Table of Contents

- 1. ServiceNow (NOW) – Earnings Review

- 2. Spotify (SPOT) – Earnings Review

- 3. Visa (V) – Earnings Review

- 4. Portfolio Earnings Preview for Next Week – Amaz …

- 5. Earnings Round-Up – Enphase (ENPH); Chipotle (C …

- a. Enphase

- 6. Meta Platforms (META) — Follow Up Call

- 7. Amazon (AMZN) – Affordable Grocery Subscription …

- 8. Snowflake (SNOW) – Innovation?

- 9. The Trade Desk (TTD) — Retail Media Partner

- 10. Shopify (SHOP) — Bullish Analyst Note

- 10. Macro

- 10. My Portfolio

Busy week! In case you missed it, below you can find detailed Tesla, Meta, Alphabet and Microsoft earnings reviews.

1. ServiceNow (NOW) – Earnings Review

ServiceNow is one of the largest enterprise software firms in the world. It automates workflows, tech stacks and projects to augment customer efficiency. For this reason, it calls itself the “leading digital workflow company.” Workflow automation buckets include: service management, operations, asset management, security, customer management, employee management and creator management. These are further grouped into workflow buckets like “customer workflows” and “creative workflows.”

- Key acronyms here include Information Technology Operations Management (ITOM) and Information Technology Service Management (ITSM).

All products and services are neatly tied into its “Now Platform.” To bolster automation capabilities, ServiceNow has been hard at work on GenAI innovation. Its Vancouver Platform release got the ball rolling by consolidating all model and app work into an intuitive set of products. It recently built on that debut with a “Washington D.C. Platform” release this year (more on this later) These platforms are a foundation for its GenAI apps and a key example of these apps is “Now Assist AI.” This is ServiceNow’s GenAI assistant/companion being infused across most of its products. “Plus SKUs” are how ServiceNow bundles all of its GenAI work into subscription packages. It upcharges clients for access to these SKUs as its approach to GenAI monetization has been more aggressive than most others. These Plus SKUs do things like automate customer service, expedite issue resolution, guide workflows and provide more conversational fetching/querying of a firm’s data.

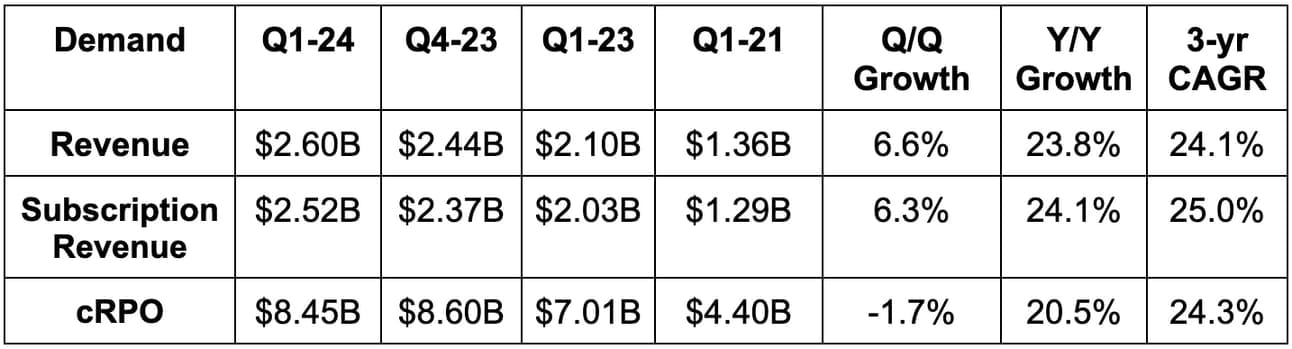

a. Demand

- Met subscription revenue guidance. Its 24.1% 3-year revenue CAGR compares to 25.0% Q/Q and 25.8% 2 quarters ago.

- Secured 8 deals worth $5 million or more in average contract value (ACV) vs. 4 deals Y/Y.

