If you enjoy reading this, please feel free to share it wherever you’d like.

1. Upstart (UPST) — My Interview with KBRA Senior Managing Director and Head of Consumer ABS Eric Neglia

a. On why a few of Upstart’s most recent capital market transactions are not beating Kroll base case CNL expectations:

“KBRA started working with Upstart while they were in the early stages of developing their credit scoring models. Given the limited performance data available at that time, we built conservatism into our CNL assumptions. As more performance data became available over time and the company developed an operational track record, we lowered our loss expectations to be more in line with that data.”

(Note: lower loss expectations are a good thing)

When firms feature little data to prove efficacy, Kroll takes a cautious approach to base case assumptions (like it should). As a newer company proves itself, these layers of conservatism are removed to reflect a more data-driven expectation. This process played out with Upstart and is why its newest transactions aren’t outperforming KBRA CNL base case assumptions by such wide margins like before. This is a matter of KBRA estimates becoming more data-driven and accurate, not a matter of Upstart’s loan underwriting abilities deteriorating.

“We want our base case CNL assumptions to accurately estimate the lifetime net losses of a collateral pool. Since Upstart’s AI credit models weren’t in place long enough to show performance data through the life of a loan or through full economic cycles, KBRA supplemented that data with proxy performance data for comparable consumer loan and marketplace lending programs to help derive and validate our base case loss assumptions.”

These proxies are actively being phased out of KBRA’s modeling as Upstart scales.

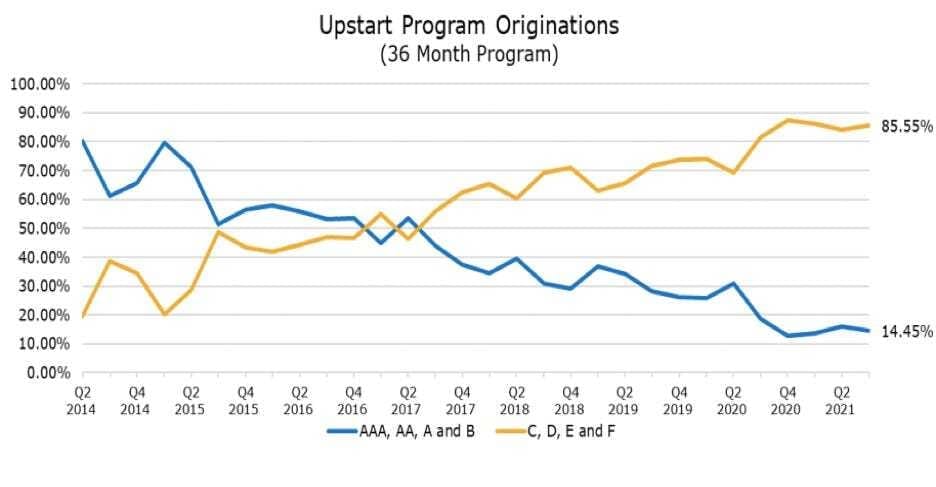

b. On Upstart’s Credit mix shift being the reason for rising delinquency:

“In Q2 2017, Upstart began shifting their program’s origination mix to include longer term loans and to borrowers with lower credit grades… Higher delinquencies and losses are expected as a result of these pool mix changes… Credit grade E & F loans represented approximately 25% of the 2020-ST3 securitization. A year later, the E & F loans represented 49% of the 2021-ST3 collateral pool balance. To account for this mix shift, KBRA’s expected closing CNL increased from 15.90% to 19.30%. Both of these transactions are performing better than KBRA’s expectations to date.”

Credit mix as the reason for rising delinquencies means lenders and loan investors are compensated via higher interest payments. He highlighted the same credit mix charts I’ve been talking about to prove his point:

“The actual performance trend against expectations is most important. If you just look at total delinquency charts all you can see is that delinquencies are rising. Delinquency rates have increased on recent securitizations, however, so have KBRA’s loss expectations due in part to pool mix changes. Nothing is outside of our expectations at this point.”

