Welcome to the 328 new readers who joined us this week. We’re delighted to have you as subscribers & determined to provide as much value & objectivity as possible.

1. Uber (UBER) -- New Position

Whether it’s “to Venmo,” “to Instagram,” “to Google” or “to Airbnb” I love investing in verbs. That level of organic familiarity breeds a combination of seamless growth & brisk operating leverage. That tandem often paves the way for compelling shareholder returns. And along those lines, I’m ready to add another verb to the portfolio: To Uber. I added this transportation and ride sharing juggernaut to my portfolio this past week.

Impressive Operating Leverage:

For the last two quarters, while countless large caps have seen material margin contraction and a halting of demand growth, Uber has not. Most recently, it improved YoY GAAP operating margin by 790 basis points to -1.6% with 2230 bps of improvement coming over the last 3 years. Over that time, its EBITDA margin has rocketed from -15% to 7.7%.

And for 2023, it guided to more margin expansion while expecting a positive inflection of its GAAP operating margin once and for all. Margins continue to expand far faster than anyone had hoped, and I do not believe analysts have finished adjusting estimates higher given all of the inefficiencies current leadership has been able to address. Where is all of this leverage coming from? A few places:

The company’s founder -- Travis Kalanick -- had a “buy revenue at all costs” leadership style. His company was born when VC dollars were flowing and he could easily fund losses with more and more capital raises. It was about revenue, market share and brand power. “Profit” did not enter the vocabulary. So Uber grew.

The company was able to effectively and rapidly scale with putrid margins and achieve a point where it enjoyed leading market share positions across several of its key markets. Uber rapidly gained brand ubiquity and facilitated transportation disruption, but it needed an operator to come in and run things more rationally. Enter former IAC CFO and Expedia CEO Dara Khosrowshahi.

Kalanick was fully out of the picture as of 2018. At that time, Dara embarked on a series of cost controls, investments in tech and automation and revamping of the organization structure to make Uber a leaner, healthier company. He ended speculative scooter and bike-sharing segments, vastly cut investments in autonomous freight and consolidated most of Uber’s core services into one umbrella. He ended Uber’s autonomous ride sharing R&D and restarted the program with a more reasonable approach through partnerships with Motional (Hyondai) and Nuro. He focused on the core business and making Uber the best place for drivers to invest their time.

These changes took years to unravel the ridiculous cost structure Uber had amassed. But now, with the investments finally taking hold, Dara thinks the company has “clearly separated itself from competitors on driver and consumer preference.” Considering that its U.S. market share set a 6 year high last quarter on higher margins, I’d have to agree.

Travis Gets a Little Credit Too:

Travis got them to a point of market control. Economies of scale are the key differentiator amid ride sharing. There’s nothing unique today about being able to call a car from your phone. What is unique is the luxury of being the biggest. This allows Uber to profitably afford driver incentives, lower ride rates and cut wait times to maintain a motivated driver fleet, happy customers and domination. Pricing competition will continue to intensify here as Lyft and local taxi services try to take back share. Leveraging its economies of scale is how Uber can stay the most profitable in the space while effectively competing for supply and demand.

While Uber is far from Amazon’s or Walmart’s scale, I think the comparison is still relevant:

It would take years and wildly deep pockets just to try to rival the footprint that those two retailers have built. And the low margin nature of the business makes this effort significantly less appealing. That lack of appeal serves as a sort of competitive moat for both companies. Similarly, Uber’s dominant and growing share of the ultra-low margin transportation business is the beginning of this same competitive advantage. Why not build another Amazon? Well… because the probability of success is quite low and the upfront costs unbearable. The same can be said for Uber.

Quantitative:

Despite all of the cost rationalization, FX and macro headwinds, Uber continues to find demand. Its gross bookings are growing at a 3-year compounded annual growth rate (CAGR) of 19.3% and revenue at a 3-year CAGR of 28.4%. That revenue compounding will slow, but should stay at or above 15% for the foreseeable future in my view.

Considering this, Uber is expected to compound earnings and cash flow (FCF) above 60% for the next 3 years. When pairing that with its 33X forward earnings multiple, there’s a lot to like about the investment at today’s price.

Assume that Uber’s revenues only compound at 12% for the next 3 years and profit only 40%. Under this scenario, that puts them at $1.88 in 2025 earnings or 17X 2025 earnings and a sub 0.5X price to earnings to growth (PEG) ratio. Just getting that PEG ratio up to a still cheap 0.8X would mean compounded returns of roughly 20%. Again, assuming a below market PEG ratio and disappointing growth.