- Slightly beat revenue estimates.

- Beat 20% Y/Y current remaining performance obligation (cRPO) estimates. cRPO is a key leading indicator for demand.

- Gross revenue retention (GRR) remained at a strong 98%.

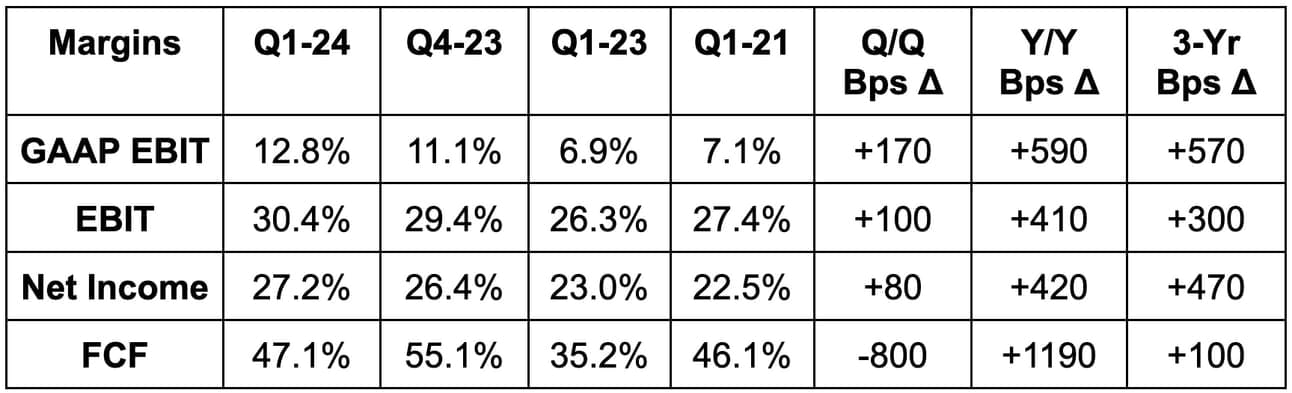

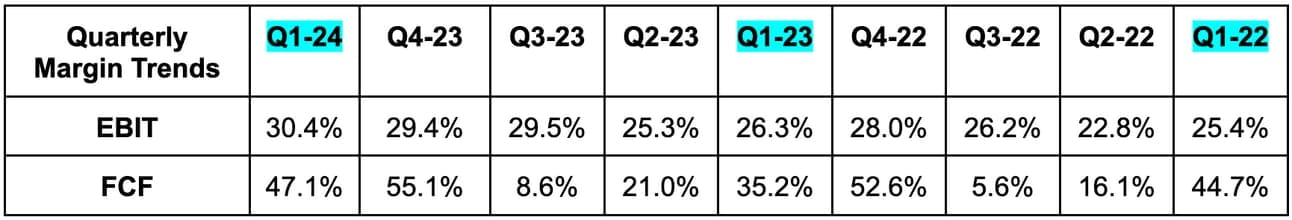

b. Margins & Profitability

- Beat EBIT estimates by 5.0%; beat EBIT margin guidance by 140 bps. Timing of marketing spend, OpEx efficiency gains and revenue outperformance drove the beat.

- Beat $3.13 EPS estimate by $0.32.

- Beat FCF estimates by 26%. Note that quarterly free cash flow generation is heavily influenced by in-period collections and is somewhat seasonal. Annual FCF generation is a better thing to track for this specific profit metric.

c. Balance Sheet

- $8.8B in cash, equivalents and investments.

- $1.5B in debt.

- Diluted shares grew by 2.0% Y/Y.

- Basic shares grew by 1.0% Y/Y.

d. Guidance & Valuation

ServiceNow slightly raised its annual subscription revenue guide. Guidance implies 21.5%-22% Y/Y growth and the raise is despite $17 million in incremental FX headwinds. In Q1 2024, NOW started utilizing an FX hedging program to reduce volatility from currency fluctuations. Still, this doesn’t completely hedge out all risk, hence the added FX headwinds in the new guide. It reiterated 84.5% subscription gross margin, 29% EBIT margin and 31% FCF margin guidance.