“As shown in our recent surveillance report, KBRA lowered its loss assumptions for all Upstart term securitizations during the most recent review, except for 2021-3 which is only five months seasoned, and all 2020 pass-through securitizations.”

c. On the weird macroeconomic back-drop:

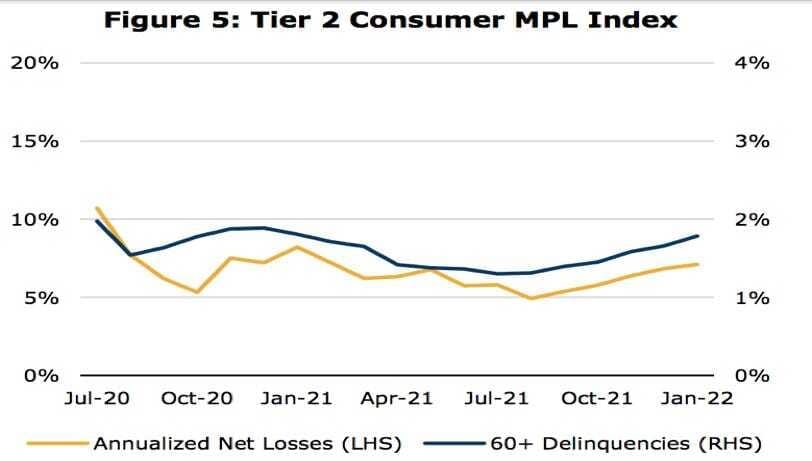

“Strong loan performance seen in consumer since mid-2020 has been influenced by a number of factors including widespread borrower assistance programs and several rounds of government stimulus. As Upstart and other platforms develop their models, it’s important for them to account for the impact of that stimulus.”

He highlighted KBRA’s consumer loan index report from January 2022 for tier 2 specifically (which is where Upstart resides) to support this point. As we can see from the image below, net losses have risen by roughly 50% from the stimulus-aided lows:

As a reminder, rising delinquency is priced into Upstart’s forward guidance (which vastly outperformed expectations).

d. On Upstart’s Performance:

“Upstart’s credit scoring model has demonstrated an ability to rank-order credit risk and predict the probability of default. To date, credit performance has generally been in line or better than KBRA’s initial expectations.”

The theme of this section of the interview was promises made, promises kept. Upstart’s bold claims are proving themselves in the results and data they’re delivering. It’s one thing to say you’re better… it’s another to show it.

Click here for my Upstart Deep Dive.

2. SoFi Technologies (SOFI) — M&A & Better Banking

a. Technisys Acquisition

SoFi is acquiring a banking technology platform called Technisys for 84 million shares of its stock representing a value of $1.1 billion based on volume weighted pricing ($890 million based on SoFi’s current price). This combined entity will create “the only end-to-end vertically integrated banking technology stack, from user interface capabilities to a customizable multi-product banking core.”

From a consumer perspective, Technisys will allow SoFi to upgrade its user experience (UX) to truly make it best in class. In recent interviews, CEO Anthony Noto has told us he thinks SoFi is close to this ambition, but not yet there. This acquisition should bring them a large step closer.

Galileo (SoFi’s business to business software provider) was already a Technisys partner as the two were actively developing a lending-as-a-service product for Galileo’s clients before the deal. That will continue. Interestingly, Technisys serves several legacy banks which marks SoFi’s accelerated entrance into that space and also serving “non-financial enterprises.”

Beyond a slicker UX, this will also allow SoFi to circumvent and pocket 3rd party servicing fees from its consumer business to enhance its unit economics further. That is due to SoFi’s plans to use Technisys’ platform to power its banking, credit and other new products (and the UX) while Galileo powers payment processing. All of SoFi’s products will be run on these two platforms by 2025. SoFi currently uses two legacy 3rd party providers for checking and savings plus an entirely separate software provider for credit. The vertical integration will save the company roughly $65 million annually (or 6.5% of its current revenue) in the years to come. In a largely commoditized banking world, cutting costs is vital as it means a company can profitably differentiate via passing savings on to the end consumer.

Galileo will also get a large boost via benefiting from bundling all of Technisys’ added utility into its offering. Technisys will be able to tap into Galileo’s elite client roster and benefit from cross-selling as well.

“We’ll have one stack for every consumer product vs. disparate stacks for each offering which is cumbersome, inefficient and expensive. The vast majority of Galileo’s partners want to offer lending, credit cards, rewards and many other products but they can’t extend their current core. Building separate cores for each new product risks the same siloed issues we see in legacy banks.” — SoFi CEO Anthony Noto

This single, internal technology core will also empower SoFi to innovate and iterate with more speed and personalization. In the company’s quest to build the industry standard for consumer digital banking and the software that powers it, this purchase greatly helped in both areas. Despite the dilution, I am a fan.

Additional Technisys notes:

- Technisys is expected to add $500-$800 million in “high margin” cumulative revenue through 2025.

- The purchase also gives Galileo an immediate presence in 16 additional countries including Chile and Brazil.

