Table of Contents

1. Taiwan Semi (TSM) Earnings Review

a. Taiwan Semi 101

Taiwan Semi builds chipsets for other companies like Nvidia, AMD and Qualcomm. It does so in its highly expensive, highly complex chip fabrication plants. These are called “fabs” for short and represent what I view as one of the deepest competitive moats on the planet.

Needed Definitions:

- Fab means a factory.

- Nanometer (NM) describes the chip technology. Smaller NM is more advanced, as it uses smaller transistors. This means TSM can pack more transistors into a single chip while making those chips more energy efficient and cost-effective.

- “Advanced Technology” revenue is revenue from 3nm (N3), N5 & N7 technology. Anything under N7 is “advanced.”

- A16 means 1.6 nanometers, not 16.

- Wafer refers to the raw materials (like silicon) that are used to manufacture chips. These materials are used to build integrated circuits (ICs). Transistors within these ICs guide and facilitate functions.

- Nvidia’s Blackwell and Hopper chips are considered ICs.

- Traditional foundry services entail the actual creation of a chip on a silicon wafer and testing these products. Packaging involves storing, integrating and prepping chip components with thermal protection, connectivity equipment and encapsulation (physical damage protection).

- Lithography is the process of using thin layers of glass to etch or print chip patterns onto wafers.

- A light-sensitive material is added to wafers.“

- Masks” (basically a chip-making stencil) are placed on top of the wafers to guide where light and chemicals (used to manipulate wafers) etch desired patterns.

- Chip-on-wafer-on-substrate (CoWoS) is a packaging process that combines chips into a single unit. It allows chips to be vertically stacked and connected to improve speed and performance.

- AI accelerators, as the name indicates, accelerate high-performance compute (HPC) workloads in the realm of AI. GPUs are a type of AI accelerator, along with Application Specific Integrated Circuit (ASICs or custom chips for specific use cases), Google’s Tensor Processing Units (TPUs; for machine learning). Some don’t include high-bandwidth memory (HBM) in this category, as HBM is for memory rather than things like data processing. TSM does include this. HBM facilitates ultra-low latency, high-bandwidth support for querying and data processing tasks. It’s a vital piece of GPU platforms like Blackwell working with needed scale, inference capabilities and latency.

b. Key Points

- Fine quarter, strong Q2 guide and fine full-year guidance.

- Global construction plans are all on (or ahead of) schedule.

- No material impact to the business from tariffs. They’re watching closely. Nothing yet.

- Reiterated multi-year forecasts.

c. Demand

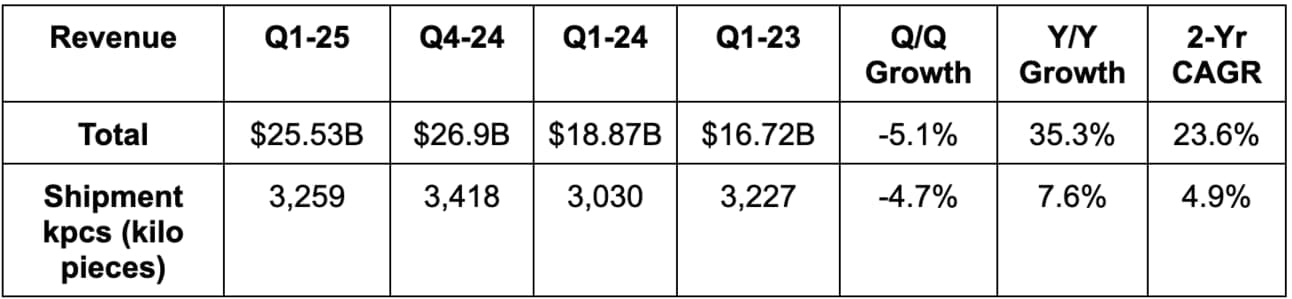

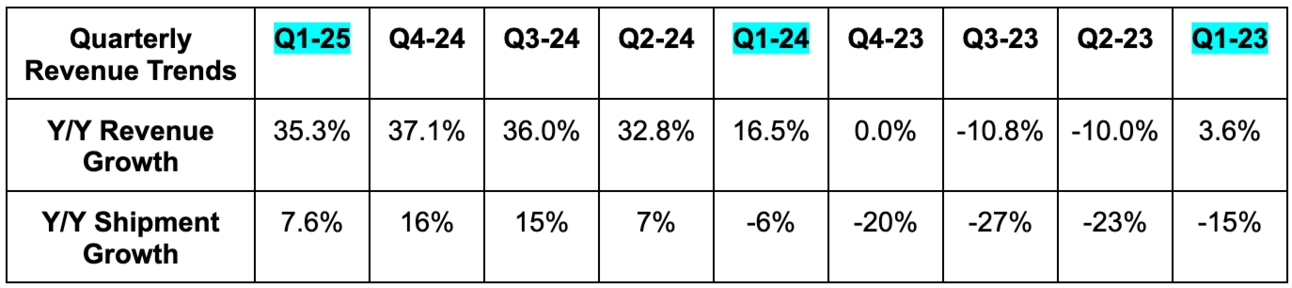

Taiwan Semi missed revenue estimates by 0.7% but beat its revenue guidance by 0.5%. Its 23.6% 2-year revenue compounded annual growth rate (CAGR) accelerated compared to 13.1% last quarter and 18.0% 2 quarters ago.