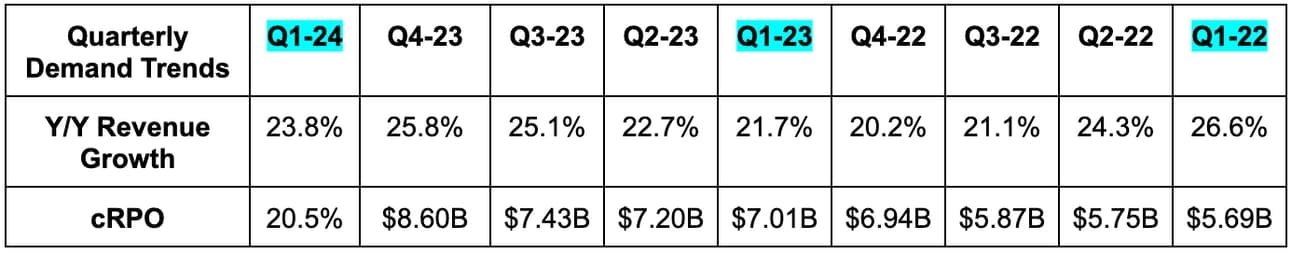

For next quarter, 20.5% Y/Y cRPO guidance needs a bit of added context. ServiceNow had a banner Q3 2023 for U.S. Federal Government wins. These contracts are generally longer in duration, which is a cRPO headwind of about 2 points for next quarter. Its 99% U.S. Federal renewal rate, thus far, bodes very well for these high value customers being retained for the long haul.

NOW trades for 53x 2024 earnings, with earnings expected to grow by 25% Y/Y.

e. Call & Release

The Platform Play:

For the last year, we’ve talked about how platform plays in enterprise software are winning. Platforms allow companies to consolidate vendors, streamline interdepartmental communication, cut costs and improve outcomes. They’re a powerful force multiplier for efficiency, and ServiceNow is that platform within digital workflows. The results speak for themselves. 15 of its 20 largest deals included 7 or more modules. ITSM and ITOM (already defined) were each included in 16 of its 20 largest deals. Security and Risk was in 11 of its largest 20 deals; creator as well as employee workflows were in half of its 20 largest deals. These customers continue to renew at a gross retention rate near 100% and continue to lean on more of its products to modernize their tech stacks. Need more evidence? NOW enjoyed 50% Y/Y growth in customers paying them $20 million or more annually.

Leadership spoke about 15 years of “decentralizing technology governance.” The 21st century has pushed all departments to invest in information technology – not just for software developers. That meant disparate usage of 3rd party vendors, heightened cybersecurity risk and low quality outcomes. It’s very hard to go back and properly integrate these vendors. It’s a lot easier to use fewer vendors who can do much more for you on their own. That’s the ServiceNow value prop – just like Salesforce in customer resource management (CRM)... just like CrowdStrike in endpoint security.

GenAI Amplifying This Platform Play:

Unsurprisingly, ServiceNow is directly integrating its Now Assist AI companion across all product categories to ensure they work as well together as humanly (or I guess artificially) as possible. The GenAI boom is becoming another avenue for more powerful cross-selling. As explained in the intro, Now Assist AI is driving significant utility and potential for how to improve and automate tedious digital workflows. GenAI was in 7 of its 10 largest contracts as clients looked to “de-risk” their tech stack siloes with ServiceNow’s unifying suite. This is why its Plus SKUs (including its GenAI services) are setting new records for ACV.

“Every business workflow in every enterprise will be engineered with GenAI at its core. We are the single pane of glass that enables end-to-end digital transformation… They can radically simplify the tech stack with us.” – CEO Bill McDermott

- ServiceNow’s overarching platform, including Now Assist AI for ITSM, is helping Hitachi resolve client issues more expediently while saving millions. More with less… with Service Now.