- Galileo and Technisys will practice a “joint go-to-market” approach where each’s utility is used to grow the value and reach of the other.

- Technisys is part of the Banking Industry Architecture Institute’s “Coreless Bank Initiative” to create compliant software for modern banking infrastructure. JP Morgan, Citi, Technisys & more are part of this initiative.

- Technisys is enjoying accelerating growth and will post around $70 million in 2021 sales.

- SoFi expects to generate a “mid-teens” internal rate of return (IRR) on this purchase through 2025 without considering any of the synergies expected.

- Importantly, Miguel Santos will continue as CEO of Technisys and the platform will be run under SoFi’s umbrella as an independent platform -- just like Galileo.

- Technisys has 60+ partners including legacy banks, neo-banks and non-financial firms vs. Galileo having slightly over 100. Technisys features a market place to seamlessly plug into other technology vendors like Plaid, Okta, Salesforce, several credit bureaus and more.

“With Technisys, we are acquiring a rare strategic asset that we believe is the best next-generation technology. Every multi-product financial services company — old and new — will need to transition off of older banking cores to cores like Technisys to keep pace with the rate of innovation it can provide... or risk being left behind.” — SoFi CEO Anthony Noto

b. Better Banking

SoFi has officially launched its 1% annual percentage yield (APY) checking and savings accounts. This is more than triple the rate offered by other disruptors like Robinhood.

More product features include:

- No overdraft fees.

- Limitless transfers between accounts.

- 2 day early paychecks and no fee.

- Access to Allpoint’s 55,000 ATMs.

SoFi Relay will be the singular dashboard for connecting all SoFi products and accounts into a single intuitive interface that frees these products to work “better together.”

Click here for my broad overview of SoFi (Deep Dive coming in 2022).

3. Lemonade (LMND) — Q4 2021 Earnings Review

In 18 months, Lemonade has evolved from a renter insurance company to one offering 5 different forms of insurance.

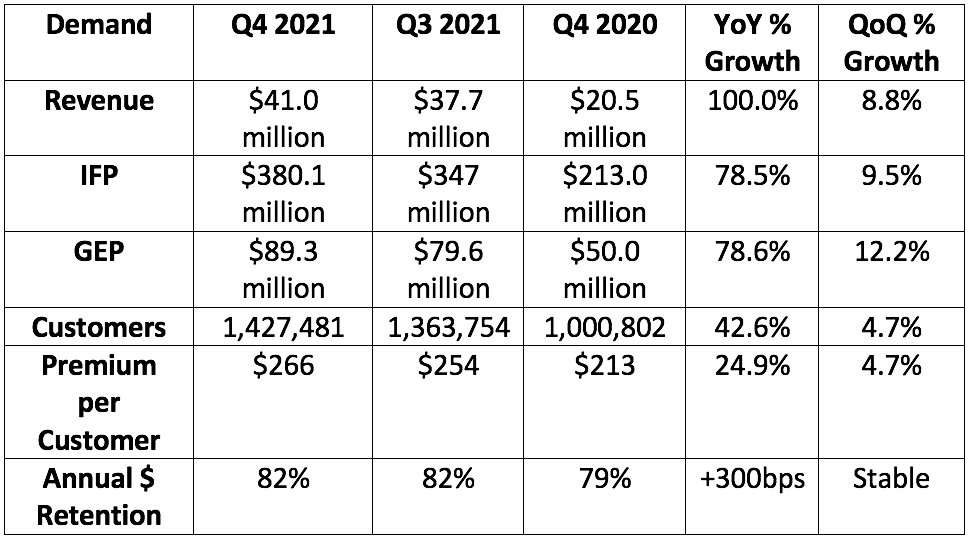

a. Demand

Lemonade guided to:

- $39.5 million in revenue with analysts expecting the same. Lemonade posted $41.0 million, beating expectations by 3.8%.

- $382 million in, In Force Premium (IFP). It posted $380.1 million, missing expectations by 0.5%.

- $88.5 million in Gross Earned Premium (GEP). It posted $89.3 million, beating expectations by 0.9%.

