To view my current portfolio, click here.

1. SoFi Technologies (SOFI) -- Student Loans

The Biden Administration offered some long-needed clarification on the student loan pay pause and possible forgiveness. I have no interest in commenting on the political viability of this move -- I solely care about how it affects SoFi. And in this case, the decision seems quite positive for the company.

The President announced that he would extend the payment pause one final time through the end of 2022. Furthermore, he declared that certain borrowers would be eligible for $10,000 in loan forgiveness (up to $20,000 for Pell Grant recipients) if their total income is below $125,000. How could that possibly be good news for a student loan originator like SoFI? Great question.

First, SoFi’s 2022 guidance assumes the moratorium will be in place through 2022 -- so the extension will not impact its 2022 forecasts negatively. Furthermore, SoFi’s average student loan balance is around $70,000, meaning eligible borrowers will only see a maximum of 28% forgiveness on their debt. The remaining payments will still be due to restart in 2023.

There has also been a quite large cohort of borrowers waiting to refinance loans until they knew if their debt would be forgiven entirely. Why refinance if you won’t owe the principal anyway? Now that these borrowers know the extent of the loan forgiveness & payment pause, they’ll be more motivated to refinance loans now. And with rates expected to continue rising throughout 2022, the urgency to refinance debt should be even more pressing for consumers.

Finally, SoFi’s average student loan borrower has an average income of more than 30% over the forgiveness cut-off. According the CEO Anthony Noto this week, the vast majority of its borrowers are not eligible for ANY forgiveness and virtually 0 are eligible for Pell Grant-level forgiveness.

After years of confusion, this moratorium seems to finally be resolved with a finite end in view. Considering student loans were SoFi’s largest and most profitable segment heading into the pause, I’m excited to see what results look like with it turned back on. Margins are already rapidly expanding and growth is already brisk without this large segment in full swing. Student loans will merely add gasoline to the momentum fire.

SoFi saw its student volume rapidly ramp into the last moratorium expiration until it was pushed out further. I expect that ramping to once again occur in a more sustainable and long-lasting manner this time around.

2. The Trade Desk (TTD) -- UID2 & Big Ten Football

a) Unified ID 2.0 (UID2)

Another demand side platform (DSP) -- MediaMath -- announced support for UID2. UID2 -- as a reminder -- is the open internet identifier that The Trade Desk built (but does not own) to replace and augment third party cookies across more channels. It’s good to see the demand side (direct TTD competition) leaning in and embracing this new open internet identifier. To me, it shows that The Trade Desk effectively removed potential conflicts of interest via vesting ownership of UID2. This allowed it to more seamlessly build adoption scale -- and it will still be a prime financial beneficiary. CEO Jeff Green is playing chess while the rest of the industry plays checkers.

“As the industry continues to innovate and work towards an alternative to the deprecation of third-party cookies, we believe it is vital that we partner with our peers and clients to enable their choice of scalable, privacy-conscious identity solutions.” -- MediaMath Chief Partnerships Officer Sylvain Le Borgne

b) Big Ten

The Big Ten Conference’s latest media deal includes a larger array of rights to Big Ten Football games for streaming platforms like Peacock. With live sports representing roughly 90% of the most watched shows in the United States, football dominating American culture and The Trade Desk being the largest demand side player in streaming, this is yet another material tailwind for the already thriving firm.

Click here for my TTD Deep Dive.

3. Duolingo (DUOL) -- Duocon 2022

a) Duocon

Notes from Senior Software Engineer Ananya Rajgarhia:

Rajgarhia went into more detail on the magic behind the newly formed home screen. As a reminder, this is the result of extensive split testing born from its leading market share. The main idea of the new screen is to create a more linear path to leaning. It consolidated features from across the app into this home screen to concoct a more centralized dashboard of progress. The path is constructed -- as always -- to maximize learning efficacy and efficiency. It features things like “spaced repetition” to intelligently source practice content needed by an individual (through its Bird Brain Algorithm) to achieve these objectives. Repetitions become increasingly difficult and also less frequent as a learner gets more comfortable. Other new tools from this upgrade include a guidebook with key grammar tips and concept explanations.

Notes from Duolingo ABC’s General Manager Daniel Falabella:

Falabella elaborated on the structure of Duolingo ABC’s (its Children’s Literacy App). Like Duolingo’s other apps, the company fixated on “not creating a product that felt like taking medicine to a kid.” It wanted it to be fun, playful and -- as always -- effective. Considering a 2nd grader’s reading proficiency is directly correlated with long term quality of life, this is an important product extension to say the least… and it seems to be working.

