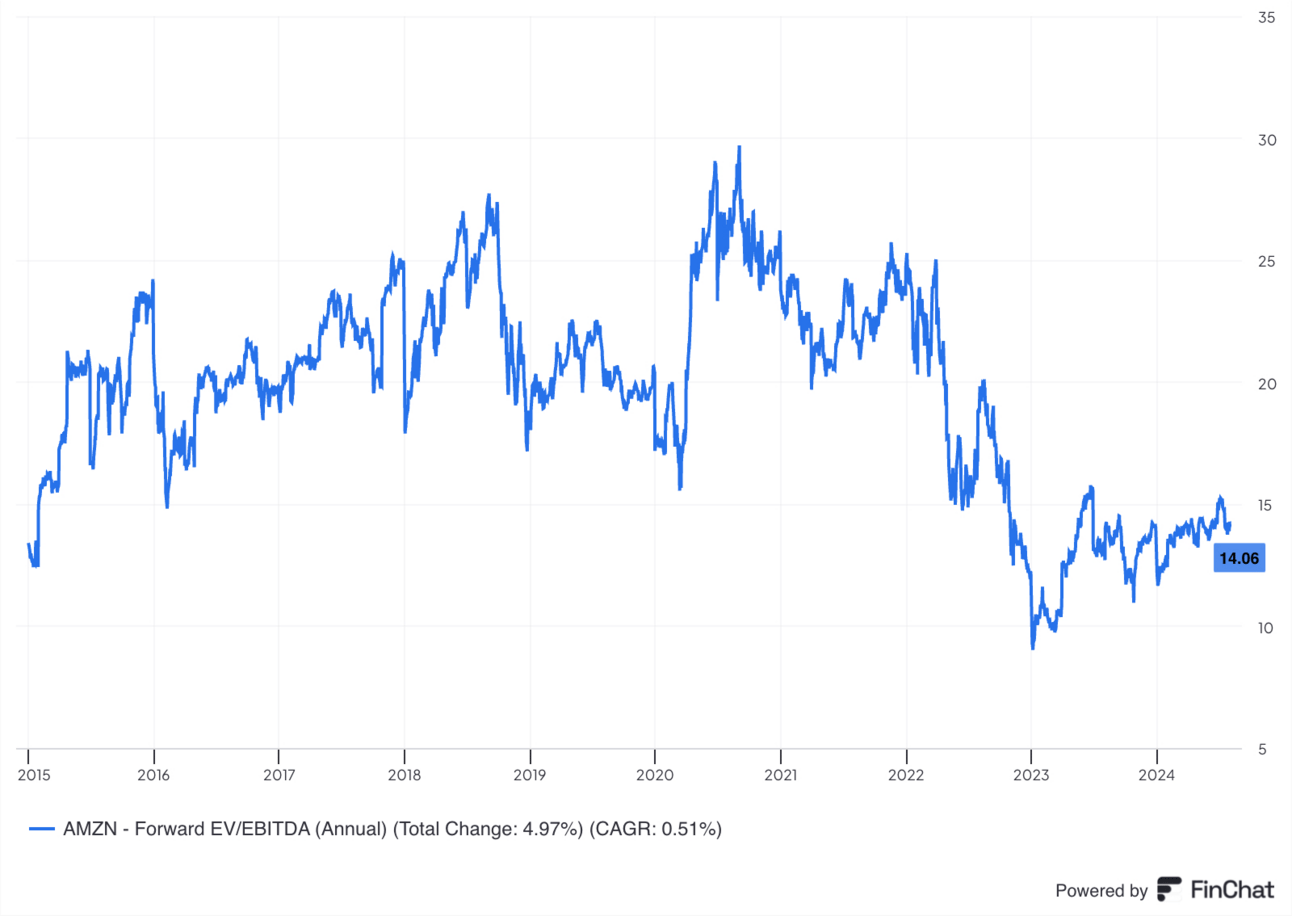

Amazon will likely trade for somewhere around 40x earnings following downward profit revisions. EPS growth estimates for this year will likely fall towards 50%. It’s expected to grow EPS during the following 2 years after that at a compounded clip of 28%.

