a. Mercado Libre 101

MELI is the e-commerce and logistics king of most of Latin America. It has a thriving marketplace and fulfillment business, with support for 3rd party merchants. It also features a rapidly growing financial services suite and payments platform, entertainment offerings through partnerships, a quickly growing ads business and a multi-tiered loyalty program called MELI+ where it laces product utility into one unique consumer bundle. The business model resembles Amazon without cloud computing and with financial services. Here are the names of its various products:

- E-commerce Marketplace is called Mercado Marketplace.

- Logistics/Shipping is called Mercado Envios. Mercado Envios Full is its full-service logistics business for merchants. It handles all inbound and outbound activity, packaging and returns. It’s similar to Supply Chain by Amazon.

- The financial services business is called Mercado Pago, with its credit business called Mercado Crédito.

- Mercado Shops is its white-label store builder for other merchants to create a site fully integrated into the ecosystem.

- Mercado Play is its entertainment business. It has key partnerships with Disney to fill out the offering.

- Mercado Coin is its stable coin. This can be used to shop on its site with exclusive perks for using it.

b. Key Points & Accounting Housekeeping

- Great quarter.

- Strong momentum in all new product categories.

- Palpable momentum heading into 2025.

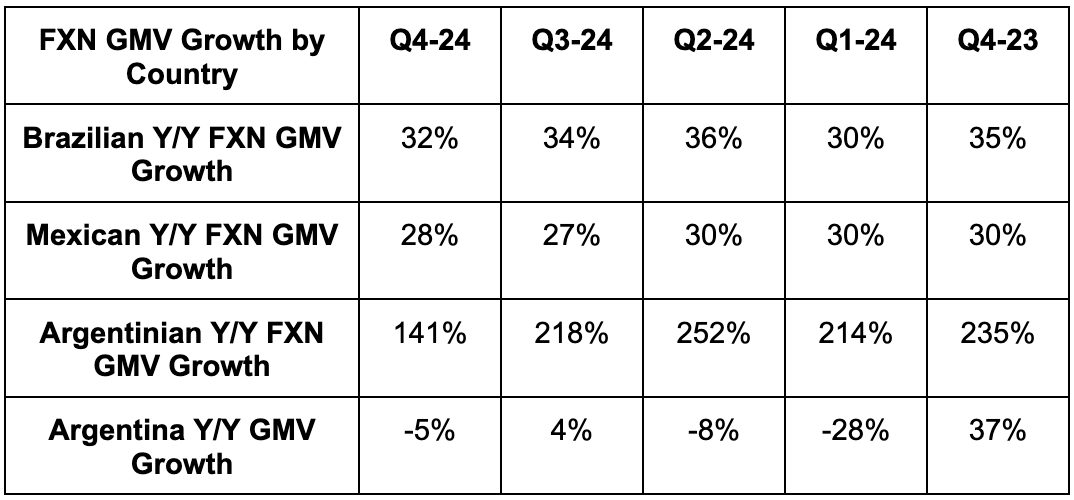

- Excited about brightening macro in Argentina.

Note that Meli made a series of changes to reporting disclosures starting two quarters ago. First, Mercado Pago, the interest income/expense item was moved from below the EBIT line to above it. This will make margin comps slightly tougher through Q1-25. For Mercado Envios, it changed its position from an agent to a principal. This means it now reports gross revenue and treats shipping as an input cost. Previously, it netted shipping costs out of reported revenue. As this increased reported revenue on an apples-to-apples basis, this will boost revenue growth a bit through Q1-25 and dilute margins. Finally, it removed peer-to-peer volume from total payment volume (TPV).