- Equinix is using Now Assist AI for Human Resource workflows to raise agent productivity by 30%.

Product News:

ServiceNow launched the “Washington, D.C.” platform this quarter. This is essentially a large batch of GenAI-inspired upgrades to the Now platform. It builds on the progress of the previous Vancouver platform release. It more seamlessly ties together NOW’s product categories to drive better interdepartmental work and communication. It offers the “workflow studio” as a unified workspace to manage productivity across teams. It allows for seamless database refreshes without complex coding; it goes deeper in terms of intelligently automating customer service and order management workflows.

ITOM for AI operations is another newer product to discuss. This, as the name indicates, laces Now Assist AI into ITOM to prioritize, rank and contextualize IT alerts with recommendations for remediation.

ServiceNow debuted StarCoder2 as part of a collaboration with Hugging Face and Nvidia. This provides access to large language models (LLMs) to automate code creation. It also deepened an already tight Nvidia partnership to include new GenAI tools for the telecom space, among other things. Finally, it added its new GenAI tools to a close Microsoft partnership for shared customers.

Going Global:

- New AoraNow partnership in Japan to accelerate its traction there. This was a banner quarter for new business in that nation.

- New $500 million investment earmarked for Saudi Arabia, which includes plans for two data centers.

- Added significantly more business with Novartis during the quarter.

- “NEOM” in the Middle East is using the Now Platform to “build the first cognitive city.”

- Added Australia’s Health Department, Italy’s IT division and a local division of Sao Paulo’s government in Brazil as customers during the quarter.

“In terms of geopolitics, we focus on what we can control. We build great products and services and have a winning culture. That’s why we perform well when others don’t.” – CEO Bill McDermott

f. Take

Another rock solid quarter from one of the highest quality enterprise software names on the planet. No drama. Just more execution. I see how the stock reacted to the report; I do not think long term shareholders should be concerned with that move in the least. Well done, ServiceNow.

2. Spotify (SPOT) – Earnings Review

a. Demand

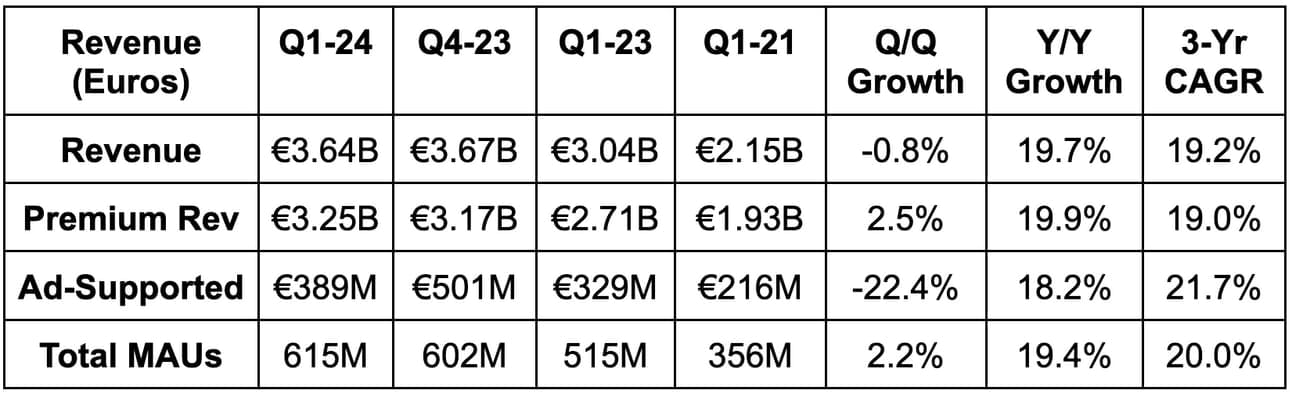

- Beat revenue estimates by 1% & beat identical revenue guidance by 1%.