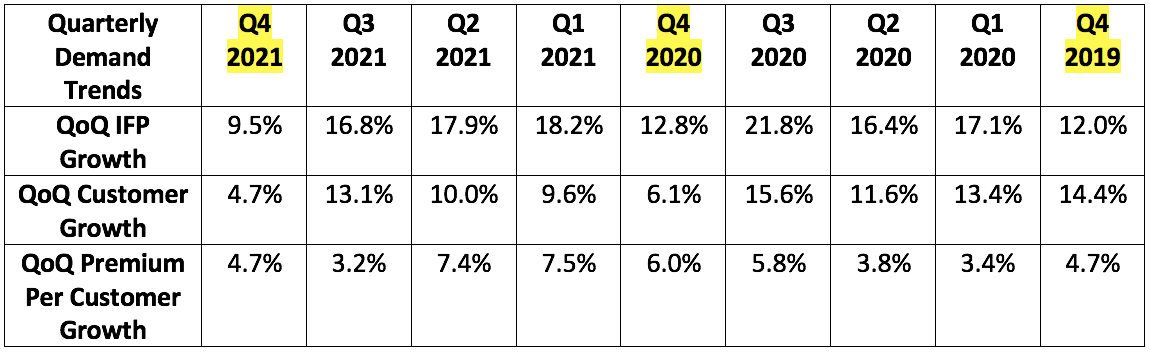

This was by far Lemonade’s most underwhelming quarter for sequential growth since it went public. Note that Q3 2020 is its strongest period of the year which did make sequential comps somewhat difficult. Still, customer and premium growth must re-accelerate for this investment case to work:

b. Profitability

Analysts were looking for Lemonade to:

- Lose $50.3 million in EBITDA. It lost $51.2 million, missing expectations by 1.7%.

- Lose $1.12 per share. It lost $1.14, missing expectations by 1.7% or $0.02.

Note that in Q3 of 2020, Lemonade conducted an accounting policy change that prevented it from recognizing premiums ceded to re-insurers as revenue which had been inflating the top line. This positively impacted adjusted gross margin as the company began dividing gross profit by an abruptly smaller number. Conversely, EBITDA margin was hit as the negative EBITDA metric was divided by an abruptly smaller number. IFP and GEP were not impacted — while revenue growth temporarily halted — which is why I used those 2 metrics for quarterly demand trends. The falling adjusted gross margin this quarter is a product of rising loss rates explained below.

c. Guide & Liquidity

Q2 2022:

- Analysts were looking for $44 million in sales. Lemonade guided to $42 million, missing expectations by 4.5%.

- Analysts were looking for -$44.6 million in EBITDA. Lemonade guided to -$67.5 million, missing expectations by 51.3%.

- Lemonade also guided to IFP of $407.5 million and GEP of $93 million. This would represent further sequential deceleration in both metrics.

2022:

- Analysts were looking for $219.3 million in sales. Lemonade guided to $203.5 million, missing expectations by 7.3%. This would represent 58.4% YoY growth.

- This guide does not include any contribution from Lemonade’s Metromile acquisition expected to close by July. KoyFin expects $74 million in 2022 Metromile revenue and Lemonade will realize roughly 50% of that this year due to the timing of the closing. Considering this, revenue estimates with Metromile included would have likely been around $240.5 million for 87.3% YoY growth.

- IFP and GEP growth including Metromile is expected to be around 70% YoY.

- Analysts were looking for an EBITDA loss of $216.2 million. Lemonade guided to an EBITDA loss of $282.5 million, missing expectations by 23.5%.

d. Notes from Co-Founder CEO Daniel Schreiber

On the stock price:

“We see our job as value creation not share price appreciation. We do not pay attention to our share price on a month to month basis. Success will reflect itself in our share price in the fullness of time but short term price fluctuations are noise that we will not credit as a signal… We have no plans for a share buyback as we have excellent investment opportunities for our cash.”

On a pivot and future profitability:

“Our largest investments are mostly behind us, or soon will be.”

Schreiber spoke on investments in recent years being predominately to debut new products required to establish the full suite of products and bundling capabilities Lemonade needed to succeed. It now feels like it has achieved a “critical mass of infrastructure” which will free it to pivot resources to harnessing this asset base.

“Investment will shift to lowering our expense ratio via automation and lowering loss ratios through AI/ML while growing LTV/CAC. In prior years, those investments took a backseat to new product launches and tech build-out and that balance will now shift… Loss and expense ratios will improve through 2022 and in the years to come.

Despite this color, it thinks it’s 2-3 quarters away from “peak losses” with 2022 being the year of max EBITDA losses. While it remains far from profitable, it sees a “clear path to profitability.” We shall see. The company reminded us that of the $1.5 billion in funds it has raised in its life, it still has 73% of that on its balance sheet. Liquidity will only be a concern if its peak loss schedule isn’t realized — it has 4 years of cash burn at its current burn rate. Several months ago, analysts expected peak EBITDA losses to come in 2021, but that has now unfortunately been pushed out.