d. Profits & Margins

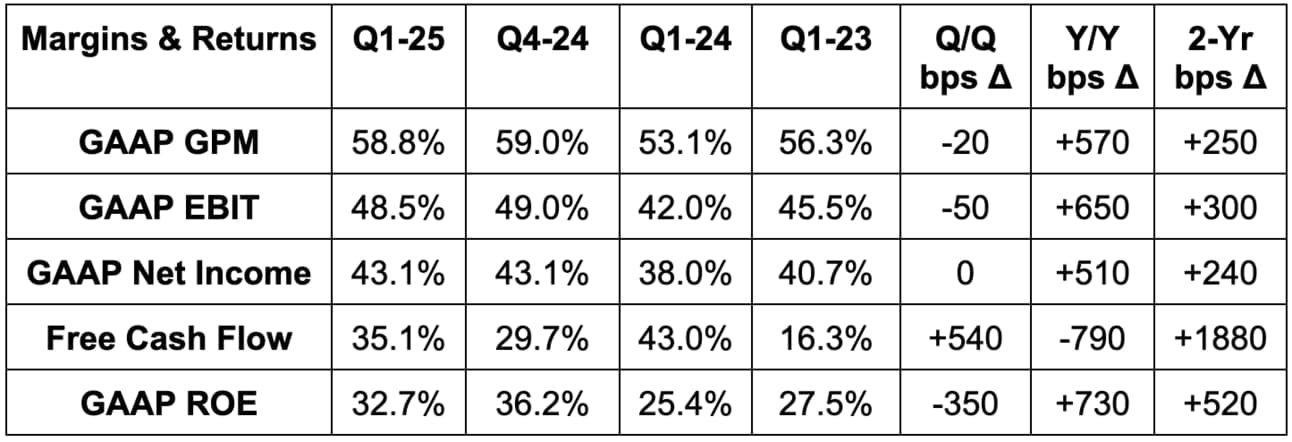

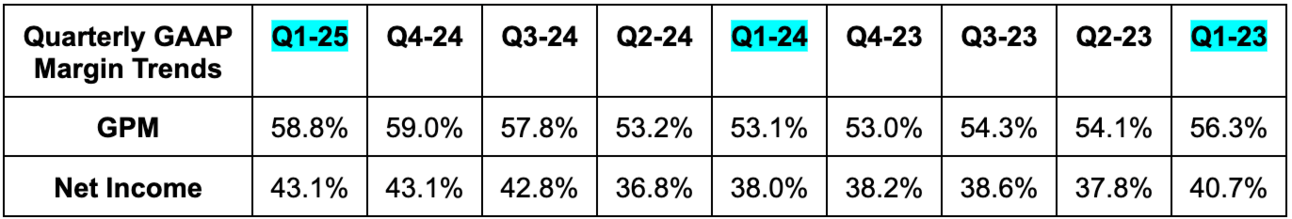

- Beat 58.1% GPM estimates by 70 basis points (bps; 1 basis point = 0.01%) & beat guidance by 80 bps.

- Beat EBIT estimates by 0.7% & beat guidance by 2.6%.

- Beat $2.06 EPS estimates by $0.06.

On gross margin, there were a few puts and takes to discuss. The ramping of its production in Japan and Arizona is dilutive to margins. It takes time for new facilities to reach the level of scale and maturity seen at its Taiwan facilities. Its supply chain in Taiwan is extremely advanced and efficient, which means margins there are better. Still, despite the absolute hit to margins from international expansion, it expects its margin profile to be best-in-class anywhere it operates. Meaning? The relative cost advantage it enjoys vs. the field will remain intact.

There was also an unplanned gross margin headwind during the quarter. Earthquakes in Taiwan led to significant production disruption and some wafer materials in process had to be discarded altogether. Still, through excellent execution (what else is new), the company was able to minimize the headache and quickly recover lost production levels. This allowed it to beat the midpoint of its revenue guidance. And it still beat its gross margin guidance by 80 bps despite this 60 bps headwind.

e. Balance Sheet

- $81B in cash & equivalents.

- $8.84B inventory.

- $4.8B long term investments.

- $30B in bonds payable.

- Share count is flat Y/Y.

“We remain committed to a sustainable and steadily increasing cash dividend per share on both an annual and quarterly basis.”

CFO Wendell Huang