Content sent during the week:

- Details on SoFi Insider Trades.

- Fed Statement Highlights & My Thoughts.

- Portfolio Update with a Brand New Holding.

Table of Contents

- 1. EBIT Comp sheets

- 2. Micron (MU) – Earnings Snapshot with More Detai …

- 3. When to Trim & Sell — Highly Opinionated Portfo …

- 4. Nike (NKE) – Earnings Review

- 5. Alphabet (GOOGL) – GenAI Innovation & More

- 6. Starbucks (SBUX) – Letter, Unions & Patience

- 7. SoFi (SOFI) – Milestone

- 8. Headlines & Quick Thoughts

- 9. Macro

1. EBIT Comp sheets

Important notes:

- This is an iteration of Peter Lynch’s PEG (P/E divided by earnings growth) ratio framework. I use EBIT and 2-year profit CAGR instead of one year of profit growth. I like to publish charts like these every few months to offer a picture of how expensive quality names are vs. other quality names at somewhat similar phases of growth.

- Forward CAGR uses next year’s profit growth & the following year.

- Not all companies make non-GAAP EBIT adjustments. For the mature growth chart, that doesn’t really matter because stock comp is not a large expense for those types of firms and adjustments are generally minimal. For the high growth chart, I used adjusted EBITDA and backed out depreciation and amortization. It’s important to account for stock comp in the same way across firms – especially those that use equity compensation liberally to pay employees.

- A higher value on the right-most column means a more expensive growth multiple.

- I used sell-side consensus estimates. I’m not expressing opinions on future profit growth.

- This is just one slice of data. It's an important slice, but other valuation metrics would surely paint these companies in related, yet different lights.

- It’s not just the rate of profit growth that fetches a premium but the visibility of that profit growth too. Visa and Apple, for example, offer better visibility than younger, less proven firms that are in the fast growth table.

a. Mature Growth

b. Fast Growth

2. Micron (MU) – Earnings Snapshot with More Detail

I usually only do snapshots for this name, but there were a lot of questions following the report, so I wanted to cover this one in a bit more detail.

Micron sells semiconductors for memory and storage. Its “Not And” (NAND) chips offer non-volatile data storage, which maintains stored information when a system’s power is turned off. Dynamic Random Access Memory (DRAM) offers volatile memory storage for personal computers, data centers, and mobile devices. This makes sure other processors have the context they need at any given time to minimize processing latency. These chips are considered to be at least partially commoditized at this point, with Micron’s cost advantages providing its edge.

- DRAM is great for short-term memory storage and rapid access.

- NAND is great for longer-term memory storage and use cases that don’t need the lowest data processing latency.

These chips provide the foundation for its solid-state drives (SSDs), which are used in things like USB flash drives. Micron sells standalone DRAM and NAND processors and also SSDs with these chips in them. SSDs replace hard disk drives (HDDs), as they’re more power efficient, durable and resilient. It provides basic memory cards for things like gaming devices and cameras too.

To cater to the vast data processing needs of GenAI and to capture its piece of that opportunity, it offers high-bandwidth memory (HBM) hardware. This vastly expands data processing capabilities and the ability to pass context between CPUs and next-gen GPUs. Nvidia is a big customer. It also offers higher-capacity SSDs to help with LLM storage.

