Table of Contents

- 1. The Trade Desk (TTD) — M&A

- 2. SoFi (SOFI) — Asset Light Lending Growth

- 3. Duolingo (DUOL) — Updates

- 4. Earnings Season Kick-Off — Big Banks

- 5. Taiwan Semi (TSM) — Earnings Review

- 6. DraftKings (DKNG) – Taxes & More Regulatory New …

- 7. Uber (UBER) – Tesla (TSLA)

- 8. Market Headlines

- 9. Macro

“Key Points” will be a new section at the top of each earnings review. After conducting detailed interviews with many of you readers, it became quite apparent that this is needed. Thank you for your feedback. Nothing else about the earnings review format is changing.

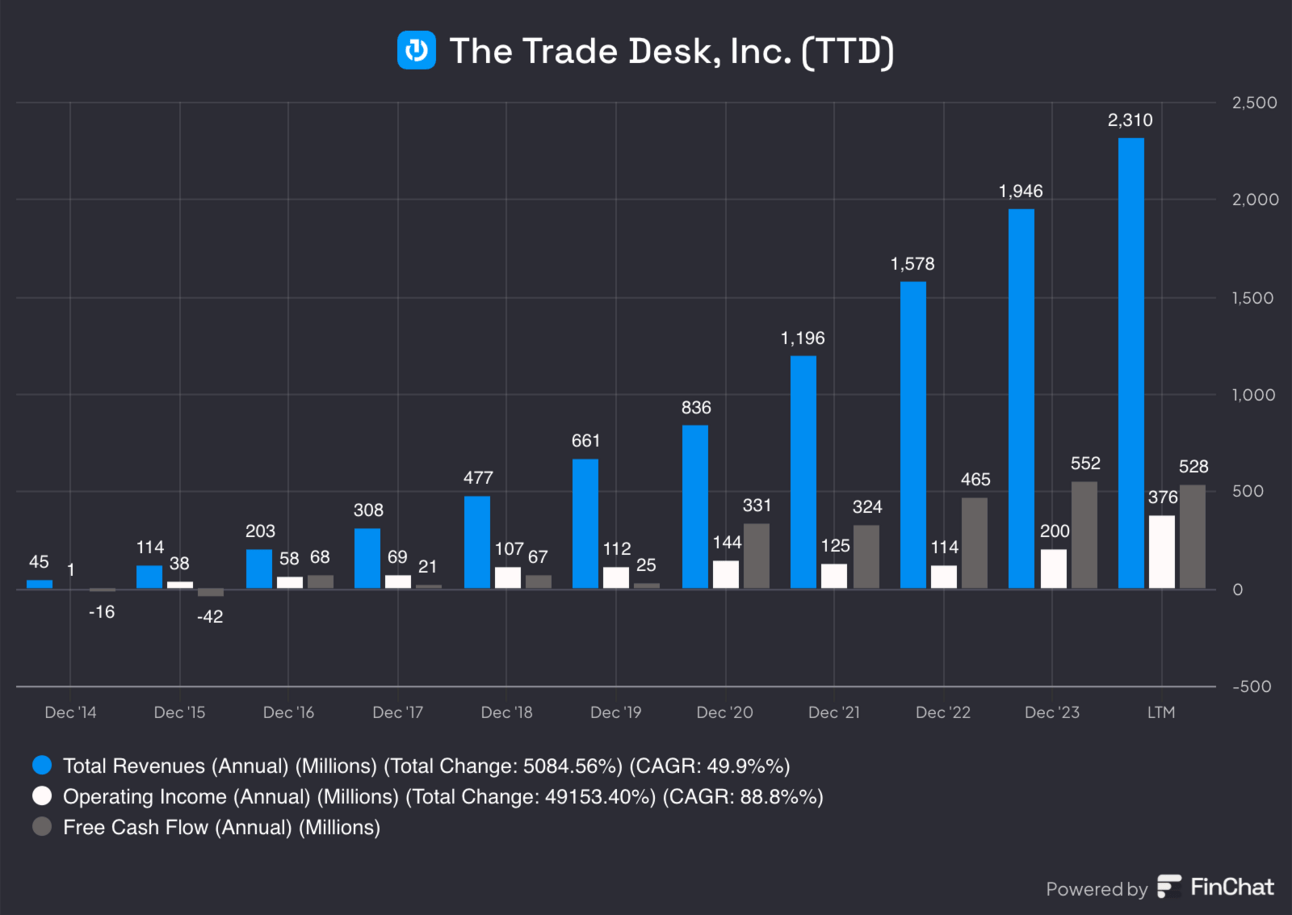

1. The Trade Desk (TTD) — M&A

The Trade Desk announced its intention to purchase Sincera. The two were already partners, and now TTD wants to own it. Sincera is an advertising data company that publishers rely on for data quality. In a world where data volume is exponentially expanding, data-driven ad buying is table stakes and using the right data is paramount, Sincera helps a lot. It sifts through and contextualizes all of this insight to help advertisers better understand who they’re marketing to, and who they should be marketing to. It also communicates to publishers what data they should be sharing with the buy-side. In turn, this augments targeting precision and enhances return on ad spend (ROAS) for buyers. At the same time, the higher value means higher propensity to pay more for impressions, which benefits publishers too. A compelling win-win that TTD has facilitated for a decade. Sincera merely supports this well-entrenched equation. TTD CEO Jeff Green often laments about advertising supply chain players unfairly disclosing the utility they provide to extract more economic value than they provide from the ecosystem. Sincera is a rare case of a company that doesn’t behave in this way.

With its fortress, debt-free balance sheet, I think purchases like this make a ton of sense. There’s every reason to go buy high-quality assets and potentially faster growth. That’s the luxury of being in such a financially healthy position. Terms for the deal were not disclosed, but the Sincera is just 2 years removed from a $4.2 million cash raise, so I would think this purchase is very small. Sincera’s co-founder, Mike O’Sullivan,” will stay on with the company (always love seeing that) and report directly to Green.