- FX neutral (FXN) revenue growth of 21% Y/Y accelerated by 1 point vs. last quarter.

- Its 19.2% 3-year revenue compounded annual growth rate (CAGR) compares to 19.1% last quarter and 19.3% 2 quarters ago.

- Met premium subscriber guidance.

- Slightly missed total monthly active user (MAU) guidance.

b. Profitability & Margins

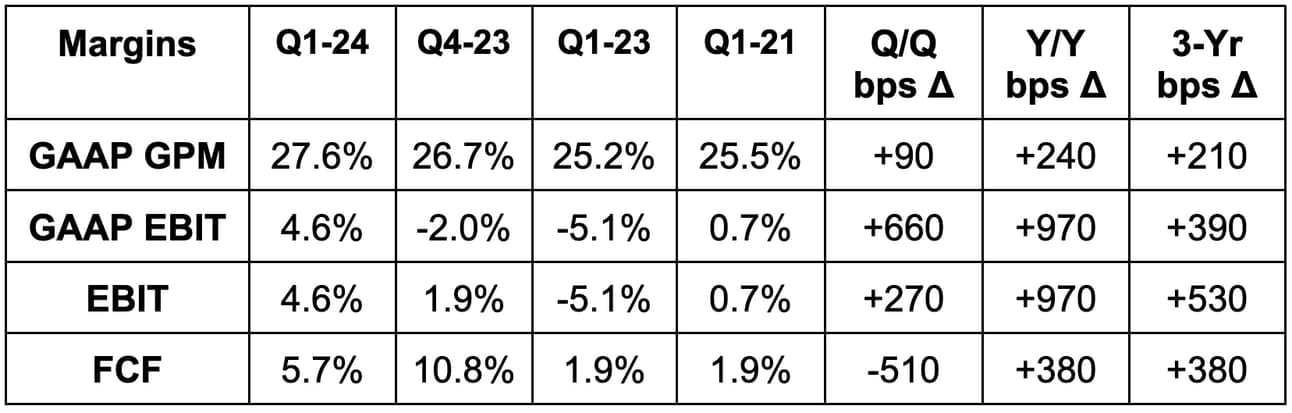

- Beat 26.5% GAAP GPM estimates by 110 basis points (bps; 1 bps = 0.01%) & beat guidance by 120 bps. This was its first quarter of over €1 billion in gross profit.

- Beat EBIT estimates by 9.8% & missed EBIT guidance by 6.7%. This was driven by €82 million in “social charges” compared to €8 million in social charges baked into the guide. Sell-side had already adjusted. These are payroll taxes paid to employees. That expense is tied to share price. Share price rose a lot, so charges rose a lot. Maybe my favorite source of an EBIT miss ever.

- Operating expenses (OpEx) fell by 9% Y/Y. Without any social charges or restructuring charges, OpEx fell by 13% Y/Y.

- Beat free cash flow (FCF) estimates by 15%.

- Beat €0.63 GAAP EPS estimates by €0.34.

c. Balance Sheet

- €4.7B in cash, equivalents & investments.

- No debt; $1.27 billion in convertible notes that will soon mature.

- Basic shares +2.3% Y/Y. Diluted shares +5.3% Y/Y.

d. Next Quarter Guidance & Valuation

- Beat revenue estimates by 1.3%.

- Beat 26.7% GAAP GPM estimates by 140 bps. That’s a large beat here.

- Beat EBIT estimates by 45%. €13M in social charges are baked into the EBIT guide.

- 16 million MAU adds; 6 million premium subscriber adds.

