Table of Contents

- 1. Starbucks (SBUX) – Earnings Review

- 2. Microsoft (MSFT) — Earnings Review

- 3. Lemonade (LMND) — Earnings Snapshot

My SoFi & PayPal earnings reviews sent today.

1. Starbucks (SBUX) – Earnings Review

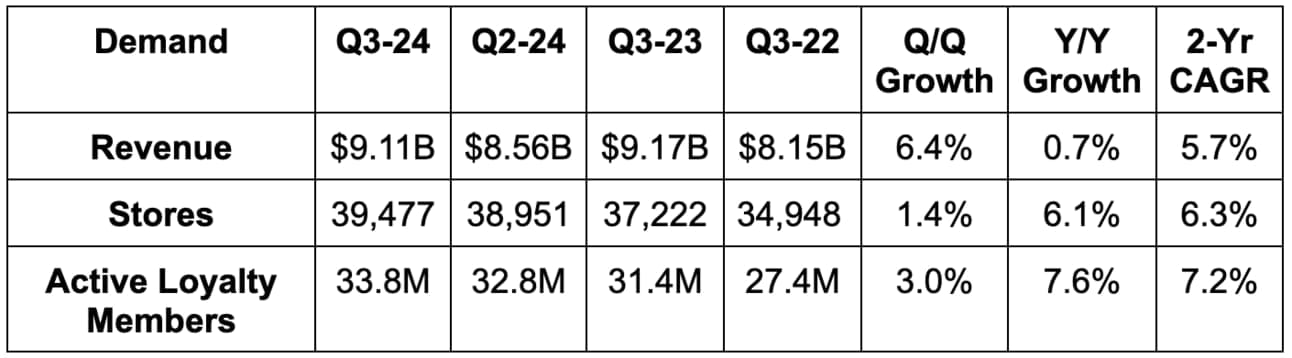

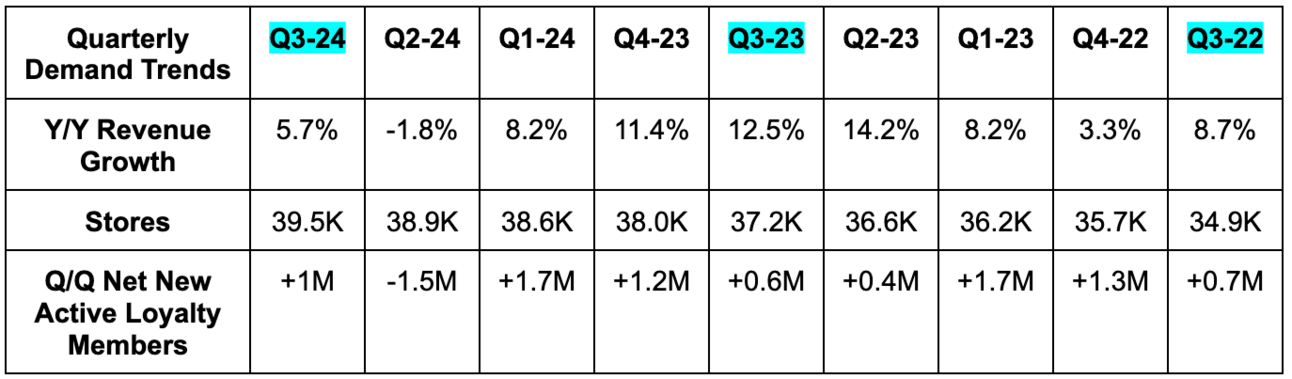

a. Demand

Missed revenue estimates by 1.5%, but met its foreign exchange neutral (FXN) revenue growth guidance. FXN revenue rose 1% Y/Y.