e. Call & Release

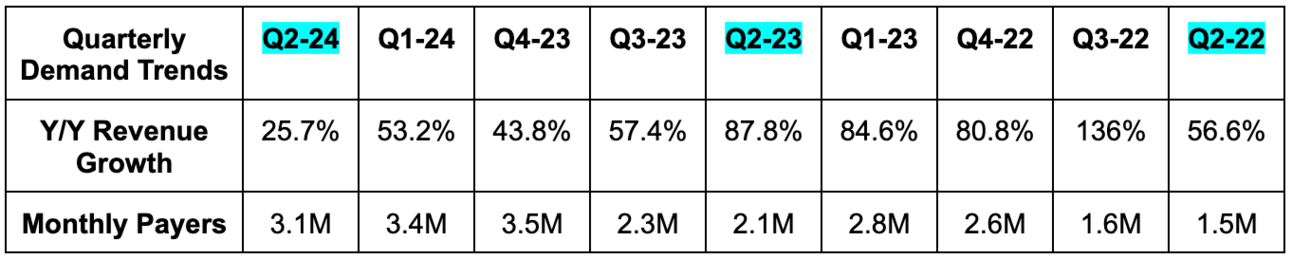

AWS & GenAI Model-Building Tools to Support AWS Growth:

Jassy and co. called out the same AWS trends that have been powering the segment’s re-acceleration in recent quarters. Cloud cost optimization efforts have wrapped up with an improving appetite for modernizing infrastructure and migrating to the cloud. Enterprises can shed a lot of fixed cost and accelerate innovation by going with a public cloud like AWS instead of trying to manage data centers internally. In a world of fragile macro and elevated cost of capital, efficiency gains like these are even more coveted. 90% of IT spend still happens on premise rather than within a public cloud; the runway remains massive; headwinds are continuing to abate.

AWS AI revenue is now at a multi-billion dollar run-rate, although we were told that last quarter and didn’t get incremental detail. From a model perspective, Amazon’s combination of Bedrock and SageMake is supporting AI workload demand for AWS. Bedrock is Amazon’s fully managed environment for using GenAI models to build applications. It offers the latest and greatest products from Meta, Mistral, Cohere, Anthropic and more and has tens of thousands of customers so far.

“Bedrock has the largest selection of models, the best generative AI capabilities in critical areas like model valuation, guardrails and more and makes it easy to switch between different model types and model sizes.”

CEO Andy Jassy

SageMaker allows developers to build custom models on top of Bedrock for more granular and company-specific needs. It’s very similar to Microsoft Copilot studio. SageMaker just added model networking upgrades during the quarter and the team is “increasingly seeing model builders standardize” on this tool.

- AWS has launched 2x more GenAI features than its public cloud competitors in the last year. That’s nice, but it doesn't have a product like Microsoft Copilot significantly raising AWS growth rates like Azure does.

- Continues to see model choice, “superior security and operational performance,” its capabilities like SageMaker and chips as giving it a best-in-class suite of tools at the intersection of cloud and GenAI tools.

- DoorDash, SAP and Workday are building apps on Bedrock.

- Databricks, Eli Lilly and ServiceNow were highlighted as AWS customer wins and expansions.

- Announced a partnership and $2 billion investment with the Australian Government to provide a secure AWS cloud for defense and intelligence.

GenAI Capacity & Hardware:

Just like Alphabet & Meta, Amazon was asked about GenAI infrastructure capacity risks. It seemed to also hint at seeing more risk to under-building vs. over-building, and also told us that AWS doesn’t even have the capacity that it likely needs today despite hefty investments. Demand is strong and costs will have to be incurred to meet that demand. Still, Jassy reminded us that AWS has been doing this for decades. It has highly sophisticated and seasoned models to predict and forecast capacity needs, can quickly react to changes and is obviously in close communication with its customers to gain a direct sense of what they need.

Price performance for high performance compute (HPC) GPUs was an important theme of the call. Amazon continues to work very closely with Nvidia, but thinks version 2 of its Trainium and Inferentia chips will provide this price performance edge. Just like Tesla and others, Amazon is hard at work on closing some of the GPU lead gap that Nvidia currently enjoys. And? It sees demand for these new chipsets early on as “large.” On the general compute CPU front, its Graviton 4 chip offers 30%-40% price performance gains vs. other alternatives (x86 processors).

GenAI Apps:

Q, the AWS GenAI code-writing companion, boasts the highest suggested code acceptance rate among all alternatives. It also outperforms benchmarks in detection of security vulnerabilities and connecting multi-step tasks. Its code transformation tech is also being used internally to save Amazon about $260 million so far in migrating Java app versions. More examples of GenAI apps for internal use and customer selling (most are review):

- Rufus GenAI shopping assistant.

- Virtually trying on an item. Alphabet and Meta are working on this too.

- Automated product listings.

- Detection of product defects in Amazon fulfillment centers.