Balance Sheet:

- $4.3 billion in unrestricted cash, equivalents & short-term investments vs. $4.21B YoY. Another $4.1 billion in restricted cash & equivalents.

- $4.4 billion in investments vs. $11.8 billion YoY.

- $9.27B in long term debt.

- Basic share count grew 3% YoY; diluted share count grew 2.7% YoY.

- Stock comp was 5.6% of revenue in 2022 vs. 6.7% YoY. Free cash flow here is not getting much of a boost from stock comp compared to most growth companies.

Risks:

Macro likely will be a headwind for ride-sharing growth, but won’t halt it. U.S. Government data from 2008 shows ride-sharing continued to grow through that recession at a slower rate. This recession should be more mild. Furthermore, Uber leadership actually sees the turbulence being a net benefit to its business. Why? It goes back to how early Uber was on cost rationalization. Its margin structure and leverage trends are now far healthier than Lyft’s while the smaller competitor is now merely beginning to implement its own operational shifts to stay competitive. Uber, conversely, can keep its foot on the gas pedal thanks to how well leadership handled the last 3 years.

So what are the most pressing risks? There are three that I see. The first is Uber maintaining its dominant share lead over the long term as fleets shift from driver-operated to autonomous. Tesla, Google and many others will all try to compete here in some capacity and that is certainly more threatening than needing to beat Lyft. The Hyundai partnership is an encouraging sign that Uber understands the risk and is addressing it in a disciplined, asset-light, partner-first manner.

The second major risk is that previous legal battles on treating drivers as contractors vs. employees could resurface. The company has done a wonderful job appeasing regulators, but politicians are not always rational or consistent and could easily make things tougher on Uber’s model.

Finally, individual drivers are not predictable. It is vulnerable to the occasional bad actor creating unsafe conditions for riders and its brand is vulnerable to that reality too. Safety is paramount to success and massive scale makes it complicated to constantly implement.

What’s Next:

Uber continues to focus on making its drivers and riders happy. Their satisfaction is the very basis of Uber’s success. Recently, products like “Upfront Fares” have boosted completed trip rates in the U.S. by 4% with unfulfilled trip rates in the U.K. falling by 23%. This means happier drivers wasting less time and earning more money. This also means less sticker shock for consumers. Small product tweaks like these will continue to be a priority

While Dara did end several speculative product expansions in 2018, Uber has since restarted that drive in a much slower, fiscally responsible way. New mobility products like car rentals and pre-bookings grew over 100% YoY and now represent 10% of its total mobility bookings as of last quarter. Its newer advertising business is also on track to reach $1 billion in high margin revenue by 2024. This implies 100% growth expected in 2023.

But perhaps the most exciting evolution of Uber’s business model is the growing contribution from its subscription business -- Uber One. Membership here grew 100% YoY last quarter to reach 12 million with those members accounting for 25% of ALL Uber bookings. Subscription revenue is innately higher quality than solely usage based due to the enhanced visibility and lower marketing spend to keep customers retained.

Specifically, members get an average of $27 in savings per month while churning 15% less frequently and 4Xing the lifetime value contribution to Uber. By securing more consistent utilization via its subscription perks, Uber becomes more efficient and more valuable to its members (and drivers).

I’m confident that all ride-share and delivery businesses will eventually embrace this approach as well. It’s the only way to ensure sufficient retention amid a sea of intense competition. Importantly however, I think Uber is the best positioned to thrive due to the product diversification in its model. This is not just a delivery company like DoorDash, not just a car rental firm like Enterprise and not just a ride sharing firm like Lyft. It’s all of the above. This added cross-selling opportunity without added marketing expenses will mean Uber can pass on more utility-building savings to its subscribers than can stand-alone companies with just 1 or 2 products. It can extract more lifetime value (LTV) with less customer acquisition cost (CAC).

Plan:

I’m comfortable making this a core holding. I started by investing 2.5% of my overall funds into the name this past week. I plan to hopefully allocate another 2.5%-3.5% over time depending on how Uber’s valuation and execution trends.

Uber News from the Week:

Uber signed a new agreement with Tata Motors in India to add 25,000 new electric vehicles to its fleet in that important market. Deliveries to Uber’s 1st & 3rd party fleet network will begin this month.

