Table of Contents

- 1. DraftKings (DKNG) – Earnings Review

- 2. Mercado Libre (MELI) – Earnings Review

- 3. Lemonade (LMND) – Earnings Review

- 4. Earnings Roundup – Block (SQ); Coinbase (COIN); …

- 5. Uber (UBER) & Domino’s (DPZ) – Domino’s Earning …

- 6. The Trade Desk (TTD) – Roku (ROKU)

- 7. CrowdStrike (CRWD) – Two Mammoth Partners

- 8. Match Group (MTCH) – Goodbye

- 8. Fed Meeting

- More Macro Data from the Week:

- 9. Portfolio

1. DraftKings (DKNG) – Earnings Review

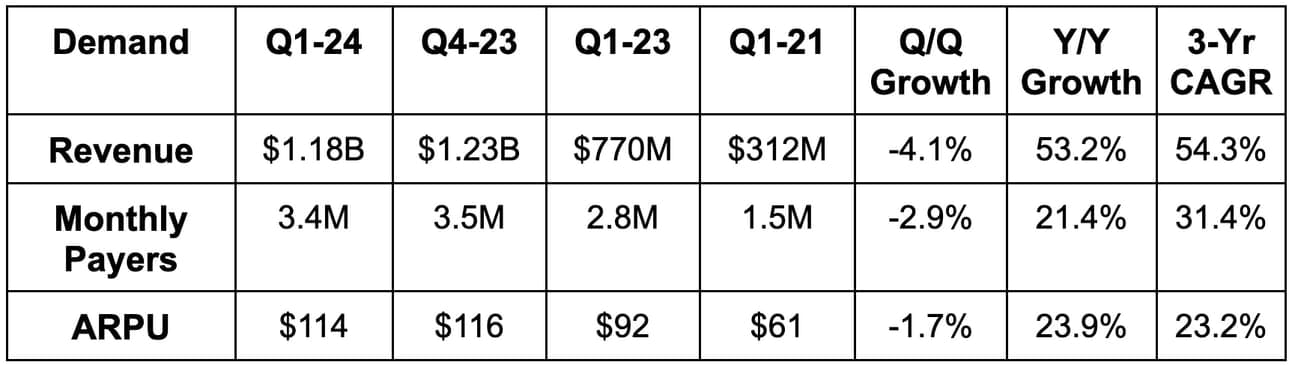

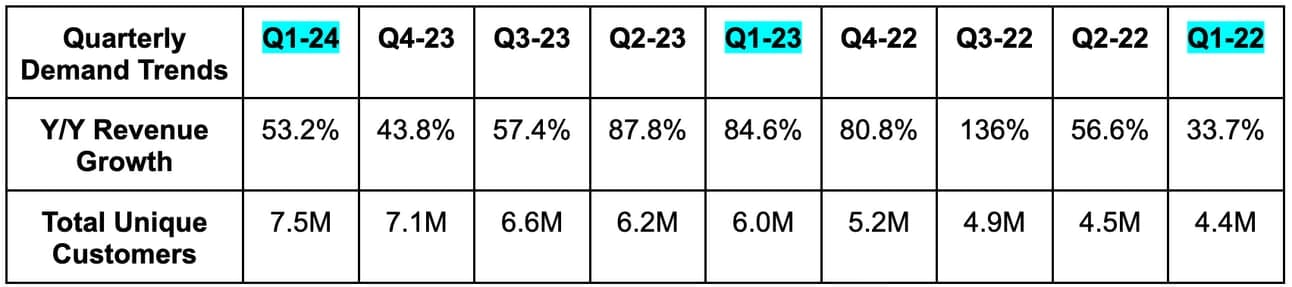

a. Demand

DraftKings met analyst revenue estimates. Its 54.3% 3-year revenue CAGR compares to 56.3% last quarter and 81.2% 2 quarters ago. A lot of DraftKings growth comes from an expanding footprint of legal gambling states. Vitally, its 2018-2022 state cohort is still growing at a 40% Y/Y clip. This indicates a long growth runway, especially considering there’s a large black market market share in the oldest legal states.