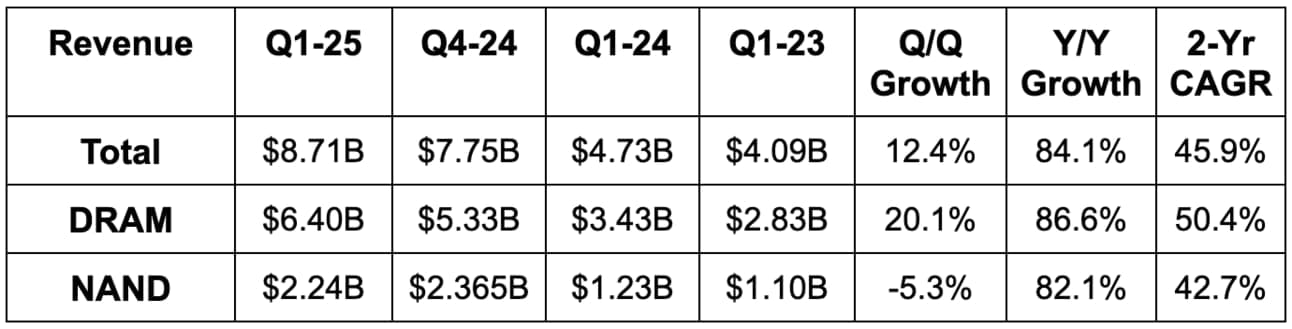

a. Results

- Roughly met revenue estimates & revenue guidance.

- DRAM bit (units of memory) shipments rose by about 12% Q/Q with average selling price (ASP) up around 8% Q/Q.

- NAND revenue fell 5% Q/Q with ASP down about 12% Y/Y.

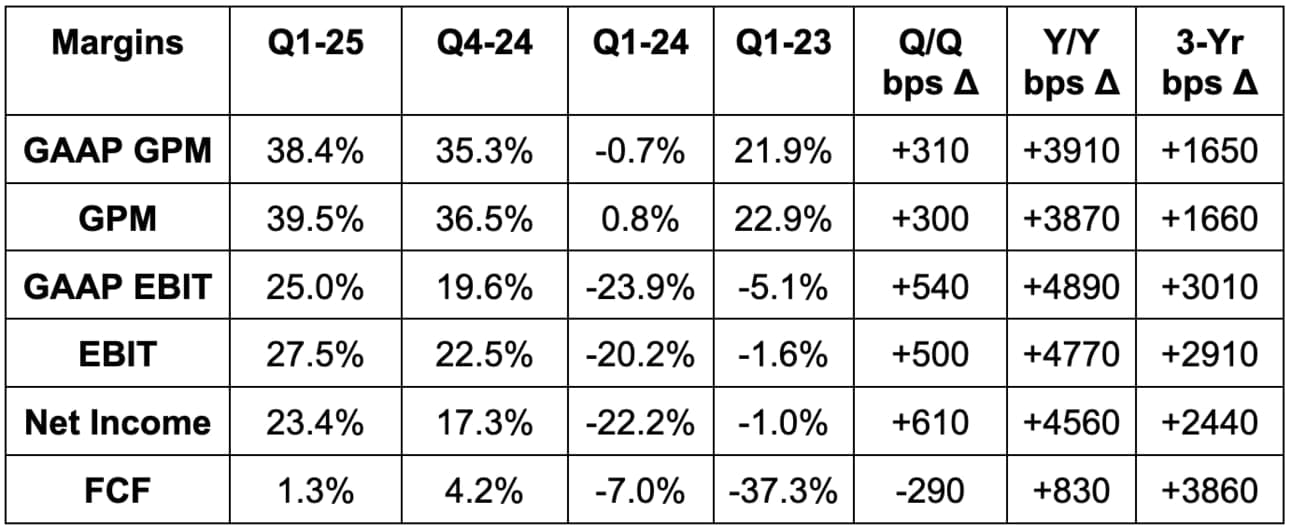

- Slightly missed GAAP GPM guidance.

- Slightly missed 39.6% GPM estimates & met GPM guidance.

- Beat EBIT estimates by 1.4% & beat guidance by 1.8%.

- Beat $1.56 GAAP EPS estimates by $0.11 & beat guidance by $0.13.

- Beat $1.77 EPS estimates by $0.02 & beat guidance by $0.05.

Gross margin & all other margins violently fluctuate based on pricing & asset utilization rates. This is a highly cyclical business.

b. Guidance & Valuation

- Missed Q2 revenue estimates by 12%. This was powered by lower NAND assumptions, disappointing inventory adjustments and “temporary moderation in near-term data center SSD purchases.”

- Missed 41% GPM estimates by 350 bps.

- Missed EBIT estimates by 25%.

- Missed $1.67 EPS estimates by $0.24.

- Guided to $14 billion for 2025 Capex.