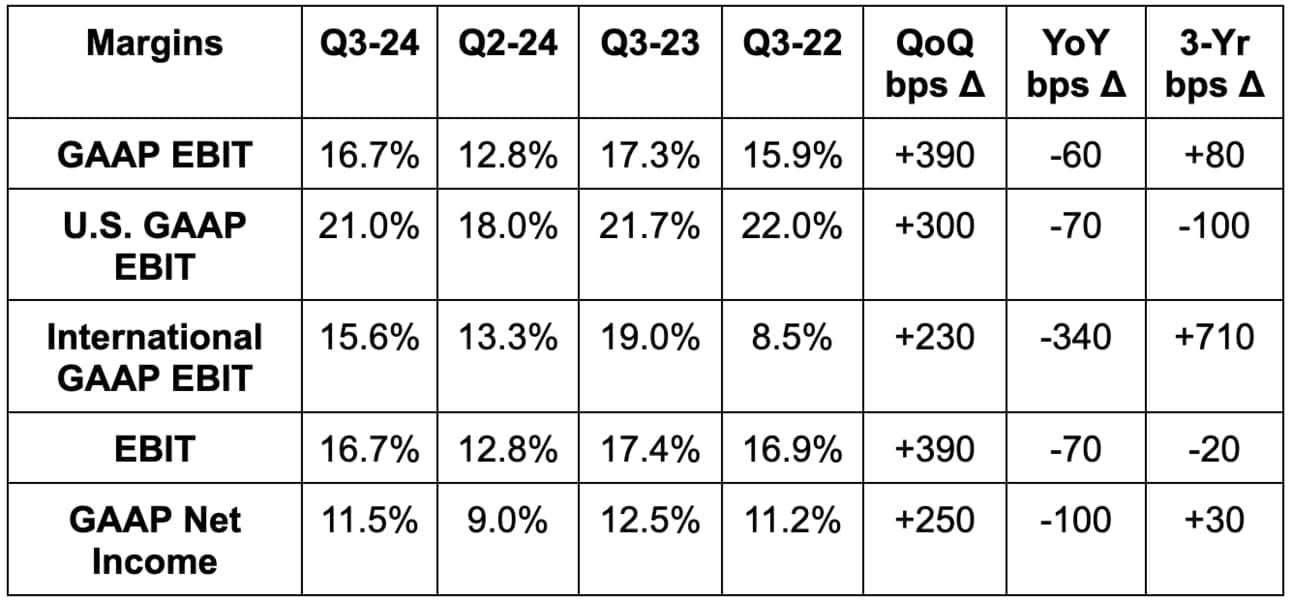

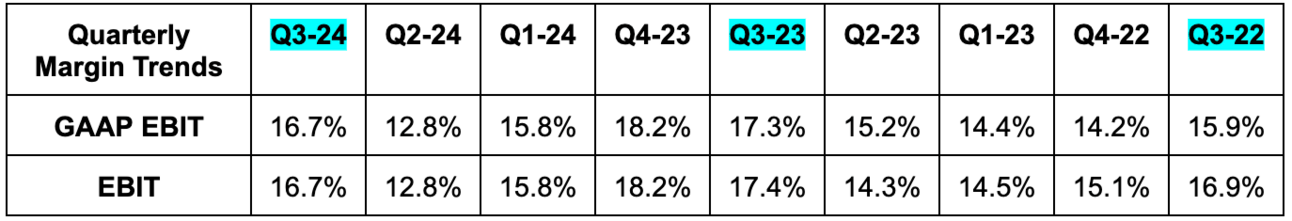

b. Profits & Margins

Slightly beat EBIT estimates and met $0.93 GAAP EPS estimates. EPS fell 6% Y/Y mainly due to higher promotional activity amid a more “cautious consumer.” Operating efficiency gains discussed later helped to offset this.

c. Balance Sheet

- $3.4B in cash & equivalents.

- $700M in investments.

- $15.5B in long term debt.

- Share count fell 1.3% Y/Y.

- Dividends rose 6% Y/Y.

- Continues to target a 50% profit payout ratio and a sub 3x lease adjusted EBITDA leverage target.

d. Guidance & Valuation

Starbucks reiterated the slashed guidance it offered last quarter. This includes low single digit revenue growth, slightly negative to flat global comp sales, 6% store growth and slight EPS growth. These were all aggressively cut last quarter. I get that this isn’t all that impressive, but it will likely bring some stability to tanking estimates – at least for now.

SBUX trades for 20x 2024 earnings. EPS is expected to be flat this year and compound at a 13% clip during the next two year period. Here’s how that compares to its historical norms;

e. Call & Release Highlights

Store Service Issues:

As I’ve written about in detail recently, Starbucks has been struggling mightily with throughput and in-store service in the USA. Leadership told us that if there’s one thing we take from the call, it’s that the upside potential to drive better service and efficiencies in its stores, order flows and supply chain is immense. Starting with throughput, customers are placing orders, waiting too long and canceling before paying. This is wasting labor hours, raw materials and money. There are a few things it’s now doing to address this issue. First, it is implementing phase one of its “Siren Craft System” in all U.S. stores this week. The first part of this (which will be a staged roll-out) includes updated employee and manager training, some minor hardware tweaks and some process improvements at its stores. It also includes an added peak time employee to handle orders, which has been wonderfully impactful for throughput and margins at Chipotle. There’s very little CapEx for phase one and changes have been well-received out of the gates. The next parts of this rollout will feature hardware (like new blenders) and store model updates, which will involve CapEx and will reach 40% of its U.S. locations by the end of next year. It will be very strategic about which stores it chooses first, as 10% of its U.S. locations are customer service outliers that could use this help the most.