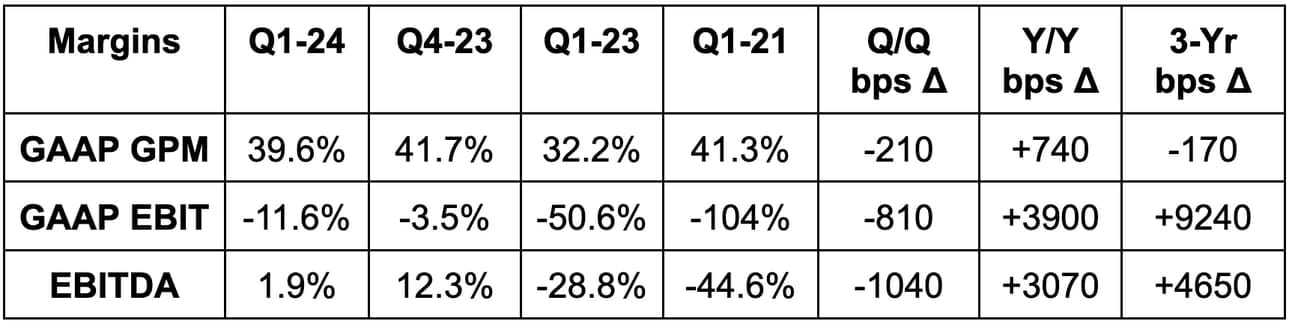

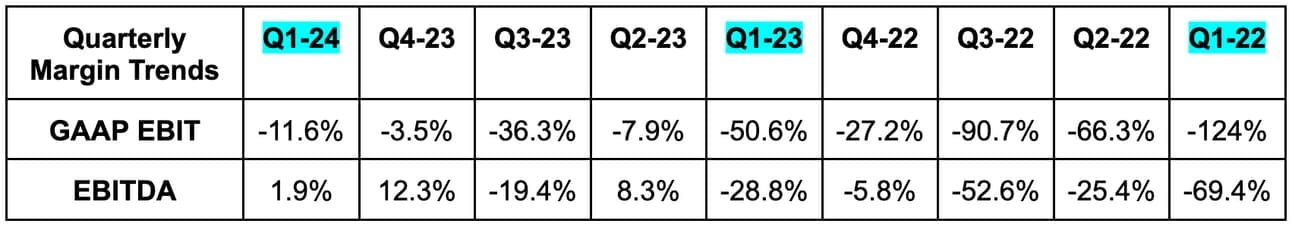

b. Profitability & Margins

- Beat GAAP EBIT estimates slightly.

- Beat $4M EBITDA estimates by $18M. It posted a 60% incremental EBITDA margin for the quarter.

- Beat -$0.11 EPS estimates by $0.14. Surprise positive EPS quarter.

- Missed GAAP GPM estimates.

Note that margins for this business are highly seasonal. Focus on Y/Y comps.

c. Balance Sheet

- $1.2 billion in cash & equivalents.

- $1.25 billion in convertible senior notes.

- No traditional debt.

- Share count rose by 4.2% Y/Y. Not ideal, not terrible, but still my least favorite part of the great report. The team did cite ramping free cash flow (FCF) confidence as a signal to likely initiate a buyback in the coming quarters.

d. Annual Guidance & Valuation

Guidance does not yet include its Jackpocket online lottery acquisition.

- Raised revenue guidance by 2.6%, which beat estimates by 2%.

- Raised EBITDA guidance by 4.2%, which beat estimates by 2.8%.

- Reiterated 46% adjusted GPM guidance.

- Sees $400 million in 2024 FCF generation.

- Sees 25% Y/Y revenue growth for Q2 and 30% growth in Q3 and Q4.