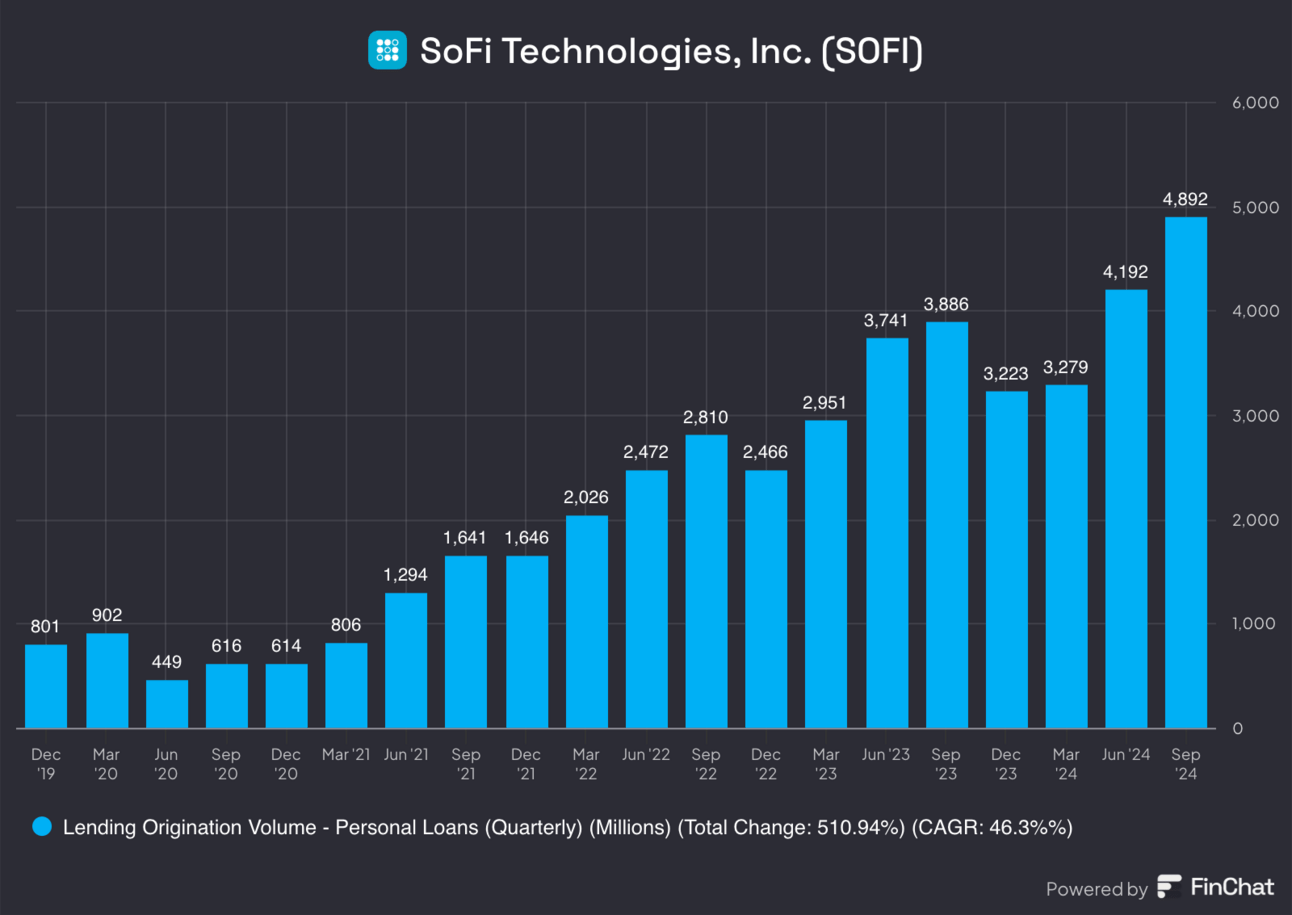

2. SoFi (SOFI) — Asset Light Lending Growth

SoFi announced a new $525 million personal loan securitization with PGIM fixed income. This follows a $350 million transaction just 7 months ago, which hints at this firm being pleased with credit performance so far. Why does this matter?

The deal likely means more gain on sale margin premium, which means more high-margin revenue for SoFi. But that’s not all. As we’ve talked about in the deep dive and several other times, SoFi must strictly adhere to capital ratio regulations as a chartered bank. By not stashing this credit on its balance sheet, SoFi can realize financial gain from these originations without placing undue stress on its capital ratios. This means it can cater to more borrower demand, collect all of that data for future cross-selling and pocket more revenue without using up any of its currently large capital ratio cushion. This greatly diminishes the balance sheet growth bottleneck and gives SoFi yet another outlet to pursue more revenue in a financially responsible way. I love these deals just like I loved the loan platform expansion to offer loans to customers within and outside of its credit demographics through partner-sourced liquidity on its own site.

"These personal loans represent an attractive investment opportunity for PGIM."

PGIM co-head of Securitized Products

In other SoFi news, Citi raised its price target from $12.50 to $18.

3. Duolingo (DUOL) — Updates

Duolingo launched its AI FaceTime feature for Android and 5 additional languages as expected. This is really where the firm’s industry-leading data scale (by a mile) shines. In partnership with OpenAI, the company merges better data with world-class models to create a GenAI-powered product that truly differentiates. Users can have full-fledged conversations with the Lily character, who has her own memory to draw from previous context and enrich learning experiences. Broken record alert: It’s launches like these that, I think, will make it clear that GenAI isn’t replacing Duolingo… it’s augmenting it. While competition like Chegg is used to cheat (something GenAI is very good at), Duolingo functions to educate and entertain. And it uses GenAI plus obsessive split-testing every step of the way to ensure it’s industry-leading product keeps getting better.

In other interesting news, the potential TikTok ban in the USA is leading to a more than 200% surge in Chinese language learning demand on the app. Many TikTok users are shifting to another app called RedNote, where dialogue between Chinese & English-based users is more frequent.