For DRAM, growth is expected to be roughly 18% Y/Y for 2024 and about 15% Y/Y in 2025. This was a reiteration. Supply is currently considered a bit “tight” due to strong HBM demand, with supply growth expected to track demand… meaning favorable pricing dynamics for this category should continue next year. It expects China revenue from its suite of DRAM products to be about 10% of total. Finally, it now thinks AI demand will lead to strong 13% sector-wide data center server growth for 2024. Growth will “continue in 2025.”

For NAND, it now sees about 12% growth for 2024 and 2025, which is lower than previously thought. It had told investors that NAND growth would be closer to 15% in 2024 and 2025. This is coming from consumer-facing categories like personal computers (PCs) and automotive. Inventory adjustments here have been less favorable than expected due to aforementioned slowing in data center SSD demand following a period of rapid growth. This is leading to CapEx cuts to allow the demand recovery to kick-in and avoid inventory gluts.

“We previously shared our expectation that customer inventory reductions in the consumer-oriented segments would impact Q2 shipments. We are now seeing a more pronounced impact of customer inventory reductions. Fiscal Q2 bit (units of memory) shipment outlook is weaker than we previously expected… We expect this adjustment period to be relatively brief and anticipate customer inventories reaching healthier levels by spring, enabling stronger bit shipments in the second half of fiscal and calendar 2025.”

CEO Sanjay Mehrotra

“The decline in 2024 and 2025 industry NAND demand outlook implies that supply actions will be needed to achieve balance.”

CEO Sanjay Mehrotra

This is a violently cyclical business. In 2023, EPS fell from $7.75 to -$5.34. It’s expected to get almost back to 2023 levels this year, with $7.04 in EPS expected. EPS is expected to grow by 46% next year to $10.30, and then shrink modestly the year after. These estimates will be highly fluid and will likely be coming down over the next few days following this guidance.

c. Balance Sheet

- $7.6B in cash & equivalents; Inventory fell 2% Q/Q.

- $13.8B in total debt (about $500 million is current).

- Dividends rose by 1.5% Y/Y; Diluted share count rose by 3.4% Y/Y.

d. More Notes

Data Center:

Data center demand for DRAM remains fantastic, with HBM a key piece of this momentum. Specifically, revenue rose by 400% Y/Y (40% Q/Q) to cross 50% of total sales for the very first time. HBM revenue rose by more than 100% Q/Q and came in ahead of expectations due to strong “capacity ramp execution.” The strong demand is leading to a favorable supply dynamic and compelling pricing power, while HBM sales remain “accretive to both DRAM and overall company gross margins. Always good to see newer products already serving as margin tailwinds.

It’s important to re-emphasize that Micron doesn’t compete with Nvidia in the world of next-gen GPUs and data centers. Instead, its HBM products serve as a complement to ensure processors within those data centers can quickly access all needed context at any given time. Micron helps next-gen data centers (or “AI factories” as Jensen Huang calls them) to be faster and more efficient. This is how this company plans to capture its GenAI opportunity, as increasingly complex models and apps will lean on the most efficient memory and storage to operate. Enter Micron.

Its newest commercial HBM product (HBM3E) is a key component of Nvidia’s Blackwell platform. So far, that mega-cap has bought up all the supply that Micron can create, but it just began shipments to its second customer, with a 3rd expecting deliveries to start early next year. As stated last quarter, HBM is sold out through the end of next year with pricing already locked in. That provides a level of multi-quarter visibility that Micron is generally not able to provide and just goes to show how robust demand for this product currently is. That has a lot to do with HBM3E delivering a 20% power consumption and 50% memory capacity lead over everyone else in the space. It’s already working on the next iteration of this product called HBM4, which it’s confident will maintain sector performance leads. Shipments there will ramp in 2026. Finally, HBM4E will come after HBM4. This will introduce “logic customization” to offer more granular HBM services for different needs. Notably, it’s producing this in partnership with TSMC rather than purely in-house and thinks the added value will improve pricing power for the product line.