2. Shopify (SHOP) -- Partner Program Upgrade

Shopify is embarking on a new, multi-year project to enhance the appeal of its already thriving partner program. Considering these partners provide niche, yet key use cases to round out Shopify’s offering, and considering they serve as a strong channel of new business referrals -- keeping them happy is paramount. The program will be rolled out in phases and will focus on “exceptional rewards, skills building and a simplified, engaging partner experience.” It will double the referral revenue share incentives and take a more hands-on approach to closing those referrals through direct selling. Win, win.

Shopify will also debut its first skills certification program. This will allow partners to stand out with graduation badges while they try to attract new business to Shopify and to stay proficient amid its rapid pace of innovation. This is an extension of its system integrator (SI) program and agreement with EY to partner and train 500 of their workers on Shopify’s product suite.

It continues to focus on becoming a more lucrative partner to work with and an easier vendor for merchant on-boarding.

3. Lemonade (LMND) -- Q4 2022 Earnings Review:

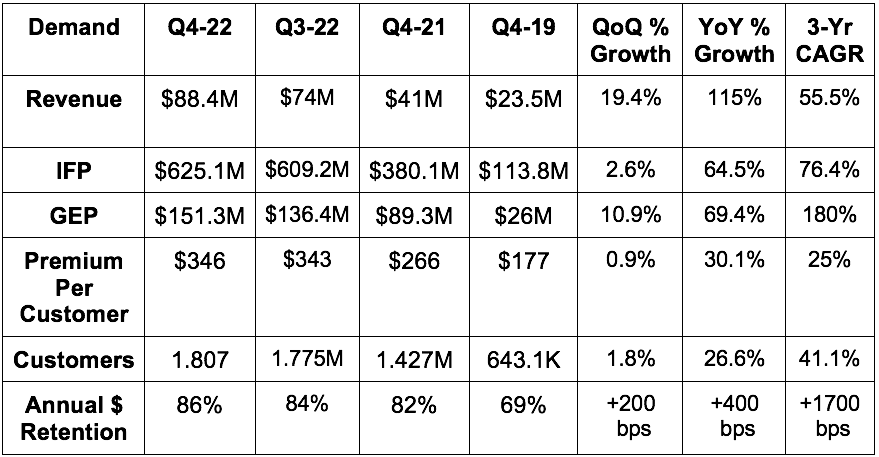

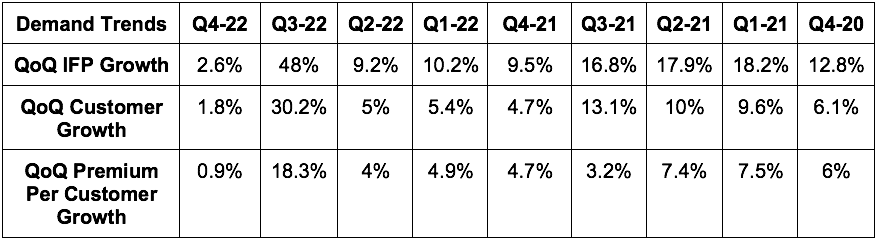

a. Demand

- Beat In Force Premium (IFP) guidance by 1.9%.

- Beat Gross Earned Premium (GEP) guidance by 1.9%.

- Beat revenue guidance by 12.6%.

More Demand Context:

- Reduced ceded premium proportion from 72% to 58% YoY. This aided revenue growth as ceded premiums can’t be recognized as revenue. Growth (including inorganic) would have been 70% without this bump.

- IFP growth ex-Metromile acquisition was 38%.

- Metromile is the source of the premium per customer growth.