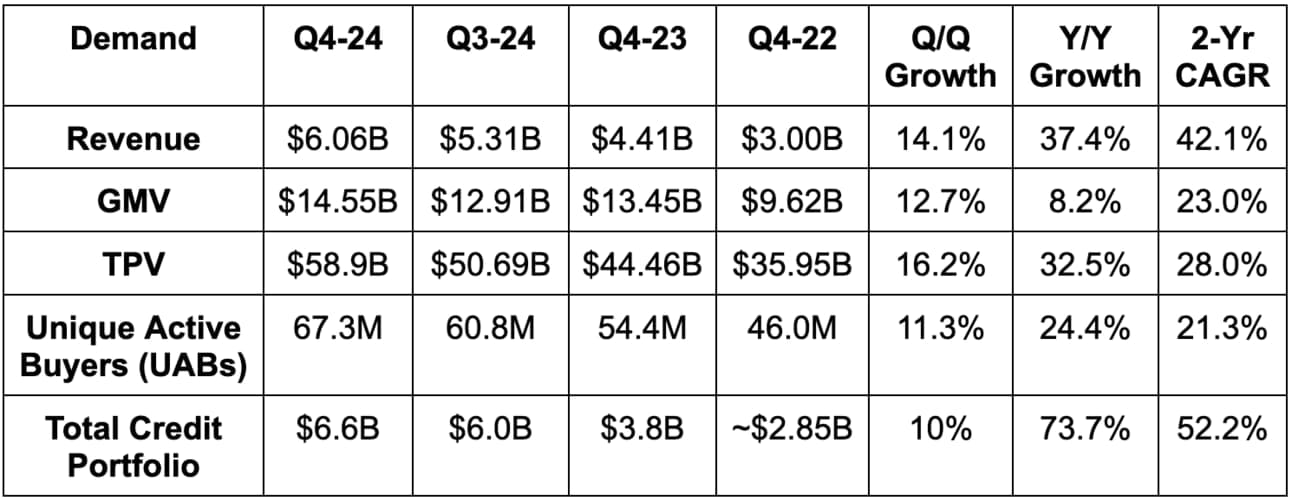

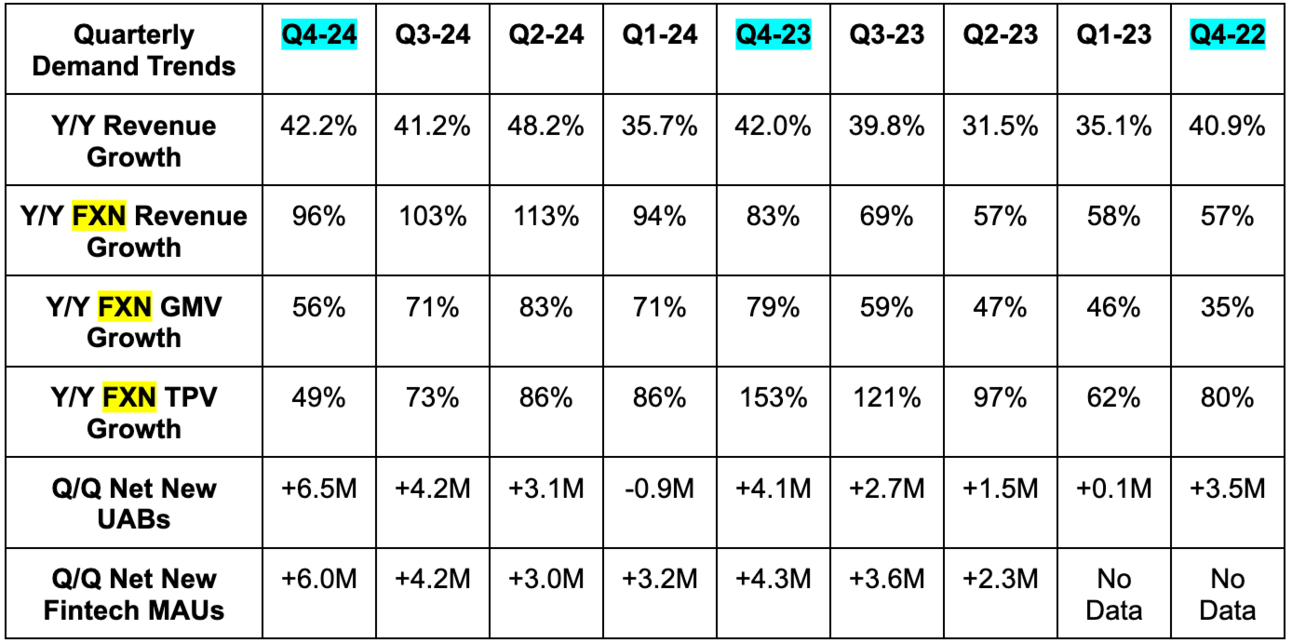

c. Demand

- Missed gross merchandise value (GMV) estimates by 2.9%. Foreign exchange neutral (FXN) GMV growth Beat estimates.

- Mexico and Brazil FXN GMV growth were both 1 point faster than expected. Argentina FXN GMV growth was slower than expected.

- Beat total payment volume (TPV) estimates by 1.0%.

- Beat revenue estimates by 1.5%.

- Excluding accounting changes, Q4 revenue rose by 24% Y/Y and 79% Y/Y FXN.

- Beat 62.6 million unique active buyer estimates by 4.7M or 7.6%.

Demand remains exceptional. Engagement and retention are both at record levels, as items sold per unique buyer rose from 7.5 to 7.8 Q/Q.