To support new HBM products, its extreme ultraviolet (EUV) lithography scaling is going well. This will ramp throughout 2025 and enable Micron to create more miniscule circuit patterns to pack more performance and density into one chip. This could also turn into a margin tailwind once the new technology is ramped, as EUV can potentially boost yields. This should supplant some usage of its currently most advanced production (or node) process called 1-beta.

All in all, Micron now sees the HBM market growing from $16 billion this year to over $100 billion in 2030. For fiscal year 2025, it expects “multiple billions” in overall HBM revenue.

- Its newest data center SSDs were selected as a “recommended vendor” for Nvidia’s Grace-Blackwell system, thanks to 34% throughput and 80% energy advantages vs. the competition.

- The 6550 ION SSD (purpose built for GenAI and high-performance compute) delivers 60% performance and 67% density advantages vs. the competition.

Mobile DRAM Demand:

Outside of data center demand, its mobile business is performing about as expected. 2024 volumes are tracking to its ~5% Y/Y growth expectation, and it expects that to slow to closer to ~3% Y/Y next year. It sees inventory dynamics here playing out as expected and thinks overall shipment volume in 2025 will be weighted towards the second half of the year.

Other Demand Buckets:

Within personal computing (PC), the refresh cycle is going more slowly than expected. It revised its PC volume guidance to roughly 0% for 2024. It sees Windows 10 refreshes later in 2025 creating renewed growth for the bucket. Micron thinks PC volume for 2025 as a whole will grow by around 5% Y/Y, with growth 2nd half-weighted like for mobile.

In automotive, disappointing sector sales and a shift to lower-priced, non-electric cars have led to demand headwinds there. It sees this as a temporary blip, as things like autonomous driving programs rely on vast sums of HBM and storage.

NAND Growth Story:

Micron envisions data center demand for NAND SSDs becoming more popular for replacing HDDs, which should create an “inflection in long-term NAND demand growth.”

Manufacturing News:

- Completed its deal with the U.S. Department of Commerce for $6.1 billion in subsidies to support its Idaho and New York fabs.

- “Entered into a preliminary agreement” with the U.S. Department of Commerce for another $275 million for its Virginia facility.

- Completed plans with the Singapore government to boost its production capacity there with new HBM facilities coming. This will “support AI demand and will be synergistic” with its non-AI production there.

Cost Advantages:

Cost reductions in 2024 have played out as expected, and it sees DRAM and NAND cost reductions for 2025 coming in at roughly 8% and 13%, respectively. Both represent reiterations of previous targets.

e. Take

Fine quarter. Its GenAI-related products are ramping nicely, while the lower growth revenue segments were a bit weaker than expected. Micron is another case of “how long do you think the GenAI infrastructure boom is going to last?” If the answer is years instead of quarters, this should do very well. King Nvidia readily leans on it for its HBM products and the demand runway there is capable of carrying the entire company… if it’s as durable as Micron and other industry players think. At the same time, when this boom eventually ends, this will likely go back to a purely cyclical vendor of commoditized memory and storage products. It will go back to years of negative growth and margin contraction, followed by years of rebounds… with the cycle churning over & over again.

3. When to Trim & Sell — Highly Opinionated Portfolio Management Piece

As Fed policy flips to dovish, disinflationary trends continue and we remain firmly in full employment territory, things have gotten fun. High fliers have doubled and even tripled in the span of a few months and pockets of the market have certainly gotten more expensive. When the fun parts of cycles unfold, the predominant questions shift from “when do I add” to “when do I trim or exit positions entirely?” In reality, there’s no one-size-fits-all approach here, as these moves depend on our own approach, risk tolerance and near-term need for liquidity. We’re all different. But while this isn’t a perfectly uniform science, I do have rules that I use to guide my decision-making process and I’ll explore them here. We will split this section into trimming decisions and exiting decisions, as I consider those separate ideas.

