Table of Contents

- 1. Shopify (SHOP) – CFO Interview with Goldman

- 2. Celsius (CELH) — Brand New Data & Quick Thought …

- 3. Starbucks (SBUX) – Brian Niccol Letter & Update …

- 4. Airbnb (ABNB) — CFO Interview with Goldman Sach …

- 5. MercadoLibre (MELI) — CFO Interview with Goldma …

- 6. Nvidia (NVDA) — Founder/CEO Jensen Huang Interv …

The Goldman conference is always busy. I’ve already sent coverage of the PayPal, Amazon and SoFI interviews. I plan to cover several more for Saturday. There are 15 left that I’d like to get to (Alphabet, Cloudflare, Visa etc.), along with Oracle and Adobe earnings and the rest of this week’s news. Realistically, some of the 13 will be pushed to next week.

1. Shopify (SHOP) – CFO Interview with Goldman

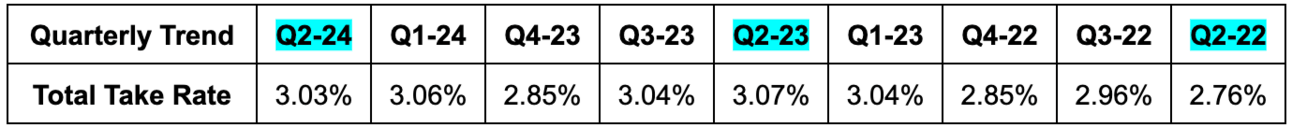

Take Rates:

Shopify has consistently grown its take rate for the last few years through the successful introduction of more merchant solutions. These solutions (payments, cross-border, marketing, credit, tax etc.) round out the Shopify product suite to ensure customers have everything they need in one place. It then partners with important industry players (like Amazon on fulfillment) to plug any remaining product gaps.

The two largest opportunities for Shopify to grow attach rate from here are in global expansion and large enterprise adoption. For its more established small and medium business (SMB) segment, there is still plenty of room for take rate gains, just not quite as much.

Shopify’s aggressive enterprise push, with Shopify Plus upgrades, Commerce Components by Shopify (CCS) and headless (back and front end separation), is really only two years in. Sales cycles take about 9 months and onboarding cycles take another 9 months. Shopify’s new clients usually start with fewer products and add more from there. All of this means the growth contribution from larger enterprises should begin to ramp starting now. Very early here. On the international side, take rate gains will be driven by debuting more of its products in more geographies. Most of its current markets do not have the full suite available. Getting closer to that point will naturally propel take rate higher.

These two items, as well as future inevitable product launches, bode well for 3.03% being a positive step in a longer, beneficial journey. Why does this matter? It means revenue growth can continue to lead volume growth in the years ahead as its overall opportunity continues to mature; Shopify can extract more financial value from the existing business. Furthermore, considering take rate is tightly related to pace of cross-selling, as take rate rises, Shopify’s margin ceiling does too. It costs far more for it to onboard its first product with a new merchant than any incremental product thereafter.

System Integrator (SI) Allies:

Large companies generally work with SIs like Accenture and EY when embarking on large overhauls of their technology stacks. Shopify hadn’t done much with SIs for years. It relied on word-of-mouth and perhaps was a bit too proud to embrace this channel. That has since completely changed. SIs are now an instrumental part of its growth engine and a vital cog in its ability to grow awareness and purchase consideration as the largest companies in the world select vendors.

During the interview, Hoffmeister told us that when Shopify started its 2022 enterprise push, “the pace at which basically all big SIs pivoted to it was really impressive.” It works with all of these big players, with one having 2x the number of its own employees trained on Shopify than Shopify has on its own. These SIs, based on the data Hoffmeister continues to observe, are advocating for Shopify’s suite as the best tech platform out there.

Approach to AI:

Shopify is not currently interested in monetizing AI as a separate, standalone package. Instead, the company is fixated on ingraining AI as deeply into its current suite as possible.

This is generally the approach the company takes to new product offerings like Managed Markets (for cross-border) and others. It takes its time in driving product-market fit and value creation. Then and only then does it monetize via more merchant solutions or subscription price hikes. AI is following the same pattern for Shopify. For now, the value creation focus is on nudging merchants to best course of action for various tasks. It’s also about using world-class models to automate marketing content creation, customer service, custom pricing, web design and so much more. Shopify’s AI suite (called Shopify Magic) is not meant to run a business for a merchant. It’s meant to offer data-driven ideas on how to optimize every aspect of their business.

Macro:

Shopify’s macro view has not changed since the Q2 earnings call. It’s not seeing consumer spending or the overall environment improve or worsen. Its continued financial outperformance is not a byproduct of an easier backdrop, but structural market share gains. Its product suite, go-to-market, geographic diversity and team are all facilitating relative resilience vs. everyone else in its space. More of the same for Shopify.

Marketing Changes:

Shopify has gotten significantly more intentional, sophisticated and precise with marketing since Hoffmeister took over two years ago. It now can track key performance indicators (KPIs) in real-time to lean into or away from channels as performance evolves on a daily basis. That has unlocked significantly more opportunities to invest in high-return marketing channels and has made Shopify more efficient from a lifetime value to customer acquisition cost (CAC) perspective. This is a testament to the systems that Shopify created to support this capability, and is broadly expected to lead to accelerating merchant gains in 2024, with revenue contributions ramping in 2025.