Advertising:

Sponsored listings continue to make up the bulk of Amazon’s ad revenue. It thinks it has significant room to keep raising ad load here, but sees video ads as maybe its most promising growth opportunity. Feedback on product value that it received at its first “Upfronts” this year, where it showed off tools and capabilities to advertisers, was called encouraging. Amazon sees a great ability to connect its Prime Video product, its marketplace and its targeting algorithms to let businesses turn marketing dollars into direct revenue on the Amazon marketplace. Happy advertisers… and happy Amazon as it gets to sell placements and more 3rd party goods.

Marketplace:

Amazon continues to see consumers increasingly seek out deals and shift to lower-priced items. This seems to be more pronounced internationally, as that’s where the revenue miss this quarter came from (with the miss in excess of incremental foreign exchange headwinds). It's still seeing nice growth in big ticket items relative to its competitors, but growth is “slower than what it would see in a more robust economy.” Revenue growth for its stores business did slow sequentially as a result, but total unit sales growth was stable when adjusting for leap day at 11% Y/Y.

Its seller fees were also lower than it expected due to “behavioral changes seen from its latest fee changes.” Its reduction in apparel fees and discounts for sellers using its inbound facilities were both more popular than it expected. This led to some take rate and overall fee compression, but that’s something it’s entirely willing to accept. More inbound facility usage cuts cost to serve as well as delivery times, and Amazon’s core North American stores business saw Q/Q margin expansion despite these changes. Overall North American margin did decline, but that was related to more investments in new bets like Project Kuiper and also higher stock comp.

- Prime Member shopper frequency and spend increased sequentially.

- Launched its marketplace with same day and next-day delivery in South Africa.

Speed and Cost to Serve:

Amazon unsurprisingly continues to improve delivery time. It has now fulfilled 5 billion units the same or next day for Prime members year-to-date, which is a convincing new record. On cost to serve, its outbound fulfillment regionalization process is largely wrapped-up. From here, it sees regionalizing inbound systems and more fulfillment center robotics can help cut cost to serve further. Finally, it thinks inventory placement algorithm investments will make it better at placing goods closer to consumers, which cuts time and speed of service while allowing it to ship more units per single box. There are many more margin tailwinds to enjoy.

There’s another important positive byproduct of lowering cost to serve. It makes selling lower-priced items actually rational to pursue for Amazon. That could make it an even more formidable player in daily essentials delivery.

More Developments:

- Amazon expects to start shipping satellites for global broadband usage as part of its Project Kuiper. It signed a deal with Vrio in Latin America to distribute the internet to 7 South American countries. It sees this new bet as having a high likelihood of turning into a “very large business.”

- The Pharmacy RxPass program expanded to Prime Members with Medicare.

- Zoox added Austin and Miami to its list of cities where its robotaxis will initially be tested.

f. Take

This wasn’t a great quarter, but I don’t see anything alarming in here for long term investors. It does seem like macro is weighing on its growth, which means lower fixed cost leverage and EBIT generation. That, in combination with leadership not telling us anything about how AWS growth looks so far in Q3, are the sources of disappointment here.

With that said, AWS was strong and actual profit generation in the quarter was well ahead of expectations. That beat wasn’t large enough to offset the EBIT guidance miss, so there will likely be downward profit revisions, but they should be modest.

And at the end of the day, we’re left with a gigantic compounding machine with market share leads in two of the most compelling secular growth stories on the planet. It has much more operating leverage left in the tank, several new bets looking like future successes, the most valuable consumer subscription on the planet (sorry Costco) and as deep of a moat as anyone. Sure, we can pick on this quarter not being excellent like Amazon’s usually are. But in my view, not a single thing about the investment case has changed. I do not think shareholders should be panicking.

To Max subs:

Do not be surprised to see an add here in the near future if the after-hours price action we’re seeing persists. I don’t care that it’s already an outsized position for me.

3. DraftKings (DKNG) — Earnings Review (Minus Tomorrow’s Call)

The call is not until tomorrow morning, but this was a noisy report, so I wanted to squeeze in coverage of the financials, guidance and letter. I’ll cover any additional interesting notes from the call on Saturday.

