During the week, I published a piece on SoFi that can be found below:

Table of Contents

- 1. Meta (META) – WhatsApp

- 2. Free Cash Flow Comp Sheets

- 3. Personal 2024 Reflection & 2025 Preview

- 4. DraftKings (DKNG) – New Data & a Subscription

- 5. Market Headlines

- 6. Macro Data

1. Meta (META) – WhatsApp

While North America has turned into Meta’s best growth market for WhatsApp, India is arguably the nation with the most developed opportunity. 500 million people there religiously use the app to communicate, and also do things like call an Uber or message a customer service team. It’s more of a super-app there in terms of common use cases vs. being more of a pure messaging app in the United States.

That difference creates a highly compelling opportunity for India to lead Meta’s WhatsApp monetization push. One of the most important tools Meta has to support this journey is unlocking payments services within the app. That makes all use cases more actionable, more end-to-end within the WhatsApp ecosystem and more profitable for Meta, considering inevitable transaction fees.

This week, Meta received approval for WhatsApp Pay to uncap its current 100 million user limit in India. The service can now roll out to another 400 million more users and unleashes the true potential of how financially impactful this app can be. Full speed ahead… in a gigantic, young, growing, business-friendly, USA-friendly, democratic, rapidly modernizing nation. Exciting news. We don’t quite know how material this opportunity can be, as Meta does not split out WhatsApp or India revenue. All we know is that WhatsApp click-to-message powered 48% Y/Y growth in its other revenue segment to reach 1.1% of total revenue last quarter, and we do know that payments is a big piece of effectively monetizing this app over time.

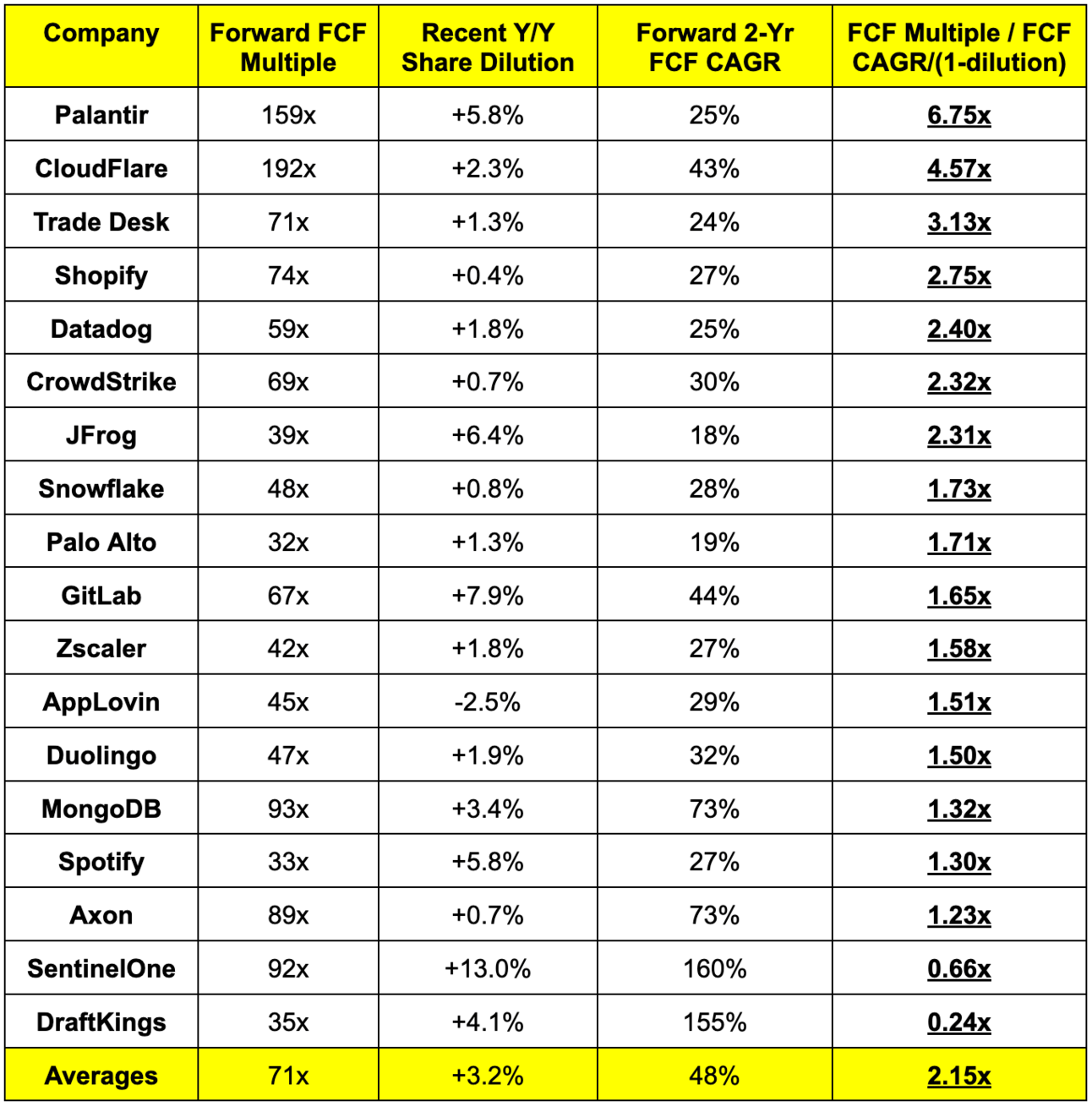

2. Free Cash Flow Comp Sheets

Free cash flow does not work well as a metric for consumer discretionary brands and companies that lend money. For the first example, free cash flow is heavily influenced by inventory fluctuations and new store opening projects. For the second example, free cash flow is essentially a byproduct of change in loan balance, where liquidating loans props up cash generation and vice versa. I don’t think including those names in this comp sheet, like I do for income statement comp sheets, is valuable or productive.

Two more notes:

- Share dilution is penalized by dividing the growth multiple by 1 - rate of dilution. It’s important to avoid ignoring this expense.

- Broadcom share count growth is being highly impacted by its purchase of VMWare.

a. Fast Growth