- Sees $150 million in Q2 EBITDA, $0 in Q3 EBITDA and more than $325 million in Q4 EBITDA. (again, highly seasonal)

DraftKings is currently inflecting to profitability across all relevant metrics. It trades for 94x 2024 earnings, 30x 2025 earnings and 18x 2026 earnings. It trades at a 2024 PEG ratio (using 2-year compounded earnings growth) of 0.75x.

e. Call & Release

A Blue Chip Brand Emerging:

Sports gambling has extremely low switching costs. The products are relatively similar and the opportunity for competitive differentiation is not abundant. That leaves the potential for spending a fortune on customer acquisition just to lose an established customer to another app. Despite this, DraftKings continues to show clear signs that differentiation is present. Sales and marketing spend again declined by 11% Y/Y, while its overall market share of sports and iCasino rose from 27% to 31%. Its customer acquisition cost (CAC) plummeted by another 40% Y/Y. If this product were purely a commodity, pulling all of that off would be close to impossible. DraftKings has achieved this for several quarters in a row. How is this happening?

I think there are several small factors adding up to something more material. First, the brand has better awareness than anyone else in the space besides ESPN and maybe Flutter’s FanDual. Its online gambling footprint is among the most broadly spread in the USA, which enables more efficient marketing and CAC. Its app interface is also (in my view) on par with FanDual’s for the two best in the market.

Its parley options are as broad or broader than anyone’s in the market, which means happier customers and a more profitable DraftKings. Its pricing and modeling algorithms are also well seasoned with more data than most competitors. This allows DraftKings to offer better uptime vs. substitutes, which is highly important for lucrative categories like live betting. Better data also allows DraftKings to personalize the customer experience more granularly while perfecting back-end processes. Competition can easily emulate and copy a front-end interface. It’s much harder to copy back-end optimizations on user experience, hold rate and engagement as those aren’t visible. Finally, its tech stack vertical integration provides a compelling cost edge.

None of these items seem monumental in isolation, but the data is telling me that the combination is forming the beginnings of a moat.

Cost Discipline from Here:

As already mentioned, DKNG just raised profit targets again. It sees more upside to payments leverage than previously assumed and sees ample opportunity for AI-powered efficiency gains. Margins will keep expanding even through expected increases in overall OpEx. This cost growth is a response to improving marketing payback periods, which unlocks more opportunities to spend.

Sources of Outperformance:

Stronger than expected customer acquisition, retention, and engagement all powered the firm’s Q1 outperformance. Its hold rate of 9.8% also beat expectations and led to the firm raising 2024 hold rate assumptions from 10.25% to 10.5%. That’s the byproduct of its more compelling parlay menu, and more average bets per parlay. It sees more upside here in the coming years. For profits, better-than-expected marketing efficiency drove the success. The outperformance during the quarter was despite abnormally favorable gambler outcomes. This cost DKNG $60 million in revenue and $42 million in EBITDA for the full year guide. It raised guidance despite this headwind.

Cross-Selling:

One of the best ways to drive retention and lifetime value is via cross-selling. The main opportunity here will be more states legalizing iCasino, but its proposed Jackpocket acquisition provides another outlet in the lottery market. It will also be able to market its current offering to that firm’s 700,000+ users (with a bit of customer overlap, I’m sure). Cross-selling means more revenue without commensurate customer acquisition costs. It means lower marketing intensity and higher quality revenue. It helps everywhere.

New States, Footprint & Regulation:

The Vermont and North Carolina debuts went very well. CAC was strong and both states will turn EBITDA positive by the second half of this year. That inflection will come much more quickly than for previous states as DraftKings perfects go-to-market.

DraftKings is live in 25 states (49% of population) for sports gambling and 5 states (11% of the population) for iCasino. It’s in Ontario (40% of Canada) for both. There are 9 states (11% of the population) considering sports gambling legalization and 5 states (12% of the population) for iCasino. The rate of sports gambling legalization is set to slow, with just 3 additional states representing the vast majority of the remaining opportunity. Texas, one of the three big stragglers, should vote on legalization in 2025. The need for more tax revenue is only increasing… legalization throughout the nation is all but inevitable.