Hoffmeister also said he’s seeing the pattern of adding more merchants continue, partially thanks to better marketing. This points to last quarter’s fantastic new merchant result not being a one-off event. That’s especially important and positive considering its decision to shorten free trials during Q2 propped up new merchant adds for that period.

This improved tech does mean Shopify will invest more than expected in marketing if returns warrant that decision from time to time. Still, there’s a reason why it guides to OpEx as a % of revenue (as Hoffmeister said). That’s Shopify communicating its commitment to ensure it maintains spend discipline.

2. Celsius (CELH) — Brand New Data & Quick Thoughts

According to new Nielsen data, Celsius saw 30% volume growth and a 19% price cut through the month ending August 24th. That’s its best result since mid-July on volume. On pricing, Celsius leadership has consistently spoken about more promotional programs and bundling as of late to drive market share growth. It does have some control over that even though it distributes through Pepsi. Still, while some declines are unsurprising, the degree of decline was somewhat notable.

This data doesn’t change much for me in terms of my thoughts on the investment. To avoid repeating myself, those thoughts can be found here.

3. Starbucks (SBUX) – Brian Niccol Letter & Updated Thoughts on the Investment

New CEO Brian Niccol penned a letter to investors describing his priorities and vision for Starbucks. After several weeks of touring stores and chatting with team members, he sees what we all see: a beloved brand that isn’t executing. In his words, he called this “drifting from its core.” To address the company’s issues, he is implementing a “Back to Starbucks” campaign. Chipotle investors are probably laughing at that name. Niccol, who comes from Starbucks, is known very positively for his back to basics Chipotle campaign that proved so successful over the years. He flawlessly executed there and seems to be determined to run a similar playbook with this coffee giant.

There are 4 priorities that make up this playbook. First, Starbucks aims to “empower baristas to take care of customers. That means giving them the “tools and time to craft great drinks.” Part of this will be via motivating employees with better career opportunities to drive higher employee retention and effort. This sounds like him addressing both the throughput and product consistency issues that Starbucks deals with. Along the same fixing product consistency lines, the second item is getting “every morning right.” This means consistently high-quality goods in an acceptable amount of time.

Thirdly, it will invest in its stores to “re-establish Starbucks as the Community Coffeehouse.” The in-store experience has significantly worsened in some parts of the U.S., and Niccol wants to fix that. Part of this will be better organization of to-go and for-here lines to cut wait times. Finally, it wants to “tell the Starbucks story.” This is likely his aim to repair brand damage across parts of the world while reigniting growth in China, although the initial focus for all of this work will be in the U.S.

To fix all that is broken, there are more investments in technology, its supply chain and its mobile ordering platform coming.

Since starting the position in the high 70s in June and sending out the investment case, the stock has performed well on nothing other than excitement surrounding Niccol. Despite this price appreciation being hype-based, I actually think the hype is warranted. That’s why I haven’t trimmed into the recent multiple expansion. Niccol is a world-class CEO joining a world-class brand is in desperate need of… well… a world-class CEO. The same issues that he fixed at Chipotle are the issues needing fixing at Starbucks. I like the setup.

4. Airbnb (ABNB) — CFO Interview with Goldman Sachs

Re-Focusing on Expanding Beyond the Core Product Offering:

When Airbnb IPOed nearly 4 years ago, its S1 featured an “experiences” business segment showing how the firm could “expand beyond the core” offering. At the time, the segment was already 4 years old and was a very small piece of the overall business. That was in 2020. With its experiences business now being 8 years old, the same is still true. This is partially related to still searching for product-market fit and also focusing away from this segment during the pandemic to ensure its core business was in great shape.

During the interview, Airbnb CFO Ellie Mertz told investors that its next two product release events will feature “real movement towards offering more services and products to deliver incremental revenue growth streams in the years to come.” Airbnb is gearing up to finally lean back into this segment. It thinks it has made great progress in tweaking its product suite here to drive real traction and incremental volume.

It’s frustrating that this has taken 8 years to be potentially ready for meaningful, sustainable go-to-market… but it’s also exciting. As leadership will frequently tell you, Airbnb has built a massive book of business with only one product. Its massive base of existing customers is ripe for cross-selling other services; the company is ready to try taking its piece of that opportunity once more.

Examples of Potential New Products:

The most intuitive area for core product expansion is offering more booking services for other parts of the travel experience. This could mean more direct help with transportation, restaurant reservations, suggesting local experiences, etc. It has done some things in this area, like a partnership with Resy for in-app reservations, but it hasn’t been a focus.

According to Mertz, Airbnb’s small presence here over the years has been deeply valuable. Airbnb has gained significant data, insight and experience, which makes efforts here thus far anything but time wasted. They now know that hosts need more help and guidance on which services to offer and how to offer them. The team also learned that any ancillary bookings business needs to be more thoughtful about timing up customer promotions and nudges. These will be big parts of the incoming, re-vamped experiences offering.

“How do we get in front of the consumer at the right time? How do we have the right product experience so that we can easily encourage you to attach [more services] to an existing sale that you're probably not booking at the same time? And so that really informs the product strategy of how we, in the future, go about expanding that product to scale.”

CFO Ellie Mertz