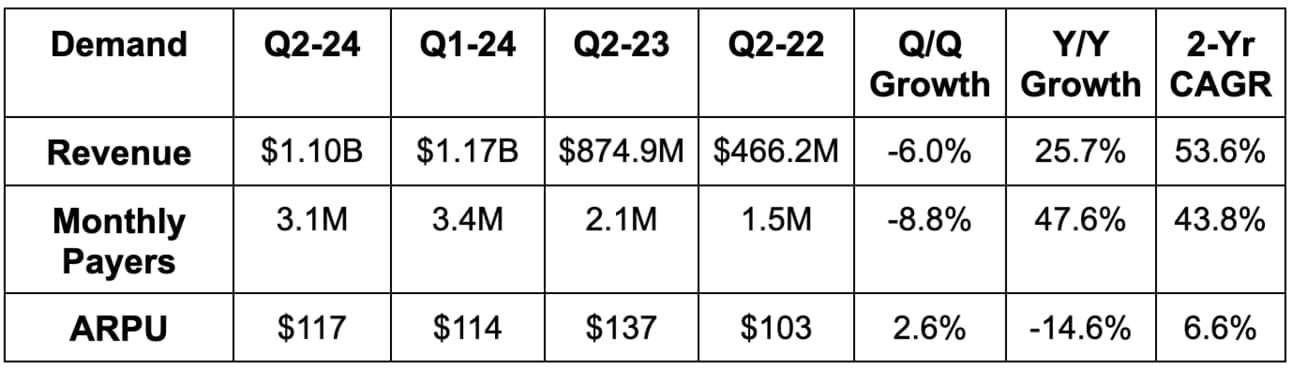

a. Demand

Missed revenue estimate by 1.6%, but beat its 25% Y/Y revenue growth guidance.

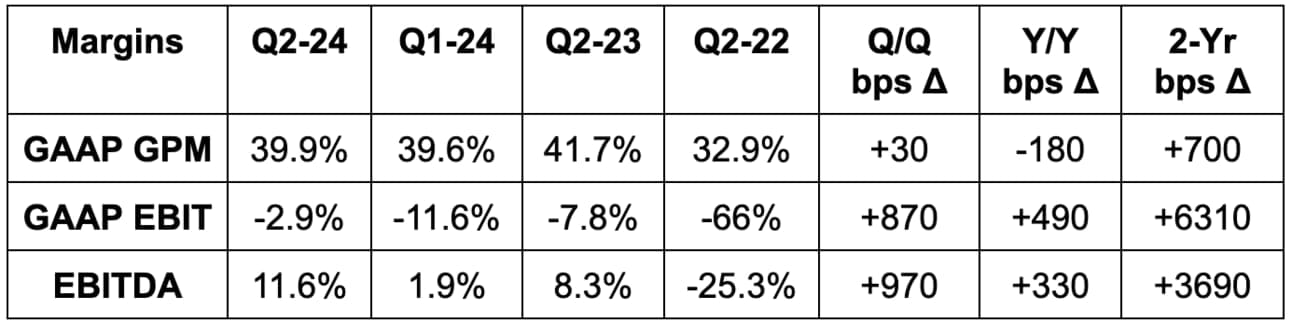

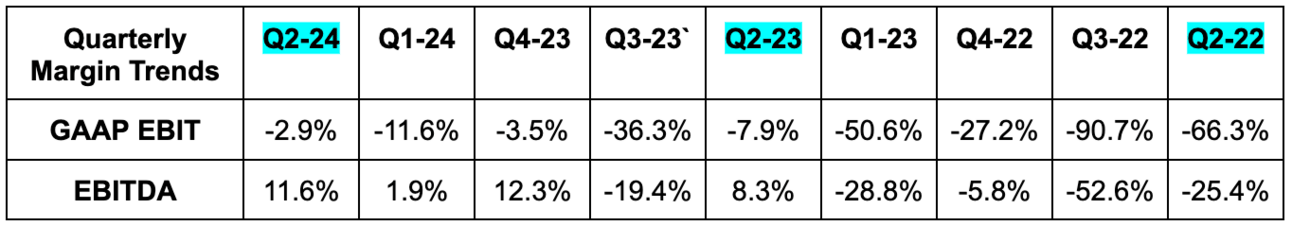

b. Profits & Margins

- Missed EBITDA estimate by 1.5% & missed EBITDA guide by 14.7%.

- Beat $0.19 EPS estimate by $0.03.

- Positive GAAP EPS was via large tax benefits.

- Missed 46% adjusted gross profit margin (GPM) estimates by 300 bps.

c. Balance Sheet

- $815 million in cash & equivalents vs. $1.27 billion 6 months ago as it closed its acquisition of Jackpocket.

- $1.25 billion in convertible notes.

- It has paid out $184 million in stock comp year-to-date vs. $207 million Y/Y. It sees stock comp falling to 7% of sales this year vs. 26% in 2022.