4. Earnings Season Kick-Off — Big Banks

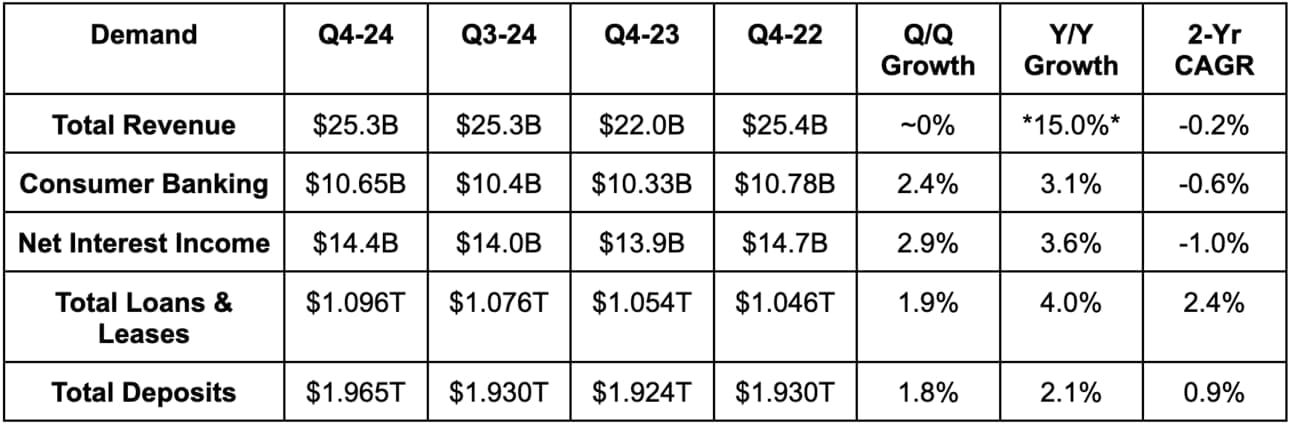

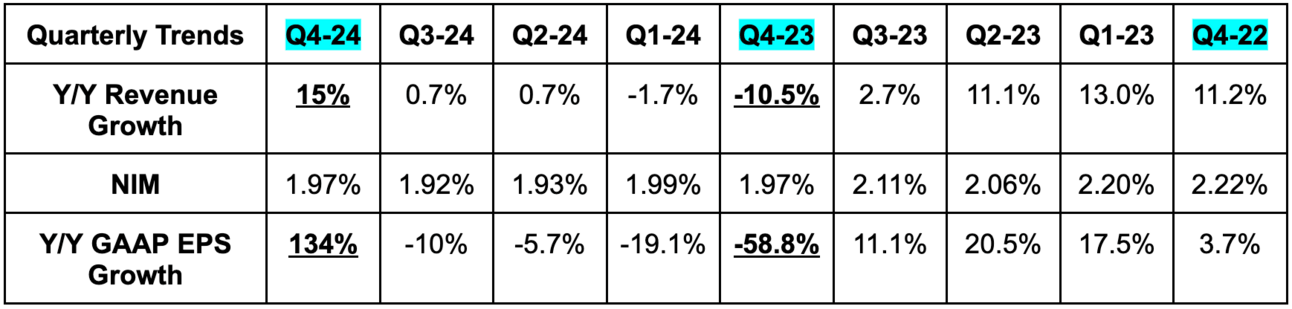

a.Bank of America (BAC)

Results:

- Beat revenue estimates by 0.9%.

- Net interest income beat estimates by 1.1%.

- Beat $0.82 EPS estimates by $0.05. EPS doubled Y/Y due to the FDIC special assessment charged. Excluding this, EPS rose by 17% Y/Y. Just like for JPM and WFC, the FDIC charge also led to very easy Y/Y return metric comps.

Guidance & Valuation:

- Bank of America expects $14.55B in Q1 net interest income, with that ramping to $15.6B by the end of the year. Growth is expected to accelerate throughout the year.

- NCO rate is expected to be 0.55% vs. 0.57% in 2024.

BofA trades for 13x forward EPS expectations. EPS is expected to grow by 14% this year and by 18% next year. This marks a notable acceleration compared to a roughly 0% earnings CAGR from 2022-2024. Guidance led to modest upward pressure on 2025 EPS expectations.

More Provision & Allowance Context:

- Total provisions were $1.45B vs. $1.54B Q/Q, $1.51B 2 quarters ago and $1.10B Y/Y.

- As you may expect, most provisions were from the consumer banking division. Provisions for that segment were $1.25B vs. $1.30B Q/Q & $1.41B Y/Y. Good to see this forward-looking indicator improving on a Q/Q & Y/Y basis.

- Allowance for credit losses came in at $13.24B vs. $13.25B Q/Q & $13.34B Y/Y thanks to modest reserve releases.