Trimming/Adding:

When something gets overly expensive and valuations rise, that always means risk/reward is deteriorating to a certain extent. As companies are rewarded for their success via higher share prices, the views of what future success looks like brighten. When all of the good is finally priced in, incremental positive headlines are mysteriously shrugged off and anything disappointing or even in-line is severely punished. We can’t possibly know if things are fully priced and local tops are in, but we can gauge shareholder optimism and future expectations. When I feel assumptions becoming overzealous and valuation multiples getting ahead of themselves, I tend to lighten up on exposure and harvest some profits. Generally speaking, these trims usually range from 5%-20% of a position, depending on how aggressive the valuation multiple expansion has been and how lofty that multiple has become.

But what does “expensive" mean?” Within my approach, it obviously has a lot to do with forward valuation multiples. But that’s not the only important ingredient. The rate of expected profit growth matters a lot, as companies can more easily grow into lofty price tags if the bottom line is expanding rapidly. Finally, the direction of estimate revisions also matters dearly to me when classifying something as “cheap” or “expensive.” Why? Because If analysts are constantly revising numbers higher, forward multiples and PEGs will likely turn out to be cheaper than they seem. And the opposite is true as well. If a share price rose, but earnings expectations rose more… that company got cheaper in my mind and vice versa. Follow the estimates! My process has nothing to do with share price and less to do with headline P/E than most traditional frameworks.

To capture all of the variables that I emphasize in trim decisions, I enthusiastically embrace Peter Lynch’s PEG ratio ideology. PEG ratios measure P/E divided by rate of expected profit growth; I tweak this formula (like in section one) by using multi-year profit CAGRs instead of one year of data. This makes the reading more structural and less prone to over-focusing on short-term results. PEGs appropriately reward growth to help us better understand if harsh share price volatility is actually warranted. As an overly generalized rule of thumb, anything below 1.0x is considered cheap, 1.0x-1.5x is considered fairly priced and anything above that is considered expensive.

A rising/falling share price does not mean something is getting more/less expensive and does not mean risk/reward is drastically changing. Let’s explore some examples to see why:

Let’s start with SoFi. The stock went from $5/share to $15/share while remaining “cheap” in my mind despite trading for 74x forward EPS. Why? Because its expected rate of multi-year profit compounding is around 90%, putting the PEG ratio at a still compelling 0.8x. The stock more than tripled, but the valuation went from stupidly cheap to cheap, so I’ve held the vast majority of my shares through the gains. Furthermore, rising estimates throughout that time have helped offset some of the P/E and PEG-level multiple expansion to keep this thing cheap. These rising estimates (which are still far below management’s expectations) also give me more confidence in current assumptions being fair or pessimistic, if anything.

Meta offers us another interesting example. One year ago, it traded for $340 with $14.00 in 2024 earnings and $17.50 in 2025 earnings expected. This put it at 24x earnings and a PEG ratio of 0.96x. The stock has nearly doubled to $600/share today, but did the valuation also nearly double and push the PEG to an expensive 2x? No. Why? Because estimate revisions have been explosively positive. Meta will end up earning $22.60 this year, not $14. It’s also expected to earn $25.40 for 2025 (not $17.50) and nearly $30 for 2026. So? The stock exploded, yet the forward multiple stayed at 24x and the PEG has stayed at a more modest level of 1.3x. This led me to hold my shares and not consider trimming at all.

Ok so when is it actually time to trim? When share price appreciation is driven by multiple expansion for names that were already fairly valued or expensive. It’s when valuations stretch from fair to somewhat greedy.

Let’s consider Shopify as a different example. From February to August of this year, Shopify fell from $90/share to $50/share. During that time, Shopify’s forward profit estimates did not budge. Its PE went from 90x to 50x and its PEG went from 2.6x to 1.5x. It’s an elite company in my mind, yet the PEG equated it to an average competitor. So? I pounced. The exact opposite has unfolded since August. The stock is up about 120% from then to today, while 2024 profit estimates rose by 33% (2025 estimates by about 10%). This paved the way for significant PEG ratio expansion, and so I lightened up on my shares. I am not a trader, but I will readily and opportunistically react when forward multiples fluctuate this violently. This worked out especially well and that’s not always going to happen. I accept that. I will sell things that go higher in the near-term and buy things that go lower. I am not trying to time local tops or bottoms… I can’t… I am just reacting to materially fluctuating risk/reward.