- Announced a $1 billion share repurchase program worth about 7% of its market cap. It told us to take this as a sign of “expectation that we will generate significant free cash flow in the coming years.”

d. Guidance & Valuation with Needed Context

Annual Guidance with a Lot of Needed Context:

Raised revenue guidance by 5.1% to $5.15 billion, which beat estimates by 3.6%. Of the $250 million guidance raise, Jackpocket M&A and a planned Washing D.C. launch only made up $90 million of it. $177 million of it was from “stronger than expected customer acquisition, engagement and retention,” which is the ideal source. DraftKings enjoyed very strong organic growth in new customers and a 40% Y/Y decline in customer acquisition cost. The team sees that persisting through the end of 2024 and into next year. It’s now enjoying a sub 3-year gross profit payback period. So? It has decided to greatly accelerate investments in promotions and marketing. Sales & marketing expenses will rise modestly Y/Y as a result.

This leads us to its updated annual EBITDA guidance, which was slashed from $500 million to $380 million, missing $450 million estimates by 15.6%. Better customer acquisition trends and higher spend will cost DraftKings about $23 million in forgone EBITDA in 2024. Jackpocket and Washington D.C. shave another $35 million from its EBITDA expectations as well. Beyond that, the new Illinois progressive state tax implementation will cost DraftKings another $50 million in EBITDA. That was expected, which is likely why estimates were $50 million lower than DraftKings guidance (which was offered before the Illinois news). Increased spend to secure more customer growth is also why it now sees “modest adjusted GPM expansion” vs. 350 bps of expansion previously.

2025 Guidance:

For 2025, the company reiterated its EBITDA guidance of $950 million. The Illinois tax change materially hurt EBITDA expectations for 2025 vs. its previous guide, but thriving customer trends and some Jackpocket and Washington D.C. help made up for that difference. I found that impressive. Furthermore, DraftKings discussed a change in state tax environment as leading it to implement a “gaming tax surcharge” starting in 2025. This will tax a portion of a customer’s net winnings on successful bets and will be added to all states with tax rates over 20% (4 of them). In Illinois, for example, this will represent a “mid single digit percentage of winnings.” This could make DraftKings less appealing to the most savvy betters out there, but I expect other players to eventually follow suit to adjust to higher tax bills. And furthermore, DraftKings sees this initiative as potentially boosting EBITDA beyond its current $950 million target, which is only possible without a material revenue or market share hit in response to this move. They’re very confident in 2025. It will be highly important for this team to fulfill its promises to build analyst and investor trust in the decades ahead.

Valuation:

DKNG trades for roughly 60x-65× 2024 earnings after some likely downward revisions. EPS is expected to compound at a triple digit clip through 2026. I don’t expect downward 2025 profit revisions given the reiterated EBITDA guide and hints at there being more upside.

Product:

Integration is off to a good start. It is on track to deliver $375 million in revenue and $125 million in EBITDA in fiscal year 2028. Not huge, but an important tool for cross-selling.

- Launched in-house player props for all major professional sports leagues.

- Launched its new risk platform.

- Will add bet & watch for NFL games this year.

- Golden Nugget revenue has accelerated since DKNG completed its migration to the DraftKings platform.

- DraftKings continues to rank very highly in iCasino traction as Eilers & Krejcik ranked it and Golden Nugget #1 and #2 in a recent survey.

Y/Y Market Share Change:

e. Take

This was always going to be a very messy quarter for DraftKings and was actually better than what I was hoping for. The Illinois tax policy change threw a wrench in 2024 estimates and made forecasting a guessing game. This quarter gives us a much better sense of the true impact, with a 2025 EBITDA guidance reiteration something that I find highly encouraging. I do think the new surcharge could hurt market share dynamics in these four states, but if DraftKings feels the need to make these changes, everyone else (including Fanduel) likely will too. And again, the reiterated 2025 EBITDA guidance will rely on lack of material market share and revenue deterioration in those highly populated states, so their confidence in that number is promising to me. This team has been quite consistent in meeting their promises.

Regardless of whether the next few quarters are choppy or not, DraftKings continues to be a dominant market share holder in a sector and geography with a very lengthy runway. It is clearly one of two budding monsters in an online gambling duopoly. The margin inflection is upon us and the growth engine continues to hum. Tax headwind could hold this company back for a short period of time, but I do not think the changes ruin the long term investment case. I need to listen to tomorrow’s call, but I find nothing in this report to be alarming; the overall investment case did not change tonight.