DKNG’s daily fantasy products are a great way for it to build early market share in states that haven’t legalized. For example, its new Pick 6 product is performing well in Texas and familiarizing bettors with the brand.

Robins was asked about potential tax rate increases in some states. He sees that as possible only in a couple of them and thinks most realize raising rates will simply push more people to the black market. He also thinks the company can offset higher taxes with lower marketing spend, but that negative trade-off could impact demand levels.

f. Take

I thought this quarter was fantastic. Anyone disagreeing is likely just looking at how the stock reacted. There’s nothing in here to fundamentally pick at.

2. Mercado Libre (MELI) – Earnings Review

Mercado Libre is an e-commerce, logistics and payments giant in Latin America with a quickly broadening product offering.

Note that Meli made a series of changes to reporting disclosures starting this quarter. I used the old method of disclosing in the charts for fair comps (with reconciliation included). First, Mercado Pago Interest Income and Expense was moved from below the EBIT line to above it. For its shipping business (Mercado Envios) it changed its position from an agent to a principal. Previously, it netted shipping costs out of gross revenue. Now, it reports revenue as gross revenue and puts shipping expenses in cost of revenue line. Finally, it removed peer-to-peer volume from total payment volume (TPV). I’ll cite the impact of these changes throughout the piece.

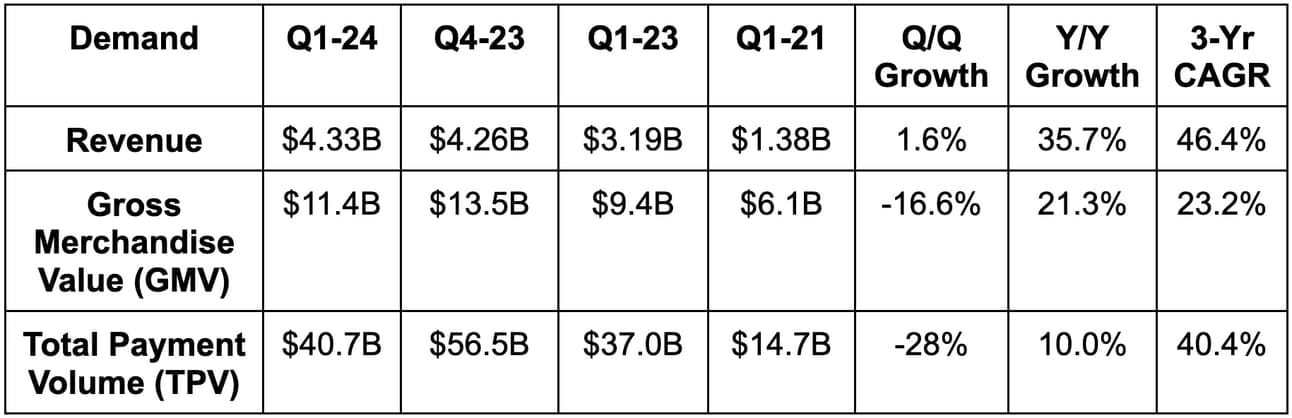

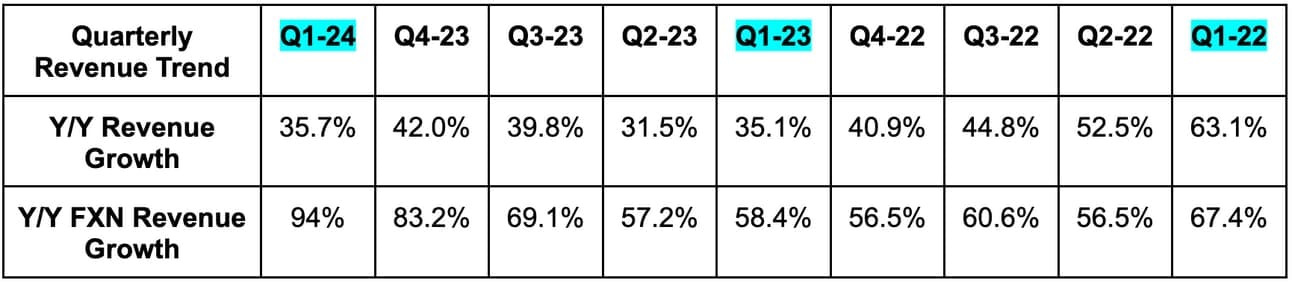

a. Demand

Meli crushed revenue estimates by 11.9%. It dealt with violent Agentinian FX headwinds during the quarter, but the team got out in front of this with the street and properly set itself up for another quarter of outperformance. Its 46.4% 3-year revenue CAGR compares to 47.4% Q/Q & 49.7% 2 quarters ago.

- Excluding aforementioned changes in reporting disclosures, revenue grew by 30% Y/Y.

- Brazil revenue rose by 44% Y/Y excluding changes and 57% Y/Y overall.

- Mexico grew by 55% Y/Y excluding changes and 59% Y/Y overall.

- Argentina fell by 19% Y/Y excluding changes and fell 22% overall (Hyperinflation & currency devaluing).

- Commerce revenue rose by 31% excluding the changes and rose 49% overall.

- Fintech rose by 28% excluding the changes and rose by 22% overall.

TPV growth and GMV growth were 86% Y/Y and 71% Y/Y FXN respectively.

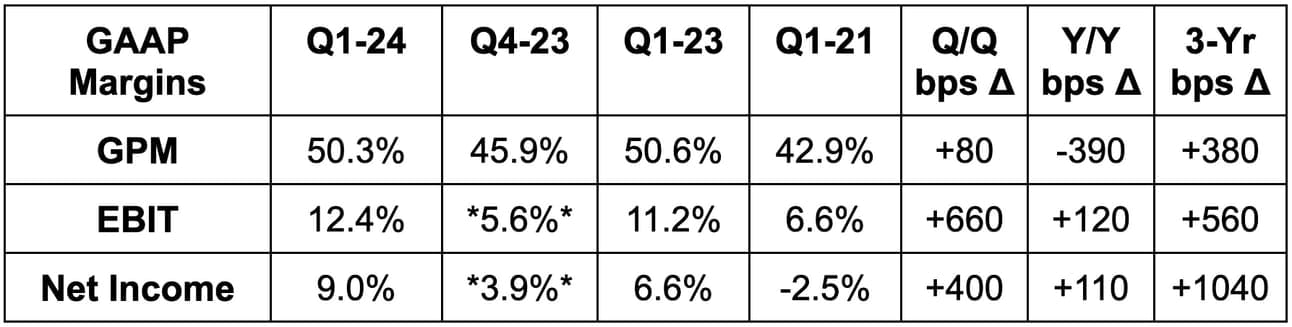

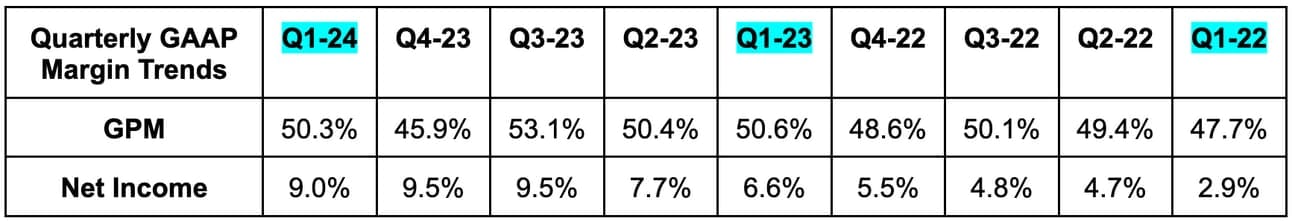

b. Profitability & Margins

- Beat EBIT estimates by 7.9%.