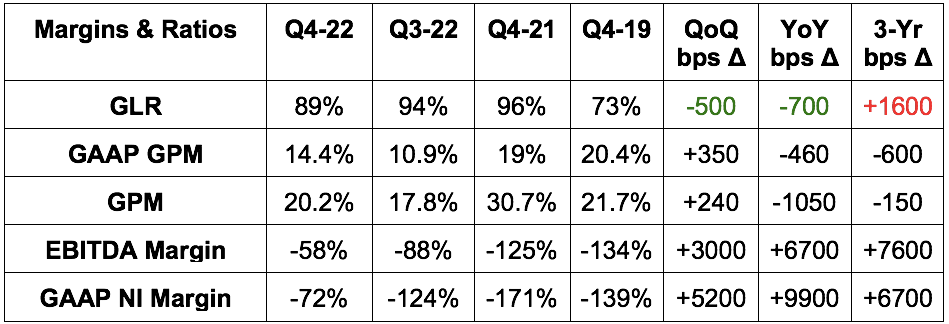

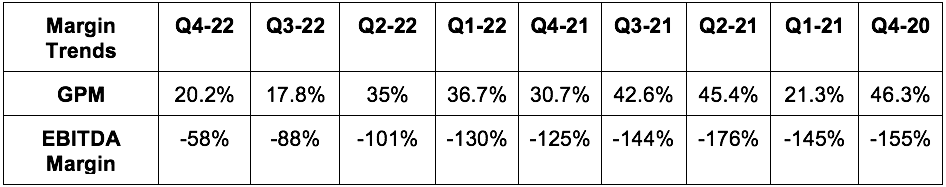

b. Profitability

- Beat EBITDA estimates by 17.3% & beat its loss guide by 18.6%. This marks the continuation of sequential dollar loss improvements as management promised.

- Beat GAAP EBIT estimates by 15.3%.

- Beat $1.21 loss per share estimates by $0.28.

More Margin Context:

- Operating expenses ex-loss adjustment expense rose 12.4% YoY. This was due to Metromile M&A. OpEx would have fallen 5.3% YoY without this inorganic impact.

- Sales & marketing expenses fell $10 million YoY as it prioritizes leverage over growth.

- Outperforming marketing efficiency helped facilitate the large EBITDA beat.

- Growth marketing as a percent of sales & marketing cost fell from 70% to 55% YoY as it pulls back on pursuit of new business.

c. Balance Sheet

- Lemonade has $1.04 billion in cash & equivalents on the balance sheet. That gives it 4+ years of cash runway at the current burn rate. It has no debt.

- Stock comp was 17.7% of sales vs. 32.6% YoY. Great progress here.

- Continues to selectively hire at a slower pace than previous years. Headcount grew 22% YoY but was flat ex-Metromile M&A.

d. 2023 Guidance

Lemonade guided to 47.2% YoY 2023 revenue growth (including inorganic) or $377 million. This missed estimates by 2.4% which actually is not what bothered me about guidance. Lemonade told us that they’re letting unprofitable plans roll-off while waiting for rate change requests to be approved to make that business rational to pursue. They’re also limiting new originations until these updates take effect. That’s the growth headwind for now and why it only expects 11.5% 2023 IFP growth vs. the 20-25% long term target it offered a few months ago. No issues on this miss from me. They’re just waiting.

EBITDA missed by 2.3% for an average quarterly loss of $60.6 million and -$242.5 million total for 2023. That represents a quarterly loss average about 20% larger than Q4 2022. Leadership told us Q3 2022 losses would be the peak “and improve thereafter.” This is “thereafter” and losses are not continuing to improve. Maybe it’s a victim of how well EBITDA losses came in for Q4 2022, but I still found this to be underwhelming. It’s still technically within that peak loss range, but it’s dangerously close to eclipsing it and the pace of loss reductions throughout 2023 will be gradual at best.

Furthermore, if it’s pulling back on growth spend until rate changes take effect, I think that should coincide with better EBITDA progress considering sales & marketing is its largest expense bucket. Even with Metromile, this should be the case considering we were told Metromile OpEx would replace much of the Lemonade auto OpEx it had already planned pre-purchase. Perhaps I’m being unfair to the team, but I expected better. Maybe it’s just sandbagging.

“As always, we’ve set our guidance in a way that we believe we can achieve… The guide reflects conservatism.” -- CFO Tim Bixby

e. Shareholder Letter

On Loss Ratios:

- Most Lemonade rate change approvals have not yet come. As they do, loss ratios are expected to continue improving.

- This is especially hitting profits in their pet policies which it’s pulling back on the most sharply for now.

- Winter Storm Elliott added about 400 bps to its loss ratios during the quarter. Its Net Promoter Score (NPS) on these storm claims was a robust +71 -- consistent with the rest of its business and well ahead of competition.

- All product loss ratios improved QoQ & YoY.

On Annual Dollar Retention (ADR):

- ADR improved to 86% from 82% YoY.

- In Illinois -- where it has had all products live for at least a year -- it saw 95% ADR vs. 87% YoY as a sign of continued product introduction boosting ADR.