To me, this seemed like Schreiber attempting to appease shareholders and convince us that Lemonade’s full focus on growth over profit is both the right one and also temporary. In our currently hawkish monetary climate, the growth-at-all-costs path has quickly gone out of favor.

On Lemonade vs. the competition:

- Vs. other disruptors — Lemonade is the only multi-product unified platform with all of a user’s insurance needs. This allows it to bolster LTV to justify more market share spend and allows it to avoid offloading business to competition.

- Vs. incumbents — While the platforms are often complete, incumbents lack the talents to lace automation throughout the process and to shift from proxy to precision based risk pricing.

“Winning with technology and growing with our customers have been two pillars guiding us since our inception and our experience to date has only served to strengthen the conviction that in choosing these pillars, we chose well. We enter 2022 in an enviable position having launched 4 products in 18 months. 5 years post launch, it’s clear our investments have yielded structural differences vs. the industry and sets us up very well for the next 5 years.”

On Lemonade Car being allowed to use precision pricing in larger states:

“Metromile’s largest state is California which is fine with precision pricing. New York has also become much more open to telematics in recent months and the trend line is in that direction as it increases fairness.”

e. Notes from Co-Founder/CTO Shai Wininger

Click here for my overview of Lemonade’s Metromile acquisition.

On Lemonade Car:

“This is an area where we expect to shine and outperform incumbents due to our ability to practice precision pricing.”

75% of Lemonade car customers in Illinois are bundling it with at least 1 other product and the debut period in the state has contributed 3X more revenue than Illinois’ pet debut last year.

“We have outstanding net promoter score (NPS) across our customer and claims experience groups so far.”

Lemonade considers Metromile to essentially be Lemonade Car 2.0, meaning it’s not making the investments in people and auto technology it would otherwise be making as it’s anticipating the assets from Metromile to become available. The growth coil is winding up.

Lemonade closing its Metromile acquisition will give it licensing in 48 other states as well as an ability to launch “pay-per-mile” insurance. It expects that within the year, Lemonade Car will be available to the majority of its customers. Ramping growth throughout 2022 is the product of this Metromile acquisition not closing until Q2.

On Lemonade’s Technological edge:

“Internally, we track the impact of every product we release and have a high degree of confidence that our technology delivers a transformative impact. Falling loss ratios by product is evidence of that along with 67% of our customers having fully automated experiences. The AI bot Jim handles 96% of all first claim notices with 33% of our customers having fully automated claims experiences. All of this allows us to deliver a superior experience and an NPS that is unequaled throughout the sector.”

On the loss ratio spiking, again:

Gross loss ratio worsening from 73% to 96% YoY is a product of two things:

- Older losses that were under-reserved. “We have a strong track record of cautious reserving, but it’s an imprecise science. Notably, there was no spike in our accident quarter loss ratio during the period suggesting no book deterioration.” — CFO Tim Bixby

- Business mix evolution to newer products which experience peaking loss ratios right at the beginning of their lives with falling loss ratios thereafter.

- Lemonade’s loss ratios continue to fall for every individual product, but the hyper growth of the new segments (with higher loss ratios vs. its renter product) is causing upward loss ratio pressure for its book overall. More on this mix shift in the next section.

- “We’ve seen a couple of quarters with rising loss ratios which is intentional and mainly a result of our shifting business mix mainly to home and pet.” — Co-Founder/CTO Shai Wininger

f. Notes from CFO Tim Bixby

Lemonade Pet premiums as a percentage of total IFP is “heading to 20%” vs. 15% sequentially. Renters is “just under 50%” vs. 53% sequentially and 56% six months ago. As a reminder, Lemonade will acquire $118 million in 2021 auto premiums when its Metromile purchase closes which would have made auto represent roughly 23% of Lemonade premiums in 2021 vs. basically 0% now.

“In terms of our outlook on long term, sustainable growth, we’ve never been more bullish. We’re merely scratching the surface on markets beyond renters that are several times larger.”

Rising operating expenses accelerated by:

- The Metromile acquisition.

- Car and other recent product launches (rapid headcount growth of 97% YoY).

- An LTV/CAC remaining comfortably over 2X — thus justifying more spend.

“We saw a doubling of our marketing efficiency throughout the last 3 years. With many other companies, a reliance on online acquisition made their acquisition price actually increase… that’s not happening for us. Our forward guidance expects the same efficiency going forward. We have modeled no improvement despite expecting it.”