- Beat $5.95 EPS estimates by $0.83.

Had I used this new method:

- Excluding changes, GPM would have been 46.7% for this quarter vs. 50.7% Y/Y.

- Excluding changes, EBIT margin would have been 12.2% vs. 13.1% Y/Y.

- Excluding changes, EBIT rose by 44% Y/Y and 26% Y/Y overall.

- Excluding changes, net income margin would have been 7.9% vs. 6.3% Y/Y.

Operating leverage was enjoyed across all three operating expense (OpEx) buckets and every single geography besides Argentina.

c. Balance Sheet

- $6.2B in cash & equivalents.

- $5.3B in debt.

- Shares fell 1% Y/Y.

d. Valuation

Meli trades for 49x 2024 GAAP EPS. EPS is expected to grow by 75.8% Y/Y.

e. Call & Release

Argentina:

The FX headwind this quarter was about as pronounced as you will ever see it. While Argentina volume rose by 214% Y/Y, real growth was negative due to foreign exchange. That country is undergoing a painful economic reform as we speak. I actually think that the reform will turn out to be a structural tailwind for MELI as their government slashes regulation and promotes private enterprise growth. It will just take time. Even now, MELI sees pain as a relative boost to its operations there, as it’s able to weather the storm better than its competition can.

Commerce:

MELI continued to enjoy rapid, 30%+ FXN commerce growth in Brazil and Mexico. Items sold growth was also strong at 32% in Brazil and 28% in Mexico. As it scales, the company keeps enjoying happier customers with its Net Promoter Score (NPS) setting new highs. While this is not an irrelevant datapoint, it is somewhat noisy due to the abstract, internally derived nature calculations. 5 different companies can measure it 5 different ways. Conversion rates rose with broadening selection, unique buyers rose by 18%+ across all markets, new cohort retention is strengthening… This segment is rocking. Take rate also continued to rise from 17.8% to 22.0% Y/Y thanks to flat shipping fee changes and advertising. Strong demand and a larger piece of the pie is a great combination.

- Debuted split payments to allow customers to purchase goods with more than one payment method.

- Mercado Pago’s checkout gateway penetration continues to rise.

- Items sold per buyer rose to 7.2 vs. 6.7 Y/Y.

- 53.5 million unique active buyers vs. 46.1 million Y/Y.

Meli + (loyalty program) delivered expected engagement, volume and retention advantages once again. One newer perk called Meli Delivery Day allows members to select one day of the week to receive free shipments. Uptake here has been stronger than expected, which is weighing on same-day delivery rates and fulfillment contribution margins just a tad. That’s a trade-off the company is more than happy to make.

Logistics:

Late deliveries reached record lows and speed of delivery set record highs despite Meli delivery day. Meli’s fulfillment penetration, which represents the proportion of orders it fulfills itself, rose from 44% to 52% Y/Y. Vitally, cost per order is stable Y/Y as it closes the gap between Meli-fulfilled margins compared to using 3rd parties. Investments to build out the fulfillment network will be relatively stable in 2024 vs. 2023 as it will keep growing the footprint like it’s “business as usual.” These continued investments and more free shipping are why shipping costs rose 60 bps as a percent of GMV Y/Y. It’s happy to use these services as lower margin loss leaders to drive customer delight and more engagement.

Advertising:

Advertising revenue rose 64% Y/Y to reach 1.9% of GMV vs. 1.4% Y/Y. This is high margin revenue and, like for Amazon, proliferation here will be fantastic for overall profitability. It continues to add new formats and grow ad-load, but it’s still early days here. Plenty of growth left to come as it consistently releases targeting algorithm upgrades to juice value per impression. To date, most of this revenue is coming from product advertising, but it sees brand advertising traction rising in the coming years. This quarter, demand for relevant Mexican cross-border placements was the standout.