CEO Daniel Schreiber on Upcoming Reinsurance Contract Renewals:

“Reinsurance prices have become tighter. Our need for reinsurance has declined as the business has grown and diversified. When we signed our agreements 3 years ago, we were a mono-line business really in 1 country. We've now got 5 lines, 4 that we're underwriting, and we're in 4 countries. So that kind of diversification helps a great deal. So we are looking at a series of options in front of us given the cost of reinsurance… Hopefully, by this time next quarter, we'll have greater clarity.”

f. My Take

While some think I’m being unfairly hard on Lemonade, I still view its EBITDA guide for 2023 as bad for the reasons explained in the guidance section.

The inconsistent and slow EBITDA loss progress makes my previously assumed path to profitability (breaking positive some time in calendar 2025) now too optimistic. Thanks to the sheer size of Lemonade’s cash position, this is not a deal-breaker. Still, it is a yellow flag and merits consideration in the same ultra-speculative light that I view Nanox and Upstart. As such, it doesn’t deserve more than 1% of my investment funds at this time. So? I trimmed about half of the position on Thursday and I have no plans to trim further unless the situation deteriorates further. I also have no plans to add until there is meaningful improvement in the financials. I hope to resume adding when or if that happens.

4. PayPal Holdings (PYPL) -- Venture Investment

PayPal and Galaxy Digital together spearheaded a $20 million fundraising round for a company called Chaos Labs. This company focuses on automating crypto security and lengthens a string of crypto-based venture investments PayPal has made in the last couple years.

5. Meta Platforms (META) -- Meta Verified & Miscellaneous

a) Meta Verified

Last weekend, Mark Zuckerberg took to Facebook to announce a new product called “Meta Verified”. This is essentially Twitter Blue’s verification subscription service on Meta’s apps. The tool will offer account verification and direct customer support along with broader placement amid search, comment and recommendation algorithms. It will cost $14.99 on iOS and $11.99 on the web which mimics Twitter’s pricing strategy as a move to blunt the impact of Apple’s hefty app store take rate. In terms of use cases, I think it’s easy to see how verification could aid entrepreneurs on its shops and marketplace products and raise buyer confidence and conversion. I also think Instagram influencers will go gaga over this superficial status symbol.

I love this move. Assuming just 0.2% of Facebook monthly active users convert (half of what Bank of America expects) this could generate about $1 billion in what will surely be extremely high margin revenue. Assuming a 70% EBIT margin on the revenue, which I don’t see as overly aggressive, it equates to 2.2% of the company’s overall 2023 EBIT. Not a massive boost, but still sizable with pessimistic assumptions. Every billion helps.

b) Other News

- Tencent and Meta are working on a partnership to sell Oculus hardware in China. Maybe this is why Tencent ended its own VR hardware investments.

- Meta will conduct another round of layoffs this year to control costs.

- BlackRock launched a Metaverse ETF.

- The FTC will allow Meta to purchase “Within Media” (VR fitness studio) for $400 million. Quick! Get it closed before they change their minds.

- Meta debuted a new language machine learning algorithm (called Large Language Model Meta AI or “LLaMA”) to augment professional research.

- Sean Avery on Twitter published some encouraging data showing Facebook saw 12% hours engaged growth in January 2023 with Instagram at 8% YoY growth and TikTok flat YoY. Instagram outperformed TikTok on a month over month growth basis while Facebook performed in-line.

6. Revolve Group (RVLV) -- Q4 2022 Earnings Review

“While the macro-environment has become more challenging in recent quarters, we have moved quickly and made progress in balancing our inventory investments while continuing to deliver profitable growth that truly stands out within our sector. With our technology and data-driven culture, financial discipline, operational excellence and innovative team, we believe we are well positioned to continue to take market share." -- Co-CEO/Co-Founder Mike Karanikolas

a. Demand

Revolve comfortably beat revenue estimates by 7.8%.

More Demand Context:

- Added 90,000 customers vs. 80,000 QoQ.

- Revolve’s bread & butter is “going out” attire and live event marketing. So? The pandemic was a large headwind to its business. That’s why Q4 2020 revenue growth was negative. That’s also why this 20% compounder grew sales by 70.3% in Q4 2021 as those headwinds abated. That made this quarter arguably its toughest YoY comp quarter ever.