Duolingo funded a 3rd party study of 105 children and their caregivers. The sample size was admittedly a bit small. Still, the students used Duolingo ABC’s for 9 weeks and saw a 28% boost to their literacy scores. Children also demonstrated a materially stronger motivation to learn. Mission accomplished.

Today, the app is entirely free to use and doesn’t feature advertisements. Duolingo takes its time with product monetization and this one is still too early-stage to extract revenue from. It will monetize eventually.

Notes from Duolingo Math Engineering Lead Sammi Siegel:

Why is Duolingo expanding into math? Similarly to literacy, income and health over the long term are strongly correlated to basic math skills.

This launch will come with the same guiding principal as the rest of Duolingo -- to enhance access to areas of education mattering the most. And with 50% of high schoolers reporting math-related anxiety, this ambition is quite relevant.

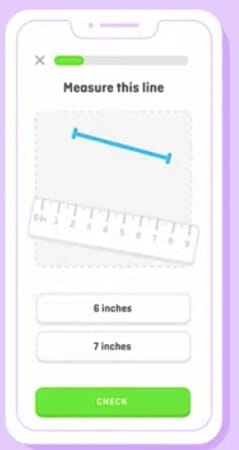

Duolingo’s Math App is now beta testing with select students. It offers immersive features like drag and rotate rulers to emulate the hands-on nature of in-person learning. All lessons are randomized so numbers are ALWAYS different and students can always practice with fresh material. The app comes with the same gamification ambitions as the language learning product and is mainly for children -- although it has a brain training function for adults as well. The official app launch will come later this year and the company will, again, take its time with monetization. This will not be a revenue contributor in 2023.

Notes from Co-Founder/CEO Luis von Ahn:

Duolingo recently partnered with the United Nations High Commissioner for Refugees. With just 3% of refugees going to college, Duolingo is fixated on enhancing access for this cohort of individuals. It’s waiving Duolingo English Test fees for these students AND hiring college counselors to consult on the best institutions for them.

In other news, Duolingo launched Cantonese for Mandarin Speakers and English for Bengali Speakers.

b) DET Milestone

Duolingo English Test crossed 4,000 institutions accepting it this past week. That makes it far and away the leader in digital english proficiency exams. And that lead is only growing with its acceptance by all 25 of the highest volume universities in the World. The test is far more convenient for prospective students across the globe vs. driving often several hours to take a test within a strict time slot. It’s also far cheaper than alternatives. Traction and success here is both encouraging and makes a lot of sense. This business is about 9% of total company sales and rising steadily. It now has its sights set on government organizations and has found some early success in Ireland.

Click here for my Duolingo Deep Dive.

4. Penn Entertainment (PENN) -- Rationalization… Finally

Finally, sports gambling app competition is pulling back on ridiculous promotional spend for market share. According to an article in the Wall Street Journal, both DraftKings and FanDuel are making this move to meet more pressing profitability targets. Growth at any cost is no longer in vogue with our tightening macro climate -- cash flow is.

To me, this is when Penn Entertainment and Barstool should start to dominate the industry and make meaningful incremental market share gains. Its Barstool brand has shown a unique ability -- thanks to its passionate 70 million+ cross-platform user base -- to rack up respectable 10%+ share while real rates were negative, cash was free and competitors spent like drunken pirates on promotions. That ability manifested in Barstool’s revenue market share in key states far outpacing its bet (also called handle) share. This was because more of its revenue came from genuine demand vs. free bets. It also manifested in Barstool Sportsbook being the closest among its peers to positive EBITDA. That is the impact of its brand power amid a sea of irrational spend.

Well, that irrational competitor spend is now winding down -- and right before Barstool’s bread & butter football season. That leaves branding within a commoditized space absolutely imperative -- and Barstool delivers that strength. It’s also nice that when it does spend on costly external marketing and promotion, it can do so by tapping into Penn’s $1.7 billion in cash and equivalents and its deeply profitable regional casino business.

Barstool… it’s time to shine.

5. PayPal (PYPL) -- Coinbase & Grants

a) Coinbase

PayPal became a member of the Coinbase Travel Rule Universal Solution Technology (TRUST) network to conjoin efforts on regulatory compliance within crypto. The network is looking to become an industry standard for best in class legal practices within the still nascent space. Other members include Gemini and Robinhood.