Fintech:

The Mercado Pago fintech platform is doing very well. User growth accelerated from 32% Y/Y last quarter to 38% Y/Y this quarter. Take rate rose from 3.7% to 4.5% too. Retention, engagement, cross-selling and everything else about this bucket came in strong. Specifically, it saw insurance policies rise from 8.1 million to 11 million and saw overall assets under management (AUM) rise 90% Y/Y. Its savings product launch in Brazil was noted as a key piece of this momentum. That will be going head to head with Nu Bank (and all other banks in the nation).

- 49 million fintech MAUs vs. 35.6M Y/Y.

Credit Underwriting:

Credit originations rose 71% Y/Y, the overall credit portfolio rose 46% Y/Y to reach $4.4 billion and Meli issued 1.5 million new cards to drive 173% FXN TPV growth. Meli remained encouraged by Brazilian and Mexican credit health and so continues to accelerate growth here.

Net interest margin after losses (NIMAL) is the highly important margin line to focus on. It fell sharply Q/Q to 31.5%, but rose on a Y/Y basis from 30.6%. The sequential decline is also not concerning, as it’s related to credit cards growing as a percent of the total portfolio from 22% to 35% Y/Y. Cards come with lower NIMAL than its lending products.

- 17.9% 90+ day non-performing loan (NPL) rate vs. 18.7% Q/Q and 28.2% Y/Y (lower is better). Provision coverage was 156% vs. 133% Y/Y (higher is better). The improvements here were helped by writing off a large chunk of delinquent loans last quarter.

- 9.3% 15-90 day NPL rate vs. 8.2% Q/Q and 7.8% Y/Y. This was hurt by Easter (fewer collections) and also leaning into more originations, which it thinks it’s pricing effectively.

Interestingly, provisions for doubtful accounts rose 70 bps as a percent of total credit revenue. This is partially due to Argentina boasting lower comparative provisions and a mix shift away from that country. Acceleration of originations drove the rest of the rise.

Acquiring (Mercado Pago Checkout):

- TPV grew in all regions including Argentina in real terms. Acquiring TPV was $30.6 billion vs. $24.3 billion Y/Y.

- Debuted a new Point Smart 2 point of sale (POS) system with longer battery life for larger merchants.

- Device-free tap-to-pay solution grew sellers by 63% Y/Y.

- Logged online payers rose 35% Y/Y.

f. Take

This was a phenomenal quarter in a uniquely dynamic Latin American operating environment. Like for DraftKings, I do not see anything to pick at. Only continued profitable compounding to praise and shareholders to congratulate. Meli earned every single bit of the 10%+ positive share price reaction. And while we don’t overly focus on these reactions… that doesn’t mean you can’t enjoy them. That is the beauty of long term investing. Thriving company sees its stock rise? Cool, your position is worth more. Thriving company sees its stock fall? Cool, risk/reward is becoming more compelling.

3. Lemonade (LMND) – Earnings Review

Lemonade is an insurance technology company trying to disrupt the gigantic legacy industry. Its tech native infrastructure is used to cut out traditional costs from the model while making claims and onboarding painless processes.

a. Demand

- Beat In Force Premium (IFP) guidance by 0.5%. Its 64% 2-year revenue CAGR compares to 67.8% last quarter and 79% two quarters ago.

- Beat gross earned premium (GEP) guidance by 2.2%.

- Beat revenue estimate by 5.0% & beat guidance by 6.3%. Please note that reserve releases/adjustments helped the revenue beat a bit this quarter as loss rate assumptions improved a tad. This is a nearly identical idea to credit reserve level adjustments for lenders. Ceded reinsurance premium commission favorability and net interest income helped too. Net interest income should become an increasingly important part of this business as the cash pile starts to grow.

- A more complete product suite across states is powering the stronger dollar retention gains.

- Premium per customer growth was driven by rate increases. It was not driven by a mix shift like it has been in the past, as Lemonade has not leaned into higher premium buckets just yet. Auto is the main example, but this is still true for home insurance too.