- Revenue rose 24% YoY in 2023 as a whole.

b. Profitability

- Missed gross margin estimates by 130 bps and missed its guide by 140 bps.

- Beat adjusted EBITDA estimates by 17.5%.

- Beat GAAP EBIT estimates by 12.1%.

- Beat $0.10 GAAP earnings per share (EPS) estimates by $0.01.

- Sharply missed FCF estimates of $26.9 million by $39.2 million.

More Margin Context:

- Gross margin contracted YoY because markdowns rose as it works through excess inventory. Its % of sales at full price remains above pre-pandemic levels but fell from a record of 87% in 2021 to 85% in 2022 (79% in 2019). Rising YoY return rates as dresses normalize as a percent of its sales also hits GPM.

- Gross margin for 2022 was 53.8% vs. 55% in 2021.

- FCF miss via inventory build (counts as cash burn) and a 23% tax rate vs. 5% YoY.

- 2022 net income fell 40% YoY. This is due to:

- Aforementioned gross margin headwinds

- The company over-earning in 2021 and normalizing marketing, fulfillment and other operating expenses.

- Fuel surcharges that rose 70% vs. the YoY period.

- Paying out $18 million in 2022 taxes vs. $4.8 million YoY. Normalizing for that tax difference would have meant -28% YoY growth.

“We have very few adjustments to our adjusted EBITDA versus a lot of companies out there.” -- Co-Founder/Co-CEO Michael Mente

c) Balance Sheet

- $234.7 million in cash & equivalents.

- $0 debt.

- Stock comp was under 1% of sales as it continues to be extremely kind to shareholders here. Considering the founders own 45% of the company, this makes sense.

- Inventory rose 26% YoY to $215.2 million and rose 1% QoQ. It “believes it is making good progress here to adjust to the dynamic demand environment.” Leadership told us it will have inventory fully rebalanced and normalized by the end of Q2. It also told us that inventory was $195 million as of the end of January as it continues to make good progress here.

d) Guidance

Revolve didn’t offer any concrete guidance. It did, however, tell us that quarter to date sales growth was in the mid-single digit range YoY. This is far better than the -2.3% YoY growth analysts were expecting for the full quarter. It did tell us that this growth could slow further in March, but this was still much better than the quarter to date consensus. Great news.

Other rough guidance outlines:

- “Significantly higher 2023 free cash flow” vs. 2022 as the inventory build reverts.

- Accelerating revenue growth throughout the year.

- Average order value growth to slow to 2%-5% YoY.

- Gross margin to bottom in Q1 2023 at 49.5% and be 52.5% for the full year 2023.

“New customer growth remains healthy YoY.” -- Co-Founder/Co-CEO Michael Mente

“Our team is exploring ways to leverage our technology to be even more efficient in 2023 and beyond. If these efforts prove successful, we could drive greater efficiency in our cost structure and implied by our outlook. To highlight one example: We are exploring a multi-million dollar opportunity to reduce shipping costs by consolidating returns from larger international regions. In some cases, we can hold international returns in-country and fulfill orders from them locally without returning the items to the U.S.” -- CFO Jesse Timermanns

e) Call & Release Highlights

On Outperformance:

“Results continue to outperform industry peers and our most relevant benchmarks -- further extending our market share gains… Our growth, profitability and strong balance sheet allow us to continue to prudently invest in long term growth while others are forced to play defense.” -- Co-Founder/Co-CEO Michael Mente

Leadership credited this outperformance in both profit and growth amid next-gen e-commerce vendors to its “core competitive advantages.” In its view, these include its vertically integrated tech stack, data driven inventory systems and operational excellence. While that’s very abstract, share gains aren’t.

Going Global:

- Revolve prices in US$ so foreign exchange makes its goods more expensive for international customers. Especially in Europe, this hurt demand in the quarter. Strength in Canada and other emerging markets offset this weakness to deliver 1% YoY international revenue growth vs. 9% growth in the U.S.

- Launched a new store in India through a Nykaa Fashion Marketplace partnership for localized returns and free shipping in the country.

- China is a key international market and the end of the pandemic lock downs could be a nice tailwind there in 2023.

- Revolve is exploring launching small fulfillment centers in important international geographies to improve delivery times and lower cost to fulfill.

On Margin Tailwinds & Lean Operations:

- January marked the beginning of order shipping from its new East Coast fulfillment center. This is expected to cut overall transportation costs and shrink delivery windows.