This is the main event for diminishing throughput issues, but there are other tailwinds here as well. It will retrofit its espresso machine to boost throughput by 15% with no quality sacrifices. It’s also extending mobile order pay (MOP) to non-loyalty members to cut time to service for that fulfillment avenue as well. It’s getting closer to its partners and helping them more directly with labor allocation, scheduling and more. This has driven down partner churn for the firm, which should mean better continuity and service. The Siren Craft system will be a big help here too by operationalizing this hands-on help.

All in all, these initiatives are expected to cut time to order fulfillment by 10-20 seconds. It has struggled to time this fulfillment time by a couple of seconds over the last few years. There are already small signs of things looking a bit better. Inbound customer service calls about orders taking too long fell 50% Y/Y during the quarter. It also updated app algorithms to improve order ready accuracy rates by 50%. Keep building on that needed progress.

China:

Intense Chinese pricing competition continues. It’s not playing this game, which is why EBIT margin maintenance there has been better than revenue maintenance. It began to see some improvement in weekly sales there during the quarter, but it is in no way out of the weeds here. Encouragingly, its highest value loyalty members continued to grow there. Specifically, it added 1.6 million to reach 22 million while “customer connection scores” set new highs. This sounds similar to a net promoter score (NPS). And while things in China are tough, it is not slowing down store openings in the least. It has ample opportunity to open more stores with sub 2-year payback periods and gaudy year one return on investment figures. It’s committed to continuing to grow in that nation and doesn’t see this temporary weakness as altering its longer term market view. It’s playing the long game there. To date, it’s only in 900 of its potentially planned 3,000 markets there. Despite this optimism, it is toying with the idea of adding more strategic partners to lower overall capital intensity and risk. This is something I would support.

Cost Cutting:

The firm’s cost savings efforts are ahead of schedule, as it thinks it will do better than its $4 billion in net savings over the next 4 years. There are a few sources of these “outperforming” efficiency gains. First, subtle tweaks to stores have yielded a 110 bps improvement to store operating expense intensity. We weren’t told where the gains came from, but the Siren Craft System should certainly build on the progress. It’s also working hard with its supply chain partners to negotiate better deals, without sacrificing quality. This netted another 100 bps in cost savings during the quarter. Finally, it sees G&A falling from 7% of sales to 6% of sales going forward (so another 100 bps of pocketed efficiency gains) as front-loaded store investments have now taken place.

Store Growth:

Somewhat counterintuitively, new Starbucks stores around the globe continue to perform very well – just like in China. For example, a new store in Joplin, Missouri netted a year 1 ROI of 65% with 30% cash flow margins, a sub 2-year payback period and $2 million in average unit volume. It has been highly incremental to overall revenue. Starbucks is going to focus on tier 2 and 3 cities like this one, where it feels the opportunity is most untapped.

Fixing Tired Product Assortment:

- Its Summer-Berry Refresher debut drove the “highest week one product launch in its history.” It was highly supply-constrained here to a point of cutting back marketing activity.

- Its new line of sugar-free energy drinks is off to a good start.

- Pumpkin Spice is poised for a Q4 return.

- Its Milano Duetto brew will launch this year and its updated iced coffee is receiving “positive feedback.”

- The CrowdStrike issue may hurt SBUX a tad next quarter as airports & hotels were two of its fastest growing segments during the quarter.

Marketing & Loyalty Push:

There are two pieces of the SBUX traffic story – loyalty and non-loyalty members. Loyalty represents 60% of revenue and is seeing healthy frequency growth. Non-loyalty is the remaining 40% and is seeing material frequency declines. Starbucks hasn’t let non-members use MOP until now, despite 25% of non-loyalty members wanting that implemented. It has finally made that change and expects to see positive traffic impacts, which should build on 7% Y/Y MOP transaction growth this quarter.

Loyalty members spend more than non-members and SBUX is most confident in its ability to convey promotional messaging via that app. And they’re right, promotional activity within the app carries better targeting levels and superior returns for the firm vs. any other channel. And there’s a ton more to do here, with just 14% of its transactions coming from promotions vs. 29% for the average competitor. It can boost that 14% while also collecting higher store revenues, as the campaigns have shown to uplift incidence rates for menu add-ons.

So? This is a large focus area for the firm. It’s determined to drive loyalty growth through MOP openings and better execution going forward.