“We are well positioned to deliver on our 2022 investor day goals.” – Founder/CEO Daniel Ek

Spotify trades for 60x 2024 earnings. It did not earn any net income last year.

e. Call & Letter

Monthly Active Users:

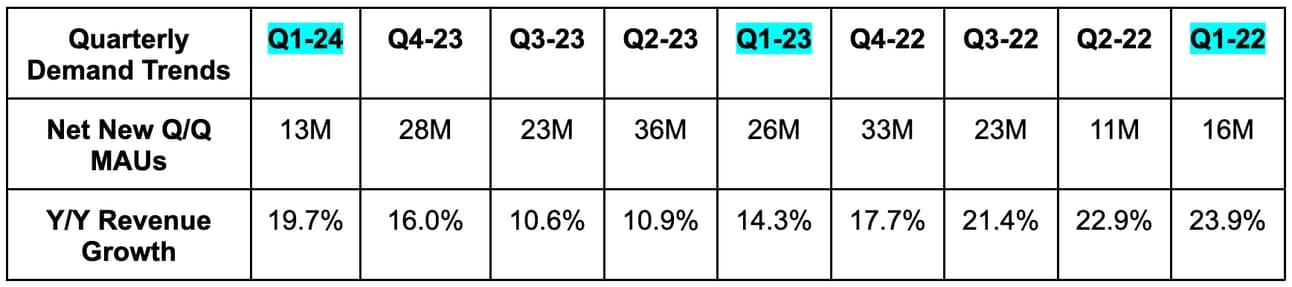

The source of the MAU miss was understandable. Spotify continued to pull back on marketing spend throughout 2023 and into 2024. That pullback in 2023 was masked by strong product debuts, better-than-expected marketing efficiency, historically strong MAU adds, and competition exiting key markets towards the end of the year. Those temporary tailwinds went away this quarter as it continued to be prudent with marketing spend. That played out while it dealt with some operational disruption from layoffs earlier this year. It thinks this disruption is now in the rear-view and it expects MAU additions to accelerate for the rest of 2024. As Ek pointed out, Spotify has demonstrated a great ability to evolve focus areas as changing times demand it. The firm leaned into top-of-funnel growth when money was free; it re-set its cost base effectively as macro got tougher; now it’s ready to get a bit more aggressive in marketing spend once more. Not nearly as aggressive as it was in 2021, but still more aggressive.

“The MAU growth we achieved in 2023 not only surpassed our most ambitious forecast, but also set a record for the most significant user growth in Spotify's history. While we anticipate continued robust growth going forward, 2023 was a truly standout year and should not be an expectation for every subsequent year.” – Founder/CEO Daniel Ek

Premium Business:

While MAU results were a tad light, premium subscriber growth was not. Total subscribers met expectations with its Family and Duo (2 people) plans leading the strength. These plans come with lower churn vs. individual subscriptions, making this trend positive for multiple reasons. Revenue per premium user continued to accelerate by a full 200 bps Q/Q. This was helped by price hikes, but also hurt by geographic mix toward lower propensity to spend nations.

A key theme of the call was “pricing-to-value.” Spotify, over the last few years, has transformed itself from a mono-line music business, to one that’s now a powerful podcasting and (already) audiobook player. It has debuted video, short-form music discovery and its AI DJ to more intelligently match content with tastes. It also just launched “Song Psychic” to get conversational answers to questions via custom song (a little weird). These additional product consumption avenues create two compelling opportunities for better monetization. First, more value justifies higher prices. It will keep adding value and will keep pricing to that value. Simple enough. Secondly, the incremental offerings create more flexibility with subscription packaging. It allows Spotify to offer bundles and á la carte style purchasing as well (like its $9.99 audiobook-only plan).

“You will see more tiers that create incremental consumer flexibility to opt into the type of deal they believe offers the greatest value for them… We’re no longer a one-trick pony.” – Founder/CEO Daniel Ek

There’s another interesting product expansion opportunity here. Spotify is quickly being pulled into the digital education space, just like it was with audiobooks. If you recall, Spotify entered audiobooks first in Germany, where music labels had more aggregated rights to audiobook content. Publishers were adding their own books and seeing great traction. So? Spotify developed a product offering internally to ensure the processes were slicker and more intuitive… and to ensure it got a larger piece of that pie. The audiobook introduction is already raising weekly engagement levels by more than 1 hour. More engagement = more value = more pricing power. The same thing is now playing out in education. Podcasters are “hacking the system in a positive way” to game it and do more things. They’re teaching guitar and DJ classes and are having great early success. Spotify is now developing internal products to manage and host this in a higher quality way.