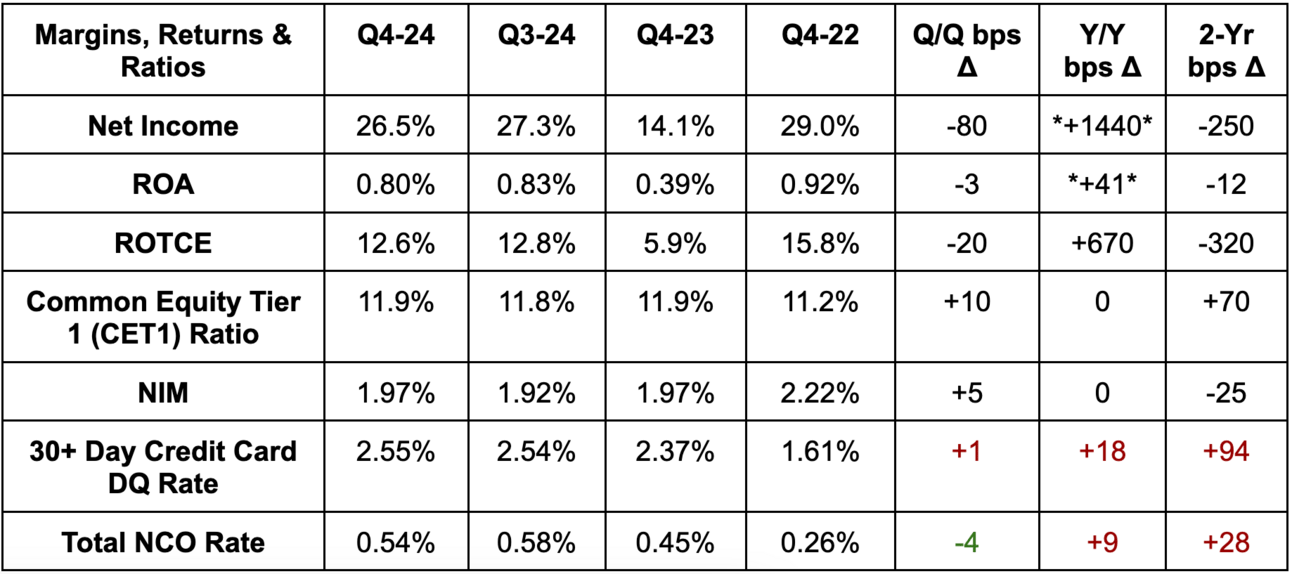

More NCO Context:

- Overall consumer NCO rate was 0.96% vs. 0.91% Q/Q & 0.79% Y/Y. The more backward-looking indicator still reflects somewhat orderly credit deterioration over the last year. Typical credit card seasonality was the source of the Q/Q rise.

- Card NCO rate was 3.79% vs. 3.70% Q/Q & 3.07% Y/Y.

- Home NCO rate was 0.14% vs. 0.07% Q/Q 7 0.26% Y/Y.

- Commercial NCO rate was 0.09% vs. 0.16% Q/Q & 0.06% Y/Y.

- Commercial real estate NCO (something BofA and others have struggled with in recent years) came in at 0.70% vs. 0.98% Q/Q & 0.62% Y/Y.

More DQ and Nonperforming Loan (NPL) Context:

- 90+ day delinquency (DQ) rate for credit cards was 1.35% vs. 1.30% Q/Q & 1.20% Y/Y.

- Loan and lease NPL ratio was 0.55% vs. 0.53% Q/Q & 0.52% Y/Y and 0.25% 2 years ago. Good to see this no longer materially worsening on a Y/Y basis.

- Total consumer NPL was $2.65B vs. $2.71B Y/Y.

- Total commercial MPL was $3.33B vs. $2.77B Y/Y. Still some issues here.

Consumer & Economy Call Quotes:

“We appear to be settled into a 2% to 3% GDP growth environment with healthy employment levels and a resilient consumer… So far in the first 2 weeks of January, they’re spending money at a 4% to 5% growth clip over last year. That’s similar to Q4.”

CEO Brian Moynihan

“Earlier in the year, we highlighted our expectation of consumer credit stabilizing at a normal level. And on commercial office losses, we said they would trend down during the year. We saw both those trends continue in the Q4.”

CEO Brian Moynihan

“Based on our more recent growth experienced, we're assuming loan and deposit growth in 2025 that's higher than 2024, and more consistent with growth in a 2% to 3% GDP environment.”

CFO Alastair Borthwick

“We don't see overall net charge-offs or the related ratio changing much in 2025, without much change in current GDP or the employment environment, we expect the net charge-off ratio to be in the range of 50 to 60 basis points of loans for 2025.

CFO Alastair Borthwick