1. Upstart (UPST) — New Product Launch

Upstart launched a Spanish language version of its AI-powered, digitally-native lending product. According to the company, this is the “first online personal loan lending platform with full support for Spanish speakers across the USA. This product launch should be an important one for the company.

Nearly 1-in-5 Americans are of Hispanic descent and this minority is discriminated against within the traditional loan setting at a clip far higher than Caucasians and Asian-Americans. Upstart’s inclusive loan operations were already boosting Hispanic approval rates by 27.2% while lowering APR by 10.5%. Filling out applications in native-tongue should boost these advantages further by allowing Spanish-speaking Americans to enter information in a more comfortable manner. Better information feeds Upstart’s algorithm and its competitive edge.

Click here for my broad overview of Upstart.

2. CrowdStrike (CRWD) — Final Notes From the 10-Q

- At the beginning of the year, CrowdStrike had one customer representing 17% of its total accounts receivable. It now has no customers representing over 10% of accounts receivable depicting meaningful concentration risk reduction as its client list rapidly grows.

- CrowdStrike’s headcount is now 4,224 employees representing 49% year over year growth. Clearly the company sees more growth ahead.

3. Lemonade (LMND) — Student Housing Data

The rise of the Delta variant is not expected to shutter college campuses like it did in 2020, but it will have another interesting impact.

COVID-19 is boosting demand for off-campus housing as students seek out more space and cleanliness than is often provided in college dorms. These off-campus rentals will need insurance plans and that should bode very well for Lemonade.

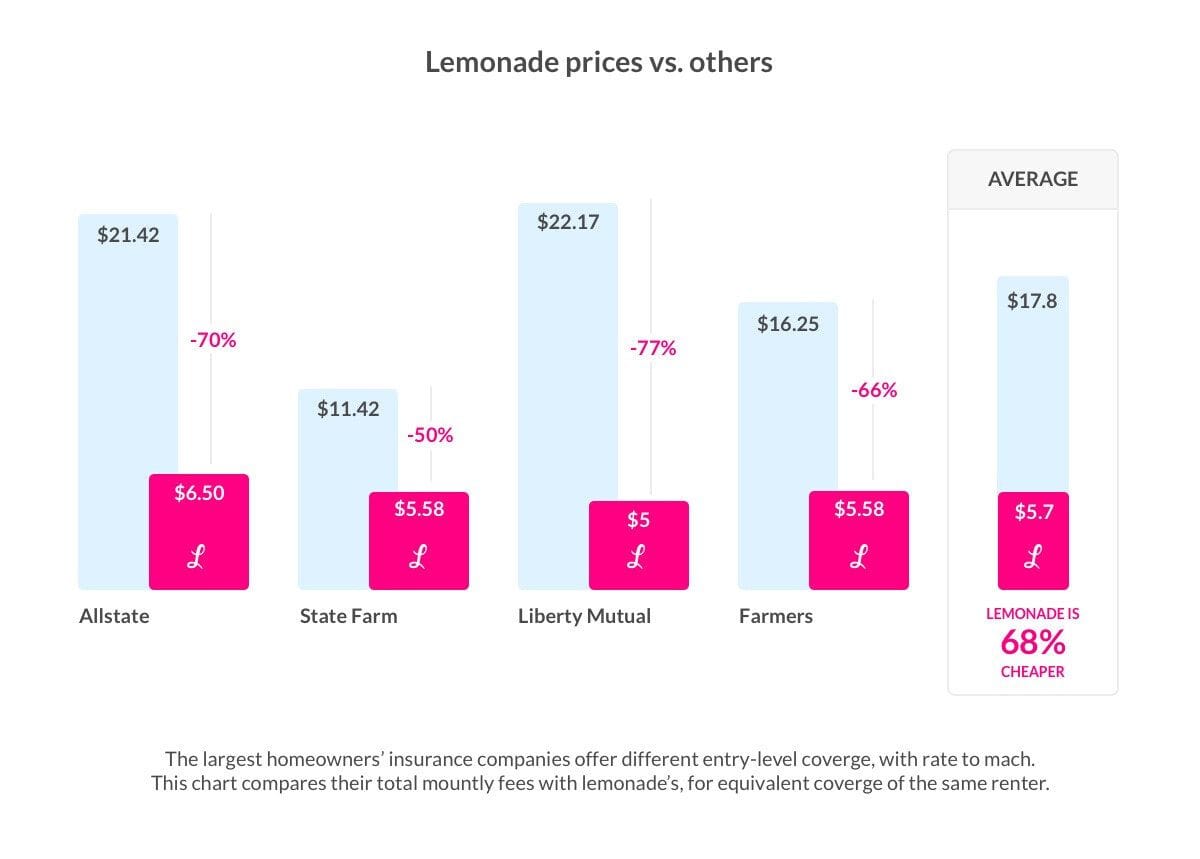

While renter plans yield far less premium than any other product Lemonade offers, the category also feeds customer growth for the company more than any other channel. Lemonade undercuts renter competition (often times by more than 50%) to win over customers new to the insurance world — such as college students. It then charges market rates on all other products it sells to a user.

Cheaper rental policies and excellent customer service both build loyalty for Lemonade to cross-sell its pet and life products or to up-sell a renter to a homeowner plan. This is where the premiums really start to pile up for the company.

Click here for my broad overview of Lemonade.

4. Olo (OLO) — New Restaurant Data

The National Restaurant Association published its mid-year “state of the restaurant industry” update which is quite relevant to Olo.

Here were the key findings:

a. Delta Variant Impact

- 52% of adults want to see restaurants incorporate more technology to make ordering and payment easier.

- 19% of adults have completely stopped going to restaurants due to the Delta variant.

- 27% of adults switched from dining in to delivery/takeout because of the Delta variant.

Olo’s core niche is incorporating more technology into a restaurant’s ordering system. The majority of consumers now calling for this change is fantastic news for the company. Furthermore, Olo’s core off-premise business will directly benefit from the 27% of adults switching from on-premise to off-premise dining.

Olo does not need pandemic tailwinds to find long term success. Still, this shorter-term boost is a reality and should be considered.

b. Industry Metrics

- Restaurant/foodservice sales are projected to reach $789 billion for 2021 — up 19.7% from 2020 following a steep drop due to the pandemic from 2019-2020.

- According to data from the Freedonia group this is poised to reach $1.1 trillion by 2024 to surpass grocery spend

- Restaurants continue to have the highest level of unfilled job openings of any industry

- This forces chains to do more with less which is where Olo thrives