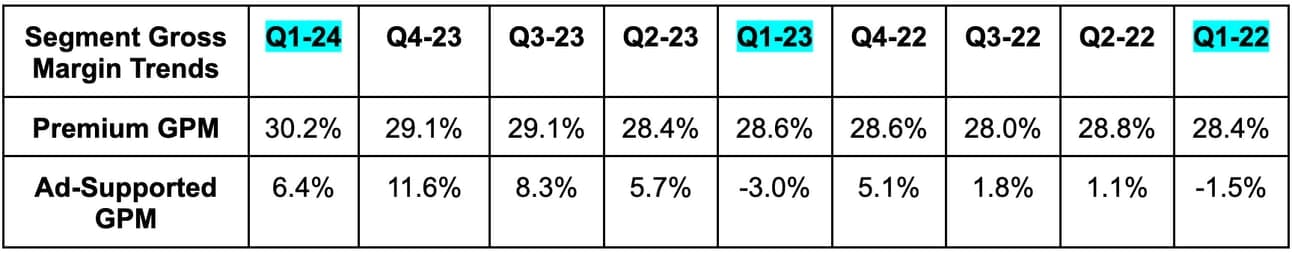

- Premium revenue growth was 20% Y/Y (21% FX neutral (FXN) growth).

- Premium subscribers rose by 14% Y/Y while revenue per subscriber rose by 5% Y/Y.

- Growth was above 13% everywhere and accelerated in all geos besides North America and Europe.

- Gross margins were strengthened by price hikes. Still, improving music and podcasting profitability were two additional, more consistent tailwinds. Gross margin is still being held back by investments to build out its audiobook business.

Ad-Based Business:

While advertising is still a much smaller piece of Spotify, its growth rate (18% Y/Y) is quickly approaching the premium arm. That’s even as programmatic, biddable impressions still make up a small portion of its ad revenue. Continuing to raise that proportion of highly targeted, granular impressions will directly prop up ad rates. That tailwind is basically entirely in front of Spotify… as it also continues to quickly grow impressions. Good combination. While the pricing environment for music is strong, podcasting remained softer, just like last quarter. Nonetheless, strong impression growth allowed both music and podcasting to enjoy healthy growth in excess of 10% Y/Y.

The Spotify Audience Network (SPAN) is Spotify’s way of serving as a conduit between buyers and platform publishers across most podcasting apps. This enjoyed 10% Q/Q growth in participating publishers following expansion into 5 new countries last quarter.

f. Take

As I’ve been vocal about on social media recently, this company has impressed me deeply over the last year. There aren’t many non-mega-cap firms that can slash their cost base without a negative demand impact. Spotify proved that they’re one of those companies… like Airbnb in 2020… like Uber and Shopify in 2022-2023… like Block right now… they have firmly placed themselves in that rare category. Spotify competes with multiple mega-cap tech firms with somewhat similar products. Differentiation here, to me, seemed tough to establish. Spotify did not get that memo and has figured out a way to outcompete richer companies with larger consumer networks than it currently has. Surprising… impressive… strong. Congratulations to shareholders on what has become a remarkable turnaround.

3. Visa (V) – Earnings Review

Visa is arguably the most important company in the world for gauging spend volume appetite for consumers and corporations. That’s what we’ll focus on in this report. Taking the credit and balance sheet risk is not its business model. It merely provides a scaled network to host complex payments flows. For this reason, it’s not a valuable gauge for credit health like Bank of America, American Express, Capital One, etc.